Social Security COLA 2026: If you’ve been wondering, “Will my Social Security check go up in 2026?”—you’re not alone. With inflation still impacting everyday essentials like rent, gas, and groceries, millions of Americans are eager to know how much more they’ll receive next year.

According to the latest June 2025 estimate, the 2026 Social Security Cost-of-Living Adjustment (COLA) is projected to be 2.5%. While that’s a more moderate increase compared to the 8.7% jump we saw in 2023, it still represents a necessary lifeline for the 71+ million Americans who rely on Social Security benefits every month. In this guide, we’ll break down what this estimate means for you, how it’s calculated, and what to expect moving forward. Whether you’re a retiree, someone with a disability, or planning for your financial future, this is the essential resource you need.

Social Security COLA 2026

The estimated 2.5% Social Security COLA for 2026 may not be a record-breaking raise, but it remains a critical tool in helping millions of Americans keep pace with inflation. If the estimate holds, average retirees can expect around $50 more per month starting in January 2026. While it may not dramatically change your lifestyle, every increase helps when you’re living on a fixed income. Make sure to monitor the official October announcement and plan your 2026 budget accordingly. The COLA may be automatic, but how you respond to it can make a big difference in your financial security.

| Feature | Details |

|---|---|

| Estimated COLA (June 2025) | 2.5% |

| Expected Monthly Increase | ~$48–$50 (for average $1,950/month benefit) |

| Annual Extra Income | ~$576–$600 |

| Effective Date | January 2026 |

| Final Announcement Date | October 2025 |

| Data Source | Social Security Administration |

| Inflation Basis | CPI-W (Consumer Price Index for Urban Wage Earners) |

| Impacted Groups | Retirees, SSI recipients, SSDI recipients, survivors |

| Previous Increases | 3.2% (2024), 8.7% (2023), 5.9% (2022) |

What Is COLA and Why Does It Matter?

COLA, or Cost-of-Living Adjustment, is a yearly increase in Social Security and Supplemental Security Income (SSI) benefits to offset the effects of inflation. COLA helps ensure that beneficiaries don’t lose purchasing power over time.

Every year, the Social Security Administration (SSA) reviews inflation data and determines whether an increase is warranted. If so, they apply a percentage bump to all eligible benefits.

COLA matters because, unlike wages, retirement or disability benefits don’t grow unless adjusted. Without it, many Americans would see their fixed incomes eroded by rising prices for essentials.

How Much Will Social Security Increase in 2026?

If the current 2.5% estimate holds, the average Social Security benefit—about $1,950/month in 2025—would increase by roughly $48–$50/month. That’s about $600 per year more in benefits.

Here’s a breakdown of what that increase could look like at various benefit levels:

| Monthly Benefit | 2.5% Increase | New Monthly Benefit |

|---|---|---|

| $1,200 | $30 | $1,230 |

| $1,500 | $37.50 | $1,537.50 |

| $1,950 | $48.75 | $1,998.75 |

| $2,500 | $62.50 | $2,562.50 |

| $3,000 | $75 | $3,075 |

Keep in mind, this is just an estimate. The official increase will be announced in October 2025, once the full inflation data for the third quarter is available.

How Is the Social Security COLA Calculated?

COLA is based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), reported by the Bureau of Labor Statistics (BLS).

Here’s a simplified version of how it’s calculated:

- The SSA calculates the average CPI-W for July, August, and September of the current year.

- It compares this to the same three-month period from the previous year.

- If there’s an increase, that percentage becomes the COLA.

For example, if CPI-W averaged 300.0 in Q3 2024 and rises to 307.5 in Q3 2025, the difference is 2.5%, which would be the COLA for 2026.

Who Will Receive the 2026 COLA?

If you receive any of the following, you’re eligible for the COLA:

- Retired workers

- Spouses and children of retirees

- Disabled workers (SSDI)

- Survivors of deceased workers

- SSI recipients

Over 71 million Americans will be impacted by this increase. That includes approximately:

- 52 million retired workers

- 7.5 million disabled workers

- 8 million SSI recipients

- 5 million survivors and dependents

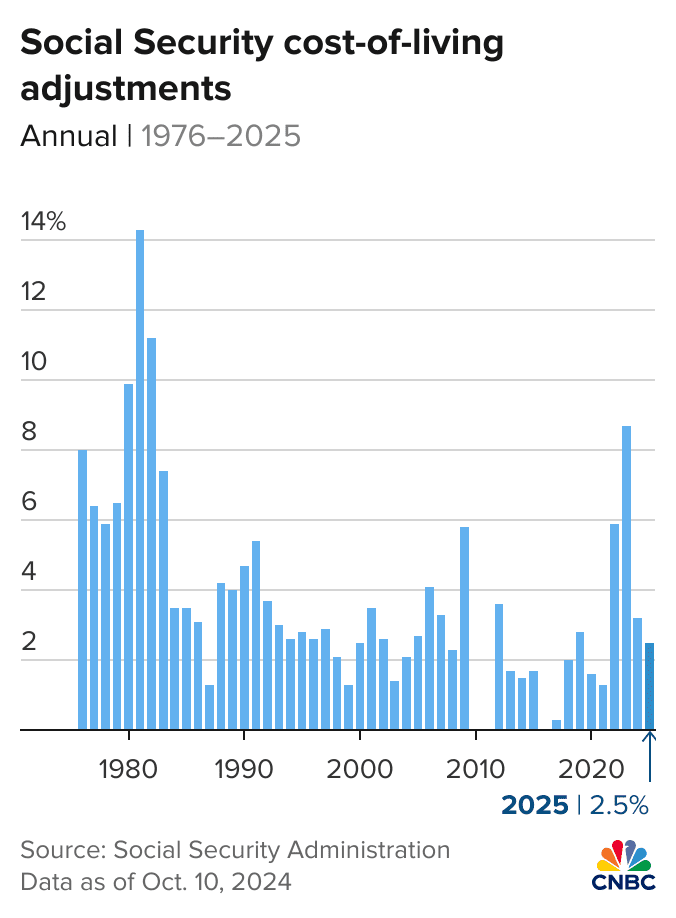

Historical COLA Comparison

Here’s how the upcoming increase compares to past years:

| Year | COLA % |

|---|---|

| 2026 (est.) | 2.5% |

| 2025 | 3.2% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

| 2019 | 2.8% |

The long-term average is about 2.6%, so 2026’s estimate is very much in line with historical trends.

What’s Driving the COLA Estimate?

The 2.5% COLA estimate reflects moderate inflation throughout 2024 and early 2025. Factors influencing this include:

- Easing energy prices: Fuel and utility costs have stabilized compared to previous years.

- Stabilized grocery prices: Food inflation has cooled, especially in processed and packaged items.

- Healthcare inflation: While still climbing, the pace has slowed compared to peak COVID years.

However, some potential risks could cause the final number to increase:

- Tariffs on imported goods

- Geopolitical conflicts impacting oil prices

- Supply chain disruptions

- Rising rent and housing costs

The COLA could still tick up if inflation accelerates over the summer.

What Can Reduce the Value of Your COLA?

Even if you’re getting more from Social Security, it doesn’t always mean you’ll feel richer. Here’s why:

- Medicare Part B premiums often increase alongside COLA, reducing the net gain.

- Rising property taxes or insurance premiums can eat into your budget.

- Bracket creep: A higher income can mean more of your Social Security becomes taxable.

For example, if you’re a single filer and your combined income goes over $25,000, up to 85% of your Social Security income may become taxable.

How to Prepare for the Social Security COLA 2026?

This is a great time to reevaluate your financial strategy. Here are some smart steps you can take now:

- Log into your My Social Security account

Check your benefit estimate and earnings history at ssa.gov/myaccount. - Review your Medicare premiums

Watch for announcements from Medicare.gov in November to see if your premiums will rise in 2026. - Recalculate your 2026 budget

Use your projected new monthly benefit to plan for household expenses, emergency funds, and discretionary spending. - Meet with a tax advisor

If your income is approaching taxable thresholds, speak with a professional about strategies to reduce your tax bill. - Consider Roth conversions or tax diversification

With expected changes in tax policy coming in 2026, now is a good time to look at tax-smart income strategies.

What’s Next: Timeline for COLA 2026

Here’s what to expect in the coming months:

- July–September 2025: BLS releases monthly CPI-W data

- October 2025: Official COLA for 2026 is announced

- December 2025: SSA mails COLA notices to beneficiaries

- January 2026: New benefit amount takes effect

CPI Surprise Alters 2026 COLA Forecast; Social Security Recipients Could See Unexpected Changes

2025 COLA Drop Shocker: How Your Social Security Check Could Take a Hit!

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy

Frequently Asked Questions (FAQs)

Q: Will the 2026 COLA be higher than 2.5%?

A: It’s possible. The final figure depends on inflation during the third quarter of 2025.

Q: When will I receive the COLA-adjusted payment?

A: The new benefit amount will appear in checks or deposits starting in January 2026.

Q: Does COLA affect only retirees?

A: No. It affects all beneficiaries, including SSDI, SSI, survivors, and children.

Q: How will I know my new benefit amount?

A: You’ll get a notice in the mail and can also check your My Social Security account in December 2025.

Q: Is COLA taxed?

A: Not directly, but the increase could push you into a higher taxable income range.