Staying Less Than 60 Days? If you or a loved one is heading to the hospital—even for just a couple of nights—you might be wondering, “What will Medicare cost me in 2025 if I stay less than 60 days?” It’s a fair question and an important one. Medicare helps millions of Americans get the care they need, but there are still costs attached, even for short hospital stays. This guide breaks it all down in plain, clear language. You’ll learn what Medicare covers for hospital stays under 60 days, how much you’ll pay, and how to avoid costly mistakes. Whether you’re planning a surgery, caring for a parent, or just doing your homework, you’re in the right place.

Staying Less Than 60 Days?

A short hospital stay under Medicare may seem simple, but hidden costs can catch you off guard. In 2025, your main responsibility will likely be the $1,676 Part A deductible and 20% of doctor and outpatient services under Part B. Understanding what’s covered—and what’s not—can save you hundreds, even thousands. Use the tools, ask the right questions, and consider supplemental insurance to protect yourself or your loved ones. Because with Medicare, the more you know, the less you owe.

| Category | Cost in 2025 | Details | Official Source |

|---|---|---|---|

| Part A Premium | $0 (if you worked 10+ years) | Based on work history | Medicare.gov |

| Part A Deductible | $1,676 per benefit period | Applies per hospital admission | |

| Days 1–60 (Hospital Stay) | $0/day after deductible | No coinsurance during this period | |

| Skilled Nursing (Days 1–20) | $0/day | Must follow a 3-day inpatient stay | |

| Part B Premium | $185/month (income-based) | Could be higher depending on income | |

| Part B Deductible | $257/year | Applies to outpatient and doctor services | |

| Part B Coinsurance | 20% of approved services | After deductible is met |

What Medicare Part A Covers for Short Stays?

Medicare Part A is hospital insurance. It covers:

- Inpatient hospital stays

- Skilled nursing facility care (after a hospital stay)

- Hospice care

- Limited home health services

For stays under 60 days, once you pay the $1,676 deductible, you’re covered at $0/day for your room, meals, and medically necessary hospital services.

What’s not covered under Part A:

- Personal care items (toiletries, socks, razors)

- Private rooms (unless medically necessary)

- Television or phone services in your room

- Long-term custodial care (like bathing or dressing help at home)

What Medicare Part B Covers During a Hospital Stay

Medicare Part B covers the doctors, labs, and outpatient services you receive—even while you’re hospitalized. This includes:

- Physicians and specialists

- Medical equipment

- Diagnostic imaging (like MRIs and CT scans)

- Outpatient surgery

You’ll pay:

- $185 monthly premium

- $257 annual deductible

- 20% of the Medicare-approved amount for most services

Even during an inpatient stay, services like X-rays, specialist visits, or emergency consultations are billed through Part B.

Real-Life Cost Breakdown: 4-Day Hospital Stay Example

Imagine you’re admitted for a 4-day stay due to chest pain. Here’s what you’d likely pay:

| Service | Cost |

|---|---|

| Part A Deductible | $1,676 (one-time per benefit period) |

| Days 1–4 of Stay | $0/day |

| Specialist Consults (3 visits @ $200 each) | $600 × 20% = $120 |

| Radiology and Labs | $300 × 20% = $60 |

| Total Out-of-Pocket | $1,856 |

This assumes you don’t have Medigap or Medicare Advantage.

How to Confirm You’re Officially Admitted as Inpatient?

One of the most common Medicare billing mistakes happens when patients believe they’re admitted as inpatients, but they’re actually under “observation” status.

Here’s how to know:

- Ask directly: “Am I admitted as an inpatient or under observation?”

- Get it in writing: Hospitals are legally required to notify you within 36 hours of observation status through the “Medicare Outpatient Observation Notice” (MOON).

- Why it matters: Observation status does not count toward the 3-day stay required for skilled nursing facility coverage.

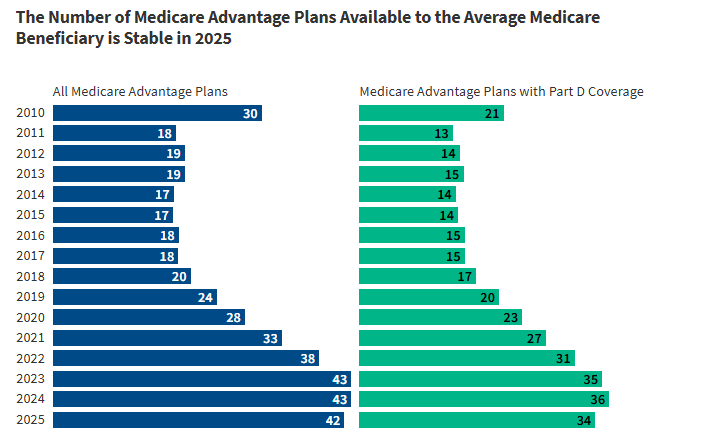

Medicare Advantage vs. Original Medicare for Short Hospital Stays

| Feature | Original Medicare | Medicare Advantage |

|---|---|---|

| Doctors & Hospitals | Any that accept Medicare | Often limited to network |

| Short-Stay Deductible | $1,676 (Part A) | Usually a flat per-day or per-visit fee |

| Extra Benefits | Not included | May include dental, vision, and hearing |

| Monthly Cost | Part B premium + Medigap (if any) | Varies by plan (some $0 premium) |

| Best For | Freedom to choose providers | Simpler billing, lower premiums |

If you expect multiple short stays, some Medicare Advantage plans charge lower up-front costs. But always check the plan’s network and coverage rules.

How to File an Appeal if Medicare Denies Coverage of Staying Less Than 60 Days?

Sometimes Medicare may deny a claim or service. Don’t panic—you have the right to appeal.

Steps to appeal:

- Read your Medicare Summary Notice (MSN) – It explains what was denied and why.

- File an appeal within 120 days – Follow instructions on the MSN.

- Include supporting documentation – Like doctor’s notes or test results.

- Track your case – Medicare must respond within 60 days.

What to Do If You Can’t Afford the Costs

If your hospital bill feels overwhelming, you’re not out of options.

Financial help programs:

- Medicaid: For those with low income and few assets. Covers Medicare costs and long-term care.

- Medicare Savings Programs (MSPs): Help pay premiums, deductibles, and coinsurance.

- Extra Help: Lowers costs for prescription drugs under Part D.

- Nonprofit hospital financial aid: Many hospitals offer payment plans or charity care.

Medicare Billing Codes to Know

Common billing codes during a short stay:

- DRG 470: Joint replacement with no major complications

- DRG 291: Heart failure and shock

- 99223: Initial inpatient visit

- G0463: Hospital outpatient clinic visit

Understanding these can help you review bills and catch overcharges.

Summary Checklist for Patients and Caregivers

Before admission:

- Confirm “inpatient” vs. “observation” status

- Understand what’s covered under Part A and Part B

- Ask if your doctors accept Medicare

After discharge:

- Review your Medicare Summary Notice (MSN)

- Double-check your billed services and codes

- Know your appeal rights

- Seek financial help if needed

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!

2025 COLA Drop Shocker: How Your Social Security Check Could Take a Hit!

Proposed Medicaid Changes Could Devastate Kentucky Families—See What’s at Stake

How Medicare Coordinates With Other Insurance?

If you have more than one form of insurance, here’s how Medicare works with them:

- Medicare is primary if you’re retired and only have Medicare.

- Employer insurance (if you’re still working) may be primary.

- Medicare is secondary if you have workers’ comp, VA benefits, or liability insurance.