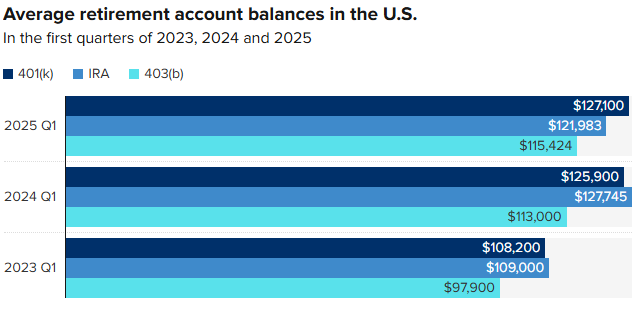

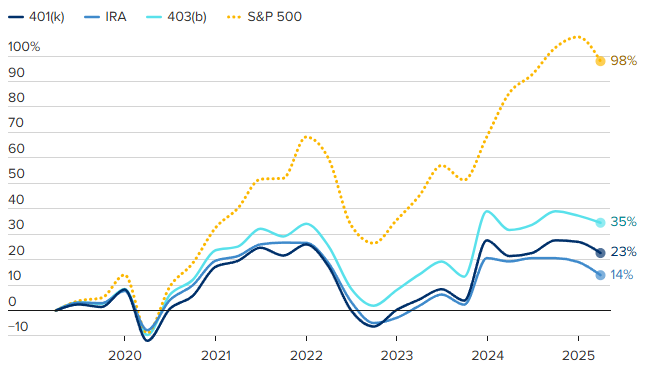

Your 401(k) Might Be Down: Despite recent market turbulence, American workers are showing remarkable determination when it comes to saving for retirement. According to the Fidelity Investments Q1 2025 Retirement Analysis, the average 401(k) balance fell 3% to $127,100 due to market shifts. But here’s the twist: instead of backing off, savers are doubling down. The average combined contribution rate hit a record 14.3%, close to Fidelity’s 15% recommendation. This tells us something big — while Wall Street may ride waves, everyday workers are sticking to the plan. And that’s a good sign for the future of retirement security.

Your 401(k) Might Be Down

Let’s be real — it’s not easy to watch your 401(k) balance drop. It can feel discouraging, even a little scary. But the bigger picture tells a different story: Americans aren’t backing down. They’re showing grit, staying consistent, and trusting the process. And that’s what real financial success is built on — not timing the market, but time in the market. If you’ve stayed the course or even increased your contributions lately, give yourself credit. That discipline will pay off down the road. And if you’re just getting started, know this: it’s never too late, or too early, to take control of your financial future. Start where you are. Stay curious. Keep learning. Your future self will thank you. Because at the end of the day, it’s not about having a perfect plan — it’s about having a plan that you actually stick with.

| Metric | Value | Notes |

|---|---|---|

| Average 401(k) Balance | $127,100 | Down 3% from Q4 2024 |

| Combined Contribution Rate | 14.3% | Includes 9.5% employee, 4.8% employer contributions |

| Participants Increasing Contributions | 17.4% | More than 1 in 6 savers added more |

| Participants Decreasing Contributions | 4.9% | Shows most are staying the course |

| Asset Allocation Changes | 6% | Majority of savers held steady |

| Source | Fidelity Investments | Official Report |

Why the Average 401(k) Balance Dropped?

Let’s not sugarcoat it: the markets had a rocky first quarter in 2025. The S&P 500 fell by 4.3% amid global uncertainty, interest rate concerns, and corporate earnings disappointments. These market moves naturally impacted retirement portfolios, which are often heavily invested in stock funds.

But context matters. The average balance falling doesn’t mean people lost their discipline — it means markets dipped. The long-term outlook for diversified portfolios remains optimistic.

Americans Are Not Giving Up

What really jumps out in Fidelity’s data is that savers are not throwing in the towel. In fact:

- 17.4% of participants increased their 401(k) contribution rate.

- Only 4.9% decreased their contributions.

- Just 6% made changes to their investment allocations.

That’s huge. Most people are keeping their money in the game — a wise move, since selling in a downturn is one of the fastest ways to lock in losses.

What This Means for You (Even If You’re Just Starting Out)

Whether you’re a recent grad starting your first job, a mid-career professional, or nearing retirement, this data matters to you. It shows that sticking to your savings plan works — even when the market is rocky.

Here’s how to apply this insight in your own financial life.

A Step-by-Step Guide to Smart Saving As Your 401(k) Might Be Down

Step 1: Start with What You Can

Don’t wait to max out your contributions if that’s not realistic today. Even 4% or 5% is a good start — especially if your employer matches.

Always contribute at least enough to get the full employer match. That’s free money.

Step 2: Set It and Forget It

Automate your contributions. Set a monthly percentage that comes straight out of your paycheck. Then, don’t touch it. Trust the process.

Step 3: Diversify Your Portfolio

Most 401(k) plans offer target-date funds, index funds, and more. Diversifying — spreading your money across multiple types of investments — reduces your risk over time.

Not sure where to start? A target-date fund that matches your estimated retirement year is a solid option for beginners.

Step 4: Increase Contributions Over Time

Did you get a raise or bonus? Bump up your contribution by 1%. You probably won’t even notice it in your take-home pay — but your future self will thank you.

Real-Life Examples of Smart 401(k) Moves

Take Jordan, a 29-year-old IT consultant. He started contributing just 5% to his 401(k) out of college. Each year, he increased his contribution by 1%. By age 35, he’s saving 13% of his salary — and now has over $95,000 in his 401(k).

Or consider Maria, a 51-year-old nurse. After her kids left home, she started making catch-up contributions, adding $7,500 more per year. She’s now on track to retire at 62, not 67.

These are everyday Americans using the system wisely. You don’t have to be wealthy to be retirement-ready — just consistent and strategic.

Behavioral Finance: Why We Struggle to Save (And How to Beat It)

Even if we know saving is important, it’s not always easy. Behavioral finance — the study of why we make irrational financial choices — tells us that people often delay saving because:

- We underestimate future needs.

- We prioritize current spending over long-term goals.

- We fear making investment mistakes.

Solution? Use automation, create visual goals (like a retirement countdown tracker), and keep financial education ongoing. Books like “Save More Tomorrow” by Richard Thaler offer great insights on using psychology to your advantage.

Tax Benefits of 401(k) Contributions

Let’s talk real dollars.

Every dollar you put into a traditional 401(k) lowers your taxable income today. For example:

- If you earn $60,000/year and contribute $6,000, you’ll only pay income tax on $54,000.

- That could mean hundreds in tax savings each year, depending on your bracket.

There’s also the Roth 401(k), where you pay taxes now but withdraw tax-free in retirement. Having both options gives flexibility later.

What Happens If the Market Stays Volatile?

Good question — and here’s the truth: nobody knows what the market will do tomorrow. But historically, markets trend upward over the long term.

If you’re 30 years from retirement, these dips are opportunities to “buy low.” Over time, these contributions may grow significantly when the market rebounds.

Even if you’re close to retirement, diversified portfolios usually include bonds and other assets to soften market blows.

Future Trends in Retirement Planning (2025 and Beyond)

With AI, automation, and fintech on the rise, the retirement landscape is shifting fast. Here are a few trends to watch:

- Robo-advisors are being integrated into employer plans to help workers personalize portfolios.

- Automatic escalation features are becoming standard — increasing your contribution rate each year.

- Portable benefits may soon allow gig workers to carry 401(k)-like accounts between jobs.

- Financial literacy tools are increasingly accessible via apps and workplace programs.

Staying ahead of these trends means more control and better planning.

Her Boyfriend Says 401(k)s Are a Scam; Dave Ramsey’s Response Left Her Speechless

Your 401(k) Crypto Dreams May Be Over — Here’s Why the Labor Department Pulled the Plug

Medicare Part B Premiums Surge in 2025; Is Your Income Pushing You Into a Higher Bracket?

Employer Tips: Building a Better 401(k) Plan for Your Team

If you’re a business owner or HR professional, you play a big role in encouraging retirement savings. Here are a few things you can do:

- Offer a strong employer match (3–5% is standard).

- Implement auto-enrollment for new hires.

- Offer financial wellness education sessions.

- Make the interface for contributions and allocation user-friendly.

A well-supported 401(k) is not just a benefit — it’s a recruiting and retention tool.