Social Security Updates for 2025: Social Security Updates for 2025 are more than just numbers and percentages—they’re about how millions of Americans will live, work, and plan for their future. Whether you’re a retiree living off your benefits, a public employee who’s been affected by WEP/GPO, or someone planning to claim benefits soon, these changes impact real lives in real ways. This year brings important updates: a 2.5% cost-of-living adjustment (COLA), elimination of benefit-reducing rules for public workers, and the growing concern of a trust fund shortfall by 2033. But here’s the good news—understanding what’s happening now can help you make better choices, avoid surprises, and even increase your income.

Social Security Updates for 2025

2025 brings important Social Security changes: a 2.5% COLA, relief for public employees, and increasing urgency around trust fund sustainability. Whether you’re already retired or years away from filing, staying informed is the best financial move you can make. Use your my Social Security account, understand the rules for working while claiming, explore smart filing ages, and plan for taxes and future cuts. Social Security isn’t just a safety net—it’s a strategic tool. Use it wisely.

| Topic | 2025 Update | Impact/Takeaway |

|---|---|---|

| COLA +2.5% | Social Security benefits increased by 2.5% in Jan 2025 (SSA.gov) | Adds ~$50/month to average benefit. Helps offset inflation. |

| WEP & GPO Repeal | Eliminated in Jan 2025 for ~2.8 million public workers | Formerly reduced benefits for teachers, police, etc. Now fully restored. |

| Earnings Limits (Pre-FRA) | $23,400 annual limit; $1 withheld for every $2 above | Working before full retirement age? Watch your income to avoid cuts. |

| OASI Trust Fund Depletion | Projected by 2033–34 unless Congress intervenes | Could result in a 20–23% cut to benefits without reform. |

| Taxation on Benefits | Up to 85% of Social Security is taxable depending on income | Plan withdrawals to avoid tax penalties and benefit reductions. |

| Disability & Survivor Benefits | Adjusted by 2.5% COLA | Average SSDI and survivor benefits have modest increases. |

| Medicare Ties | Medicare Part B premiums may offset your COLA gain | Check how much will be deducted from your benefit automatically. |

| SSA Office Delays | Staff shortages continue into 2025 | Plan ahead—expect slower service and use online tools. |

| Retirement Strategy Guidance | Claiming at 70 gives up to 32% more than at 62 | Delaying benefits significantly increases monthly checks. |

| Scam Alert | Phishing and SSA impersonators are on the rise | Always use SSA.gov and beware of unsolicited calls or emails. |

| Younger Worker Advice | Gen X/Y/Z should not rely solely on Social Security | Invest early in 401(k)s, Roth IRAs, and consider delaying benefits. |

COLA 2025: How Much More Will You Get?

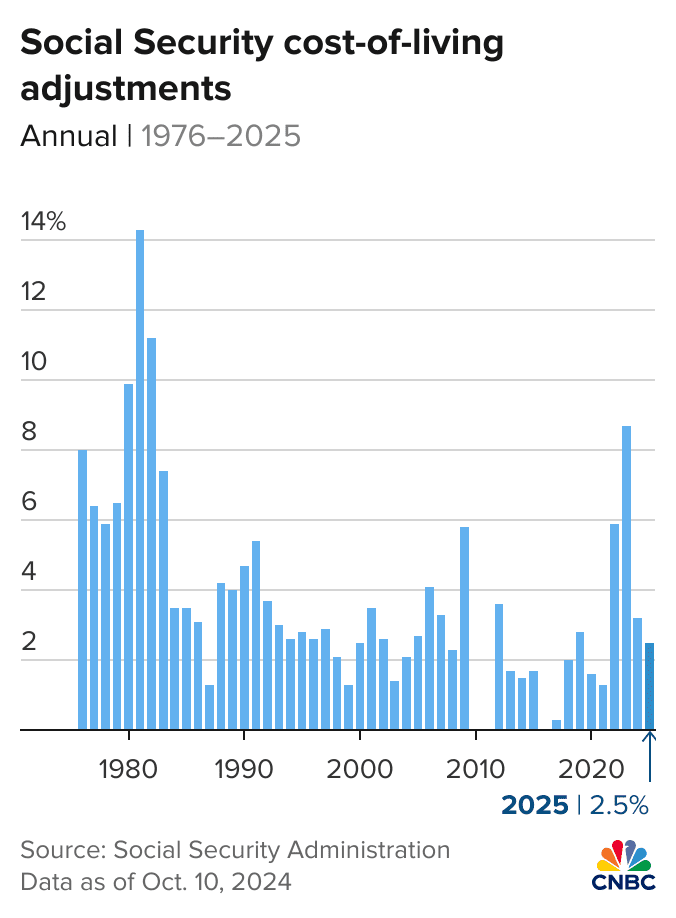

In January 2025, Social Security beneficiaries received a 2.5% cost-of-living adjustment (COLA), based on CPI-W inflation trends from Q3 2023 to Q3 2024. For the average retiree, that’s about $50 more per month.

- 2024 average benefit: $1,827/month

- 2025 average benefit: ~$1,876/month

- For couples: Average combined benefits now exceed $3,050/month

The COLA is meant to help cover rising prices for essentials like groceries, gas, and housing. But retirees are noticing it’s not always enough to match real-world inflation, especially for healthcare and housing.

Historical perspective:

In 2023, the COLA was a much larger 8.7%—the highest in 40 years. As inflation eases, COLA is returning to normal levels. According to SSA.gov, future COLAs may hover between 2–3% if inflation stabilizes.

Working While Collecting Benefits: Know the 2025 Earnings Limits

If you’re under full retirement age and still working, you need to know the earnings limit rules.

- Under FRA: You can earn up to $23,400/year

- Earn more? SSA withholds $1 for every $2 over the limit

- Year you reach FRA: Limit rises to $62,160

- SSA withholds $1 for every $3 above the cap

- After FRA: No limits. You can earn freely.

Example:

Let’s say you’re 64, claiming early, and earn $30,000/year. That’s $6,600 over the $23,400 limit. SSA will withhold $3,300 from your annual benefits.

Planning tip: Work part-time or delay benefits until you stop working full-time to maximize your check and reduce withholdings.

WEP and GPO Repealed: A Win for Public Workers

Until this year, millions of Americans—especially teachers, law enforcement, and local government employees—were affected by the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

These two rules reduced Social Security benefits for people who also received a government pension. In January 2025, these rules were repealed.

- ~2.8 million people now qualify for full benefits

- Some may receive retroactive payments back to January 2024

- Monthly benefit increases range from $360 to over $1,000

Check your eligibility: If you previously saw reductions due to WEP or GPO, log into your my Social Security account or call SSA for your updated estimate.

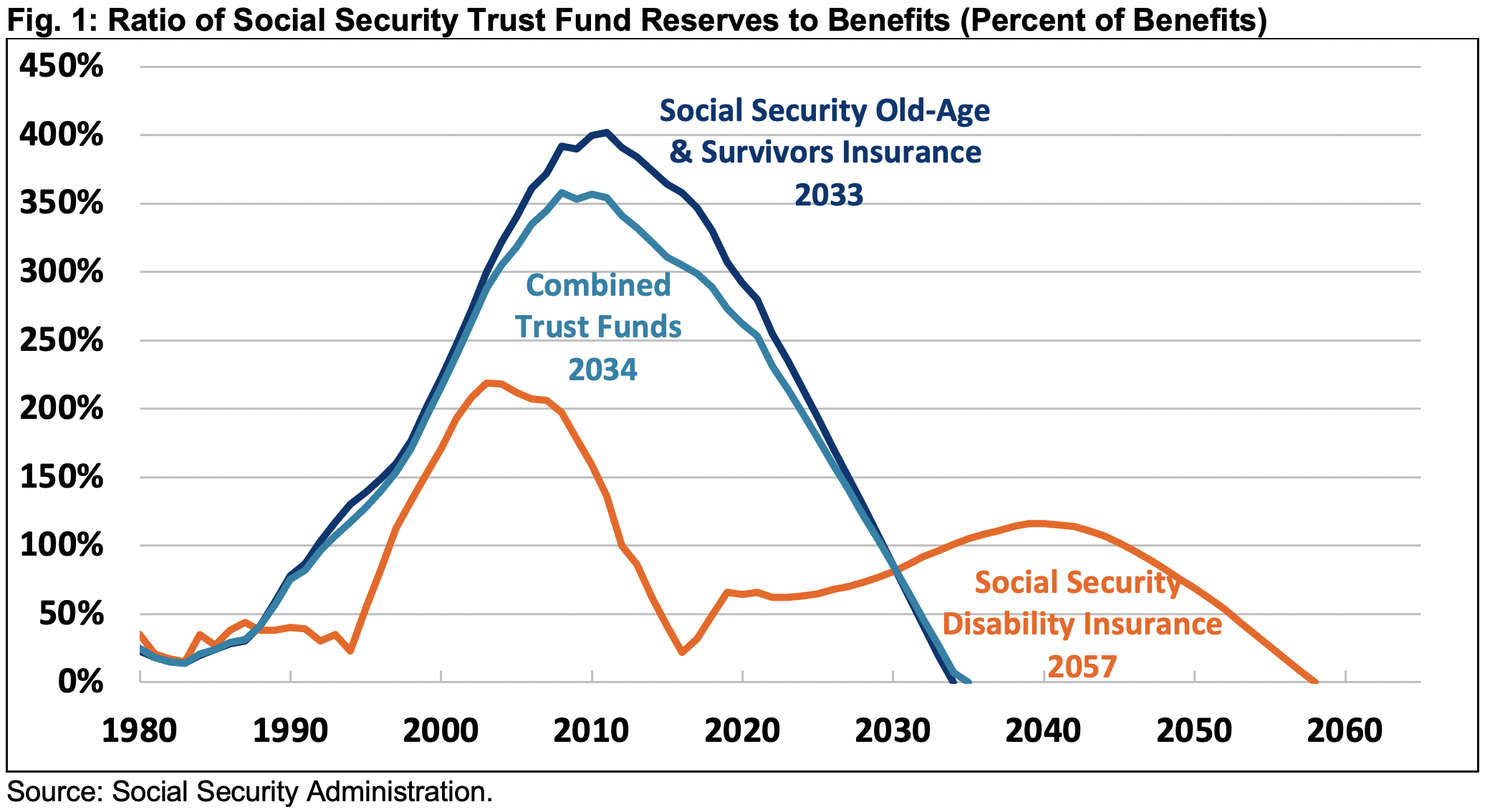

Trust Fund Shortfall: Will Benefits Be Cut?

The Old Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivor benefits, is projected to run out of reserves by 2033 or 2034.

If Congress does nothing, benefits would automatically drop by 20–23% across the board.

Why? Because more people are retiring than paying in. As Baby Boomers leave the workforce and life expectancy increases, the system is stretched thin.

Possible solutions being debated:

- Raise the full retirement age to 68–69

- Increase or eliminate the income cap ($176,100 in 2025)

- Reduce COLA calculations

- Introduce means testing for high-income earners

Planning tip: Model retirement income with and without the projected 20% cut, so you’re prepared either way.

Social Security Taxes: Yes, They Still Apply

Depending on your income, up to 85% of your Social Security benefit may be taxable.

Income thresholds:

- Individual: $25,000–34,000 = up to 50% taxable

- Joint filers: $32,000–44,000 = up to 50% taxable

- Over those limits? Up to 85% is taxable

What counts as income?

- Wages, pensions, dividends, IRA/401(k) withdrawals

- Half of your Social Security benefit

Tip: Consider Roth conversions before retirement or stagger withdrawals to reduce income spikes. Work with a tax advisor who understands retirement strategies.

Social Security Updates for 2025: Disability and Survivor Benefits Also Increase

The 2.5% COLA applies to SSDI (Social Security Disability Insurance) and survivor benefits too.

- SSDI average benefit: $1,537 → ~$1,575/month

- Widows/widowers: ~$1,755 → $1,799/month

- Dependent children: Also see increases

If you rely on these benefits, check your COLA letter or log into your SSA account to verify new amounts.

Medicare & Social Security: Watch Those Deductions

Many retirees forget that Medicare Part B premiums are deducted directly from Social Security benefits.

- The 2025 base premium is expected to increase slightly

- That increase could offset part of your COLA

Example: If your COLA gave you $50/month, and Part B premiums rise by $12/month, your net gain is only $38.

Filing Strategies: Age 62, 67, or 70?

You can claim retirement benefits as early as 62, but your monthly check will be reduced by 25–30%.

- FRA (Full Retirement Age): 67 for most people today

- Delaying to age 70 boosts benefits by up to 32%

Example:

- Claiming at 62: $1,000/month

- Waiting until 70: $1,320/month

- Difference over 20 years: $76,800 more if you delay

Strategy tip: If you’re healthy, have other income sources, and live past 80, you’ll come out ahead by waiting.

Younger Americans: Why Gen X, Millennials & Gen Z Should Care

Don’t assume Social Security will be enough.

- Future benefits will replace a smaller % of pre-retirement income

- COLA and early filing reductions impact long-term payouts

- Many younger Americans will live into their 90s

Tips for younger workers:

- Contribute max to 401(k) and IRA early

- Open a Roth IRA for tax-free income later

- Avoid relying solely on government benefits

Protect Yourself from Scams

Unfortunately, Social Security scams are on the rise.

Red flags:

- Calls threatening arrest or suspending benefits

- Emails asking for your Social Security number

- Fake websites mimicking SSA.gov

Protect yourself:

- Use only SSA.gov

- Never give personal info over phone/email unless you initiated the contact

- Report scams to the Federal Trade Commission (FTC)

Survivors Could Be Owed $255 from Social Security; Here’s Who Qualifies for the Lump Sum

Social Security Payments for July 2025 — Exact Dates and What to Expect This Month

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits