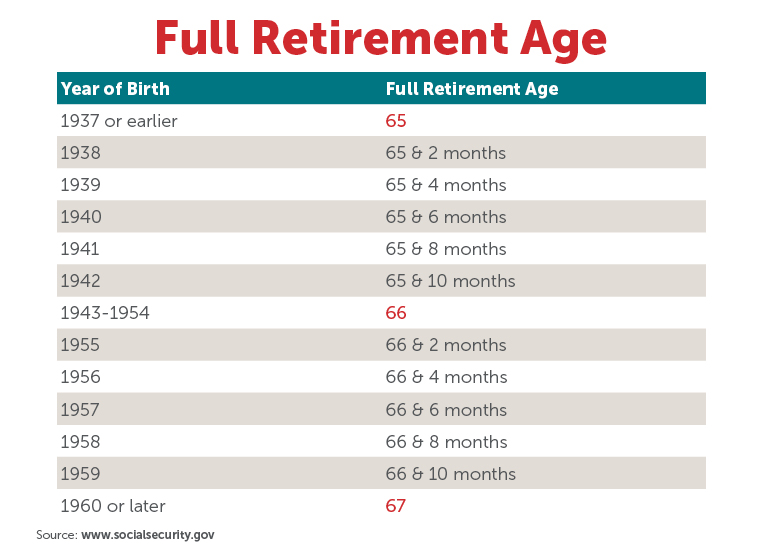

The U.S. Prepares for the Biggest Pension Reform in History: The United States is preparing for one of the most significant pension reforms in history. Social Security, which has supported millions of Americans throughout their retirement, is undergoing a series of changes that could impact how and when people retire in the future. Traditionally, 65 has been the magic number when it comes to retirement, but now, the Full Retirement Age (FRA) is being raised to 67 for those born in 1960 or later. This change is expected to be part of the broader reform that could include further increases to 69 between 2026-2033. So, what does this mean for you, whether you’re already retired or still planning for the future? Let’s dive deep into the details and explore what these changes really mean for your finances and retirement planning.

The U.S. Prepares for the Biggest Pension Reform in History

The upcoming changes to Social Security represent a major shift in how Americans will plan for retirement. With the Full Retirement Age increasing to 67 and the possibility of further increases to 69, it’s essential to adapt your retirement strategy accordingly. Whether you are nearing retirement or just starting your career, understanding these changes will allow you to make better decisions and secure a more stable financial future.

| Topic | Details |

|---|---|

| Full Retirement Age (FRA) | FRA now 67 for those born in 1960 or later; discussions about raising it further to 69. |

| Early Retirement Penalties | Claiming benefits at 62 now results in a 30% reduction in monthly payments. |

| Projected Benefit Cuts | Social Security benefits may face cuts of up to 20% by 2033 unless reform is implemented. |

| Impact on Individuals | Individuals may need to work longer to receive full benefits. |

| Legislative Developments | Monitor future legislative changes to avoid surprises. |

Why The U.S. Prepares for the Biggest Pension Reform in History?

Social Security has been a cornerstone of retirement security for Americans for decades, but it’s facing financial difficulties. Here are some of the core reasons for these upcoming pension reforms:

1. Demographic Shifts:

The aging population is one of the biggest factors driving these pensionreforms. As baby boomers retire, the number of people collecting Social Security benefits is increasing rapidly. At the same time, the number of people contributing to the system (through payroll taxes) is decreasing. This creates a funding gap.

In 1960, there were 5.1 workers for every person collecting Social Security. By 2030, the number is expected to drop to just 2.3 workers for each beneficiary. That’s a huge shift, and it puts tremendous pressure on the Social Security system.

2. Increased Life Expectancy:

People are living longer than ever before. In 1935, when Social Security was first established, life expectancy was just 60 years. Today, it’s more than 78 years, with many people living into their 90s. This means they are receiving benefits for a much longer period, which strains the system.

3. Rising Healthcare Costs:

With longer lifespans, Americans also face higher healthcare costs in retirement. Social Security, although helpful, may not cover everything, and this is why many people will need to save more for retirement and consider alternative income sources.

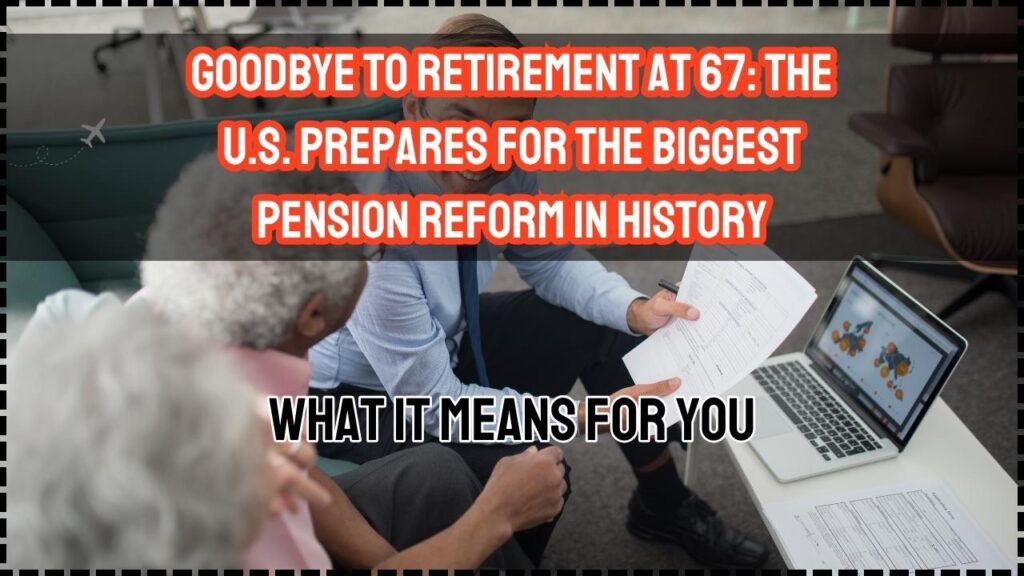

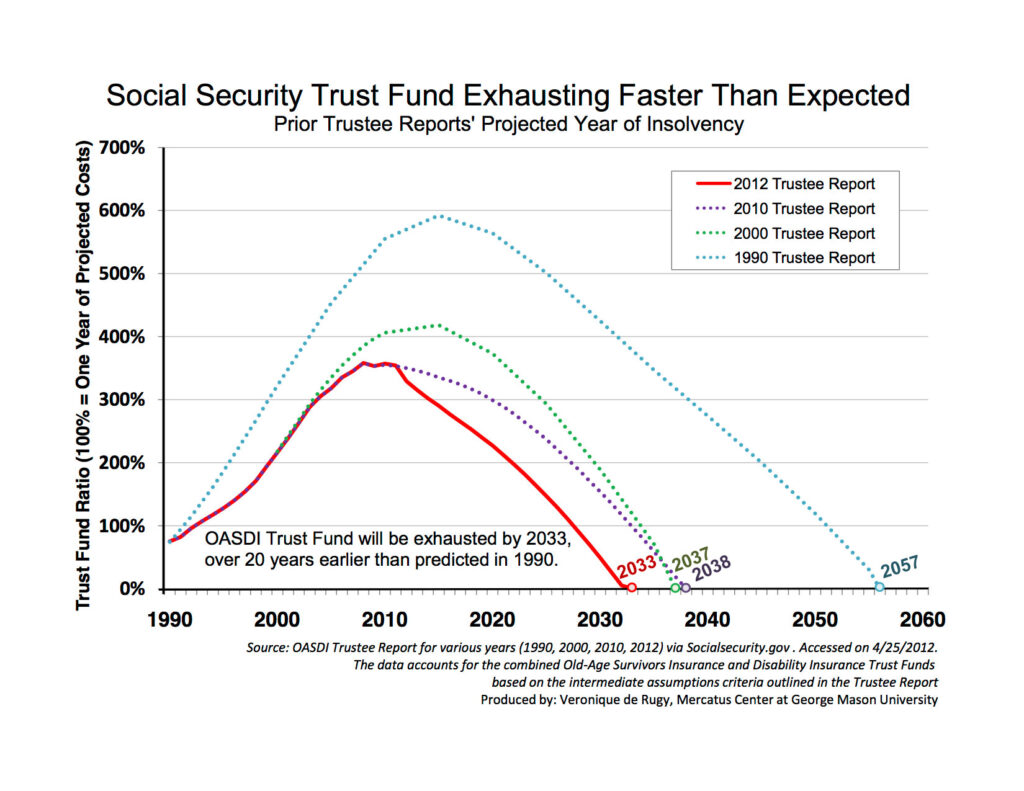

4. Program Insolvency Risks:

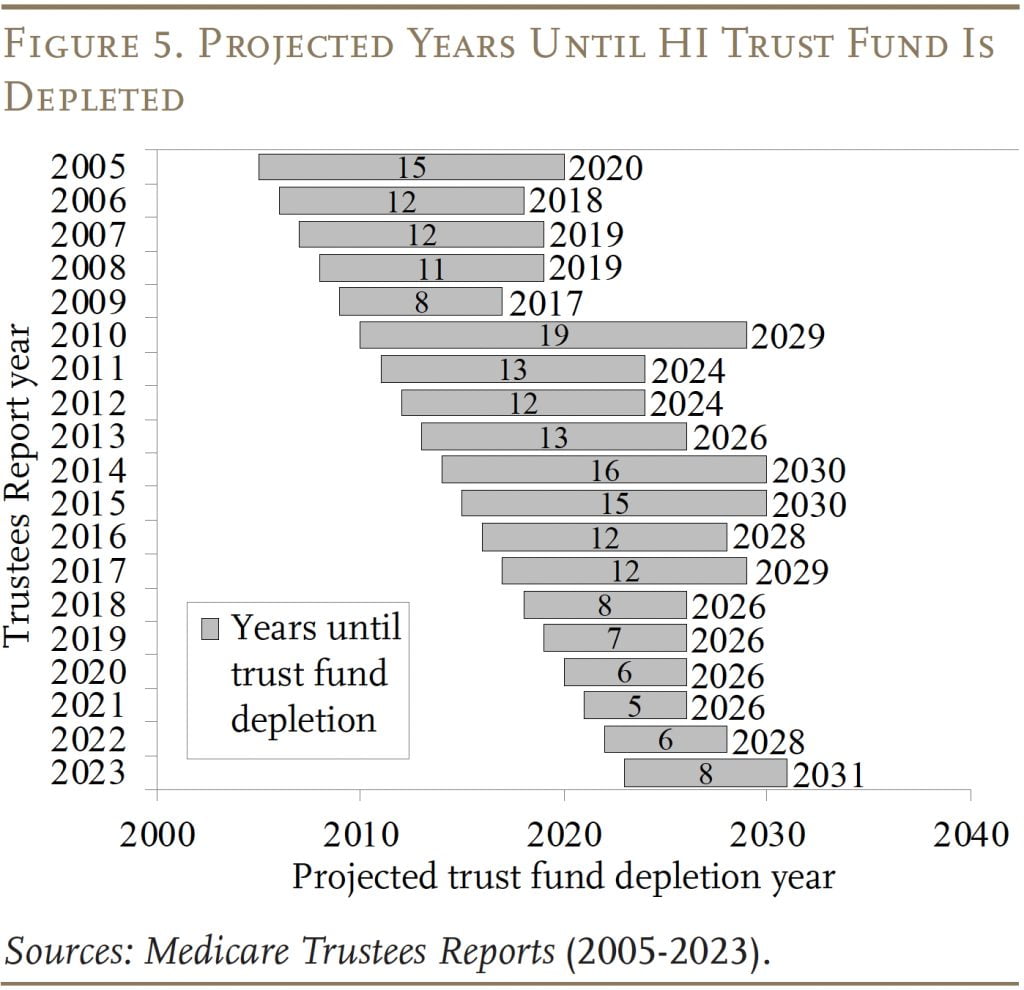

Social Security is projected to face a shortfall starting around 2033, when the trust fund is expected to be depleted. At that point, the program could only pay about 75% of scheduled benefits unless Congress takes action. This is why changes like raising the Full Retirement Age (FRA) and reducing benefits for early retirees are being discussed.

How the Full Retirement Age (FRA) Affects You?

The Full Retirement Age (FRA) is a key component of Social Security. FRA is the age at which you are eligible to receive your full, unreduced Social Security benefits. While it has traditionally been 65, it’s now set at 67 for people born in 1960 or later. This means if you were born in 1960 or later, you won’t receive your full Social Security benefit until you reach 67.

- Retire at 62: You can start your benefits at age 62, but they will be reduced by 30%.

- Retire at 67: You will receive your full, unreduced benefits.

- Retire at 70: If you delay retirement, you will receive 8% more in benefits per year after FRA up until age 70.

Example: If your monthly Social Security benefit at FRA (67) would be $2,000, waiting until age 70 could increase that amount to $2,560. On the flip side, if you retire at 62, you may only receive $1,400 per month instead of the full $2,000.

Key Takeaways on FRA:

- The earlier you retire, the lower your monthly benefits will be.

- Delaying retirement increases your benefits.

- For those born after 1960, 67 is the magic number.

The Impact of Working Longer

If you are able to work a few more years, it can make a world of difference in your financial future. Here’s why delaying retirement can be a smart move:

- Bigger Social Security Checks: By delaying retirement until age 70, your Social Security benefits will increase by 8% per year. Over time, this can add up to a significant boost to your monthly checks.

- More Time to Save: The more years you work, the more you can save in your 401(k), IRA, or other retirement savings accounts. Even contributing a little more each year can result in a significant increase in your retirement nest egg.

- Employer Benefits: Many employers offer health insurance, life insurance, and even retirement savings matches. Staying employed longer means that you can benefit from these perks.

The Future of Social Security Benefits

The Risk of Cuts

Without significant pension reform, Social Security benefits could face cuts of up to 20% by 2033. The Social Security Trust Fund is projected to run out of money, and if that happens, the government will only be able to pay about 75% of benefits to retirees.

Legislative Action Needed

To avoid cuts, Congress will likely need to enact new policies. These might include raising taxes, cutting benefits for higher earners, or adjusting the formula for calculating benefits. While the exact reforms are unknown, it’s critical to stay updated on any changes to the law.

How to Plan for These Changes?

Adapting to these changes requires smart planning and foresight. Here’s a step-by-step guide to ensure you’re prepared for retirement:

- Know Your Full Retirement Age (FRA): Find out when you’ll hit your FRA. If you were born after 1960, your FRA is 67.

- Consider Working Longer: Delaying retirement even by a few years can greatly increase your benefits. Evaluate if you can afford to work longer.

- Maximize Your Social Security: Use the Social Security Benefits Calculator to estimate your benefits at different ages.

- Supplement Your Savings: Don’t rely entirely on Social Security. Contribute to a 401(k), IRA, or other savings plans to secure your financial future.

- Stay Informed: Social Security rules are changing. Watch for new legislation that could affect your retirement plans.

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!

Full Retirement Age Is Changing Again – What It Means for Your Social Security Benefits

Terrified of Going Broke in Retirement? These 9 Expert Tips Can Save Your Future