Retirement Pyramid May Be the Perfect Blueprint: When planning for retirement, most of us think about one thing: money. Whether you’re 30 or 60, ensuring that you’ll have enough savings to enjoy your golden years without worry is a big deal. The good news is there’s a simple, structured way to maximize your income and minimize stress – and it’s called the Retirement Pyramid.

The Retirement Pyramid is a modern approach to retirement planning that helps you create a solid, stress-free financial foundation. It’s like building a house: you start with a strong base, then add layers of income sources to protect yourself from market volatility, health issues, or unexpected expenses. This strategy isn’t just for the rich; anyone can use it to ensure a comfortable, secure future. So, whether you’re just starting to plan or you’re already in retirement, understanding the Retirement Pyramid can help you make smarter decisions about your finances.

Retirement Pyramid May Be the Perfect Blueprint

Building a Retirement Pyramid isn’t just about saving; it’s about designing a financial future that’s secure, reliable, and flexible. By layering income sources and focusing on diversification, you can reduce stress, manage risk, and ensure that you can live comfortably, no matter what the future holds. The Retirement Pyramid offers a clear, straightforward method to structure your retirement strategy so that you’re prepared for whatever life throws your way. Whether you’re new to retirement planning or you’ve already accumulated a significant nest egg, this method can help ensure that your golden years are truly stress-free.

| Key Takeaways | Details |

|---|---|

| Concept | The Retirement Pyramid offers a structured approach to managing retirement income with guaranteed, reliable streams at the base and growth potential at the top. |

| Base Level | Guaranteed income like Social Security, pensions, and annuities that cover essential living expenses. |

| Middle Level | Income-producing assets such as dividend stocks, bonds, and rental properties that provide regular income. |

| Top Level | Growth-oriented investments like stocks or business ventures, offering potential for appreciation and legacy goals. |

| Benefits | Reduces reliance on one income stream, offers peace of mind, and ensures income stability. |

| Strategy | Diversifying income sources, regularly reviewing your plan, and tailoring your assets to fit your lifestyle. |

What is the Retirement Pyramid?

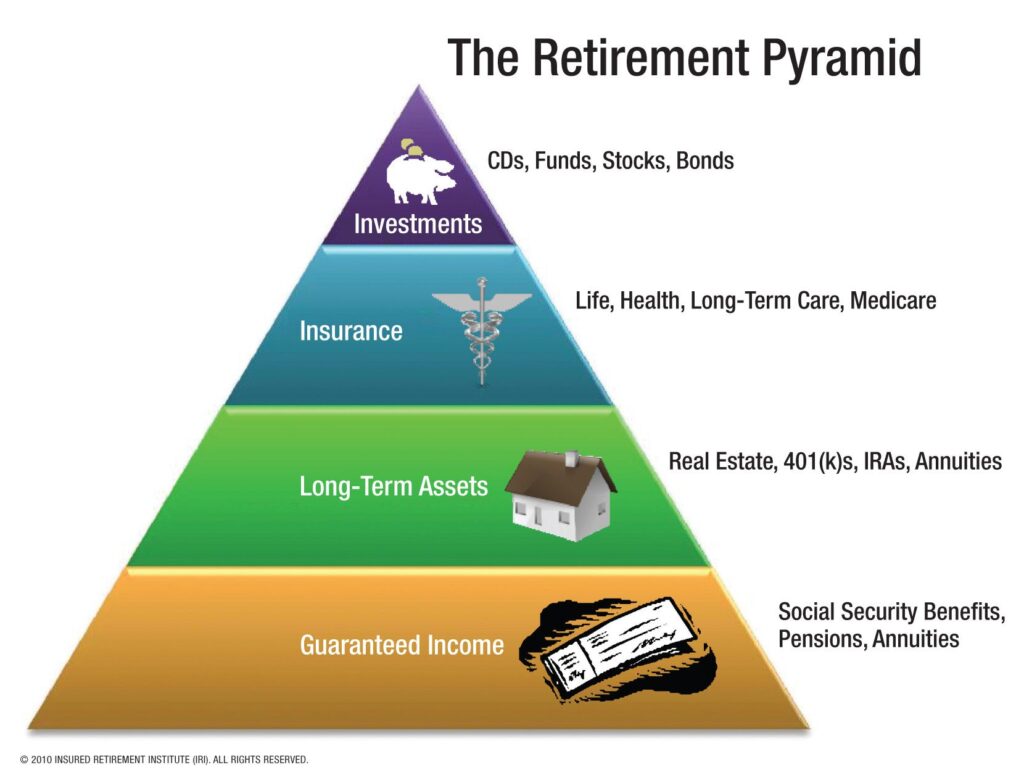

Picture this: you’ve spent years saving, working, and planning for your retirement. You’ve got a nice nest egg, but how do you make sure it lasts without stressing about market fluctuations, health costs, or running out of money? The Retirement Pyramid is here to help. This model divides your income sources into three distinct levels, each with a different purpose, so you can build a strategy that’s flexible, reliable, and designed for long-term success.

The Three Levels of the Retirement Pyramid

- The Base Level – Guaranteed Income Sources

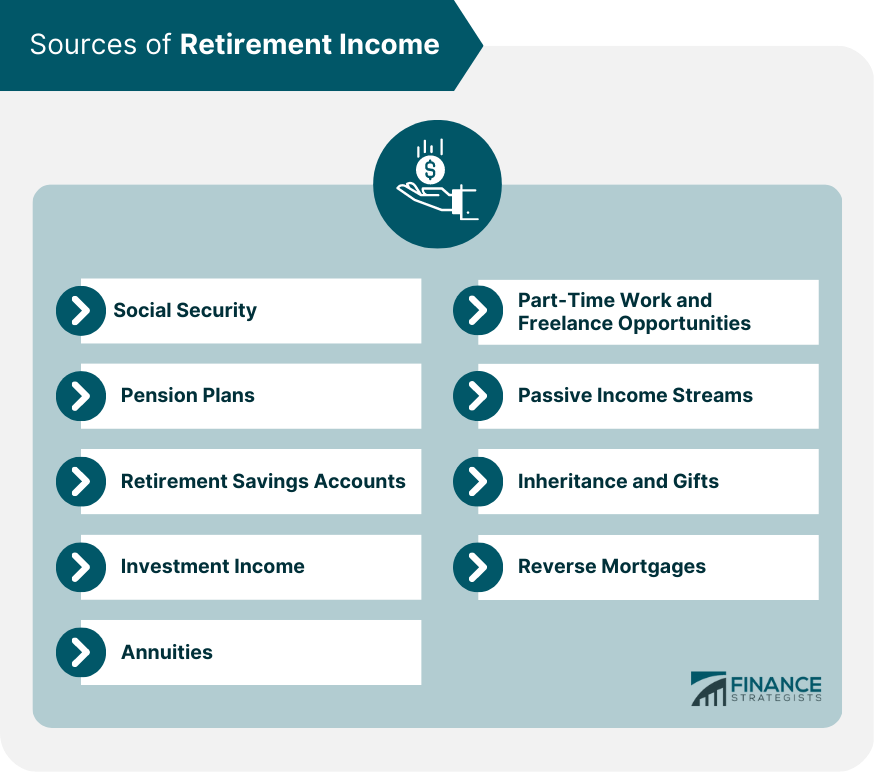

At the bottom of the pyramid lies the most essential part of your financial foundation: guaranteed income. This is money that you can rely on, no matter what. Think of Social Security, pensions, or annuities. These sources are reliable and can help cover your basic living expenses. The beauty of this level is that it takes a lot of the pressure off your investments. When you know your essentials are covered, you have the freedom to focus on growth in the upper levels of the pyramid.

Example:

Let’s say your monthly expenses are $2,500. You have Social Security bringing in $1,500, and you’ve also got a small pension or annuity that gives you another $800. That means $2,300 of your $2,500 in expenses are already covered. With just $200 to cover from your savings or investments, you can breathe easy, knowing your essential needs are covered no matter what happens in the market.

- The Middle Level – Income-Producing Assets

The second layer of the pyramid includes income-producing investments. These could be rental properties, dividend-paying stocks, or bonds. These assets can provide a steady stream of income and allow for flexibility in your strategy. If you’re still working, this could be a great way to boost your savings. If you’re already retired, this level can provide additional income to supplement your base-level sources.

Example:

Let’s say you own a rental property that brings in $1,000 a month, or you have $200,000 invested in dividend stocks that generate $6,000 annually. This extra income helps to cover discretionary spending—things like travel, hobbies, or spoiling the grandkids—without dipping into your savings.

- The Top Level – Growth-Oriented Investments

The top of the pyramid is for growth. This layer consists of riskier investments, like stocks, mutual funds, or even small business ventures. These investments won’t necessarily provide regular income in the short term, but they have the potential for long-term appreciation. This is where you can aim to grow your wealth or leave a legacy for future generations.

Example:

You’ve invested in a diversified stock portfolio that’s grown by 7% a year on average. While the returns aren’t guaranteed, the long-term growth of your investments can provide a substantial nest egg to leave your children or use for larger purchases in the future.

Why Does the Retirement Pyramid Work?

The beauty of the Retirement Pyramid is its simplicity. It’s built to reduce your reliance on any one source of income. By ensuring that you have guaranteed income at the base, you can handle market downturns without worry. The middle and top levels are designed to provide more flexibility and growth potential.

Let’s break down why this method works:

1. Diversification Reduces Risk

Think of it this way: if you put all your eggs in one basket, and that basket falls, you could be in trouble. But if you spread your eggs out—say, across a few baskets—then even if one basket falls, you’re still okay. The Retirement Pyramid ensures you don’t rely solely on your savings or just on Social Security. With multiple income streams, you’re better prepared for whatever life throws your way.

2. Guaranteed Income Provides Peace of Mind

The stress of worrying about running out of money in retirement is real. But by ensuring that essential living expenses are covered by guaranteed sources like Social Security and pensions, you remove a lot of that worry. With this peace of mind, you’re free to enjoy your retirement without constantly checking the stock market.

3. Flexibility to Adapt

Life isn’t static, and neither should your retirement plan be. The pyramid allows you to adapt. Whether your health changes, market conditions fluctuate, or you just want to pursue a new passion project, the pyramid gives you the flexibility to adjust your income sources and strategy as needed.

Additional Tips for Implementing the Retirement Pyramid

Now that you understand the basics of the Retirement Pyramid, here are a few tips to help you make it work for you:

1. Start Early

It’s never too late to start planning, but the earlier you begin, the more time your investments have to grow. Even if you’re just starting your career, consider putting aside a portion of your income into long-term growth assets. Time is your biggest ally.

2. Work with a Financial Advisor

While the Retirement Pyramid is a powerful framework, it’s important to personalize it to your specific situation. Working with a financial advisor can help you determine how much of your income should be allocated to each level of the pyramid, taking into account your unique financial goals, risk tolerance, and retirement timeline.

3. Reassess Regularly

Life changes, and so should your retirement plan. Regularly reassess your pyramid to make sure it’s still aligned with your goals. If your income-producing assets aren’t performing as expected or if you’ve experienced a major life change, like health issues or divorce, adjusting your pyramid can keep you on track.

4. Consider Inflation and Healthcare Costs

As you plan for retirement, don’t forget to factor in rising costs, especially healthcare. With inflation and healthcare costs rising every year, it’s important to adjust your pyramid accordingly. This might mean allocating more resources to growth-oriented investments or finding additional income sources to cover the increased costs.

Retired? Don’t Panic—Smart Strategies for Withdrawing Savings During Market Volatility

Retiring in These States? You’ll Need Over $1 Million Just to Cover the Basics

Social Security Payments Frozen for Some Retirees—Do You Owe These Debts?