UK Pension Tax Cliff Poses Tough Retirement Choices Amid Assisted Dying Debate: Planning for retirement should feel like preparing for a well-earned rest. But in the UK, it’s quickly turning into a high-stakes situation—especially if you’re approaching age 75. The term causing all the drama? The “pension tax cliff.” This isn’t just accounting jargon—it could cost families thousands, even hundreds of thousands of pounds, depending on when a loved one passes away. Combine that with the ongoing scrutiny around assisted dying laws, and the issue becomes ethically loaded too. Retirement shouldn’t mean spending your final years worrying about tax traps or whether your passing date is “on your side.” This updated guide delivers essential insights, actionable advice, and deeper comparisons to help both families and professionals prepare confidently.

UK Pension Tax Cliff Poses Tough Retirement Choices Amid Assisted Dying Debate

The UK pension tax cliff isn’t just about numbers—it poses existential questions for retirees, families, and financial professionals alike. Dying a day too late shouldn’t cost a family their inheritance. But unless you plan now, it just might. By understanding the rules, making smart financial moves early, and watching legislative updates, retirees can protect their legacy—and reduce anxiety. And remember: when it comes to taxes and assisted dying, no decision should be shaped by financial pressure alone. Take charge now. Talk to the experts. And give yourself—and those you love—the gift of certainty before 2027 rolls in.

| Key Point | Details |

|---|---|

| Pension Tax Cliff | Pensions passed on after age 75 may face both inheritance tax (40%) and income tax, potentially eroding 60–90% of the value |

| Personal Allowance Freeze | Stuck at £12,570 until at least 2028; state pensions alone are projected to exceed that by 2027 |

| Death Timing Matters | Dying before 75 = tax-free pension inheritance; dying after = potential double tax hit |

| Assisted Dying Laws | Ongoing debate in England and Wales brings financial timing into ethical decisions |

| 2027 Policy Reform | Pension wealth counts toward inheritance tax on deaths aged 75+, unless withdrawn early |

| Consultation & Safeguards | MPs and charities pushing for protections to ensure tax rules don’t influence end-of-life choices |

| Strategic Planning Tips | Early withdrawals, gifting, ISAs, trusts, updating nominees, working with advisors |

| Official Source | Gov.uk – Inheritance Tax and Pensions |

What Is the UK Pension Tax Cliff?

If you die before hitting age 75, a defined contribution pension (such as a SIPP or private pension pot) can be passed on tax-free. That’s right—no income tax, no inheritance tax, no deductions.

But die at age 75 or later, and your pension pot hits a double whammy:

- It enters your estate, potentially triggering inheritance tax at 40%.

- Your beneficiaries may owe income tax, paying between 20% and 45% when they start taking the money out.

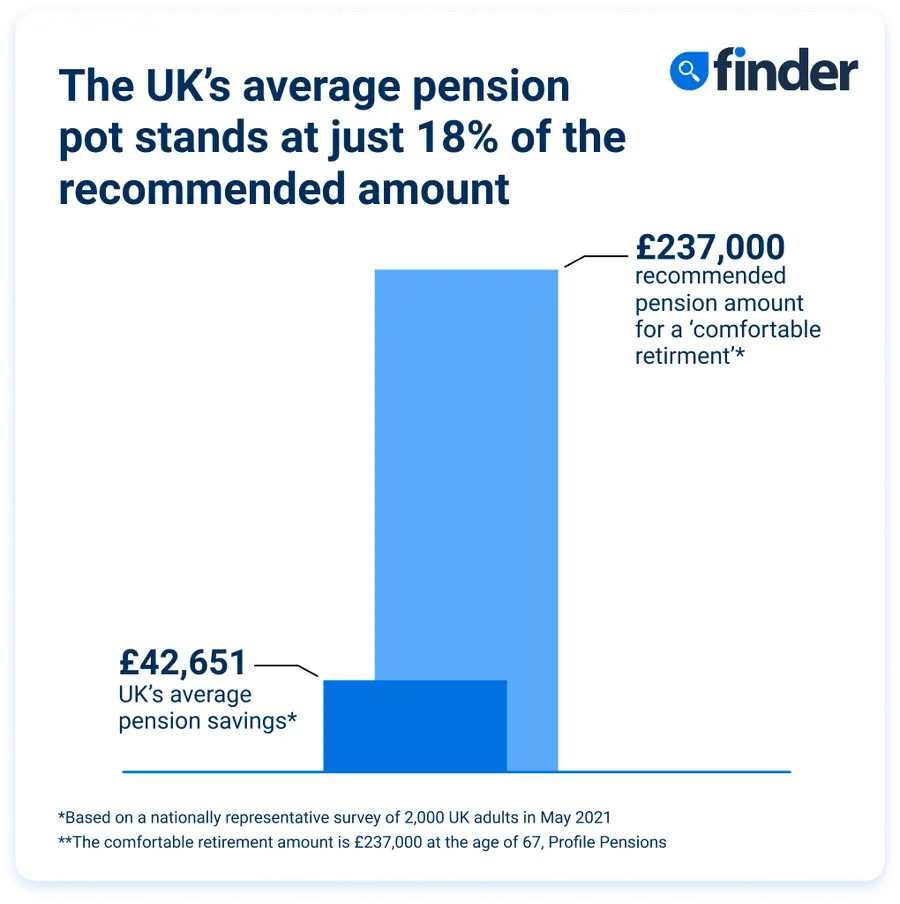

Imagine a £500,000 pension pot. If you die before 75, your loved ones could receive the full amount. If you die after, it might shrink by £200,000 or more in taxes. The message: even dying one day too late could devastate a family’s inheritance.

Mike Ambery of Standard Life puts it bluntly: “It’s not just unfair—it’s unpredictable. Families could lose £200,000+ simply due to timing.”

Why More Pensioners Are at Risk?

1. Rising State Pensions + Frozen Allowance

The UK personal allowance, which lets you earn up to £12,570 tax-free, hasn’t changed since 2021. Meanwhile, pension increases are tied to the triple lock, which ensures payouts rise annually by inflation, wage growth, or 2.5% (whichever is highest).

By April 2027, the state pension alone is expected to exceed the personal allowance, meaning pensioners will pay income tax before they even touch private pensions.

- Nearly 2.5 million pensioners could be paying tax on just their state pension by 2027.

- The average new bill is expected to be around £63 annually.

2. The 75-Year “Death Tax” Cliff

Before 75, pension pots are tax-free to pass on—but after 75, they become headline victims of both income and inheritance tax.

The sudden switch sounds extreme, but it’s the reality: families can lose up to 60–90%, just based on when someone dies.

Assisted Dying Legislation: The Financial-Ethics Intersection

In England and Wales, proposals are under review to legalize assisted dying for terminally ill individuals under strict safeguards. That’s a profound debate on its own. But when you layer financial factors on top, the stakes feel even higher.

For example:

- Will a terminally ill person nearing 75 feel pressured to set a date for financial reasons?

- Could families find themselves weighing tax savings against the value of extra time?

- Will tax experts and policymakers ensure assisted dying isn’t influenced—even indirectly—by financial considerations?

Rachel Vahey from AJ Bell emphasizes that while pensions alone won’t drive end-of-life choices, “insurance and strong safeguards must ensure financial pressure isn’t a factor in assisted dying.”

Five Smart Moves Before 2027

Here’s how retirees and families can act now:

Strategy 1: Begin Drawing Down Before Age 75

Instead of letting your pension pot sit untouched, consider making modest withdrawals while you’re still under 75. This helps shrink the pot and reduce exposure to future taxes.

Strategy 2: Annual Gifting and Long-Term Exemptions

You can gift up to £3,000 tax-free each year. Plus, larger gifts survive for seven years before inheritance tax applies. A little forethought now can save tens of thousands later.

Strategy 3: Nominate Beneficiaries Clearly

Ensure pension provider forms are updated to avoid probate delays or defaulting rules. This can save both time and taxes—and reduce stress for your heirs.

Strategy 4: Use ISAs and Trusts

Moving money into ISAs gives tax-free growth and inheritance. Trusts offer structured ways to pass wealth while limiting tax liabilities. Both can be powerful tools for strategic estate planning.

Strategy 5: Consult an Experienced Financial Advisor

These rules are nuanced—getting help from an expert can dramatically improve outcomes. Advisors can tailor withdrawal, gifting, and saving strategies to your situation.

Comparing the UK System to the U.S.

To put this in perspective:

The U.S. Retirement System:

- Roth IRAs can be passed tax-free (after a 5-year holding requirement).

- Required Minimum Distributions (RMDs) start at age 73 for traditional IRAs.

- Estate taxes apply only to estates over about $13 million (in 2025), with no separate inheritance tax.

The UK System:

- Full tax-free pension inheritance is lost at age 75.

- State pensions are becoming taxable due to personal allowance freezes.

- Post-75 inheritance tax follows quickly, even for moderate-sized estates.

Bottom line: the UK’s system is steep, sudden—and likely to hurt more families than U.S. rules do by comparison.

What Experts and Think Tanks Want to Change?

Think tanks like the Institute for Fiscal Studies (IFS) advocate for fairer, smoother taxation rules:

Reform Proposals:

- Apply consistent tax treatment on pension death benefits—no “jump” at 75.

- Limit total tax exposure so it never exceeds 55%.

- Require providers to proactively warn pension holders approaching age 75.

These changes wouldn’t eliminate tax—they’d just make it predictable, fair, and free from moral hazards.

UK Pension Alert: Millions of Savers Unknowingly Losing Money to Hidden Fees – Are You One of Them?

Rachel Reeves’ Pension Megafund: A £6,000 Boost or a Gender Pay Gap in Disguise?

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

Final Checklist for Action Today

- Calculate your total pension value and possible tax burden.

- Meet with a tax-savvy financial planner.

- Begin drawing down pension funds if you’re approaching age 75.

- Regularly update nomination forms across all providers.

- Use gifting allowances, ISAs, and trusts where appropriate.

- Stay informed about April 2027 implementation and any legislative changes.