Student Loan Relief at Last: The U.S. Department of Education has made a notable move that could ease the financial burden of millions of student loan borrowers. Recently, it was announced that federal student loan interest rates will be lowered for the upcoming academic year. This is a welcome change for many who have struggled with rising debt, especially during the past few years of economic upheaval. If you have student loans, it’s crucial to understand how this shift affects your finances, what steps you should take, and how to navigate the changes to ensure you’re getting the best possible deal.

Student Loan Relief at Last

The recent reduction in student loan interest rates is a crucial step in the right direction for borrowers who have faced mounting debt. While the changes may seem small at first glance, they represent a long-awaited effort to reduce the financial burden on millions of Americans. In the future, further reforms such as the Affordable Loans for Students Act may offer even greater relief, making it easier for borrowers to manage their debt. As a borrower, now is the time to review your loan details, explore repayment options, and stay informed about any future changes. Lower interest rates, combined with smart repayment strategies, can help you get closer to paying off your loans faster and more efficiently.

| Key Data | Details |

|---|---|

| Interest Rate Change | Federal student loan interest rates will drop by 0.14 percentage points for loans disbursed between July 1, 2025, and June 30, 2026. |

| Reason for Change | The change follows a drop in 10-year Treasury yields, which directly affect student loan rates. |

| Impact on Borrowers | This will reduce monthly payments slightly for federal student loan holders. |

| Potential Future Changes | Proposed legislation to lower interest rates to 2% across the board is under consideration. |

| Who Benefits | All borrowers with federal student loans disbursed during the stated period. |

| More Information | Official updates available through the U.S. Department of Education website. |

| Savings for Borrowers | Reduced interest rates will lower the overall cost of loans, making them more affordable for borrowers in the long run. |

Context: Why Student Loan Relief at Last Change Matters

Student loans are a significant financial burden on millions of Americans. As of recent estimates, over 43 million borrowers collectively owe more than $1.7 trillion in federal student loans. The average borrower graduates with around $37,000 in student loan debt. For many, this debt feels overwhelming, especially as the cost of education continues to rise faster than inflation.

Interest rates on federal student loans are directly tied to the 10-year Treasury note yield. As a result, when the Treasury rates fluctuate, so do student loan rates. In recent years, rising inflation and the Federal Reserve’s decisions to hike interest rates have driven up student loan interest rates. But with the recent economic adjustments and a decrease in Treasury yields, the Department of Education has decided to reduce the interest rates for the upcoming year.

This change, though modest, signals a shift in policy and could provide much-needed relief to borrowers. However, it’s also part of a larger conversation about how to make education more affordable and student loan debt more manageable.

Understanding the Impact of Lower Interest Rates

Who Will Benefit?

If you’re one of the millions with federal student loans, this interest rate reduction is likely to benefit you. The new rates apply to a variety of loan types, including Direct Subsidized Loans, Direct Unsubsidized Loans, PLUS Loans, and Consolidation Loans.

For example, if you borrowed $10,000 for college with a 6% interest rate, a reduction of 0.14% would save you approximately $14 annually. While that might not seem like a lot initially, over the life of your loan, those savings can add up.

This change comes at a crucial time, as millions of borrowers prepare to re-enter repayment after the pandemic-related payment pause. Though the decrease in interest rates is modest, it offers some financial relief and provides an opportunity for borrowers to reassess their repayment strategies.

The Broader Economic Picture: What’s Behind This Change?

The decision to lower interest rates is influenced by broader economic factors. The yield on 10-year Treasury notes, a key indicator of U.S. government borrowing costs, has seen a recent decline. As Treasury yields drop, so do interest rates on federal loans.

Inflation, federal interest rates, and the broader economic climate all play a role in determining student loan rates. During times of economic uncertainty, such as a recession or periods of inflation, interest rates tend to rise. However, when the economy stabilizes, rates may decrease, as we are seeing now. The Department of Education has adjusted loan interest rates in response to this stabilization, giving borrowers a slight reprieve.

A Global Perspective on Student Loan Interest Rates

While the U.S. faces a student loan crisis, it’s interesting to note how student loan interest rates compare globally. In countries like Germany and Norway, tuition fees are either minimal or non-existent, and student loan rates are much lower than in the U.S. For example, in Germany, public university education is free, and student loan interest rates are near 0%. In contrast, in the U.S., rates have historically been much higher, leaving borrowers to shoulder a massive financial burden long after graduation.

In comparison, the U.S. system is in many ways unique—both in its reliance on student loans and the relatively high interest rates. Lowering these rates is one step toward making U.S. higher education more accessible.

Borrower Testimonials

Many borrowers are feeling the relief. Take Amanda, a 29-year-old graduate with $40,000 in student loan debt. She says, “The interest rate drop isn’t huge, but it’s a step in the right direction. Every little bit helps, especially with my loan payments about to restart.”

For others like Tyler, who has been out of school for five years, this reduction feels like a more significant relief. “I’ve been paying off my loans for years and this drop will help me clear my debt faster without adding as much interest. It’s encouraging to see the government finally paying attention.”

What Should Borrowers Do Now?

1. Stay Informed About Changes

The first step in managing your student loans is to stay informed. The Department of Education often updates its guidelines and interest rates annually, and it’s essential to know how these changes impact you.

2. Check Your Current Loan Details

Log in to your loan servicer’s website to review your loan details. This is where you’ll find your current interest rates, balances, and repayment plans. Understanding this information will help you gauge the impact of the rate reduction.

3. Refinance to Secure a Better Rate

For those with private loans, refinancing could be a good option to lower your interest rate even further. However, if you’re working with federal loans, remember that refinancing will make you ineligible for certain benefits, like income-driven repayment and loan forgiveness.

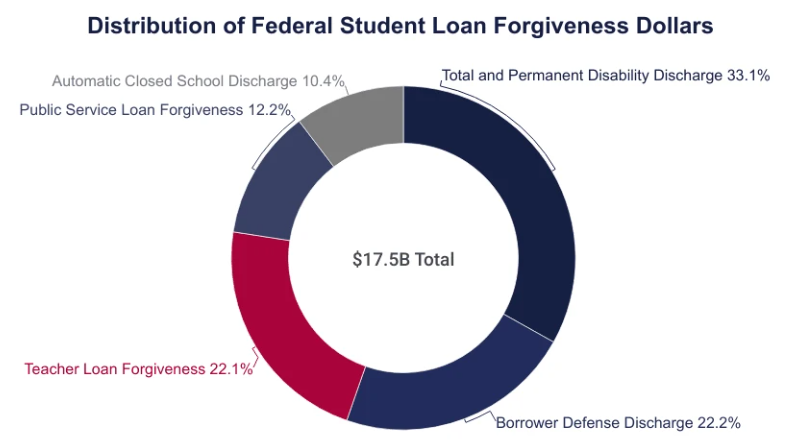

4. Consider Loan Forgiveness Programs

If you work in public service, you might be eligible for the Public Service Loan Forgiveness (PSLF) program. Keep track of your qualifying payments and stay in touch with your loan servicer to ensure you’re on the right path.

5. Reevaluate Your Repayment Strategy

With lower rates, now could be the perfect time to consider accelerating your repayment. If you’re able, try to make extra payments toward the principal of your loan, which will help you pay off your loans faster and reduce the total interest you pay in the long run.