Social Security June Payments: If you’re one of the 71 million Americans relying on Social Security or SSI benefits, you’ve probably asked yourself: “When exactly is my payment coming in this June?” Whether you’re budgeting for rent, medication, or that summer road trip with your grandkids, knowing your exact check date is essential for smart planning. In this easy-to-read yet comprehensive guide, we break down June 2025 Social Security and SSI payment dates, eligibility details, how to avoid delays, and pro tips for managing your benefits efficiently and safely.

Social Security June Payments

Let’s be real—when it comes to money, timing matters. Whether you’re a retiree keeping the lights on, a caregiver looking after a loved one, or someone with disabilities navigating everyday life, knowing exactly when your Social Security or SSI check lands can bring a much-needed sense of control. These aren’t just government payouts—they’re lifelines. They cover rent, groceries, medicine… and sometimes, a little treat like your favorite diner breakfast or a gift for your grandchild’s graduation. Planning ahead makes all the difference. So here’s what we recommend:

- Mark your payment date on your calendar or phone.

- Use direct deposit so you’re not waiting on the mail.

- Check your account online for updates or changes.

- Reach out for help—from SSA, your bank, or someone you trust—if anything seems off.

- And finally, watch out for scammers. If it sounds fishy, it probably is.

You worked hard for your benefits. You deserve peace of mind, stability, and the freedom to enjoy your life—not stress over when your check is coming. This guide is here to help you do just that—plan smarter, stress less, and live more.

| Feature | Details |

|---|---|

| Topic | Social Security June Payments: Exact Dates You’ll Get Your 2025 Check |

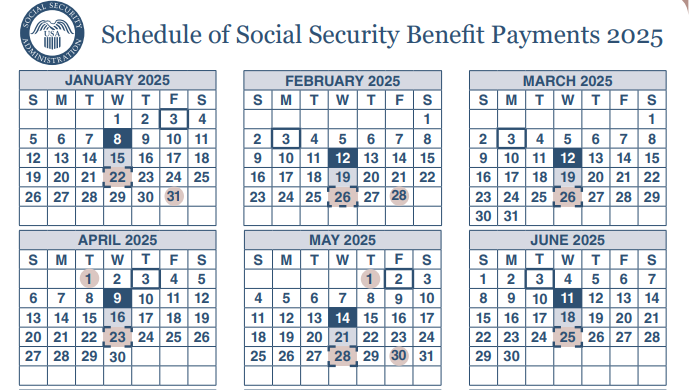

| Payment Dates | June 3, 11, 18, 25 for Social Security; May 30 (early) for June SSI |

| Who Gets Paid When | Depends on birthdate and benefit start date |

| No SSI Payment in June | June payment moved early to May 30, 2025 |

| Monthly Benefit Average (2025) | $1,907 for retirees; $943 SSI for individuals |

| Official Payment Calendar | SSA Calendar |

| Scam Warning | Never give your SSN over the phone or email |

| Direct Deposit Recommended | Secure, fast, and consistent payment delivery |

What Is Social Security & SSI?

Think of Social Security as America’s financial safety net. It was created in 1935 during the Great Depression to support older adults, and it’s since grown to help millions of:

- Retired workers

- People with disabilities

- Survivors of deceased workers

- Low-income individuals and children with disabilities (SSI)

Together, Social Security and SSI serve over 71 million Americans each month.

June 2025 Social Security Payment Schedule

Social Security (Retirement, Disability, Survivors)

Your exact payday depends on your birthdate and when you first started receiving benefits.

| If you… | You’ll be paid on… |

|---|---|

| Started benefits before May 1997 | June 3, 2025 (Tuesday) |

| Birthday is 1st–10th | June 11, 2025 (Wednesday) |

| Birthday is 11th–20th | June 18, 2025 (Wednesday) |

| Birthday is 21st–31st | June 25, 2025 (Wednesday) |

SSI Payments – Early This June

Since June 1, 2025 falls on a Sunday, SSI checks were delivered early on May 30, 2025 (Friday).

That means you will not receive a separate SSI check in June—so plan accordingly.

Real-Life Example: Joe’s June Payday

Joe, a 72-year-old Vietnam vet from Indiana, started collecting Social Security in 1995. He’ll receive his payment on June 3.

His niece Maria, who started benefits last year and has a birthday on June 17, will get her check on June 18.

Joe also receives SSI, and since the payment was made early (on May 30), he knows not to expect anything new in June.

COLA & 2025 Social Security Checks

The Cost-of-Living Adjustment (COLA) helps Social Security benefits keep up with inflation. In 2025, the COLA increase is 2.6%, raising the average monthly benefit for retirees to $1,907, up from $1,848 in 2024.

How to Prepare Financially For Social Security June Payments?

Social Security is dependable—but your budget needs to be, too. Here’s how to make sure your check stretches:

- Make a budget for fixed expenses like rent, groceries, and utilities.

- Schedule auto-payments the day after your check is expected.

- Avoid payday lenders with high interest rates.

- Use local resources like senior centers, food banks, or utility assistance.

SSA Technology Tools That Make Life Easier

The Social Security Administration (SSA) has modernized many of its services. You don’t need to stand in line to get stuff done.

Top Digital Tools:

- my Social Security – Track payments, update info, download proof of income.

- Benefit Planners – Estimate your future retirement, disability, and spousal benefits.

- Online Applications – Apply for benefits, Medicare, or appeals digitally.

Not tech-savvy? You can still call SSA at 1-800-772-1213, Monday–Friday, 8am–7pm.

How to Apply for Social Security June Payments?

Applying for Social Security or Supplemental Security Income (SSI) isn’t as complicated as it may seem—especially if you know where to start. Whether you’re nearing retirement, living with a disability, or helping a loved one, this guide walks you through the application process step-by-step.

Step 1: Decide Which Benefits You’re Applying For

Before anything else, figure out which benefit applies to your situation:

- Retirement Benefits – Typically available starting at age 62.

- Disability Benefits (SSDI) – For people who can’t work due to a medical condition expected to last at least one year.

- SSI (Supplemental Security Income) – For low-income individuals who are aged 65 or older, blind, or disabled.

- Survivors Benefits – For family members of deceased workers.

- Spousal Benefits – For spouses, ex-spouses, or dependents of someone receiving benefits.

Step 2: Gather the Required Documents

The SSA will need to verify your identity, work history, income, and possibly your medical condition. Here’s what you may need:

- Social Security number (yours and your spouse’s, if applicable)

- Birth certificate or proof of birth

- W-2 forms or self-employment tax returns from the last year

- Bank routing number for direct deposit

- Medical records if applying for SSDI or SSI

- Proof of U.S. citizenship or lawful immigration status

Don’t have all the paperwork? Apply anyway—they’ll tell you what can be submitted later.

Step 3: Apply Online, by Phone, or in Person

You’ve got options:

- Apply online:

The fastest way to apply is through the Social Security Administration’s website. You can: - Apply for retirement or spousal benefits online

- Start a disability claim

- File an appeal for a denied claim

- Apply by phone:

Call SSA at 1-800-772-1213 (TTY: 1-800-325-0778), Monday through Friday, 8 a.m. to 7 p.m. - Apply in person:

Visit your nearest Social Security office. Be sure to call ahead and bring your documents.

Step 4: Wait for a Decision

After applying, you’ll receive a letter in the mail explaining the SSA’s decision. This can take anywhere from a few weeks to several months, depending on the type of benefit and whether they need more info.

If your application is approved, the letter will tell you:

- When your payments will start

- How much you’ll receive monthly

- How to access your account online

If your application is denied, you have the right to appeal. The SSA offers a clear appeals process, and you can get help from an advocate or legal aid service if needed.

Step 5: Create a “my Social Security” Account

Once you’re approved, create a my Social Security account to manage everything in one place:

- Track benefit payments

- View tax documents

- Update your address or direct deposit info

- Request replacement documents

It’s safe, secure, and available 24/7.

Common Problems & How to Fix Them

| Problem | Solution |

|---|---|

| Changed banks | Update info on my Social Security |

| Moved houses | Update your address online or call SSA |

| Direct deposit failed | Wait 3 days, then call 1-800-772-1213 |

| Paper check lost | Report it and request a replacement |

| Received scam calls | Report to SSA Fraud Center |

Scam Alert: Stay Sharp, Stay Safe

Scammers are sneaky. They might claim your SSN is suspended or demand gift card payments. Don’t fall for it.

Red Flags:

- Calls asking for your SSN or bank info

- Threats of arrest or suspension of benefits

- Requests for Bitcoin or prepaid cards

Stay Safe:

- Hang up immediately

- Report at oig.ssa.gov

- Only trust ssa.gov and official phone numbers

Say Goodbye to Your Social Security Benefits If You Make These 5 Costly Mistakes in June 2025

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy

June 2025 Social Security Payment Dates Revealed; Find Out When Your Money Arrives

Pro Tips for Seniors, Caregivers & Financial Advisors

Managing Social Security isn’t always simple—but with a bit of planning and the right information, it can become a lot more manageable. Whether you’re receiving benefits yourself or supporting someone who is, these tips can help you stay organized and avoid common pitfalls.

For Seniors:

- Set up auto-pay for rent, utilities, and other essentials so you’re not caught off guard by due dates.

- Keep track of your payment schedule using a calendar or reminder system that fits your routine.

- If managing money becomes stressful, don’t hesitate to ask a trusted family member or friend for help. It’s completely okay to lean on others when needed.

For Caregivers:

- Organize important information in one place—such as Social Security login credentials, bank details, and emergency contacts.

- Assist your loved one in setting up a my Social Security account if they haven’t already—it makes managing their benefits much easier.

- If necessary, become a representative payee through the SSA to legally manage your loved one’s benefits on their behalf.

For Financial Advisors:

- Review Social Security plans with clients annually, especially when COLA adjustments or retirement age decisions come into play.

- Provide guidance on how benefits may impact taxes, especially for clients with additional income streams.

- Help clients understand how to spot and avoid Social Security scams, particularly if they’re unfamiliar with online systems.

Remember: behind every Social Security payment is a real person with real needs. Taking the time to understand and support the process can make a world of difference in someone’s day-to-day life.