Costs to Live Comfortably in Virginia and Maryland: If you’re wondering how much it truly costs to live comfortably in Virginia and Maryland, you’re not alone. These two states—known for their proximity to Washington, D.C., strong job markets, and vibrant suburban and urban communities—are among the most desirable places to live in the Mid-Atlantic region. But with that desirability comes a higher price tag.

Recent 2025 data from SmartAsset and the MIT Living Wage Calculator reveal that individuals and families in Virginia and Maryland require significantly higher incomes than the national average to maintain a comfortable lifestyle. Rising housing prices, childcare expenses, transportation costs, and healthcare premiums all play a role in shaping the true cost of living in these states.

This guide provides a comprehensive breakdown of what it takes to afford a comfortable life in both states. Whether you’re a single professional, growing family, or relocating retiree, we’ll walk you through the numbers, regional comparisons, practical strategies, and expert insights to help you navigate the financial realities of living in Virginia and Maryland in 2025.

Costs to Live Comfortably in Virginia and Maryland

Living comfortably in Virginia or Maryland in 2025 means budgeting wisely, choosing your ZIP and lifestyle with care, and planning ahead. Here’s what you need to know:

- $106K–109K/year for a single adult; $242K–259K/year for a family of four.

- Major costs: housing, childcare, transportation, utilities, insurance.

- Use the 50/30/20 rule, explore metro/transit options, share housing, and leverage remote work or local incentives.

Yes—it’s a stretch. But with smart planning, location savvy, and proactive budgeting, you can build a life that’s both comfortable and affordable. Want a metro‑specific deep dive—DC‑area commutes, Richmond growth, or Chesapeake Bay families? I’ve got the playbook ready.

| State / Household | Single Adult | Family of Four | YoY Cost Rise |

|---|---|---|---|

| Virginia | $106,704 | $241,696 | +6.7% / +2.8% |

| Maryland | $108,867 | $259,168 | +5.8% / +8.2% |

| Richmond, VA (rent) | $68K | — | Rent +40% in 5 yrs |

| Utility avg per mo (VA) | $387/mo | — | — |

Context: Why Costs Are High in These States

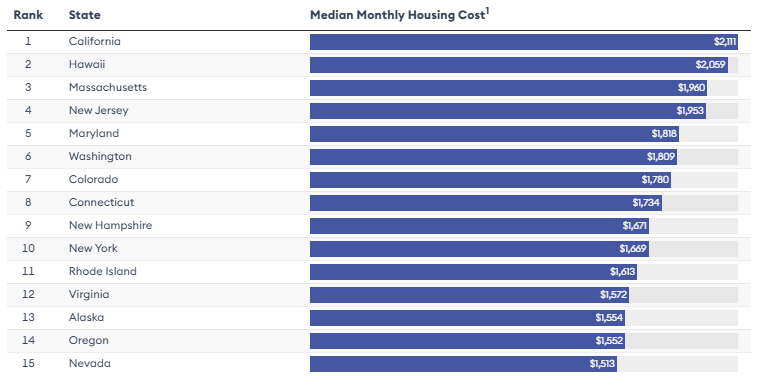

Virginia and Maryland sit in the top 10 of highest-cost states for a comfortable lifestyle. The 2025 SmartAsset study, using the MIT Living Wage Calculator, reports:

- Single adult needs per year:

• Virginia = $106,704

• Maryland = $108,867 - Family of four needs per year:

• Virginia = $241,696

• Maryland = $259,168

That’s way above national averages. You’ll spend more on almost everything—from fancy groceries to daycare. Let’s unpack the details.

Why Costs Stack Up?

1. Housing + Utilities

- In Virginia, expect rent between $1,474–$2,750/month. The median home value is around $396K .

- Arlington, VA exceeds $881K for a home, and you’ll pay steep rent—dual incomes are basically required .

- Maryland housing costs are about 2.2% higher than Virginia; transportation runs about 3.7% higher .

Utilities add up to roughly $387 monthly in Virginia (~$4,644/year), covering electricity, gas, internet, and water .

2. Groceries & Household Supplies

Groceries cost about $366 monthly (~$4,389/year) for a single adult in Virginia . Add in cleaning products, toiletries, and you’re looking at an extra $100–200 monthly.

3. Healthcare

The typical adult shells out around $8,400 annually for healthcare in Virginia . That includes insurance trials, co‑pays, prescriptions, dental visits, and mental-health apps like therapy or meditation.

4. Transportation

Single adults spend $9,876–$18,377/year depending on car usage . Choosing Metro (train and bus) saves serious coin: day passes can be over $60/month, and annual Metro membership with employer discounts is even cheaper .

5. Childcare & K‑12 Education

- Infant daycare in Virginia costs about $16,397/year .

- In Maryland daycare expenses range from $12K–20K/year ; some estimates show families spending $31,601/year per child, with daycare alone at $19,906 .

6. Taxes

- Virginia income tax rates range from 2% to 5.75%, plus a 5.3% state sales tax (with ~1% local tax on groceries) .

- Maryland has income tax brackets up to nearly 5.75%, plus local county taxes. There are refunds and credits for families, seniors, and veterans—check the Maryland Comptroller’s website.

7. Insurance & Other Policies

- Car insurance in these areas typically costs $1,200–1,800 annually (higher for teen drivers or high-risk codes).

- Renter’s or home insurance adds $300–1,000/year depending on ZIP code (flood zones, fire-prone areas).

8. Recreation & Lifestyle

Living comfortably means going out sometimes—dining, movies, sports, concerts. Budget $200–400 monthly for a few dinners out, local festivals, youth sports or recreation memberships. Big events in DC, Richmond, or Baltimore drive up your social spending.

9. Hidden Costs & Inflation

- HOA fees, condo maintenance, pest control, landscaping—can tack $100–400/month if you own.

- Flood insurance in coastal parts of Hampton Roads or Chesapeake may cost $600–2,500/year.

- Daycare has jumped nearly 52% since 2023 .

Pro Tips to Handle The Costs to Live Comfortably in Virginia and Maryland

Step 1: Choose Your ZIP Wisely

Suburbs like Woodbridge, VA ($500K median home) cost less than Arlington ($881K). Comfortable living in Woodbridge demands around $124K/year—far less than upscale metro zones . Similarly, regions like Elkridge, MD, are typically 10–20% cheaper than Chevy Chase or Bethesda.

Step 2: Use the 50/30/20 Rule

Allocate income like this:

- 50% for needs

- 30% for wants

- 20% for savings and debt

With $9K monthly take-home (~$130K annual), essentials stay under $4.5K/month—tight but manageable if you pick your neighborhood, transport, and insurance wisely.

Step 3: Transportation Hacks

Take a weekly Metro pass ($60.75), bike commute parts of your route, Uber-share to weekend events—skip the full-time car unless necessary.

Step 4: Consider Roommates or Multi-Family Housing

Split rent, utilities, and cleaning expenses by living with roommates or extended family. It’s common among teachers, early-career folks, and families.

Step 5: Remote Work & Salary Negotiation

If you earn a DC or NYC salary but live in VA or MD, you keep more buying power. Negotiate roles that pay what big cities offer but let you live in lower-cost areas.

Step 6: Tax Credits & Incentives

- Virginia offers Homestead and elderly exemptions.

- Maryland has Earned Income Credits, Child & Dependent Care Credit, and Subtraction Modification programs.

Look for benefits if you work in nursing, firefighting, education, or clean energy.

Step 7: Emergency Fund

Build 3–6 months’ worth of your Living Wage number. That’s $30K–50K—critical buffer for job loss, medical emergency, or major repairs.

Career Opportunities & Income Boosters

Tech & Government

Northern Virginia (Tysons Corner, Reston, Dulles corridor) hosts Amazon HQ2, top federal IT contractors, and health‑tech startups. Median incomes often exceed $120K. If you’re in cybersecurity, software, or federal contracting, you’re in the sweet spot.

Healthcare & Education

Richmond and Norfolk see demand for nurses, therapists, educators—especially with joint VA/MD licensure. Public-school pay ranges $55–75K; private or charter schools often offer $70K+.

Skilled Trades

Electricians, plumbers, and HVAC techs in high-growth suburban counties (Prince William, Montgomery, Anne Arundel) earn $60–80K, with apprenticeships and certification funding available via trade unions or community colleges.

Entrepreneurship

FXBG, Alexandria, and Silver Spring boost small-business owners. Low-cost shared workspaces and state Small Business Credits help get things rolling.

Guide: How to Plan for Comfortable Living

Step 1: Use Cost-of-Living Tools

Plug your ZIP into SmartAsset or MIT’s Living Wage Calculator. Adjust parameters for family size, car vs. transit, and renter vs. homeowner .

Step 2: Map Your Lifestyle Choices

Decide on transit, kids, pets, hobbies. Each choice alters your number by $500–1,000 monthly.

Step 3: Compare Housing Alternatives

Look across metro counties and rural areas. Tools like Zillow and local MLS can show differences of $200–600/month for similar homes.

Step 4: Build a Realistic Budget

Include housing, utilities, fuel or transit, groceries, childcare, insurance, recreation, savings. Use spreadsheets or budgeting apps.

Step 5: Track Monthly & Adjust

Check your actual spend vs. your plan. Adjust categories if you overspend more than 5%.

Step 6: Plan for the Future

Factor in salary increases of 2–4% annually—still below inflation (~6–8%)—so raise expectations, investments, and cost-savings strategies.

Step 7: Re-evaluate Every Year

Costs shift; so should your strategy. Consider refinance, move closer to work, upgrade skills, or revisit transportation efficiencies.

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

Moody’s Shocks Markets By Slashing America’s Pristine Credit Rating Over Soaring Debt

How Much Do You Really Need to Retire? The ‘Magic Number’ Most Americans Are Aiming For