Survivors Could Be Owed $255 from Social Security: Survivors could be owed $255 from Social Security — and far too many eligible Americans don’t even know it. This one-time payment, known as the Social Security Lump-Sum Death Benefit (LSDB), has been around for decades, but awareness is low and the rules can be confusing. Whether you’re a surviving spouse, child, caregiver, or financial professional, this guide walks you through everything you need to know — with real examples, legal context, up-to-date legislation, and actionable steps. Let’s dive in.

Survivors Could Be Owed $255 from Social Security

The $255 Social Security death benefit may be modest, but it’s a meaningful source of support in the wake of a loved one’s passing. It’s an often-overlooked benefit that many Americans miss — either because they didn’t know about it or didn’t apply on time. With potential increases on the horizon, and millions in unclaimed benefits left behind each year, now is the time to act. Whether you’re applying for yourself or guiding someone else, make sure this simple, impactful benefit doesn’t slip through the cracks.

| Topic | Detail |

|---|---|

| Benefit Amount | $255 lump-sum death payment |

| Who Qualifies | Surviving spouse, divorced spouse, or eligible children |

| Application Deadline | Must apply within 2 years of the worker’s death |

| Application Process | Call 1‑800‑772‑1213 or visit a Social Security office (no online app) |

| Official Website | SSA.gov – Survivor Benefits Eligibility |

| Related Legislation | Social Security Survivor Benefits Equity Act (S.5178) – proposes increasing to $2,900 in 2025 |

| 2023 Stats | 842,000 payments totaling $215 million; only 38% of qualifying deaths received payment |

What Is the Social Security $255 Death Benefit?

The Lump-Sum Death Benefit (LSDB) is a one-time payment of $255 issued to eligible survivors of someone who worked and paid into the Social Security system.

It was created in 1939 and originally based on a worker’s earnings. However, in 1954, the payment was capped at $255, and it’s remained unchanged ever since — despite inflation, economic shifts, and major changes in funeral costs.

While $255 doesn’t go far today, it’s still a meaningful benefit, especially for low-income households. And with millions of eligible survivors unaware or missing the deadline, there’s good reason to spread awareness and clarify the rules.

Historical Context: Why Is It Only $255?

The original Social Security Act didn’t include survivor benefits. In 1939, the law was amended to include both ongoing monthly benefits for dependents and a small one-time death payment.

Back then, the lump-sum benefit was calculated as three times the worker’s Primary Insurance Amount (PIA) — effectively a percentage of lifetime earnings. But in 1954, Congress capped it at $255 to standardize payouts and reduce complexity.

By 1981, another amendment limited eligibility, narrowing the scope to only a surviving spouse or child living in the same household or receiving ongoing benefits.

Today, that $255 is worth less than $25 in 1954 dollars — a huge decline in real value.

Why It Still Matters?

Even though $255 may not cover much, many families rely on every bit of support during difficult times. Funeral costs now average more than $8,000 in the U.S., according to the National Funeral Directors Association.

Here are some reasons this benefit still matters:

- Financial support during a stressful time

- Low awareness means many leave money unclaimed

- Symbolic closure that helps the survivor feel acknowledged

- A possible signal for broader survivor benefits or Social Security eligibility

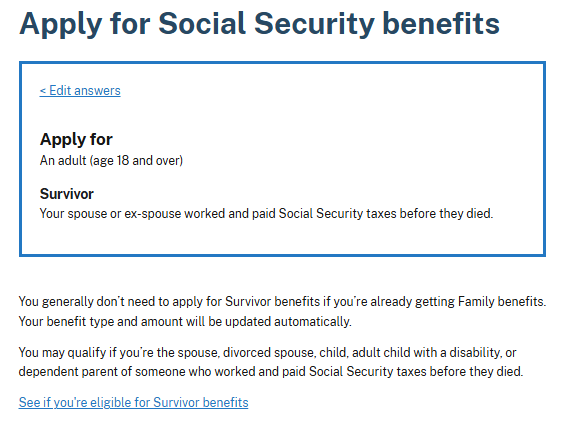

Who Qualifies for the $255 Death Benefit?

1. Surviving Spouse

To qualify as a spouse, you must meet one of the following:

- Lived in the same household as the deceased at the time of death

- Were already receiving benefits on the deceased’s Social Security record

- Were eligible to receive survivor benefits based on age or disability (even if not yet filed)

In some cases, divorced spouses may also qualify — if:

- The marriage lasted 10 years or more

- The surviving ex-spouse is unmarried

- Other survivor benefits criteria are met

2. Eligible Children

If no surviving spouse qualifies, the benefit can go to a child who:

- Is unmarried and under age 18

- Is under 19 and a full-time student in high school

- Is disabled, with the disability starting before age 22

The child must be eligible for monthly survivor benefits in the month of the worker’s death.

3. Who Does Not Qualify

You cannot receive the $255 death benefit if:

- You don’t apply within 2 years of the worker’s death

- You are a distant relative, like a cousin, aunt, or grandchild, unless legally adopted or dependent

- The deceased didn’t have enough work credits under Social Security

- You’re a funeral home or estate administrator — the benefit is not payable to estates

Step-by-Step: How to Apply for the Survivors Could Be Owed $255 from Social Security

Step 1: Confirm Eligibility

Before contacting SSA, gather key details:

- Date of death

- Relationship to the deceased

- Whether you were receiving benefits already

Step 2: Collect Documents

You may need the following:

- Death certificate (original or certified copy)

- Marriage certificate (if claiming as spouse)

- Birth certificate (if claiming as child)

- Social Security numbers (yours and deceased’s)

- Proof of citizenship or legal residency

Step 3: Contact the SSA

- Call 1‑800‑772‑1213 (TTY: 1‑800‑325‑0778)

- Visit your local SSA office

- Complete Form SSA-8 (Application for Lump-Sum Death Payment)

Online applications are not available for this benefit.

Step 4: Await Decision and Payment

Processing time varies, but it typically takes a few weeks. If approved, the payment is issued via direct deposit or check.

If more than one child qualifies, the payment is divided equally. The total benefit is still $255, regardless of how many children are eligible.

What About Monthly Survivor Benefits?

The $255 payment is separate from monthly survivor benefits, which include:

- Widow or widower benefits

- Child benefits

- Dependent parent benefits

- Benefits for disabled children and young spouses caring for minor children

These are based on the deceased worker’s earning record and can be significantly higher than the lump sum.

Legislation Watch: Could It Increase?

There’s growing political pressure to modernize the lump-sum death benefit. In 2024, the Social Security Survivor Benefits Equity Act (S.5178) was introduced in the Senate. If passed, it would:

- Increase the benefit to $2,900

- Adjust it annually based on the Consumer Price Index for Urban Wage Earners (CPI-W)

- Apply to deaths occurring after January 1, 2025

As of mid-2025, the bill remains under committee review and has not yet passed.

Professional Perspective: Why Financial Advisors Should Care

If you’re an estate planner, financial advisor, or social worker, here’s why this benefit matters:

- It’s a trigger conversation for other survivor benefits

- Encourages clients to check SSA records and benefit eligibility

- Helps avoid missed opportunities — especially in underserved communities

- Demonstrates proactive financial care

Many professionals miss this simple support measure during estate settlement — adding this small but significant check-in to your process builds trust and goodwill.

Common Mistakes to Avoid

- Waiting too long to apply (must be within 2 years)

- Assuming it’s automatic (it’s not — survivors must apply)

- Thinking it’s included in other benefits (it’s a separate payment)

- Not gathering all required documentation, which slows the process

Social Security Cuts Paused! What It Means for Student Loan Defaulters in 2025

Still Waiting on Your Social Security Back Pay? Retroactive Payments Are Rolling Out Now

CPI Surprise Alters 2026 COLA Forecast; Social Security Recipients Could See Unexpected Changes