Social Security and Medicare Face Early Insolvency: The U.S. government’s Social Security and Medicare programs have long been pillars of support for millions of Americans, ensuring financial stability and healthcare access for retirees and individuals with disabilities. However, recent reports from the Social Security and Medicare Trustees have raised alarm bells, revealing that both programs are on track for earlier-than-expected insolvency. In fact, experts are projecting that these programs could run out of money much sooner than previously anticipated, threatening the benefits millions rely on. This news has caused widespread concern, not only for the current generation of retirees but also for younger Americans who are paying into the system but may face reduced benefits in the future. Let’s break down the situation, explore what the reports say, and discuss what needs to be done to prevent a financial crisis.

Social Security and Medicare Face Early Insolvency

The early insolvency of Social Security and Medicare represents a major challenge for the United States. These programs provide vital support to millions of Americans, and without proper funding, there could be severe consequences for retirees, disabled individuals, and seniors in need of healthcare. However, it’s not all doom and gloom. With the right legislative action, we can ensure that these programs remain solvent and continue to provide the support that so many depend on. It’s crucial that policymakers act now to preserve the future of Social Security and Medicare for the generations to come.

| Key Information | Details |

|---|---|

| Projected Insolvency of Social Security Trust Fund | 2034 (OASI and OASDI combined) |

| Projected Insolvency of Medicare Trust Fund | 2033 (Hospital Insurance Trust Fund) |

| Current Funding Gap | 19% benefit reduction if no intervention is made |

| Factors Impacting Shortfalls | Increased healthcare costs, demographic changes, legislative shifts |

| Potential Solutions | Raising payroll taxes, adjusting benefits, diversifying investments |

| Sources | Social Security Trustees Medicare Trustees |

What the Reports Say: Social Security and Medicare Face Early Insolvency

The 2025 annual reports from the Social Security and Medicare Boards of Trustees have outlined alarming projections. The Trustees estimate that the Social Security Trust Fund will run out by 2034, and the Medicare Hospital Insurance Trust Fund could be depleted as early as 2033.

Social Security Insolvency

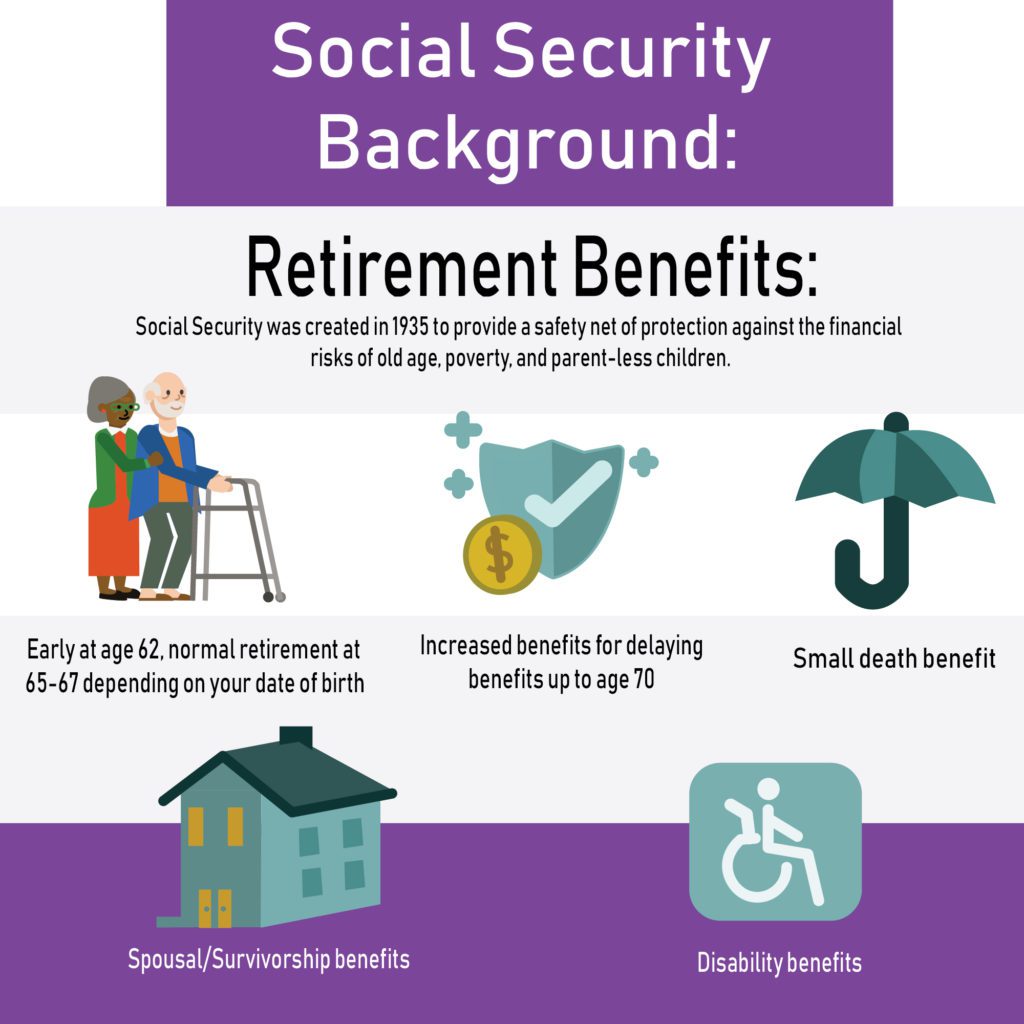

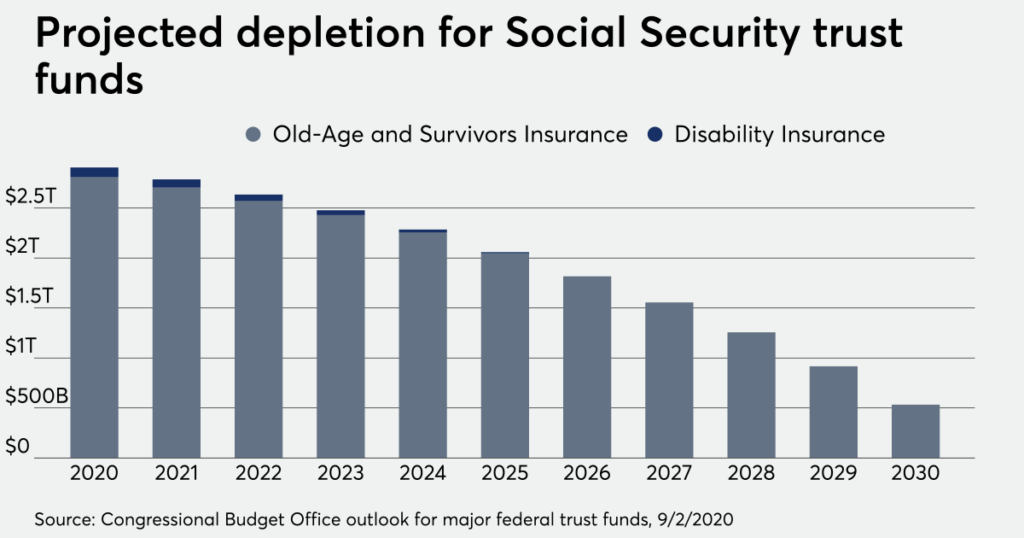

Social Security is composed of two main programs: the Old-Age and Survivors Insurance (OASI) program, which provides benefits to retirees and survivors of deceased workers, and the Disability Insurance (DI) program, which offers financial assistance to individuals with disabilities. Together, these make up the Old-Age, Survivors, and Disability Insurance (OASDI) trust fund.

The OASI fund is projected to be depleted by 2033, meaning it will only be able to pay 77% of scheduled benefits. Combined, the OASDI fund could face a 19% cut across all benefits by 2034 if no legislative action is taken. The situation has worsened partly due to an unexpected increase in benefits following the enactment of the Social Security Fairness Act in January 2025. This act increased benefits for certain groups of workers, accelerating the depletion timeline.

Medicare Insolvency

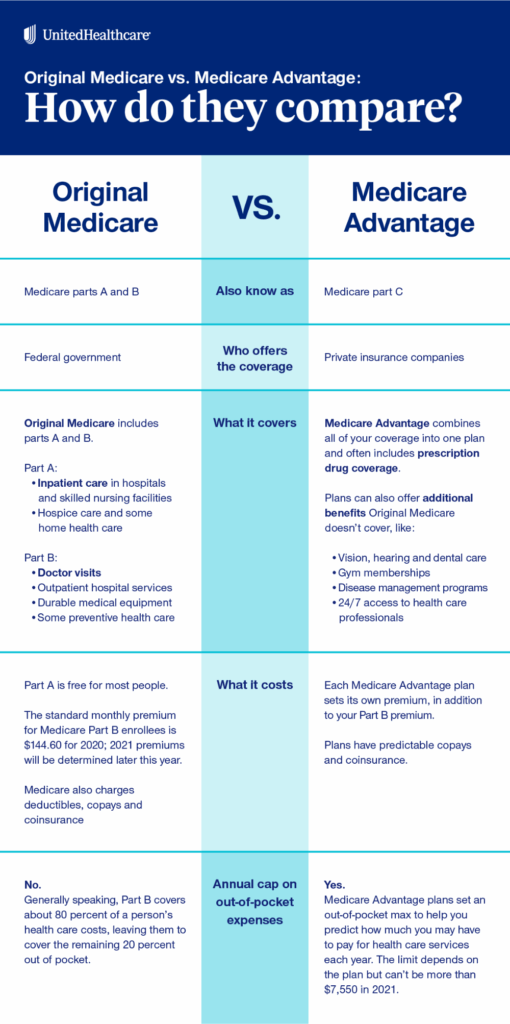

Medicare, which helps cover healthcare costs for Americans aged 65 and older, is facing similar problems. Specifically, the Medicare Hospital Insurance (HI) Trust Fund, which finances Medicare Part A services like hospital stays, is expected to run dry by 2033. After this date, the HI trust fund will be able to cover only about 89% of its obligations.

This shortfall is driven by several factors, including higher-than-expected healthcare spending in 2024 and an increase in hospital and hospice service utilization. These factors are putting more strain on the fund, accelerating its depletion.

Why Should You Care About Social Security and Medicare’s Insolvency?

Millions Depend on These Programs

The Social Security program is a financial lifeline for more than 70 million Americans, including retirees, disabled individuals, and survivors of deceased workers. It provides monthly income that many rely on for basic living expenses. Without Social Security, many of these individuals would face serious financial hardship.

Similarly, Medicare provides critical healthcare coverage for seniors, allowing them to access medical care without the burden of astronomical costs. Without Medicare, seniors would be forced to bear the brunt of healthcare expenses, which can quickly become unaffordable.

Impact on Younger Generations

Even if you’re young and healthy, the Social Security and Medicare programs matter. Younger generations are still paying into the system, and if these funds run out, it could mean lower benefits for them in the future. The key issue here is whether the government will take the necessary steps to ensure that Social Security and Medicare remain sustainable for future generations.

Historical Context: The Origins of Social Security and Medicare

Social Security was established in 1935 as part of President Franklin D. Roosevelt’s New Deal, intended to provide financial support to elderly Americans who were suffering from poverty after the Great Depression. The Medicare program was signed into law in 1965 under President Lyndon B. Johnson, aiming to ensure that seniors had access to health care without incurring massive expenses.

Both programs were revolutionary at the time and remain critical to American life. Social Security transformed retirement planning for Americans, and Medicare made healthcare accessible to those who might otherwise not afford it.

Factors Contributing to the Shortfalls

Several factors are contributing to the financial troubles facing Social Security and Medicare, and understanding them can help us gauge how serious the problem is and what might need to be done to address it.

1. Demographic Shifts

America’s population is aging, and more people are retiring, which means more people are drawing benefits from Social Security and Medicare. The baby boomer generation, which is retiring in large numbers, has placed a heavy burden on these programs. Meanwhile, the birth rate has been declining, meaning fewer workers are paying into the system.

2. Rising Healthcare Costs

As medical care becomes more expensive, the Medicare program faces growing expenses. New treatments, advanced technologies, and an aging population all contribute to these rising costs, and without adequate funding, Medicare could face a crisis in the next decade.

3. Economic Challenges

Slower wage growth and other economic challenges have reduced the funds flowing into the system. When wages stagnate, less payroll tax revenue is collected, leaving Social Security and Medicare underfunded.

Case Study: Impact of Insolvency on Real People

Consider John, a 72-year-old retiree who relies on Social Security to cover most of his monthly expenses. Without his Social Security check, John would struggle to pay for his housing, food, and medical costs. If the program faces a 19% reduction by 2034, John would lose over $300 a month, severely affecting his quality of life.

Similarly, Jane, a 68-year-old woman with multiple chronic health conditions, depends on Medicare to cover the costs of her doctor’s visits and hospital stays. If Medicare’s trust fund runs out in 2033, she could be left with significant out-of-pocket medical expenses.

These examples highlight just how crucial it is to address the financial instability of these programs.

Potential Solutions to Prevent Insolvency

While the situation is urgent, there are potential solutions that could prevent a crisis. Let’s take a look at some of the options on the table:

1. Increase Payroll Taxes

One potential solution is to raise payroll taxes. Right now, workers pay 6.2% of their wages into Social Security and 1.45% into Medicare. By increasing the payroll tax rate, the government could generate more revenue to fund these programs.

Another option would be to eliminate the cap on taxable earnings, which is currently set at $160,200. This means that high earners are not paying into the system on income beyond this threshold. Removing the cap could increase revenue from the wealthiest Americans.

2. Adjust Benefits

Another option would be to adjust the benefits provided by Social Security and Medicare. This could include raising the retirement age, which has already been increased in the past. Alternatively, lawmakers could adjust benefit formulas to ensure that the programs remain sustainable.

3. Invest in Other Assets

The Social Security Trust Fund primarily invests in U.S. Treasury bonds. Some experts argue that allowing the fund to invest in a broader range of assets, such as stocks, could yield higher returns and help offset some of the financial challenges.

4. Reform Healthcare Spending

For Medicare, one of the most straightforward solutions would be to tackle rising healthcare costs. This could involve negotiating better prices for prescription drugs, reducing unnecessary medical procedures, or improving the overall efficiency of the healthcare system.

Social Security Privatization Could Backfire — Here’s Why Experts Are Sounding the Alarm

Social Security’s 2026 Boost Could Be the Biggest Game-Changer for Retirees in Years: Check Details

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits