Viral Ring Trick Is Flipping Financial Education on Its Head: The phrase “Say Goodbye to Budget Stress” has taken on a new twist with the emergence of a surprising financial hack: the Viral Ring Trick. It’s been lighting up TikTok, Reddit, and even YouTube comment threads, sparking debates across generations. From finance gurus to everyday savers, folks are either impressed or concerned.

So, what is this all about? In plain English, it’s a clever use of credit cards, loan leverage, and return policies that some claim can help you score “free cash.” But is it too good to be true? Let’s walk through the logic, the math, the risks, and safer alternatives, so you can decide if this “hack” is helpful or hype.

Viral Ring Trick Is Flipping Financial Education on Its Head

The viral ring trick is a masterclass in financial creativity, but it’s not a silver bullet. Sure, you can squeeze a few hundred bucks out of it, but you also risk triggering high-interest debt, damaging your credit, or worse—getting stuck with a piece of jewelry you never wanted in the first place. For most people, building strong habits—saving automatically, budgeting smart, and investing patiently—pays off far more than any viral hack. If you want true financial freedom, the answer isn’t tricks. It’s clarity, consistency, and control.

| Topic | Summary & Stats | Professional Insight | Official Source |

|---|---|---|---|

| The ring trick in a nutshell | Buy a ring using a 0% APR credit card, appraise it, get a loan using it as collateral, then return the ring for a refund—keep the loan. | It’s a type of short-term arbitrage with razor-thin margins. | Consumer Financial Protection Bureau |

| Potential profit | ~4% annual yield = ~$440/year on $11,000, if managed perfectly. | Returns are minor, but risks can be major. | Investopedia |

| Major risk | A missed return deadline or unexpected fees can lead to 20%+ APR interest and loss. | One error can cancel the benefit entirely. | [Card Issuer Policies] |

| Who should try | Only highly organized, financially literate individuals. | Not for beginners, students, or debt-strapped consumers. | — |

| Safer alternatives | High-yield savings, CDs, balance transfer cards, budgeting tools. | Consistent, predictable strategies outperform gimmicks. | NerdWallet |

What Is the Viral Ring Trick?

At its core, the viral ring trick is a form of credit arbitrage—using one type of financial product to access another, with the intent of profiting off the difference.

Here’s how it typically plays out:

- Buy an expensive engagement ring using a 0% APR credit card—these often come with a 12–18 month promotional period where no interest is charged.

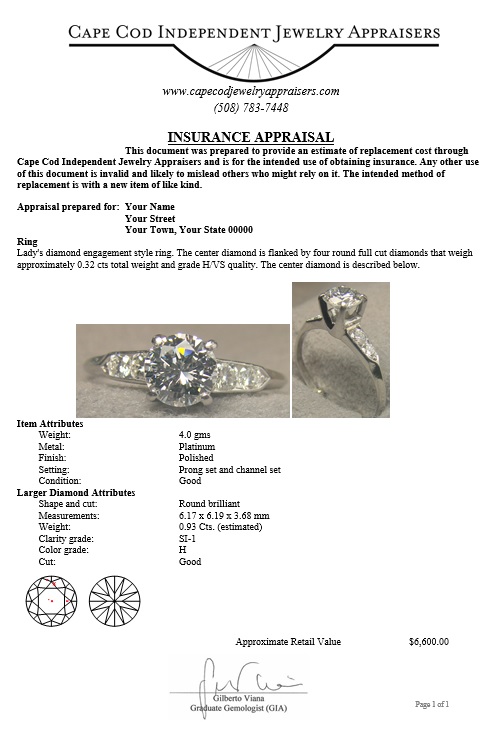

- Immediately get the ring appraised by a certified jeweler.

- Use that appraisal to secure a personal loan—often through peer-to-peer lending or jewelry-secured loan programs.

- Pay off the credit card with the loan funds before any interest is incurred.

- Return the ring within the retailer’s return window (usually 30 to 90 days).

- Meanwhile, stash the borrowed funds in a high-yield savings account, collecting 4–5% annual interest.

- Repay the loan slowly over time while pocketing the interest difference.

In theory, it’s a no-risk profit move. But reality, as usual, comes with layers.

Where Did This Idea Come From?

This financial “trick” went viral after a Redditor in NYC detailed his experience on a personal finance subreddit. He claimed to have made around $400 in interest on borrowed funds while returning the ring before his 90-day return period expired.

The story spread quickly, with TikTok influencers mimicking the steps and calling it a “loophole the banks don’t want you to know.”

But financial advisors weren’t sold. Dave Ramsey himself called it “over-engineered” and “pointless.” He pointed out that the energy it takes to pull this off isn’t worth the minor financial reward.

Real-Life Scenario: Nick’s $11,000 Ring Flip

Nick, a marketing professional with an 800+ credit score, shared how he did this:

- Bought an $11,000 ring from a major jewelry chain using a Chase Freedom card with 0% APR for 15 months.

- Paid $95 for a certified appraisal, which valued the ring at $10,000.

- Took out a secured loan for $7,500 based on the appraisal.

- Used the loan funds to pay off the card before any interest was charged.

- Returned the ring on day 85 of a 90-day return policy.

- Left the $7,500 in a 4.35% APY account at Ally Bank for 12 months.

- Total earned: ~$326 in interest (after subtracting appraisal cost and a small loan fee).

While it worked, Nick admitted it was “a one-time stunt that only makes sense if you already know what you’re doing.”

Step-by-Step Breakdown: How the Viral Ring Trick Is Flipping Financial Education on Its Head Works

Step 1: Apply for a 0% APR Credit Card

Find a card with at least 12–15 months of no interest on purchases. Cards like Citi Simplicity or Chase Freedom Flex often have rotating deals.

Step 2: Buy a Returnable Ring

Choose a jewelry store with a clear, generous return policy—ideally 60–90 days. Avoid clearance or custom pieces with no refund eligibility.

Step 3: Appraise the Ring

Go to a GIA-certified appraiser. Get a written valuation to use as collateral for a loan. Expect to pay around $50–$150 for this service.

Step 4: Secure a Personal Loan

Use online lenders like LendingClub or platforms such as LightStream. Ensure the rate is lower than your expected savings APY.

Step 5: Pay Off the Credit Card

Use the loan funds to pay off your credit card before the 0% APR window closes.

Step 6: Return the Ring

Return the item within the return window, receive your refund to cover the loan or keep in savings.

Step 7: Collect Interest and Repay the Loan

With no card debt and the refund in savings, pay back the loan over time, collecting small gains in interest.

Risks: What Could Go Wrong?

The trick sounds smooth, but there are significant risks you must consider.

Missed Deadline

If you miss the return window—by even a day—you’re stuck with an expensive ring and a loan.

Credit Score Dip

Buying an $11,000 ring on credit can spike your utilization ratio, temporarily hurting your FICO score.

Lower Appraisal

Appraisers often give conservative estimates. If your ring appraises for $8,000 instead of $11,000, your loan amount shrinks.

Interest Backfire

If your timing is off, you might trigger the end of the 0% APR period—resulting in retroactive interest at 18%–24%.

Legal and Ethical Concerns

Some financial institutions may consider this kind of behavior “abuse” or “gaming the system.” While not illegal, it can lead to account closures or blacklisting from future promotions.

Who Should Actually Try This?

Let’s be honest: this trick isn’t for everyone.

Ideal for:

- Professionals with high credit scores and solid savings

- People familiar with interest rates, APRs, and loan contracts

- Individuals who are ultra-organized and track every due date

Avoid if:

- You struggle to pay off credit card debt

- You’re new to managing multiple financial products

- You tend to forget due dates or don’t like reading fine print

Safer, Smarter Alternatives

Even if this trick isn’t your jam, here are proven alternatives that work for almost everyone:

High-Yield Savings Accounts

Earn 4–5% interest just by parking your cash. Try banks like Ally, Capital One 360, or Discover.

Balance Transfer Credit Cards

These cards let you transfer existing debt to a 0% APR card—helpful for escaping high-interest charges.

Certificates of Deposit (CDs)

Lock in your money for 6–12 months with fixed interest returns, now often over 5%.

Side Hustles

Sometimes, it’s easier to earn $400 doing a weekend gig than manipulating credit products.

Budget Automation

Use tools like YNAB or Mint to gain control of your finances with zero risk.

Feeling the Squeeze? 10 Smart Financial Moves to Survive Economic Uncertainty

8 Proven Strategies to Stay Financially Afloat When Times Get Tough

Not Gold, Not Copper—Egyptians Used Iron From Space in Sacred Objects, New Study Reveals