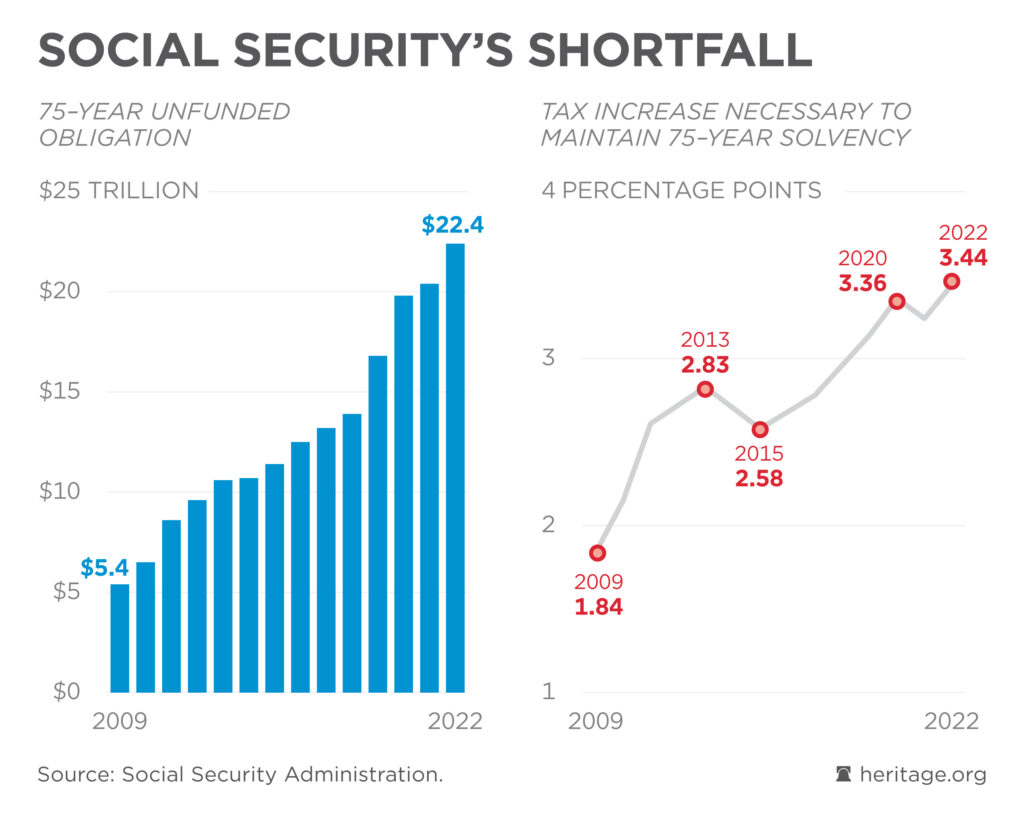

Social Security May Run Out of Funds: The Social Security system, a cornerstone of financial security for millions of Americans, may face a critical funding shortfall sooner than expected. If current trends continue, the Social Security trust funds could be depleted as early as 2033, which is one year earlier than previous projections. This situation could lead to significant reductions in benefits unless policymakers take action. But what does this mean for you, the average citizen, and how can you prepare for potential changes in the system?

Social Security May Run Out of Funds

The Social Security program is facing a critical funding challenge, and it’s up to lawmakers to address this issue before it impacts millions of Americans. While the projected depletion of the trust funds by 2033 is concerning, there are steps you can take now to prepare for any potential reductions in benefits. By understanding your benefits, diversifying your retirement savings, and staying informed about legislative changes, you can secure your financial future and ensure you’re not caught off guard when retirement comes.

| Topic | Key Data & Stats |

|---|---|

| Social Security Trust Fund Depletion | Projections indicate trust funds could run out by 2033, one year earlier than anticipated. |

| Benefit Reduction | If trust funds are depleted, benefits may be cut by 23% unless corrective action is taken. |

| Demographic Challenges | The number of retirees is increasing, while the workforce contributing to Social Security is shrinking. |

| Possible Solutions | Suggested solutions include raising the payroll tax, increasing the retirement age, and modifying the benefit formula. |

| Policy Action Needed | Comprehensive reforms are needed to ensure the long-term viability of the program. |

| Official Source for More Info | Social Security Administration |

As you may already know, Social Security has been a safety net for millions of Americans for decades, ensuring that those who have worked their entire lives can retire with peace of mind. The reality of the trust fund shortfall paints a stark picture: without timely action, future retirees may face lower benefits or even a reduction in the standard of living they’ve worked hard to secure.

Let’s dive into what is happening, why it’s happening, and what you can do to prepare for the future.

The Current State of Social Security

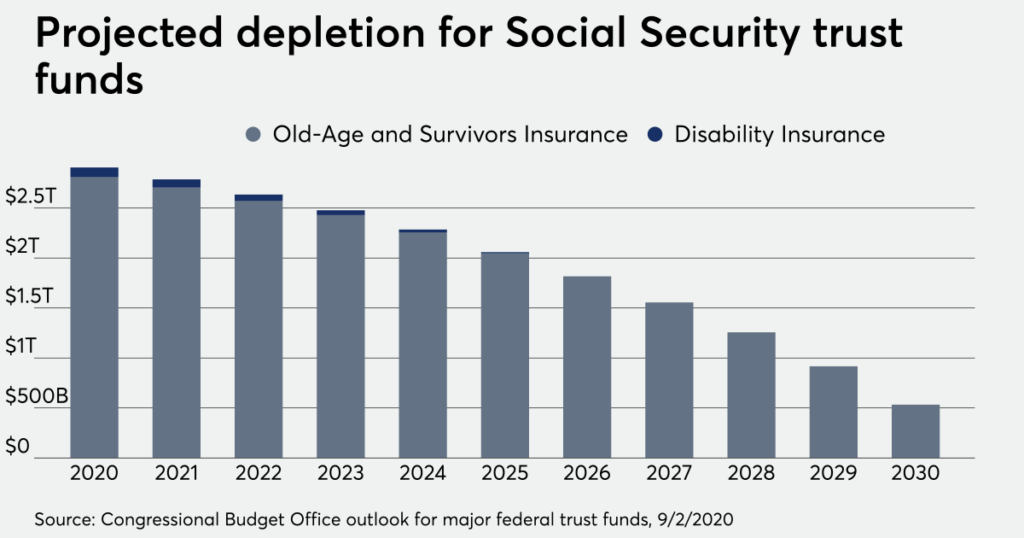

The Social Security program is funded primarily by payroll taxes paid by workers and employers. These taxes go into two trust funds: one for Old-Age and Survivors Insurance (OASI), and the other for Disability Insurance (DI). The funds are then used to provide monthly benefits to retirees, disabled workers, and survivors of deceased workers.

But here’s the issue: the system is facing a funding shortfall. The population of retirees is increasing as the Baby Boomer generation continues to age, while the number of working-age individuals contributing to Social Security is decreasing. This means the program is paying out more than it is bringing in, and unless action is taken, the trust funds could be depleted by 2033.

Why 2033? What’s Happening with the Demographics?

The primary reason for the projected shortfall is the shift in demographics. In the 1960s, there were about 5.1 workers for every retiree. By 2023, that number has shrunk to just 2.8 workers for every retiree. This decline in the workforce has put immense pressure on the system, which was never designed to handle such an imbalance.

In addition to the decrease in workers, life expectancy has risen significantly since Social Security was established in 1935. People are living longer, which means that benefits are being paid out for a longer period of time. While this is great news for the quality of life, it poses a challenge for the funding structure of the system.

The Impact of Increased Disability Claims

Another factor influencing the solvency of Social Security is the increase in disability claims. More individuals are applying for disability benefits, and this number has been rising steadily in recent years. As the population ages, the likelihood of individuals requiring disability benefits increases. The growing number of recipients adds additional strain to the trust funds, further exacerbating the financial issues facing the program.

What Will Happen If the Trust Fund Runs Out?

If the Social Security trust funds are depleted by 2033, the program will only be able to pay out about 77% of the benefits currently promised to beneficiaries. In simpler terms, if you’re counting on Social Security as a large portion of your retirement income, you may have to make do with a 23% reduction in the amount you receive.

This would be a devastating blow to millions of Americans, especially those who rely on Social Security as their primary source of income. For some, it’s the difference between being able to cover basic living expenses and not.

What Will Social Security Look Like for Future Generations?

If no action is taken, future generations may face a more precarious retirement. Social Security is designed to be a safety net, but without intervention, it may not be enough to provide the level of financial security people expect when they retire. Future retirees may need to depend on other sources of income, such as personal savings, investments, or employer-sponsored retirement plans like 401(k)s.

How to Prepare for the Future: Social Security May Run Out of Funds

It’s never too early to start planning for retirement, especially if you rely on Social Security to help make ends meet. Here’s a step-by-step guide on how to prepare for potential changes in Social Security:

1. Understand Your Benefits

First things first, it’s important to understand how much you can expect from Social Security. Use the Social Security Administration’s online calculator to estimate your benefits based on your earnings history. Knowing this will give you a clearer picture of how Social Security will factor into your retirement.

2. Diversify Your Retirement Savings

Don’t put all your eggs in one basket. While Social Security is a reliable safety net, it shouldn’t be your only source of retirement income. Consider contributing to a 401(k) or an IRA to build up additional retirement savings. The more diversified your savings, the better prepared you’ll be for any reductions in Social Security benefits.

3. Save More Now

If you’re concerned about future cuts to Social Security, now is the time to increase your savings rate. Whether it’s a higher 401(k) contribution or a larger emergency fund, building a financial cushion can help ensure you’re not dependent on Social Security alone when you retire.

4. Plan for Healthcare Costs

As you age, healthcare will likely become one of your biggest expenses. Make sure you’re planning ahead by considering options like Health Savings Accounts (HSAs) or long-term care insurance. Social Security doesn’t cover everything, so it’s important to have additional resources to cover medical bills.

5. Keep an Eye on Legislative Changes

The Social Security system is not static; it can change as lawmakers address the funding shortfall. Keep an eye on news from the Social Security Administration (SSA) and Congress for updates on potential reforms. Stay informed so you can adjust your retirement plan accordingly.

What Are the Possible Solutions to Fix Social Security?

Several potential solutions have been proposed to address the funding gap in Social Security:

1. Raising Payroll Taxes

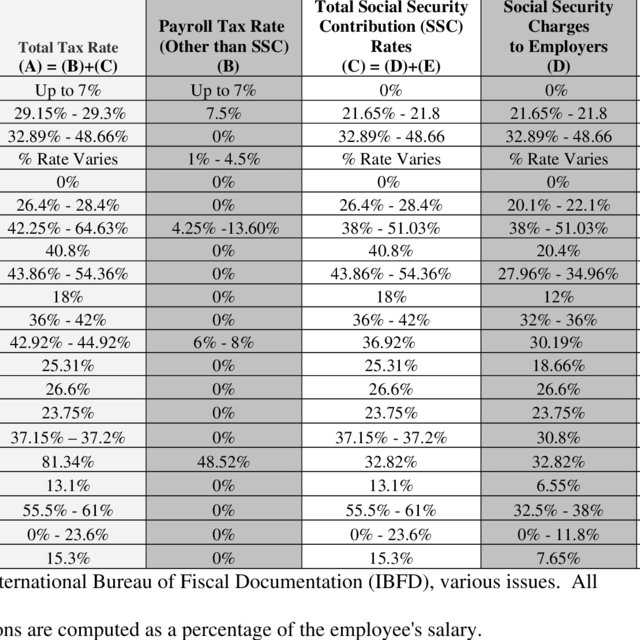

One of the most straightforward solutions is to increase the payroll tax rate. Currently, workers pay a 6.2% tax on their earnings up to a certain amount (around $160,000 in 2025). Raising this rate or expanding the tax base could provide additional revenue for the program.

2. Raising the Retirement Age

Another option is to gradually increase the full retirement age. Right now, you can start receiving full benefits at age 66 or 67, depending on when you were born. Raising the retirement age by a few years could reduce the number of people drawing benefits at any given time.

3. Modifying the Benefit Formula

Changes to the way Social Security benefits are calculated could also help reduce the program’s financial strain. This might involve means-testing, where higher-income earners receive smaller benefits, or adjusting the formula to slow the growth of benefits.

4. Increasing the Taxable Earnings Cap

Currently, earnings above a certain threshold are not taxed for Social Security purposes. Increasing or eliminating this cap would allow high earners to contribute more to the system.

5. Investing the Trust Fund More Aggressively

Some have suggested that the Social Security Trust Fund could be invested more aggressively in stocks or other high-return assets. This would generate more revenue to support benefits, although this idea has met with significant opposition due to potential risks and political concerns.

Social Security Privatization Could Backfire — Here’s Why Experts Are Sounding the Alarm

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits