Why Disability Tax Credits Are More Important: In 2025, Disability Tax Credits (DTC) are more essential than ever for Canadians. The DTC is a vital tool for individuals living with disabilities, offering them the financial support they need to manage the extra costs associated with their conditions. Whether it’s funding for medical expenses, assistive devices, or even daily living support, these credits can make a world of difference. With new programs like the Canada Disability Benefit (CDB) now tied to DTC eligibility, there’s even more reason to ensure that individuals who qualify are receiving the benefits they deserve. This article explains why the DTC is becoming more significant, how it works, and how Canadians can take full advantage of this opportunity.

Why Disability Tax Credits Are More Important?

As we move further into 2025, the Disability Tax Credit (DTC) has never been more crucial. Not only does it reduce the amount of tax you owe, but it also opens the door to additional financial benefits like the Canada Disability Benefit (CDB) and the Registered Disability Savings Plan (RDSP). The increased eligibility, simplified application process, and retroactive claims make now the perfect time for Canadians to apply. If you’re living with a disability, don’t miss out on these life-changing benefits.

| Key Data | Details |

|---|---|

| Canada Disability Benefit (CDB) | Up to $200/month for eligible individuals, with a maximum of $2,400 annually. |

| Maximum Refund for DTC | $8,996 depending on individual circumstances. |

| Eligibility for Retroactive Claims | Individuals can apply for retroactive DTC claims for up to 10 years, possibly securing significant refunds. |

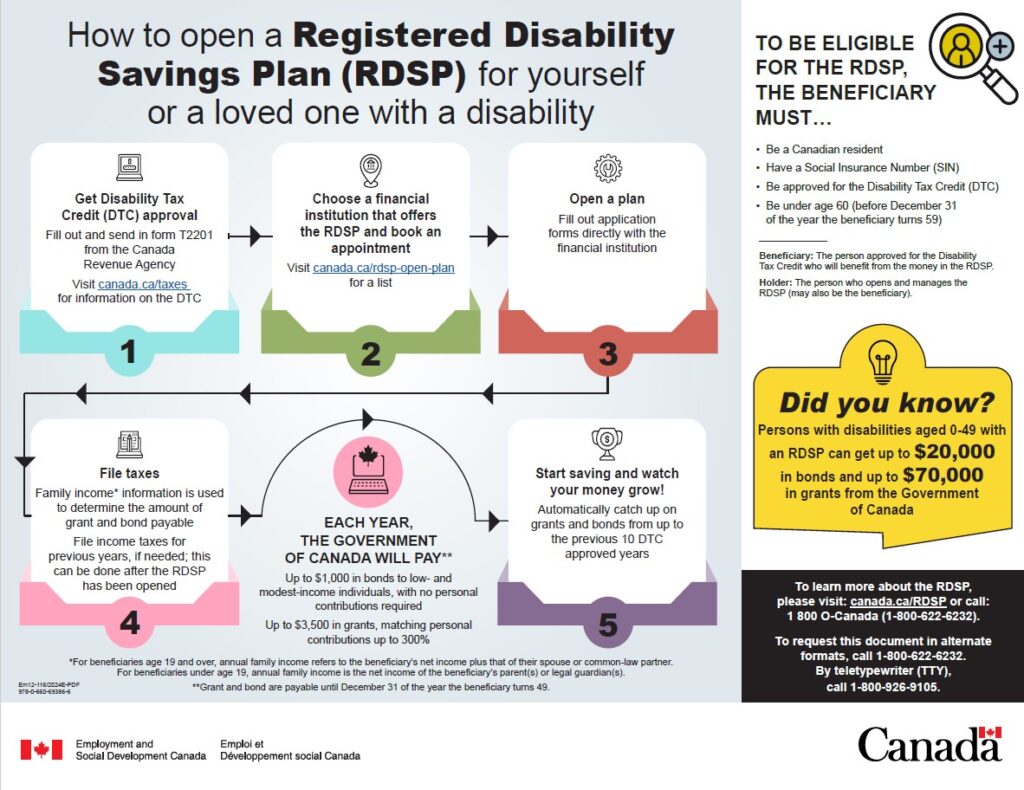

| Registered Disability Savings Plan (RDSP) | Enables individuals to save long-term with government grants and bonds. |

| Broader Eligibility | More conditions now qualify for the DTC, including neurological and psychological impairments. |

| Application Process | Simplified through Form T2201 with online submission options via the Canada Revenue Agency (CRA) portal. |

| Official Website for Reference | CRA DTC Information |

Introduction to Disability Tax Credits (DTC)

Imagine a world where living with a disability doesn’t leave you financially strained or worried about how to manage extra costs. For many Canadians, the Disability Tax Credit is the lifeline they’ve been waiting for. This non-refundable credit offers relief for those living with disabilities by reducing the amount of tax they need to pay. The DTC can ease the financial burden, helping individuals access medical care, mobility aids, and daily living support.

The introduction of the Canada Disability Benefit (CDB) in 2025 has taken this support even further, creating a much-needed safety net for those who qualify. While both programs are crucial on their own, the fact that they now work in tandem has made the DTC more important than ever. In this article, we’ll explore how these programs intersect, how they can benefit Canadians, and why now is the perfect time to apply if you haven’t already.

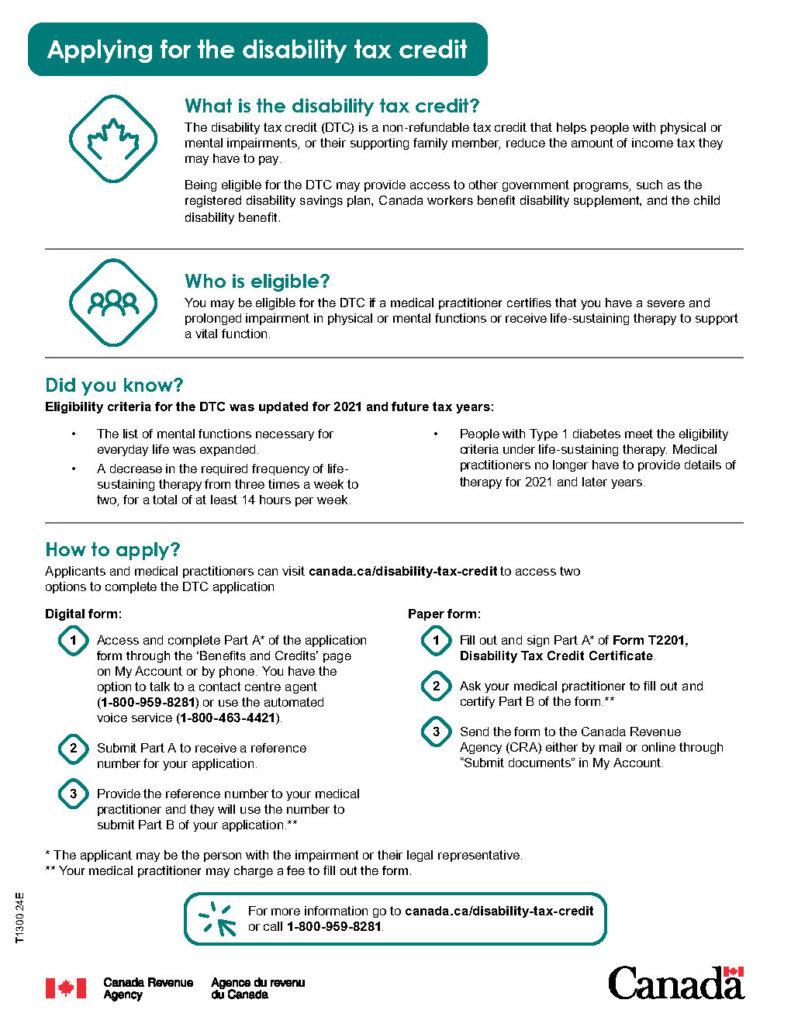

What is the Disability Tax Credit (DTC)?

The Disability Tax Credit (DTC) is a program designed to assist people with disabilities by reducing the amount of taxes they owe. The credit is available to anyone who meets the necessary medical criteria, which usually requires a diagnosis of a severe and prolonged impairment. If you qualify, this credit can significantly lower the taxes you owe, and in some cases, lead to tax refunds.

How Does the DTC Work?

The DTC works by reducing your taxable income. If you’re eligible, the amount you owe in taxes gets reduced based on the amount of the credit. The value of the credit varies depending on your income level and other factors, but in 2025, it can be as high as $8,996 for individuals with severe disabilities. This credit also helps open the door to other financial programs, including the Canada Disability Benefit (CDB), the Registered Disability Savings Plan (RDSP), and the Child Disability Benefit.

Step-by-Step Guide: How to Apply for the Disability Tax Credits?

Applying for the DTC might seem overwhelming, but it’s a straightforward process once you break it down. Here’s how to get started:

1. Confirm Your Eligibility

The first step is to ensure that you or the person applying has a severe and prolonged disability. The Canada Revenue Agency (CRA) has specific criteria that must be met, such as:

- Physical or mental impairments that last at least 12 months.

- Conditions that limit basic daily functions like walking, dressing, or feeding oneself.

Some common conditions that may qualify include diabetes, multiple sclerosis, vision or hearing impairments, and developmental disorders.

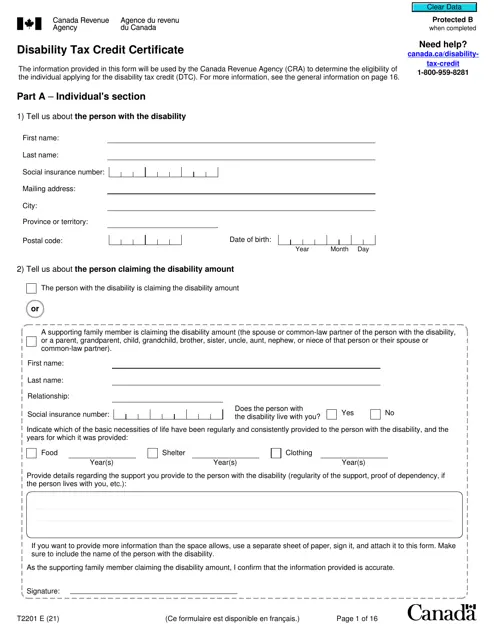

2. Complete Form T2201

Once you’ve confirmed eligibility, you need to fill out Form T2201 – the Disability Tax Credit Certificate. This form requires a medical professional to certify your condition. It’s important to find a healthcare provider who understands the details of the form and is willing to fill it out for you.

- Section A of the form is for you, the applicant.

- Section B is where your healthcare provider completes the details about your condition and how it affects your daily life.

After filling out the form, submit it to the CRA for review.

3. Wait for CRA’s Decision

The CRA will review your application and decide whether you qualify. This process can take several weeks, so it’s important to be patient. If you’re approved, you’ll receive confirmation from the CRA, and your credit will be applied to reduce your tax burden.

- Pro Tip: Even if you’re denied the first time, you can appeal the decision by providing additional documentation from your healthcare provider.

4. Take Advantage of Retroactive Claims

If you’ve had a disability for several years but haven’t applied for the DTC, you can request retroactive claims. This means you can apply for DTC for up to 10 previous years and potentially receive a significant tax refund. Make sure to include all the necessary medical documentation to support your claim.

Why is the DTC More Important Now?

In 2025, the Canada Disability Benefit (CDB) was introduced as part of Canada’s ongoing efforts to help those living with disabilities. The CDB is a monthly financial support program that provides up to $200 per month for eligible individuals. However, this benefit is tied directly to the Disability Tax Credit. To qualify for the CDB, you must first be approved for the DTC.

The DTC doesn’t just help with taxes anymore—it’s now a gateway to additional benefits. Here are some reasons why the DTC is more important than ever:

1. Increased Financial Relief

With the CDB providing monthly support, the DTC now helps individuals access greater financial relief. This is especially important for those facing high medical or living costs due to their disability. The combined support from the DTC and CDB offers a more comprehensive safety net.

2. Broader Eligibility

The DTC eligibility criteria have expanded to include a wider range of conditions, including psychological and neurological impairments. This means more Canadians will be able to apply and receive the benefits they need.

3. Simplified Application Process

The application process for the DTC has become more accessible. With the option to apply online through the CRA portal, it’s easier than ever to submit your claim. The CRA also offers more resources to help individuals through the process.

4. Maximizing the Benefits

While the DTC helps reduce your taxes, it’s important to explore other government programs you may be eligible for, including the RDSP and Child Disability Benefit. These programs work together to create a more comprehensive financial solution for those with disabilities.

Pro Tip: Speak with a tax professional or financial advisor to ensure that you’re taking full advantage of all available benefits.

Why Some Canadians Miss Out on DTC (And How to Avoid It)?

Despite its importance, many Canadians miss out on claiming the DTC, which can result in lost financial support. Below are common reasons people miss out, and tips to make sure you don’t fall through the cracks:

1. Not Knowing About the DTC

Many individuals with disabilities don’t know about the credit or think they don’t qualify. If you have a disability that impacts your daily life, it’s worth investigating whether you qualify. Don’t assume you’re not eligible—even if you have a disability, you may meet the requirements.

2. Not Filling Out the Forms Correctly

One of the most common issues is failing to fill out the application correctly or failing to provide enough medical documentation. Always ensure that your healthcare provider fills out the necessary sections of Form T2201 and that it’s signed properly.

3. Missing the Deadline

While you can apply for retroactive claims, you can’t always go back and claim missed benefits if too much time passes. Apply as soon as possible to ensure that you don’t miss out on important tax relief.

4. Appealing if Denied

If your initial application is denied, don’t give up. You can appeal the decision and provide additional medical information to support your case. Many individuals who initially fail to qualify eventually receive the credit upon appeal.

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

New $2,400 Disability Benefit for Canadians; Who’s Eligible and How to Apply Before It’s Too Late

$1700 CPP Payments In July 2025; Check Payment Date, Eligibility