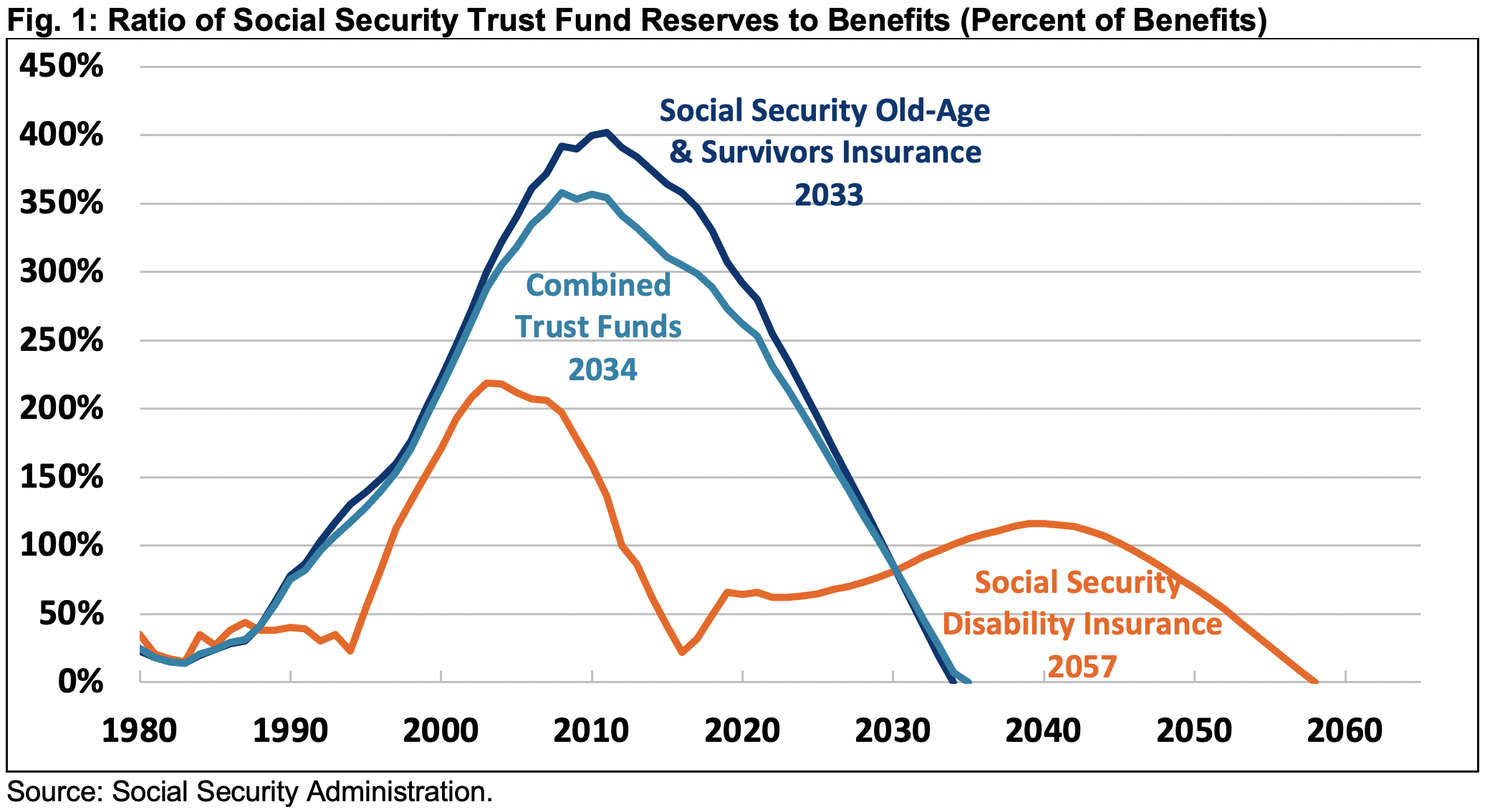

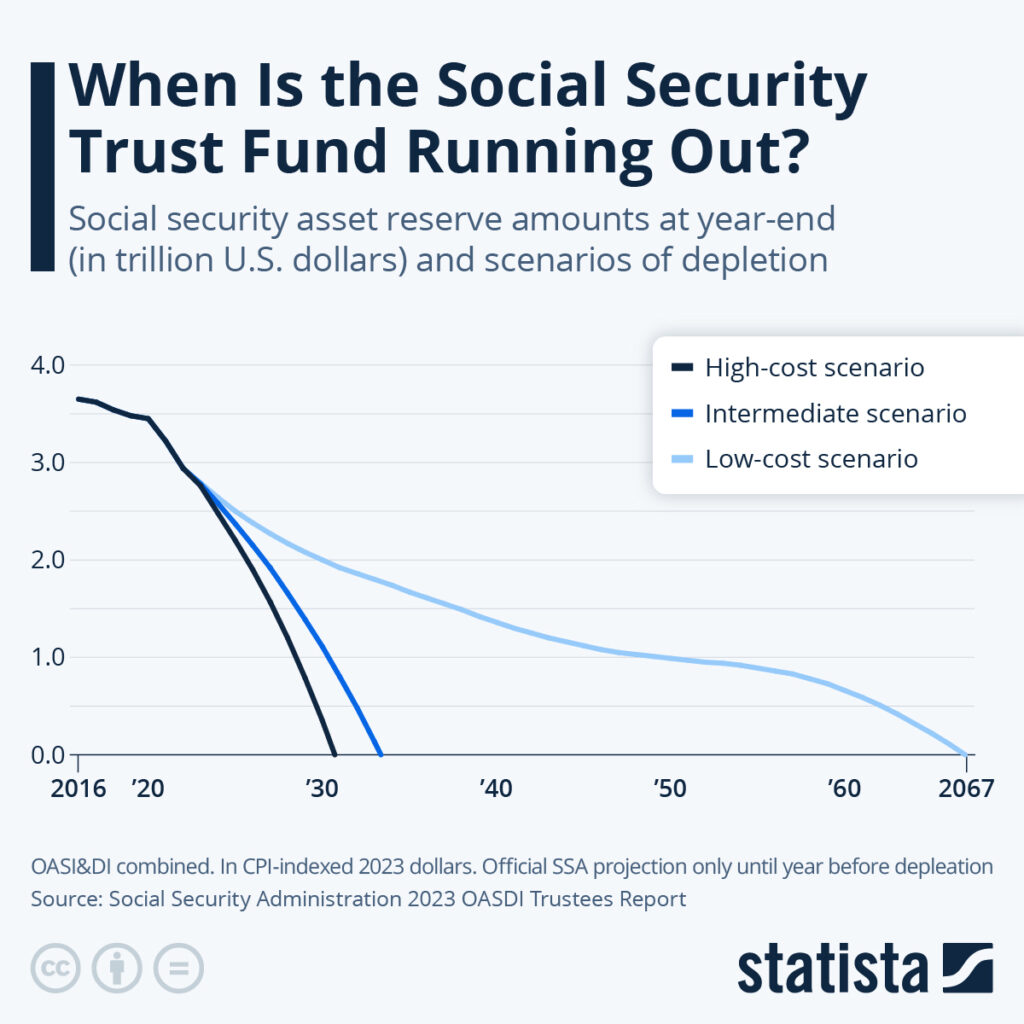

When Will Social Security Benefits Be Cut? If you’ve been hearing chatter about Social Security running out of money, you’re not imagining things. The question “When will Social Security benefits be cut?” has become more than just political clickbait—it’s a growing concern for retirees, middle-aged professionals, and even Gen Z workers just entering the labor force. Recent reports from the Social Security Administration (SSA) and the Congressional Budget Office (CBO) confirm the worries: without legislative action, benefits could be automatically reduced by 19% to 23% as early as 2033. That’s not some distant “what if”—it’s less than a decade away. Let’s break it down so it’s clear, honest, and useful—whether you’re 10 years from retirement or 40 years from it.

When Will Social Security Benefits Be Cut?

While the headlines might sound scary, Social Security isn’t disappearing—but it is facing significant cuts unless Congress takes action soon. Benefit reductions of up to 23% could start by 2033, affecting everyone from current retirees to future generations. The best thing you can do is get informed, take control of your finances, and stay flexible. With the right preparation, you can still enjoy a stable and secure retirement—regardless of what happens in Washington.

| Topic | Details |

|---|---|

| Projected Cut Timeline | 2033 (OASI trust fund); 2034 (Combined OASDI trust funds) |

| Expected Benefit Cut | 19–23% across the board if no legislative action is taken |

| Main Cause | Aging population, slower wage growth, longer life expectancy |

| Recent Acceleration Factors | Social Security Fairness Act of 2025 |

| Who’s Affected | All current and future Social Security beneficiaries |

| Fix Options | Raise payroll taxes, adjust benefits, raise retirement age, means testing |

| Official Source | Social Security Administration (SSA) |

What’s Happening With Social Security?

Social Security isn’t going bankrupt, but it’s facing a serious financial shortfall.

Here’s how it works: Social Security is funded by a payroll tax—6.2% from workers and 6.2% from employers, totaling 12.4%. This money goes straight to current retirees and beneficiaries—not into individual accounts.

Now, think about this: in the 1950s, there were 16 workers for every retiree. Today, it’s fewer than 3 workers per retiree, and by 2035, it’s projected to drop below 2.5. That’s not enough to keep the system fully funded, especially as Americans are living longer and retiring earlier.

The system relies on two trust funds to make up the difference:

- OASI (Old-Age and Survivors Insurance) – retirement and survivor benefits

- DI (Disability Insurance) – benefits for disabled workers

According to the 2024 Trustees Report, the OASI fund will be depleted by 2033, and the combined OASDI fund will be empty by 2034.

What Happens When Social Security Benefits Be Cut?

This is where the real worry kicks in.

If the trust fund reserves run dry, Social Security will only be able to pay out what it collects in real-time payroll taxes—about 77–80% of promised benefits.

That means:

- A retiree expecting $2,000/month may only receive $1,540/month.

- A disabled worker receiving $1,500/month could see it drop to $1,200/month.

- Over 20 years, that’s more than $100,000 lost in lifetime income.

These cuts would happen automatically unless Congress passes new legislation to prevent them.

Why Is This Happening?

The issue is multi-layered. Here’s the plain truth:

1. We’re living longer

Great news for humanity, bad news for programs that pay by the month. More years on benefits means higher costs.

2. We’re having fewer children

Low birth rates reduce the number of workers funding the system.

3. Wages aren’t growing fast enough

Since payroll taxes are based on wages, slow growth equals less revenue.

4. Government policy has played a role

In 2025, Congress passed the Social Security Fairness Act, which repealed the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). While it helped many public sector retirees, it shortened the trust fund lifespan by one year, according to Plan Adviser.

Who Will Be Affected?

Everyone who receives Social Security benefits—now or in the future—could be impacted. Here’s how it breaks down by generation:

Baby Boomers (Born 1946–1964)

- Already retired or retiring soon.

- Still at risk of benefit cuts by the time the trust fund is depleted.

Gen X (Born 1965–1980)

- Likely to retire right into a reduced-benefit era.

- Could be forced to delay retirement or work part-time.

Millennials (Born 1981–1996)

- Will pay into the system longer and receive proportionately less unless reforms occur.

- Still have time to prepare through savings and investments.

Gen Z (Born 1997–2012)

- May see the biggest shifts: later retirement age, means-tested benefits, or more personal responsibility.

- Need to diversify their retirement income early.

What Are the Possible Fixes?

Congress has several tools in its toolbox to avoid or reduce these cuts. None of them are painless, but most are manageable:

Raise or Eliminate the Payroll Tax Cap

Only income up to $168,600 (2024) is currently taxed for Social Security. Raising this cap or eliminating it entirely could close most of the shortfall.

Increase the Payroll Tax Rate

Raising the combined 12.4% tax slightly—by even 1%—could extend solvency significantly.

Raise the Retirement Age

Gradually increasing full retirement age from 67 to 68 or 70 would reduce long-term obligations.

Adjust the Benefit Formula

Introduce “means testing” so that wealthier retirees receive smaller checks.

Use a Combination Approach

Most likely, any real solution will involve a mix of tax increases and benefit adjustments phased in over time.

Timeline: What to Expect Year-by-Year

| Year | Expected Milestone |

|---|---|

| 2025 | Debate over reforms intensifies after Fairness Act |

| 2027 | Potential legislation passed with phased-in solutions |

| 2030 | Trust fund reserves decline steeply |

| 2033 | OASI trust fund depleted; 23% cuts possible |

| 2034 | Combined OASDI trust fund depleted; 20% cuts possible |

| 2035 | Benefits paid only from payroll taxes (77–80%) |

What You Can Do Right Now?

You can’t control Washington, but you can control how you prepare. Here’s a practical plan:

If You’re Nearing Retirement (Age 55+)

- Delay benefits until age 70 if you can—it increases your payout by up to 32%.

- Meet with a financial planner to model scenarios.

- Use official calculators: SSA Estimator

If You’re in Your 40s or 50s

- Max out retirement savings: 401(k), Roth IRA, and HSA contributions.

- Eliminate high-interest debt before retirement.

- Diversify your investments for steady income later.

If You’re Under 40

- Start early—even $100/month makes a difference with compound interest.

- Invest in tax-advantaged accounts (Roth IRAs, HSAs).

- Don’t count solely on Social Security; build multiple income streams.

Myth-Busting: Common Misunderstandings About Social Security

Myth 1: Social Security is going away.

Nope. Even if the trust fund dries up, tax revenue will still cover 77–80% of benefits.

Myth 2: It’s only for retirees.

False. About 22% of beneficiaries are disabled workers or survivors of deceased workers.

Myth 3: Politicians stole the money.

Funds are invested in U.S. Treasury bonds. The government owes that money back—with interest.

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits

Big Changes to Social Security in 2025: Who Can Still Claim Full Retirement Benefits?

Social Security Payments for July 2025 — Exact Dates and What to Expect This Month