Student Loan Debt Could Haunt You Into Retirement: yes, even your Social Security benefits aren’t safe. Most folks think that once they’ve hit retirement age, their financial worries are behind them. But if you’ve still got unpaid student loans—whether they’re from your own education or loans you took out for your kids—those debts can follow you all the way into your golden years.

This article walks you through exactly how that happens, who’s at risk, and what steps you can take to protect your retirement and keep more of your hard-earned benefits. Whether you’re a retiree, caregiver, working professional, or future borrower, this guide is for you.

Student Loan Debt Could Haunt You Into Retirement

Student loan debt doesn’t vanish when you retire. If you’re not careful, it can reduce the Social Security checks you depend on—and cause serious financial stress. But with the right tools, smart choices, and a bit of persistence, you can beat the system, protect your income, and even build toward retirement. Whether it’s through rehabilitation, IDR, forgiveness, or tribal resources, there are paths forward. But you’ve got to act early—before that garnishment letter lands in your mailbox.

| Topic | Details | Source / Link |

|---|---|---|

| Garnishment risk | Up to 15% of Social Security retirement or disability benefits can be garnished for defaulted federal student loans | TateEsq.com |

| SSI protection | Supplemental Security Income (SSI) is exempt from garnishment | SSA.gov |

| Older adults impacted | Over 452,000 borrowers age 62+ are in default | CFPB.gov |

| Forgiveness options | IDR, SAVE Plan, PSLF, TPD Discharge | StudentAid.gov |

| Employer match | Under SECURE Act 2.0, employers can match student loan payments in retirement accounts | IRS.gov |

Why Student Loan Debt Doesn’t Go Away?

Student loans are unlike other types of consumer debt. You can’t usually get rid of them in bankruptcy. They don’t disappear when you hit a certain age. And if they fall into default—which means you haven’t made a payment in at least 270 days—the federal government has powerful tools to collect.

That includes garnishing your tax refunds, wages, and even your Social Security benefits.

Yes, that means if you’re relying on Social Security retirement or SSDI to get by, a chunk could be taken from your monthly check—up to 15% of your benefit, as long as you’re left with at least $750/month.

A Hidden Burden for Older Americans

This isn’t a rare problem.

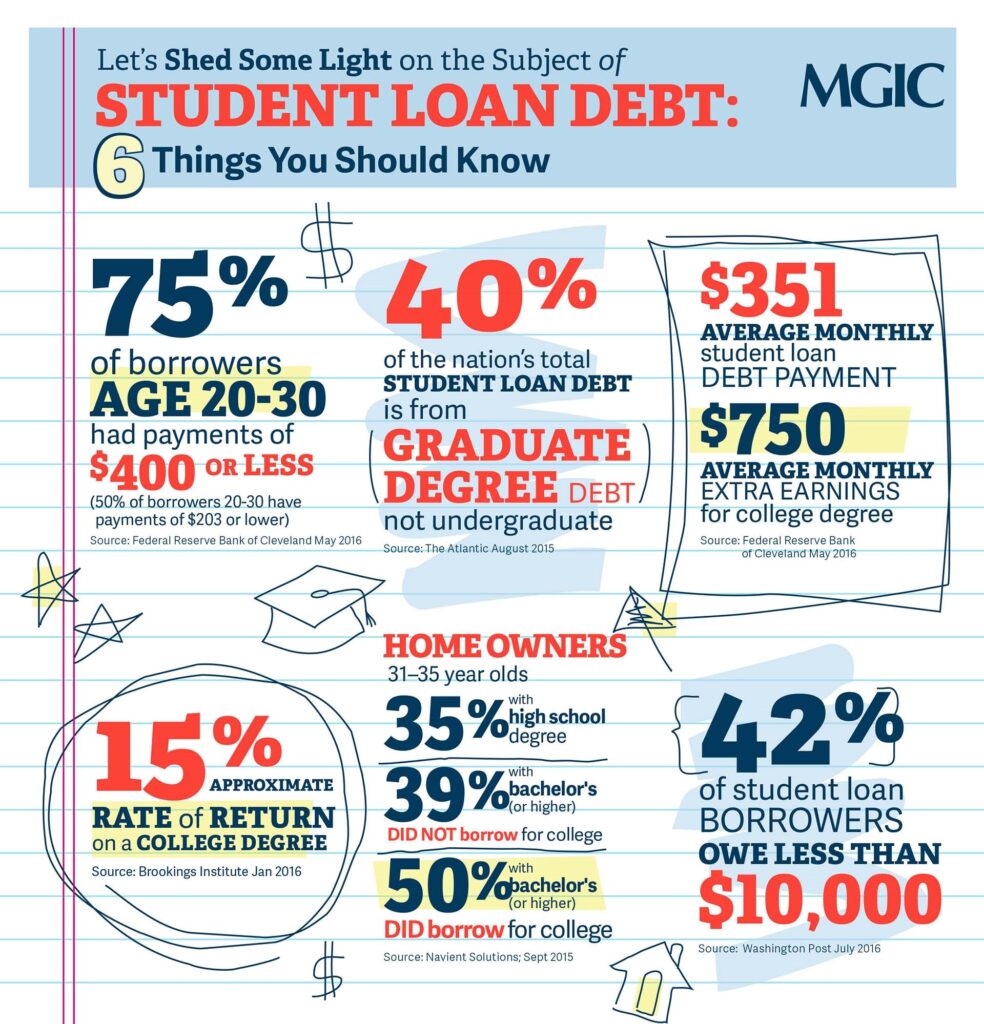

- According to the Consumer Financial Protection Bureau, more than 3 million Americans over 60 owe student loans.

- Of those, around 40% are in default.

- And over 452,000 seniors aged 62 and up are at risk of losing part of their Social Security income to garnishment.

Many of these seniors are not even paying back their own college loans. Instead, they’re paying off Parent PLUS loans they took out for their children’s education. These loans come with high interest rates and fewer repayment options, making it harder to stay current—especially on a fixed income.

How Garnishment Works?

Once your loan is in default, it gets handed over to the Treasury Offset Program. The government doesn’t need to take you to court. They’ll simply send a letter informing you that they’ll begin garnishing your Social Security retirement or disability benefits.

Here’s what you need to know:

- Up to 15% of your monthly Social Security check can be withheld.

- Garnishment continues until the loan is paid in full, or until you rehabilitate or consolidate the debt.

- SSI (Supplemental Security Income) is protected and cannot be touched.

You will receive a notice about 60-65 days before the garnishment begins, giving you time to act. If you do nothing, the garnishment will continue.

Credit Damage, Employment Hurdles, and Missed Opportunities

Defaulting on a student loan doesn’t just affect your retirement—it can damage your credit score, limit access to housing, and even hurt your chances of getting hired, especially in professions that require security clearances or credit checks.

Elizabeth Warren has described this as a “financial scarlet letter” that follows borrowers throughout their lives. Once a default hits your credit report, it stays for seven years—making life harder even if you manage to rehabilitate the loan later.

The Human Cost: Real Examples

Consider Mary, a 73-year-old widow who borrowed $28,000 in Parent PLUS loans to send her daughter to college. With interest, her balance ballooned to over $41,000. After losing part-time work during the pandemic, she defaulted. In early 2025, she received a letter informing her that $180/month would be withheld from her Social Security check. That’s money she needs for medication and groceries.

Then there’s Jonas, 61, a veteran with chronic back problems. He lives on a fixed disability check. He defaulted on an old federal loan in 2019, and when the COVID moratorium ended, he started losing $145/month. He eventually enrolled in Income-Driven Repayment (IDR) and got his garnishment lifted—but it took over five months of paperwork and hardship.

How to Stop Garnishment and Protect Your Benefits As Student Loan Debt Could Haunt You Into Retirement

If you’re in default or close to it, the good news is you have options. But time is critical. Here’s a step-by-step guide.

Step 1: Check Your Loan Status

Log in to studentaid.gov using your FSA ID. Review your loans:

- Are they federal or private?

- Are they in default?

- Who is servicing them?

Private loans can’t garnish Social Security directly—but they can sue you and garnish wages or bank accounts.

Step 2: Get Out of Default

Options include:

- Rehabilitation – Make 9 voluntary, on-time payments in a 10-month period.

- Consolidation – Combine your federal loans into one new loan and choose an IDR plan.

- Fresh Start – A Biden-era program that gives defaulted borrowers a clean slate.

Rehabilitation removes the default mark from your credit report, which can significantly boost your score.

Step 3: Enroll in an IDR Plan

Income-Driven Repayment plans—like SAVE (Saving on a Valuable Education)—base your payment on income and family size.

Many retirees or people on SSDI may qualify for $0 monthly payments—and even those $0 payments count toward loan forgiveness.

Step 4: Apply for Forgiveness

Here are the main forgiveness options:

- Public Service Loan Forgiveness (PSLF): If you’ve worked in public or nonprofit roles for 10+ years.

- Total and Permanent Disability (TPD) Discharge: If you’re unable to work due to medical disability.

- SAVE Plan Forgiveness: After 20-25 years of payments under IDR plans.

Special Programs for Native Americans

If you’re Native American or Alaska Native, you may be eligible for unique benefits and support:

- Indian Health Service (IHS) Loan Repayment: For those in qualifying health careers.

- Bureau of Indian Education (BIE) Higher Ed Grants

- Tribal College and University (TCU) scholarships

- Some tribes even offer loan forgiveness programs for tribal members who return to serve the community.

What About the SECURE Act 2.0?

Passed in late 2022, the SECURE Act 2.0 allows employers to treat student loan payments like 401(k) contributions. That means:

- Your employer can contribute to your retirement account even if you’re only paying loans, not putting money into the plan yourself.

Adoption is still growing, but if your workplace offers a retirement plan, ask HR if this benefit is available. It’s a great way to keep growing your savings even while tackling debt.

Your Retirement Protection Checklist

- Check your student loan status

- Exit default (rehabilitate or consolidate)

- Enroll in IDR—preferably the SAVE plan

- Apply for TPD or PSLF if eligible

- Contact SSA/Treasury if garnishment was issued in error

- Push your employer to adopt SECURE Act match

- Explore Native-specific grants or forgiveness programs

- Revisit your plan yearly—life changes, and so can your options

Student Loan Relief at Last? Here’s Why the Department of Education Just Lowered Interest Rates

How to Graduate Debt-Free: Proven Tips to Slash College Costs Before It’s Too Late

Over 20 Million Americans Are Behind on Student Loans; How This Crisis Could Shake the U.S. Economy