New Magic Number You’ll Need for a Comfortable Retirement: When it comes to retirement planning, there’s a number that keeps coming up—$1 million. For years, people have been told that in order to retire comfortably, they need to save up at least $1 million. But here’s the thing: that’s no longer the magic number. As times change and the cost of living continues to shift, the amount you need for a comfortable retirement may not be as high as you think. In fact, new data shows that the ideal retirement savings goal is lower than many expected. So, what’s the new magic number? And how can you plan accordingly? In this article, we’re going to dive deep into what the new “magic number” for retirement really is, the factors that can impact your savings goal, and practical advice to help you reach your retirement dreams. Whether you’re a 25-year-old just starting to save or a 50-year-old planning for a second career, you’ll find useful insights here. Let’s get started!

New Magic Number You’ll Need for a Comfortable Retirement

The new magic number for retirement isn’t a fixed $1 million anymore. It’s now estimated that you’ll need about $1.26 million to retire comfortably, but remember that everyone’s situation is different. Your retirement savings goal depends on your location, lifestyle, health, and other personal factors. Start planning early, save consistently, and don’t hesitate to consult with a professional to ensure your retirement years are stress-free and secure.

| Key Insights | Details |

|---|---|

| New Magic Number | The new average savings goal for a comfortable retirement is $1.26 million, down from $1.46 million in 2024. |

| Key Factors Affecting Savings | Location, lifestyle choices, health, longevity, and income sources all play a role in determining how much you need to retire comfortably. |

| Savings Milestones | Fidelity recommends saving: 1x income by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by retirement at 67. |

| Social Security and Pensions | Supplementing your savings with Social Security, pensions, or part-time work can lower your personal savings goal. |

| Financial Planning Tips | Start early, set realistic goals, regularly review your retirement plan, and consult with a financial advisor to stay on track. |

| Official Resources | Visit the official Social Security Administration website for more details on benefits and retirement planning resources. |

Understanding the New Magic Number You’ll Need for a Comfortable Retirement

What is the Magic Number for Retirement?

The term “magic number” in the world of retirement planning refers to the amount of money you need to have saved up in order to live comfortably after you stop working. For decades, people have been told that $1 million was the gold standard. But as the economy changes, so too does the ideal savings target. In fact, according to Northwestern Mutual’s 2025 Planning & Progress Study, the average American believes they need $1.26 million to retire comfortably. This figure is a decrease from last year’s target of $1.46 million, and it reflects a shift in both the financial landscape and people’s expectations for their retirement years.

This new number is important because it acknowledges the economic realities of 2025. Inflation is easing, and there is a sense of cautious optimism around personal finance. However, this number is still just an average. It’s based on a general understanding of what most people need, but it’s not a one-size-fits-all figure. Every individual’s situation is different.

Why Is $1.26 Million the New Target?

So, why has the number dropped? A few key factors contribute to this shift:

- Inflation and Economic Conditions: The economic landscape in 2025 is a bit more favorable than in previous years. With inflation slowing down and the cost of living stabilizing, people need less money than before to maintain a comfortable lifestyle during retirement.

- Better Financial Literacy: As more people are becoming financially savvy, there’s a better understanding of how to plan for retirement. The rise of online resources and tools has made it easier for individuals to set realistic, personalized goals.

- Shifting Retirement Expectations: Many people are rethinking what retirement looks like. Not everyone wants to retire early or live a life of luxury—many are just looking for financial security, and they may continue to work part-time or find other ways to supplement their income.

While $1.26 million is a great starting point, it’s important to consider how your personal circumstances will affect that number.

What Affects Your Retirement Savings Goal?

Location Matters

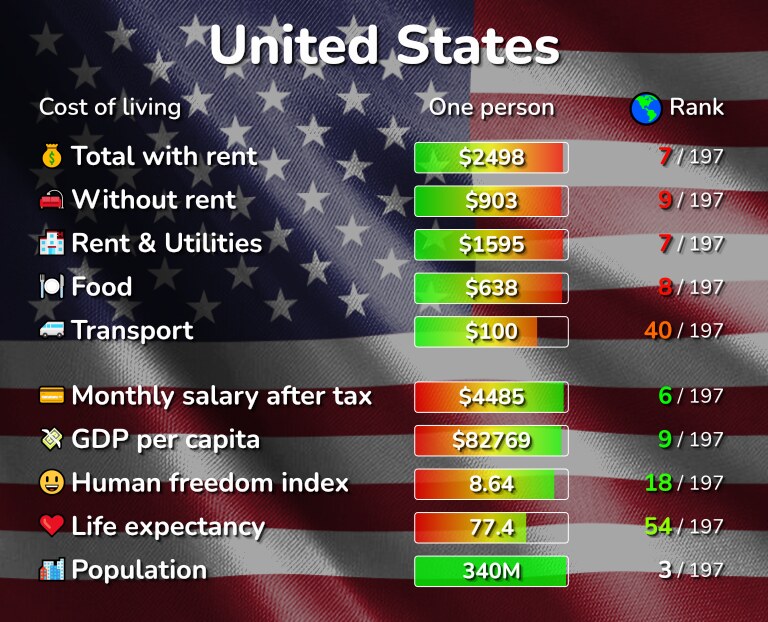

The first factor that will influence how much you need to save for retirement is where you live. Costs of living can vary widely depending on your location. For example:

- Living in expensive cities like New York, San Francisco, or Los Angeles may require a higher savings goal—especially since housing and healthcare costs are often sky-high.

- On the other hand, retiring in a city or town with a lower cost of living, like Boise, Idaho, or San Antonio, Texas, could allow you to live comfortably on a smaller retirement fund.

If you haven’t considered the cost of living in your desired retirement destination, it’s a good idea to factor this in. Websites like Numbeo can help you compare living costs in different cities. For example, housing can represent a large chunk of your budget, and where you live will determine whether you need a larger nest egg or can comfortably live with less.

Lifestyle Choices

What kind of lifestyle do you want during retirement? Are you planning to travel the world, play golf every day, or spend time with family? The more active and adventurous your retirement lifestyle, the more you’ll need to save. Here’s a breakdown:

- A Simple, Low-Cost Retirement: If you’re planning to live in a modest home, stay local, and don’t need much for entertainment, your savings goal could be lower.

- A Luxurious Retirement: If you plan on traveling, dining out frequently, or living in a larger home, you’ll need a more significant retirement fund to cover these expenses.

The key is to be honest with yourself about the life you want in retirement. Planning for your ideal lifestyle will help ensure you have enough to live comfortably. It’s also important to consider whether your ideal lifestyle will change over time. Many people find that they need less money in the later stages of retirement, so planning for flexibility is essential.

Health and Longevity

Health care is one of the most significant costs for retirees. As you age, your medical expenses are likely to increase. The average 65-year-old couple retiring today can expect to pay around $300,000 for healthcare in retirement (according to Fidelity’s Retirement Health Care Cost Estimate).

Additionally, if you live longer than expected, you may need more savings to cover living expenses. This is why it’s essential to plan for a longer life. The longer you live, the more money you’ll need. In the United States, life expectancy has been gradually increasing, with many people living well into their 80s or even 90s. It’s important to plan for these extended years.

The key takeaway here is that medical expenses can easily wipe out your savings if you’re not careful. You should look into Medicare Advantage plans and consider setting aside extra savings in a Health Savings Account (HSA) to cover health-related costs.

Income Sources Beyond Savings

Social Security, pensions, and other retirement accounts will help supplement your savings. For many people, Social Security is a crucial part of their retirement income, but it may not be enough on its own. Pensions, part-time work, or rental income can also supplement your retirement savings.

For example, the average Social Security benefit in 2025 is around $1,800 per month. This is a helpful cushion, but not nearly enough to cover most people’s expenses. You’ll need to plan how much to save in addition to this.

In addition, pensions are becoming less common, but if you have access to one, it’s important to factor that into your retirement plan. You might also consider creating additional income streams, such as renting out property, starting a small business, or working part-time.

How to Achieve Your Retirement Goals?

Start Early

The earlier you start saving for retirement, the better. Even if you’re young, contributing to a 401(k) or IRA can provide you with significant tax advantages and compound interest. The longer your money has to grow, the more you’ll have in the end.

If you start saving in your 20s, you’ll likely need to save less each year to reach your retirement goal compared to someone who starts in their 40s. The time value of money is powerful, and early savings can significantly reduce the burden later in life.

Save Consistently

Aim to save a certain percentage of your income each month. A general rule of thumb is to save at least 15% of your gross income for retirement. If you start in your 20s, this percentage may be enough to set you up for a comfortable retirement. If you’re older, you might need to save a higher percentage.

Additionally, if you have access to an employer-sponsored retirement plan, such as a 401(k), take full advantage of any employer match. This is essentially free money, and it can help you achieve your retirement goals much faster.

Review Your Plan Regularly

Retirement planning isn’t a set-it-and-forget-it type of task. You should regularly review your savings, expenses, and goals to make sure you’re on track. If your situation changes, be sure to adjust your strategy accordingly.

For example, if you receive a raise or a bonus at work, consider increasing your retirement contributions. Additionally, if you incur new financial obligations, such as caring for elderly parents, you may need to reevaluate your retirement savings strategy.

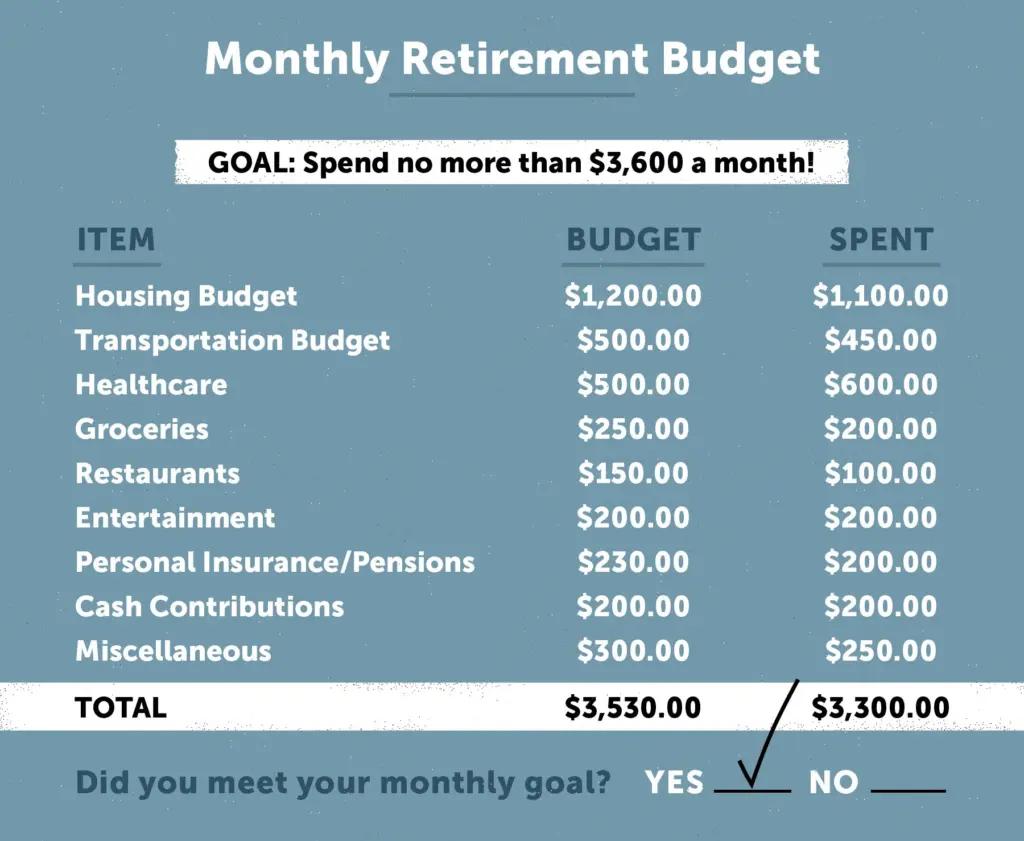

Reduce Retirement Expenses

Cutting unnecessary expenses now can make a significant impact on your retirement savings. Here are some tips for reducing your retirement costs:

- Downsize Your Home: Selling a larger home and moving to a smaller, more affordable one can free up a lot of cash for your retirement fund.

- Budget Wisely: Keeping track of your spending and finding ways to live frugally will help you save more. Apps like Mint and YNAB (You Need a Budget) can help you stay on top of your finances.

- Health Insurance: Health insurance costs can eat up a significant portion of your retirement savings. Consider options like Medicare Advantage or a Health Savings Account (HSA) to manage your healthcare costs.

Additionally, look into whether downsizing to a smaller home or relocating to a more affordable area might make sense for you in retirement. For some, selling their current home and purchasing a more modest property can be a game-changer.

Consult a Financial Advisor

Retirement planning can be complex. A financial advisor can help you create a personalized plan and offer advice on tax strategies, investment options, and how to manage your withdrawals in retirement. To find a trusted advisor, look for certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!

New GOP Retirement Plan Could Cost Millennials $420,000: What You’re Not Being Told

Terrified of Going Broke in Retirement? These 9 Expert Tips Can Save Your Future