Social Security Could Run Dry Sooner: Social Security could run dry sooner than expected, and that’s a big deal whether you’re nearing retirement or just starting your first job. This isn’t a drill — it’s a financial wake-up call for every American family.

According to the 2024 Social Security Trustees Report, the system’s main trust funds — which support retirement and disability benefits — could be depleted by 2034. That’s one year earlier than previously forecast. Medicare’s Hospital Insurance trust fund isn’t far behind, with a projected exhaustion date of 2033. While that doesn’t mean benefits will disappear overnight, it does mean reduced payouts, increased pressure on Congress, and more responsibility on individual Americans to prepare for retirement. Let’s break it all down — in plain English, with clear facts, relatable examples, and steps you can take now.

Social Security Could Run Dry Sooner

Social Security is far from dead — but it’s running on a clock. Without action, every American’s benefits could be cut by 20% or more starting in 2034. That’s not a “maybe.” That’s what the math says. But we’re not powerless. With the right steps — saving smarter, planning longer, and pushing for reform — we can weather the storm. Whether you’re a 30-year-old saving for the future or a 65-year-old planning to file next year, the key is awareness and action.

| Topic | Data / Insight | Reference |

|---|---|---|

| Projected Trust Fund Depletion | OASI: 2033; Combined (OASI + DI): 2034; Medicare Part A: 2033 | SSA Trustees Report |

| Post-Depletion Payments | Social Security: 77–81% of promised benefits; Medicare Part A: ~89% of costs covered | Medicare.gov |

| Average Monthly Retirement Benefit | $1,910 (as of 2024); could drop to ~$1,550 after cuts | SSA.gov |

| Payroll Tax | 12.4% on income up to $168,600 (split between employee and employer) | IRS.gov |

| Reasons for Depletion | Demographic shifts, slower wage growth, rising healthcare costs, new benefits legislation | CRFB.org |

| Solution Options | Tax increases, benefit cuts, age changes, or general revenue injections | SSA, Congressional Budget Office |

| Actionable Steps | Delay filing, build diversified savings, monitor policy changes | Financial advisors, SSA tools |

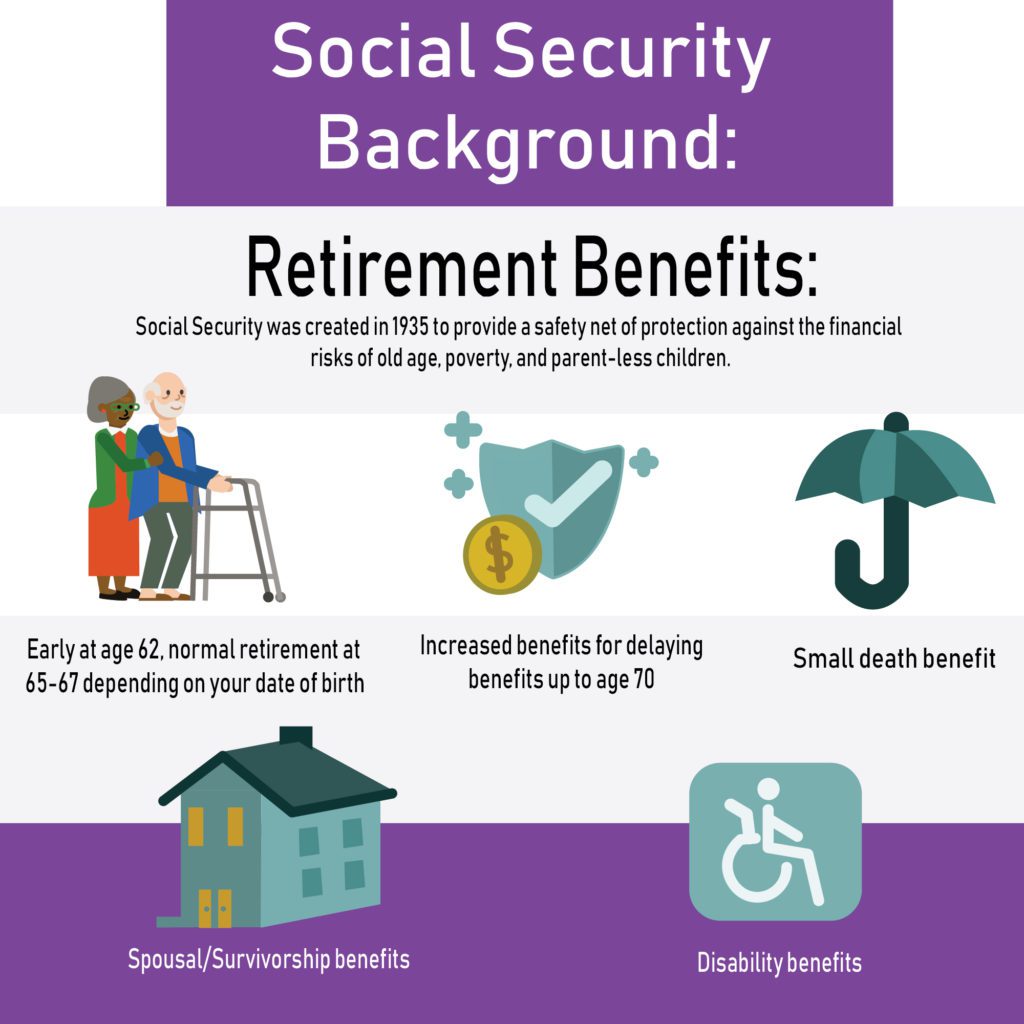

What Is Social Security and Why Was It Created?

Social Security was signed into law in 1935 by President Franklin D. Roosevelt during the Great Depression. Its mission? To be a financial safety net for retirees, the disabled, and surviving family members. For nearly 90 years, it’s helped millions of Americans stay afloat when work was no longer an option.

Today, nearly 67 million people receive Social Security benefits, including retirees, disabled workers, and survivors. It’s funded by payroll taxes paid by today’s workers to support current beneficiaries — a system often described as a pay-as-you-go model.

The big issue? We now have fewer workers paying into the system for every retiree taking money out. Back in 1960, there were over 5 workers per retiree. Now, we’re down to about 2.7 workers per retiree — and that number is still shrinking.

Why Social Security Could Run Dry Sooner?

1. Demographic Shift

People are living longer, having fewer children, and retiring in droves. Baby Boomers — those born between 1946 and 1964 — are retiring at an average rate of about 10,000 per day. This puts enormous pressure on Social Security’s cash flow.

2. New Legislation Expanding Benefits

The 2025 Social Security Fairness Act repealed provisions that previously limited public-sector retirees from receiving full benefits if they had a pension. This meant millions of new recipients, with retroactive payments in some cases.

3. Rising Healthcare Costs

Medicare, closely linked to Social Security, faces its own funding crisis due to soaring hospital costs, hospice care, and long-term services. These medical expenses are driving depletion faster than expected.

4. Lower Wage Growth and Income Cap

Social Security taxes are only collected on wages up to a certain cap ($168,600 in 2024). High-income earners pay no tax on income above that. Raising or removing that cap could dramatically increase funding — but politically, that’s a tough battle.

What Happens When the Trust Fund Runs Out?

Here’s the critical thing: Social Security won’t vanish — but benefits will be reduced.

Even if the trust fund is depleted, payroll taxes from current workers will continue to fund the system. However, that revenue will only cover about 77–81% of scheduled benefits starting in 2034.

For Medicare, the trust fund for Part A (hospital insurance) would be able to pay just 89% of expected costs. That might mean higher co-pays, fewer services, or delays in reimbursements to hospitals.

If you’re retired today and getting $1,910 a month, you could see that drop to around $1,550–$1,600 in a few years unless reforms are passed.

Who’s Most Affected?

Retirees and Near-Retirees

If you’re already collecting Social Security or plan to within the next 5–10 years, you’re at risk of direct cuts if Congress doesn’t act.

Gen X and Millennials

You’ll likely face changes to full retirement age (already 67 for most people), and your benefit checks could be smaller. But you still have time to save and adapt.

Gen Z

Retirement might seem a lifetime away, but Social Security is foundational. Without reform, you could face a retirement system where full benefits kick in at 70 or later — with more responsibility falling on your own savings.

What Can You Do Now?

Step 1: Understand Your Statement

Create a free account at SSA.gov/myaccount and download your Social Security Statement. It shows your earnings history and projects future benefits based on different retirement ages.

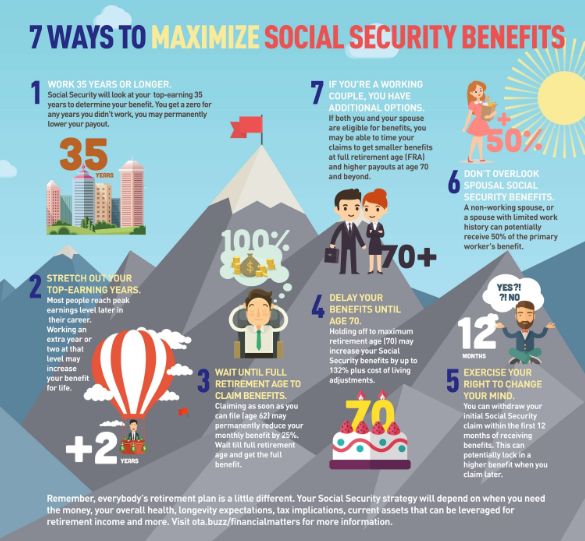

Step 2: Delay Your Filing

If you can afford to wait beyond your Full Retirement Age (67 for most), you’ll get an 8% boost in benefits each year you delay, up to age 70.

Step 3: Diversify Retirement Income

Build up personal savings outside of Social Security:

- 401(k) or 403(b): Tax-advantaged, often with employer match

- IRA or Roth IRA: Offers flexibility and tax advantages

- HSAs (Health Savings Accounts): Great for healthcare expenses in retirement

Step 4: Adjust Expectations and Budget

Plan for the possibility that Social Security might cover 20% less than currently promised. That might mean working a few years longer, moving to a lower-cost area, or adjusting your lifestyle in retirement.

Step 5: Contact Your Representatives

Congress will decide whether benefits get cut, taxes increase, or new solutions are implemented. Call or write your U.S. representative to demand sustainable reforms. Many Americans support lifting the income cap or slowly adjusting the full retirement age — but it takes political will.

What Could Congress Do?

Congress has several options:

- Raise the payroll tax slightly for all workers

- Lift or eliminate the taxable income cap so high earners contribute more

- Gradually increase full retirement age

- Lower benefits for high-income retirees

- Adjust cost-of-living calculations

Any one of these would help, but a combination will likely be needed to close the funding gap.

Real-World Example: How One Family Is Adapting

Let’s look at Sam and Maria from Colorado. Sam is 64 and plans to retire at 67. They’ve saved moderately in a 401(k) but expected Social Security to cover at least half their income. When they learned about potential cuts, they made three big moves:

- Pushed back Sam’s retirement to age 69

- Downsized to a smaller home

- Began maxing out their Roth IRA and HSA accounts

They now project that even with a 20% cut, they’ll meet 90% of their retirement goals — with a little buffer from side income like tutoring and consulting.

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits

Social Security Employees Sound Alarm on Delays; Here’s How Your Benefits Could Be Affected

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026