Social Security Privatization Could Backfire: If you’ve been hearing chatter about Social Security privatization, you’re not alone. With big tech leaders like Elon Musk supporting government efficiency overhauls and lawmakers raising eyebrows at the long-term sustainability of Social Security, one of America’s most trusted safety nets is under scrutiny like never before.

But before jumping on the privatization bandwagon, it’s crucial to understand what’s really at stake. Experts—left, right, and center—are voicing serious concerns about the potential fallout. From market risks and rising fees to trillion-dollar transition gaps and weaker public protections, the dangers are real and far-reaching. This guide breaks it all down for you—clearly and conversationally. Whether you’re a student, young professional, retiree, or policymaker, we’ll help you grasp the facts and understand what privatizing Social Security really means for your wallet and your future.

Social Security Privatization Could Backfire

Social Security is one of the most successful government programs in American history. It provides guaranteed income, protects the disabled and survivors, and lifts millions out of poverty every year. While reform is necessary to ensure its long-term health, full or partial privatization poses significant dangers. From high transition costs and financial risk to erosion of critical protections, the stakes are simply too high. Experts agree: there are smarter, safer ways to fix Social Security without turning it into a gamble. Educate yourself. Diversify your retirement plan. And demand that Congress protect this cornerstone of American retirement.

| Topic | Details |

|---|---|

| What’s Happening? | Push to allow Americans to divert payroll taxes into private retirement accounts. |

| Main Concerns | Market risk, huge transition costs, high fees, and loss of guaranteed benefits. |

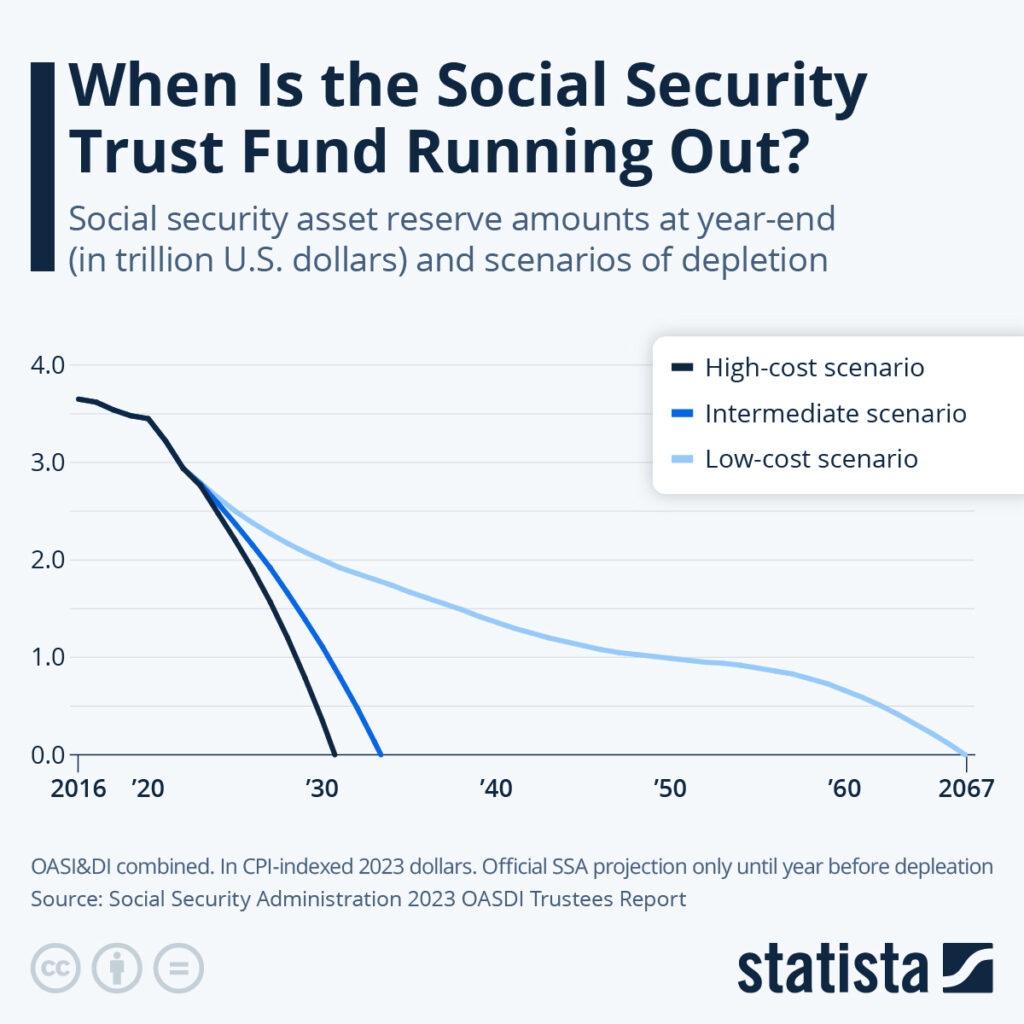

| Trust Fund Depletion Timeline | By 2033–2034, Social Security will only be able to pay ~77% of scheduled benefits. |

| Past Attempts at Reform | Major privatization push in 2005 under President George W. Bush failed after public opposition. |

| Global Examples | Chile’s pension privatization system collapsed; the UK reversed course on personal pensions. |

| Official Resources | Visit ssa.gov to check benefits and access planning tools. |

| Proposed Reforms | Raising income cap, adjusting COLA, means-testing, delaying retirement age. |

What Is Social Security Privatization?

Currently, Social Security operates as a public insurance program. American workers and employers contribute through FICA payroll taxes. These contributions fund the benefits for current retirees, disabled workers, and survivors of deceased workers. It’s a pay-as-you-go system.

Privatization, on the other hand, would allow workers to place some or all of their Social Security contributions into private investment accounts, similar to IRAs or 401(k)s. These accounts would be managed by financial institutions and tied to the stock and bond markets.

The idea behind privatization is that investments could yield higher returns than traditional Social Security. But this approach brings serious trade-offs—especially for working-class Americans who rely most heavily on the program.

Historical Background: How Did We Get Here?

The Social Security Act was signed into law in 1935 during the Great Depression by President Franklin D. Roosevelt. Over the decades, the program expanded to include benefits for disabled workers and dependents.

Key historical moments include:

- 1983: The Greenspan Commission helped reform Social Security to address funding shortfalls.

- 2005: President George W. Bush proposed partial privatization. The public backlash was swift and intense. His plan never made it through Congress.

- 2024–2025: With tech billionaires influencing government reform via initiatives like the Department of Government Efficiency (DOGE), concerns are rising about privatization creeping back into the national conversation.

Why Experts Are Sounding the Alarm Over Social Security Privatization Could Backfire?

1. Market Volatility Makes Retirement Risky

Social Security today provides guaranteed benefits, regardless of how the stock market performs. Privatized accounts, however, rise and fall with the market. If a crash hits—like in 2008 or during the COVID-19 pandemic—your retirement savings could take a nosedive.

For example, someone retiring in 2008 might have seen a 40% drop in their private investment account. Traditional Social Security, by contrast, continued to send checks, untouched by the financial chaos.

2. Transitioning to Privatization Would Cost Trillions

If younger workers start putting money into private accounts, where will the government get funds to pay current retirees? That money still has to come from somewhere.

According to estimates by the Center on Budget and Policy Priorities, transition costs for a partially privatized system could exceed $2 trillion over 10 years. That’s debt taxpayers would have to carry for decades.

3. Wall Street Would Profit—You Might Not

Privatization introduces fund management fees, often between 0.5% to 2% annually. Over time, even a 1% fee can eat up 25% or more of your total retirement savings.

Example:

- A $100,000 account invested over 35 years at 7% returns becomes about $760,000.

- With a 1% fee, it drops to around $570,000—nearly $200,000 lost to fees.

These fees go to Wall Street firms, not you.

4. Disability and Survivor Benefits Could Disappear

Social Security isn’t just about retirement. It also covers:

- Over 6 million disabled workers

- Nearly 4 million children and surviving spouses

Most privatization plans either eliminate or drastically reduce these benefits. Private insurance plans to replace them are often expensive, harder to qualify for, and far less comprehensive.

Case Studies: What Happened Around the World?

Chile

Chile was the first country to fully privatize its pension system in the 1980s. For decades, it was praised as a model. But over time, most retirees were left with monthly benefits under $200. Protests erupted, and in 2022, Chile moved back to a partially public system.

United Kingdom

In the UK, people were encouraged to “opt out” of public pensions in the 1990s. Many were misled or sold high-fee private plans that underperformed. The government was eventually forced to step in and compensate affected citizens.

These examples show how privatization can go wrong—and stay wrong for decades.

Common Myths About Social Security Privatization

Myth #1: The program is going bankrupt.

Reality: Social Security is not going bankrupt. Without any changes, it will still pay around 77% of benefits by 2034. That’s a cut, yes—but not collapse.

Myth #2: Privatized accounts are always better.

Reality: Stock market returns are not guaranteed. Privatized systems reward the wealthy, but average workers face real risk.

Myth #3: It’s too late to fix the system.

Reality: Modest adjustments—like raising the cap on taxable income—could shore up the system for decades.

What Can Americans Do Right Now?

1. Check Your Social Security Record

Visit your MySSA account to view your earnings history, projected benefits, and full retirement age.

2. Diversify Your Retirement Portfolio

- Max out contributions to 401(k)s or IRAs.

- Use Roth accounts for tax-free growth.

- Open a Health Savings Account (HSA) if eligible—it can double as retirement savings.

3. Get Involved Politically

Contact your lawmakers and voice your support for sustainable reforms that protect—not privatize—Social Security. Ask them to:

- Lift the payroll tax cap (currently $168,600 as of 2024)

- Close loopholes that allow untaxed income at the top

- Ensure disability and survivor benefits remain intact

For Professionals: What HR Managers and Financial Advisors Should Know

HR and Benefits Managers

- Offer education sessions about Social Security and retirement planning.

- Ensure employees understand the difference between 401(k)s, IRAs, and Social Security.

Financial Advisors

- Position Social Security as the risk-free floor in a retirement plan.

- Plan for scenarios where benefits may be reduced by 20–25%.

- Guide clients to consider long-term care and disability protections beyond private accounts.

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits

Social Security Just Processed 2.5 Million Retroactive Payments — Are You Owed a Surprise Payout?