Thousands of Pensioners Missing Out on £694 Boost: If you were born after 1951 and are approaching or have reached retirement age, here’s something that could put extra cash in your pocket—£694 per year, for life, just by deferring your State Pension. That’s real, government-approved money that many pensioners are simply not claiming.

This little-known strategy—State Pension deferral—lets you delay claiming your pension to receive more money later. It’s especially useful if you’re still working, have savings, or don’t need your pension right away. Thousands of eligible people are missing out, often because they’ve never even heard of it. Let’s break down what it is, how it works, who should use it, and how to get started. Whether you’re a retiree, family caregiver, or financial adviser, this guide will help you understand and act with confidence.

Thousands of Pensioners Missing Out on £694 Boost

Navigating retirement can feel overwhelming. Between forms, rules, and financial choices, it’s easy to miss out on things like the £694 pension boost. But here’s the good news: it’s not too late to take a breath, step back, and make a smart decision that fits your life. If you’re still working, in good health, and don’t need your pension just yet, holding off for a bit could pay off big time in the long run. Think of it like planting a seed that grows into a little extra income—year after year.

But if you’re someone who needs that money now, or you’re managing on a tight budget, that’s totally valid too. In that case, checking out Pension Credit or other support could be a real game-changer. The bottom line? This isn’t about rushing a decision—it’s about knowing your options, and choosing what works best for you. You’ve worked hard for this moment. You deserve every penny, every bit of peace of mind, and every opportunity to live the retirement you’ve earned. Take five minutes today to check your pension forecast, or have a chat with someone you trust. A small step now could make a big difference in your future.

| Topic | Details |

|---|---|

| Who’s Eligible? | Men born on/after April 6, 1951; Women on/after April 6, 1953 |

| Amount Missed | £694.20 per year (~£13.35 weekly after deferring one year) |

| Current State Pension | £221.20/week (as of 2025) |

| Deferral Increase | 1% every 9 weeks deferred (~5.8% per year) |

| How to Qualify | Must reach State Pension age after April 6, 2016 |

| Claim & Info | gov.uk/state-pension |

| Extra Help | Pension Credit |

How the State Pension System Works in the UK?

The UK State Pension is a regular payment from the government to people who’ve reached retirement age and paid or been credited with enough National Insurance (NI) contributions.

There are two systems:

- Basic State Pension: For those who reached retirement age before April 6, 2016.

- New State Pension: For those retiring after that date. This is the group eligible for deferral increases.

You typically need:

- At least 10 qualifying years of NI contributions to get anything.

- 35 qualifying years to receive the full new State Pension, currently set at £221.20 per week (2025–26 tax year).

What Is State Pension Deferral?

Deferral means delaying your claim for your State Pension. The longer you wait, the more you’ll receive weekly when you finally start drawing it.

For example, if you defer for:

- 9 weeks: Pension increases by 1%

- 1 year: Pension increases by approximately 5.8%

- That means an additional £694.20 per year if you’re entitled to the full pension

This increase continues for the rest of your life.

Should You Defer or Claim Immediately? A Decision Checklist

Use this quick checklist to see if deferring makes sense for you:

Reasons to Defer

- You’re still working and don’t need the money yet.

- You have other income (e.g. private pension, savings).

- You’re in good health and expect to live for another 15–20 years.

- You want to maximize long-term income.

- You want to reduce your current tax bill by keeping your income lower this year.

Reasons to Claim Now

- You need the income immediately.

- You have a shortened life expectancy due to health concerns.

- You qualify for Pension Credit or other means-tested benefits (which could be affected by deferral).

- You live in a country where deferred pension increases won’t apply.

Pros and Cons of Deferring Your Pension

| Pros | Cons |

|---|---|

| Increases your pension for life | You miss out on short-term income |

| Great for healthy or high-earning retirees | If you die early, you may lose out financially |

| Automatically deferred unless claimed | No lump sum option (for those who retire after 2016) |

| Helps manage tax if still working | Doesn’t suit those relying on income-based benefits |

Real-Life Case Studies

Tony: Still Working at 66

Tony works part-time and defers his pension for 1 year. His weekly pension jumps from £221.20 to around £234.55. That’s £694 extra every year for life. If he lives 20 more years, that’s nearly £14,000 more in retirement.

Mary: Living on Low Income

Mary takes her pension immediately and applies for Pension Credit. She receives £3,900/year extra in benefits and qualifies for a free TV license and housing support.

Deferring wouldn’t have helped Mary, but Pension Credit made a big difference.

What Happens If You Already Claimed But Want to Stop?

You’re allowed to cancel your pension claim if you’ve started receiving payments within the past 12 months. You’ll have to repay everything you’ve received, and then you can defer to boost your future payments.

After 12 months, you cannot cancel—your pension becomes fixed.

How This Affects Couples or Surviving Partners

If you defer your pension and later pass away, your surviving spouse or civil partner may be able to inherit the increased amount, but only under certain conditions. For example:

- If you deferred the old State Pension, a lump sum might be paid out.

- If you’re under the new system (post-2016), survivors might inherit the increase only if certain rules apply.

Other Benefits to Consider

Pension Credit

If your weekly income is below:

- £218.15 (single) or

- £332.95 (couple)

…you might be eligible for Pension Credit, worth about £3,900 annually. It also opens the door to:

- Free dental care

- Cold Weather Payments

- Council Tax reductions

Attendance Allowance

If you have a disability or need help with daily tasks, Attendance Allowance provides extra money and is not means-tested.

State Pension Age Could Soar to 70—Triple Lock Under Threat in Shocking New Forecast

State Pensioners Born Before 1959 Set to Receive £1,362 in Surprise Extra Benefits

DWP Bonus: State Pensioners Could Get Extra £230 – But Only If You Tick These Boxes

How to Apply for or Defer the Thousands of Pensioners Missing Out on £694 Boost?

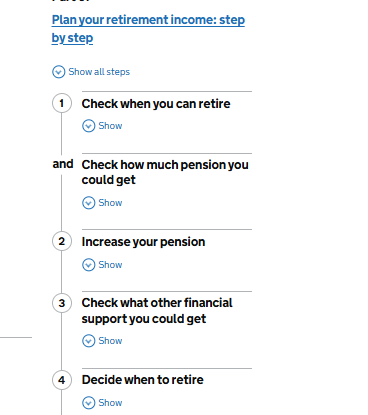

1. Get Your Pension Forecast

Use Check your State Pension to see what you’re eligible for.

2. Decide Whether to Defer

If you do nothing, your pension is automatically deferred.

3. Claim When You’re Ready

- Online: gov.uk/get-state-pension

- Phone: 0800 731 7898

- By post: Fill out form BR1

You’ll start receiving your higher payments once your claim is processed.