The Truth About European Pensions: When it comes to pensions, one of the biggest concerns for workers approaching retirement is how much money they’ll have to live on once their working years are over. Many people in the UK are wondering why pensioners in other European countries are getting a lot more than those in the UK. The truth is that pensions vary significantly between countries, and the differences are often shocking. In fact, certain European countries are paying up to £8,000 more in annual pension benefits than the UK. Let’s break down why this is happening, and what that means for people who are getting ready to retire.

The Truth About European Pensions

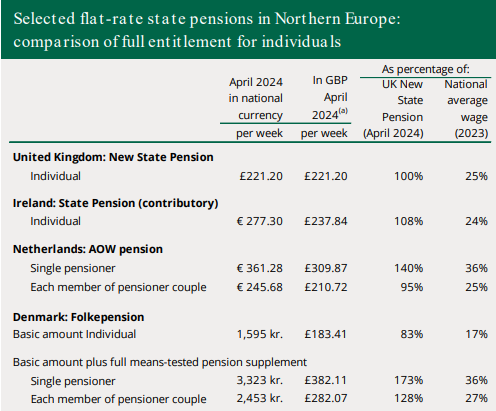

When it comes to pensions, there’s no one-size-fits-all solution. While it’s true that pension payouts are higher in certain European countries compared to the UK, the system each country has in place can be drastically different. The Icelandic, German, and French pension systems offer earnings-related pensions, rewarding individuals for their income and contributions over their careers. Meanwhile, the UK offers a flat-rate pension, meaning everyone receives the same amount regardless of their earnings.

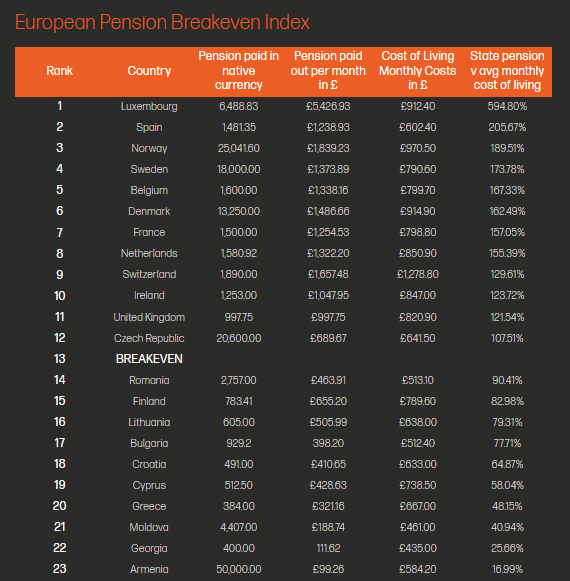

Before making any decisions about your own retirement planning, it’s crucial to consider not just how much you’ll get in pension benefits but also the cost of living in the country you’re in or thinking about retiring to. Countries with higher pensions may also have a higher cost of living, which could offset the increased income.

| Country | Annual Pension | Pension Type | Key Difference from the UK | Cost of Living | Official Link |

|---|---|---|---|---|---|

| Iceland | £20,063 | Earnings-Related | Higher pension payout | 40-50% higher than UK | Icelandic Pension System |

| France | £15,000+ | Earnings-Related | Based on working years & earnings | Lower than Iceland but still higher than the UK | French Pension Information |

| Germany | £18,000 | Earnings-Related | Payments linked to earnings | Similar to France, but more variable | German Pension System |

| United Kingdom | £11,973 | Flat-Rate | Standard payment for all | Relatively lower | UK State Pension |

Why Are Pensions in Some European Countries Higher Than the UK?

Before we dive into the details, let’s get clear on one thing. It’s not just about how much money countries are paying their retired citizens. There’s a whole range of factors at play here, including each country’s pension system, the cost of living, and how pensions are calculated. We’ll cover all of that in a bit, but let’s first look at some numbers to put things into perspective.

The UK Pension System

As of 2025, the UK provides a flat-rate state pension of around £11,973 a year for a single person. This is an important point to note because the UK’s system is based on how long you’ve worked and contributed to National Insurance, rather than your earnings while working. It’s a simple, standard payment across the board.

Pensions in Europe: Higher than the UK

In contrast, some European countries offer significantly higher pensions, often because their systems are earnings-related. For example, Iceland tops the list with a pension of about £20,063 annually, which is over £8,000 more than what UK pensioners receive. Other countries, such as Germany and France, also provide more generous pension benefits. But what makes these countries so different?

Why the Huge Disparity in Pension Payouts?

Let’s break this down. Pensions in Iceland, France, and Germany are calculated differently than in the UK. Instead of receiving a flat-rate pension, Iceland and others provide earnings-related pensions, meaning that the amount a person receives is based on their income during their working years. In this case, the more you earned, the more you paid into the system, and thus, the more you’ll get when you retire.

In France and Germany, while earnings still play a key role, the system is not entirely flat-rate. Both countries have what are called “pay-as-you-go” systems, where contributions from current workers fund the pensions of retired individuals. This system allows pensions to be more generous, as the amount depends on what workers paid into the system over the years.

Meanwhile, the UK’s flat-rate system means that everyone, regardless of how much they earned in their working years, gets the same pension amount. While this may seem fair on the surface, it leaves many workers who had high earnings during their careers with significantly less money in retirement compared to those in countries with earnings-based pension systems.

The Role of Cost of Living

One thing you have to keep in mind when comparing pensions between countries is the cost of living. While Iceland’s pension payout may seem a lot higher than the UK’s, the cost of living in Iceland is around 40% higher than in the UK. This means that although Icelandic pensioners get more money, they also spend more on basic needs like housing, food, and healthcare. The same goes for countries like Switzerland, which also offer high pension payouts, but with a much higher cost of living than the UK.

So, just because pensions are higher in other countries, it doesn’t always mean that pensioners have more purchasing power. For instance, in Germany and France, pensions may be higher than in the UK, but the cost of living is generally similar or lower.

Understanding The Truth About European Pensions

1. Earnings-Related Pension Systems (Iceland, Germany, France)

These systems are based on how much a person has earned throughout their working years. The more you’ve earned and contributed to the system, the higher your pension will be. This is a progressive system that rewards workers who have paid higher taxes during their careers.

Pro Tip: If you’re planning to move abroad or are considering your retirement options, consider countries that offer earnings-based pensions, as these may provide a more comfortable lifestyle post-retirement.

2. Flat-Rate Pension Systems (UK, some other countries)

In this system, everyone receives the same pension amount, regardless of how much they earned in their working years. It’s simple and easy to understand, but it doesn’t take into account the disparities in income that many workers experience.

Pro Tip: If you live in the UK and rely solely on the state pension, consider supplementing it with a personal pension plan or workplace pension to ensure a more secure retirement.

The Impact of Inflation on Pensions

Another important consideration when comparing pensions across different countries is the effect of inflation. Inflation impacts the real value of pensions over time. For example, if inflation is high in a country, the purchasing power of pension payouts can decrease. This is especially critical for fixed pensions, like the UK state pension.

Countries that offer index-linked pensions (pensions that increase with inflation) may provide better long-term security for pensioners. Unfortunately, the UK state pension is only partially inflation-linked, meaning that although the UK pension does rise with inflation, it doesn’t always keep pace with the actual cost of living, especially in times of high inflation.

In countries like Iceland, inflation adjustments are made regularly, so pensioners’ incomes are better protected against the erosive effects of inflation.

The Role of Supplementary Pensions

Most European countries, including Germany and France, have a strong emphasis on supplementary pensions. This means that citizens are encouraged or required to save for retirement beyond the state pension. In Germany, for example, many workers contribute to both a state pension plan and a private pension plan. Similarly, France encourages private savings through employer-sponsored pensions.

If you live in the UK, it’s worth exploring personal pension plans (like a self-invested personal pension or SIPP) or contributing more to your workplace pension to ensure you can maintain a similar standard of living to pensioners in other European countries.

Practical Tips for Optimizing Your Pension

Here are some actionable steps you can take to maximize your pension benefits:

- Contribute Early and Often: The earlier you start contributing to your pension, the more it can grow over time. Compound interest works best when you start early.

- Consider Private Pension Plans: Even if you’re in a country with a flat-rate pension, adding a private pension can boost your retirement income.

- Track Your Pension: Make sure you’re aware of how much you’ll receive from your state pension and whether it’s enough for your needs. Use online calculators and financial planning tools to track and predict future payments.

- Stay Informed: Pensions are complicated, and laws often change. Stay updated on pension reforms in your country and adjust your retirement plans accordingly.

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

Extra £90 Coming Soon for Millions in the UK—Check If You Qualify!

Labour Says You Could Save £6,000 More—But Will Their Pension Plan Deliver?