What $500,000 Annuity Really Pays You Every Month: When you retire, one of the biggest questions you’ll face is how to make your hard-earned savings last. If you’ve been saving up in a retirement account, one option that could provide consistent, predictable income in your golden years is an annuity. Specifically, how much could a $500,000 annuity pay you every month if you retire at 65?

In this article, we’ll walk you through exactly what a $500,000 annuity can offer and break down the details so you can make an informed decision for your retirement. You’ll learn how annuities work, the factors that affect monthly payouts, and whether or not this type of investment is right for you. By the time you’re done reading, you’ll have a clearer understanding of annuities and how they fit into a retirement strategy. Plus, you’ll get answers to the most common questions around annuity payouts and how they can help you secure a steady income during retirement.

What $500,000 Annuity Really Pays You Every Month

A $500,000 annuity can be a reliable source of retirement income, but how much it pays each month depends on factors like your age, gender, the type of annuity you choose, and the current interest rate environment. As you near retirement, it’s crucial to consider these factors to ensure the annuity is a good fit for your financial goals. If you’re looking for predictable income in your retirement years, a fixed annuity might be a good choice. However, if you want flexibility or to leave a legacy, you may want to explore other options. Always consult with a financial advisor to tailor the right strategy for you.

| Key Factor | Details |

|---|---|

| Monthly Payout (Male) | Approx. $3,237 per month |

| Monthly Payout (Female) | Approx. $3,103 per month |

| Joint Life (Couple) | Approx. $2,863 per month |

| Annuity Type | Immediate Fixed Annuity (payouts begin right away) |

| Impact of Age | Older individuals typically get higher payouts |

| Life Expectancy Factor | Women generally receive slightly lower payouts due to longer life expectancy |

What is an Annuity?

At its core, an annuity is a financial product that provides you with regular payments in exchange for a lump sum of money. It’s commonly used as a way to guarantee an income stream during retirement. Think of it like signing up for a monthly subscription, but instead of Netflix, you’re subscribing to peace of mind about your financial future.

In this case, we’re talking about a fixed annuity, which means that once you invest, you’ll receive a set amount each month for the rest of your life or for a specified term, depending on the terms of the contract.

The benefit of an annuity is that it offers predictable and guaranteed income, which can be especially helpful if you’re worried about outliving your savings. You’ve worked hard for that $500,000, and you want to make sure it keeps working for you as you enjoy your retirement.

What $500,000 Annuity Really Pays You Every Month?

To break it down, the amount a $500,000 annuity pays you monthly depends on several key factors:

- Your age: The older you are when you purchase an annuity, the higher your monthly payments will be. That’s because the insurance company assumes you won’t need payouts for as long.

- Your gender: Insurance companies factor in life expectancy. Women, on average, live longer than men, so they tend to receive lower monthly payments than men for the same lump sum investment.

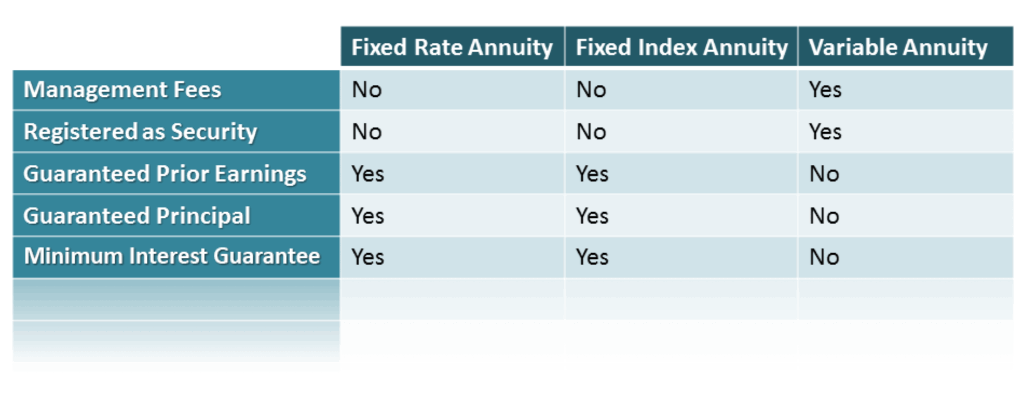

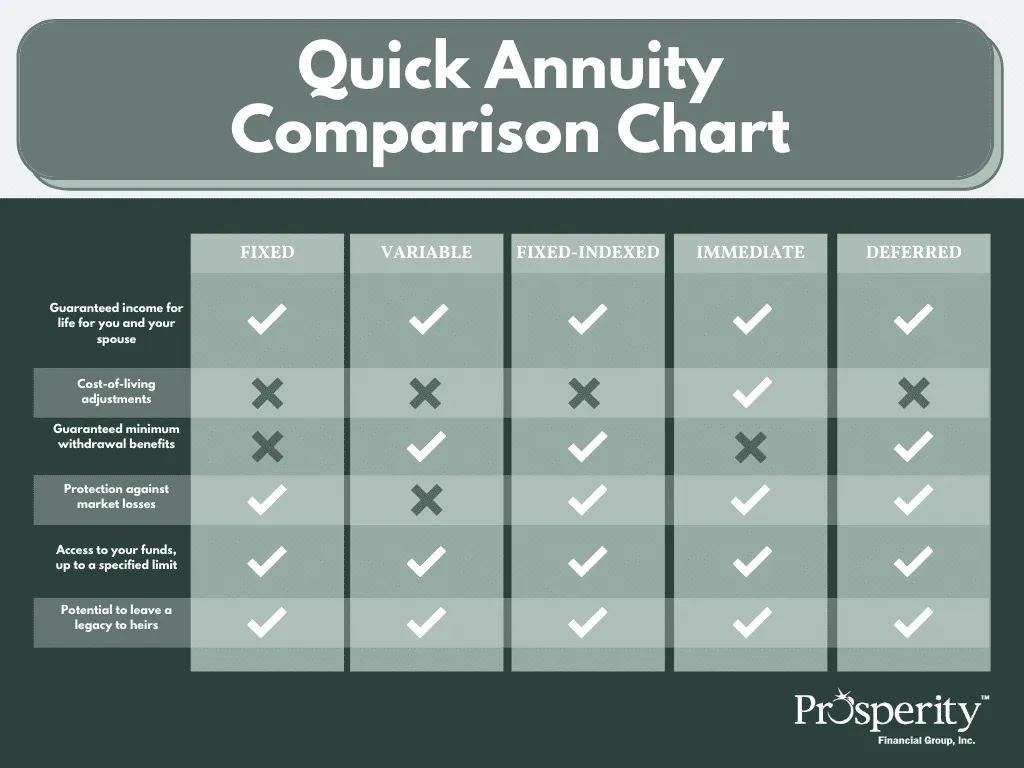

- The type of annuity: There are different types of annuities, and some may offer more flexibility or higher payouts but come with added risks or fees.

- Interest rates: The rate environment has a significant effect on annuity payouts. When interest rates are higher, you might see a larger payout. Conversely, when interest rates are lower, the opposite is true.

Let’s dive into the specifics using a $500,000 lump sum investment:

- If you’re 65 years old and a male, you could expect around $3,237 per month for the rest of your life with a fixed annuity.

- If you’re 65 years old and a female, your payout might be slightly less, around $3,103 per month, because women typically live longer than men.

- If you’re married and opt for a joint life annuity, where payments continue as long as one of you is alive, the monthly payout might be closer to $2,863 for a couple of both 65 years old.

Example Scenarios: Real-World Impact

Imagine you’re a 65-year-old male, recently retired, with $500,000 saved up. You purchase an immediate fixed annuity with a guaranteed monthly payout. You can expect $3,237 per month. This means that for as long as you live, you’ll receive this amount each month, no matter what happens. If you’re planning for a secure, predictable income in your later years, this could be a powerful tool in your retirement strategy.

Now, let’s take a look at the case of a couple. If you and your spouse are both 65 and decide to purchase a joint life annuity, you’ll get around $2,863 per month. While the payout is slightly lower than an individual annuity, it’s designed to ensure that if one partner passes away, the surviving partner will continue receiving payments until their death.

Factors That Affect Your Annuity Payout

It’s not just about the amount of money you invest—it’s also about what kind of annuity you choose and what options you add to it. Let’s go over some of the factors that impact how much you can expect to receive each month.

1. Your Age

The younger you are, the longer you’re expected to live, so your monthly payments will be lower. In contrast, if you buy the annuity at an older age, the company expects to make fewer payments, so they’ll offer higher monthly payouts. For example, someone who purchases an annuity at 60 may receive a lower payout than someone who buys it at 70.

2. Gender

Annuities are actuarially priced, meaning they are based on statistical life expectancies. Since women, on average, live longer than men, they typically receive lower monthly payments for the same lump sum.

3. Interest Rates

Annuity rates are influenced by the current interest rate environment. When interest rates are higher, annuities tend to offer higher payouts because the insurance company can earn more money from its investments. If you purchase an annuity when interest rates are low, your payout will be smaller.

4. Inflation Protection

Some annuities come with inflation protection, meaning that your monthly payout increases over time to keep pace with inflation. However, these annuities often come with lower starting payouts. While it may seem like a good idea to ensure your payout keeps up with rising prices, it’s important to weigh the tradeoff between higher initial payouts and the potential future benefit of inflation-adjusted payouts.

5. Duration and Type of Annuity

- Immediate Annuity: This starts paying out as soon as you make the investment. If you want to start receiving income immediately, this is a great option.

- Deferred Annuity: You receive payments starting at a later date, usually after a few years. Because you’re waiting for the income to begin, these annuities often offer larger monthly payments once the payouts start.

6. Payment Options

You can choose different payout options, such as:

- Lifetime payments: Payments continue for the rest of your life, no matter how long you live.

- Fixed term: Payments stop after a specified period.

- Joint life: If you’re married, you can opt for payments that continue as long as one spouse is alive.

7. Other Features

Some annuities come with additional options like death benefits or long-term care riders, which allow your heirs to receive the remaining value of the annuity if you pass away early, or provide funds for long-term care needs. However, these features usually come at an added cost.

Annuity Alternatives to Consider

While annuities are a great option for many, they’re not the only game in town. Here are a few alternatives to consider if you’re looking for income in retirement:

- Dividend-Paying Stocks: These can provide regular income through dividends. While they’re not as guaranteed as an annuity, they offer more potential for growth and flexibility. With dividend-paying stocks, you can also benefit from potential stock price appreciation, something that annuities don’t offer.

- Bonds: Bonds pay a fixed amount of interest over time. Municipal, corporate, and government bonds can all be great options for low-risk income. Bonds offer less risk than stocks but don’t carry the guarantee of lifetime income that annuities do.

- Real Estate: Owning rental property or investing in real estate investment trusts (REITs) can provide a steady income stream. Real estate has historically been a strong performer, though it can require more active management.

- Systematic Withdrawals: Instead of locking your money into an annuity, you can choose to withdraw a set amount each month from your retirement savings. However, you’ll need to make sure you manage your withdrawals to avoid running out of money. A good rule of thumb is the 4% withdrawal rule, which suggests taking 4% of your savings annually to ensure the longevity of your funds.

Common Mistakes to Avoid When Purchasing an Annuity

Here are some common pitfalls to watch out for when buying an annuity:

- Not Understanding Fees: Some annuities come with high fees, such as surrender charges or administrative costs. Always read the fine print to understand how much you’ll pay.

- Not Shopping Around: Different insurance companies offer different terms and rates. Always compare offerings before making a commitment.

- Overlooking Inflation: If your annuity doesn’t adjust for inflation, you could find your monthly payout losing purchasing power over time. Make sure to factor in inflation.

- Not Considering Alternatives: Annuities aren’t the only option for generating retirement income. Make sure you consider all your options to find what works best for you.

How to Shop for the Best Annuity?

When shopping for an annuity, it’s important to take the following steps:

- Evaluate Your Needs: Do you need income for life, or are you just looking for a specific term? Decide on what fits your retirement goals.

- Compare Different Providers: Different insurance companies offer different rates. Compare these and consider their financial strength (you can check ratings at agencies like A.M. Best or Standard & Poor’s).

- Understand Your Annuity’s Terms: Ensure you understand any potential fees, the payout structure, and whether it includes inflation protection or other riders.

- Consult a Financial Advisor: If you’re unsure whether an annuity is right for you, a financial advisor can help you navigate the options and find the best fit for your retirement.

Retired? Don’t Panic—Smart Strategies for Withdrawing Savings During Market Volatility

Retiring in These States? You’ll Need Over $1 Million Just to Cover the Basics

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!