Social Security’s 2026 Boost: As we look ahead to 2026, there’s growing buzz around a significant change coming to Social Security benefits. A projected boost in the Cost-of-Living Adjustment (COLA) for Social Security recipients could be one of the most substantial in years, offering much-needed relief to retirees. For many, this increase might represent a long-awaited financial lifeline, but what does it mean for you? Let’s break it down. The boost is expected to be driven by factors like inflation, economic recovery, and the specific way the Social Security Administration (SSA) calculates these adjustments. While it’s still early days, experts predict that the 2026 COLA might provide some of the largest increases seen in the last decade. But before diving into the specifics of what that means, let’s first understand how COLA works and what this potential increase could mean for retirees.

Social Security’s 2026 Boost

The projected 2.5% increase in the 2026 Social Security COLA is a welcome change for many retirees, offering much-needed relief amid rising costs. While it’s not a cure-all, the increase can help retirees stay ahead of inflation and make their monthly budgets a bit more manageable. As always, staying informed about Social Security updates and understanding how these changes impact your finances is crucial. Whether you’re a retiree or approaching retirement, it’s never too early to start preparing. Be sure to keep an eye on the official Social Security website and consult with a financial advisor for tailored advice. Additionally, consider how other retirement planning options like IRAs and 401(k)s can complement your Social Security benefits. With the right financial strategies in place, you can better navigate the challenges and opportunities that lie ahead.

Given that Medicare and long-term care expenses will continue to rise, it’s critical to factor these into your financial plan, ensuring you have enough resources to maintain your lifestyle throughout retirement. Even with the projected COLA increase, careful planning and savings are key to a secure retirement. By staying proactive and adjusting your financial plans in advance, you can make the most of the opportunities that the 2026 COLA increase offers, and ensure that your retirement years are as comfortable and financially secure as possible.

| Topic | Details |

|---|---|

| Projected COLA Increase | The 2026 COLA increase is projected to be 2.5% based on current inflation estimates. |

| Impact on Retiree Benefits | The average monthly Social Security benefit is expected to rise from $1,980.86 to $2,030.38. |

| Why It Matters | This increase will help seniors keep up with rising prices, particularly for food, healthcare, and housing. |

| Key Dates | Official COLA adjustment announced October 2025, based on inflation data from July to September 2025. |

| New Law Impact | The Social Security Fairness Act, passed in January 2025, will repeal provisions that affect many public retirees. |

| Official Source | For more information, visit the Social Security Administration website. |

How Social Security’s COLA Works?

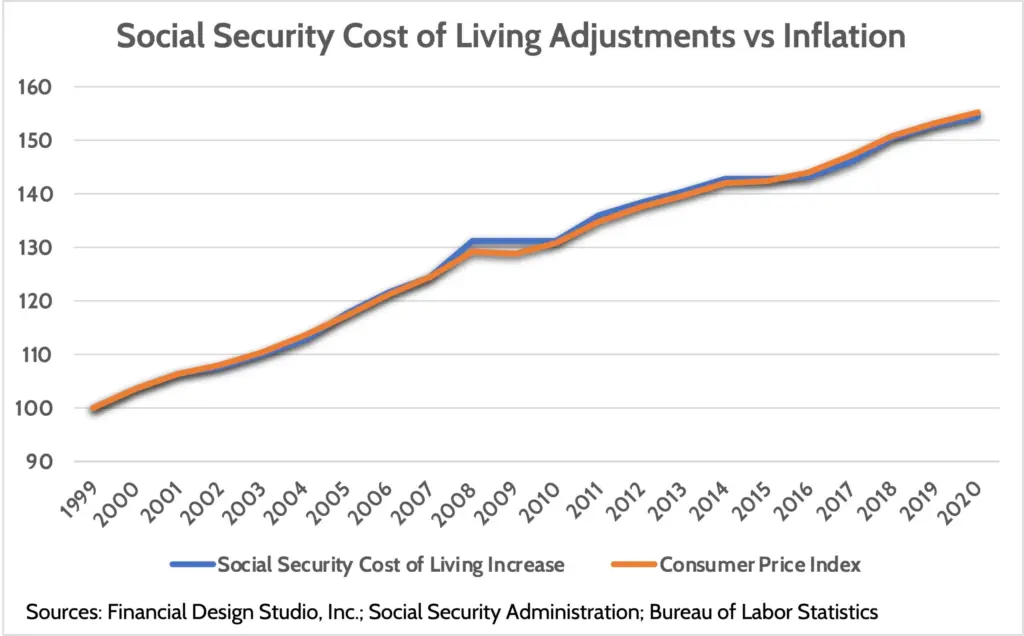

Every year, Social Security benefits are adjusted based on changes in inflation. This adjustment is called COLA, or Cost-of-Living Adjustment, and it’s designed to ensure that Social Security benefits keep up with the rising costs of goods and services. The adjustment is made using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the average price changes of a basket of common goods.

For 2026, many experts predict that the COLA will be around 2.5%. This would be a significant improvement compared to previous years, where increases have been lower. For example, in 2024, the COLA increase was just 1.3%. While even a small increase helps, it’s clear that a 2.5% boost could provide real financial relief for retirees.

Why Is the 2026 COLA Expected to Be High?

Several factors are contributing to this projected increase. First, inflation has been higher than usual in recent years. After the economic turmoil caused by the COVID-19 pandemic, prices have been rising steadily, especially for things like food, healthcare, and housing. While inflation is expected to moderate a bit, experts believe it will still be high enough to trigger a 2.5% COLA.

Another key factor is the way COLA is calculated. The CPI-W tracks the cost of living for urban wage earners, but seniors often face higher-than-average inflation in categories like healthcare, housing, and food. For this reason, some experts argue that the COLA formula might not fully reflect the unique challenges faced by retirees.

The pandemic also caused disruptions in the global supply chain, which drove up prices across a wide range of goods and services. Even though the global economy is beginning to recover, some of these price hikes might persist, making the 2.5% increase a necessary step for retirees to keep up with their everyday costs.

What Does This Mean for Retirees?

The 2026 COLA increase will directly impact the monthly benefits of Social Security recipients. Let’s put this into perspective. The average monthly Social Security benefit for retirees is currently about $1,980.86. With a 2.5% increase, that number could rise to $2,030.38, adding about $49.52 to each retiree’s check.

While this might not seem like a huge jump, for many seniors, this extra income can make a big difference. Whether it’s helping to cover rising medical costs, paying for groceries, or keeping up with rent increases, every little bit counts. Additionally, this projected boost comes at a time when many retirees are feeling the pinch of rising inflation.

The Growing Need for Retirement Planning

It’s worth noting that as inflation rises, many retirees are finding that their purchasing power is being squeezed. Even modest increases in Social Security benefits can help combat this erosion. However, for some seniors, this will not be enough, and it underscores the importance of retirement planning and exploring additional savings and investment strategies.

Retirees should also be aware of Medicare costs. As medical expenses continue to climb, it’s essential to consider Medicare premiums and prescription drug costs, which are rising at rates above general inflation. The COLA increase might cover some of these expenses, but it may not be sufficient to entirely offset them. This highlights the importance of budgeting and potentially seeking additional healthcare coverage or supplemental insurance plans.

What Other Changes Could Impact Retirees in 2026?

While the COLA boost is certainly the headline, other changes could also benefit retirees in 2026. One of the most important changes is the Social Security Fairness Act, signed into law in January 2025. This law repeals two provisions—the Government Pension Offset (GPO) and Windfall Elimination Provision (WEP)—which have long affected public sector retirees.

These provisions used to reduce benefits for people who worked in both government jobs and private-sector jobs, causing many public-sector retirees to receive smaller Social Security benefits. With the repeal of these provisions, many retirees who were previously affected will see an increase in their monthly benefits starting in 2026.

Impact of Other Legislative Changes on Social Security Benefits

The Social Security Fairness Act isn’t the only legislative change affecting retirees. Another key law to be aware of is the Secure 2.0 Act of 2022, which has made several changes to retirement plans. This includes provisions that could impact individual retirement accounts (IRAs), 401(k) contributions, and other retirement savings. Though it doesn’t directly change Social Security benefits, these adjustments can impact the overall retirement income of seniors.

Additionally, ongoing discussions in Congress around Social Security reform could potentially influence future COLA adjustments. Lawmakers have been debating potential fixes to ensure the solvency of the Social Security program, and changes to the funding mechanism could have long-term effects on future benefits. While changes to the funding may not immediately affect the 2026 COLA, it’s essential to keep an eye on these developments.

Another change on the horizon is the potential increase in Social Security taxes. Discussions have taken place about increasing the payroll tax rate or removing the payroll tax cap. If these changes are implemented, they could provide more funding to the program but may also affect the amount of benefits available to future retirees.

Step-by-Step Guide: How to Prepare for the Social Security’s 2026 Boost

- Understand the Projected Increase

- While nothing is final until October 2025, it’s important to stay informed about the expected COLA increase. Following updates from the Social Security Administration (SSA) will ensure you don’t miss important information.

- Check Your Social Security Statements

- Log into your My Social Security account to review your statements and ensure your benefit amounts are accurate. This will give you a clearer picture of what you can expect after the boost is applied.

- Budget for Potential Changes

- While the 2.5% increase may not seem massive, it’s still a positive adjustment. Retirees should adjust their budgets accordingly, particularly for areas like healthcare, food, and housing.

- Stay Updated on Legislative Changes

- Keep an eye on the Social Security Fairness Act and other legislative changes that could impact your benefits. Public-sector retirees, in particular, will want to understand how WEP and GPO repeal may affect them.

- Consult with a Financial Advisor

- If you’re unsure how the COLA boost and other changes will affect your personal finances, it’s a good idea to consult with a financial advisor. They can help you plan for the future and ensure you’re making the most of your retirement benefits.

- Explore Additional Retirement Savings Options

- Don’t rely solely on Social Security benefits. Consider investing in additional retirement savings such as 401(k), IRAs, and annuity products to supplement your future income. These vehicles can offer tax advantages and increase your overall financial security.

- Revisit Your Estate Planning

- As you approach retirement, it’s also important to review your estate planning documents, including your will, trust, and healthcare directives. Having these in place can provide peace of mind as you enter this next phase of life.

Social Security Surprise: This Group of Retirees Just Got an Unexpected Boost in Their Checks

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy