Smart Strategies for Withdrawing Savings During Market Volatility: is your go-to guide for staying calm, smart, and secure with your retirement money, even when markets get bumpy. Whether you’re a recent retiree or gearing up to leave the 9-to-5 grind, this guide breaks down everything you need to know—in plain English. Let’s face it: the market isn’t always kind. Stocks can drop, inflation can rise, and headlines can make you second-guess your financial plan. The good news? There are proven, flexible strategies that help you preserve your savings, stay on budget, and sleep well at night.

Smart Strategies for Withdrawing Savings During Market Volatility

Retiring into a volatile market doesn’t mean you’re doomed. With smart planning, a cash and bond buffer, bucket strategy, flexible withdrawals, tax-efficiency, healthcare planning, and emotional control, you can enjoy peace of mind and long-term success. Markets will rise and fall, but your strategy doesn’t have to. With discipline, structure, and adaptability, you’ll have the tools to live comfortably—no matter what Wall Street does next.

| Topic | Detail |

|---|---|

| Cash Buffer | Keep 12–18 months of expenses in a high-yield savings account (4.3–5.0% APY) |

| I-Bonds | Pay fixed + inflation-adjusted rate (currently ~3.98%) – safe from volatility |

| Withdrawal Rule | Use the 4–5% rule, with flexibility based on market conditions |

| Bucket Strategy | Divide assets into short-, mid-, and long-term buckets for structure |

| Guardrail System | Adjust withdrawals up/down based on portfolio performance (±10% triggers) |

| Tax Strategies | Withdraw from taxable, then tax-deferred, then Roth for maximum efficiency |

| Roth Conversions | Convert traditional IRA funds during market dips or low-income years |

| Diversified Income | Include Social Security, dividends, annuities, rentals, or part-time work |

| Healthcare Planning | Budget for Medicare, long-term care, and out-of-pocket costs |

| Stable-Value Funds | Provide 3–5% returns with low volatility—good for mid-term needs |

| Behavioral Finance Tips | Limit market checking, use rebalancing, and consult advisors for discipline |

| Required Minimum Distributions (RMDs) | Start at age 73; plan withdrawals to avoid penalties |

1. Build an Inflation-Proof Cash and Bond Buffer

Having quick-access money during downturns is key. Here’s how to do it smartly:

High-Yield Savings Accounts (HYSAs): These earn 4.3–5.0% APY from reputable banks like Ally, SoFi, and Discover. Perfect for 12–18 months’ worth of living expenses.

Series I Bonds: Backed by the U.S. Treasury, they offer a fixed rate plus inflation protection. Current rates are around 3.98% (as of June 2025). They’re tax-deferred and protected from market volatility, though they must be held for at least one year.

Bond Ladders: Invest in bonds that mature in staggered intervals (e.g., 1 to 5 years) so you always have some maturing soon. You’ll avoid selling long-term assets at a loss.

Stable-Value Funds: Often available in 401(k)s, these funds return 3–5% with minimal volatility. Great for medium-term needs.

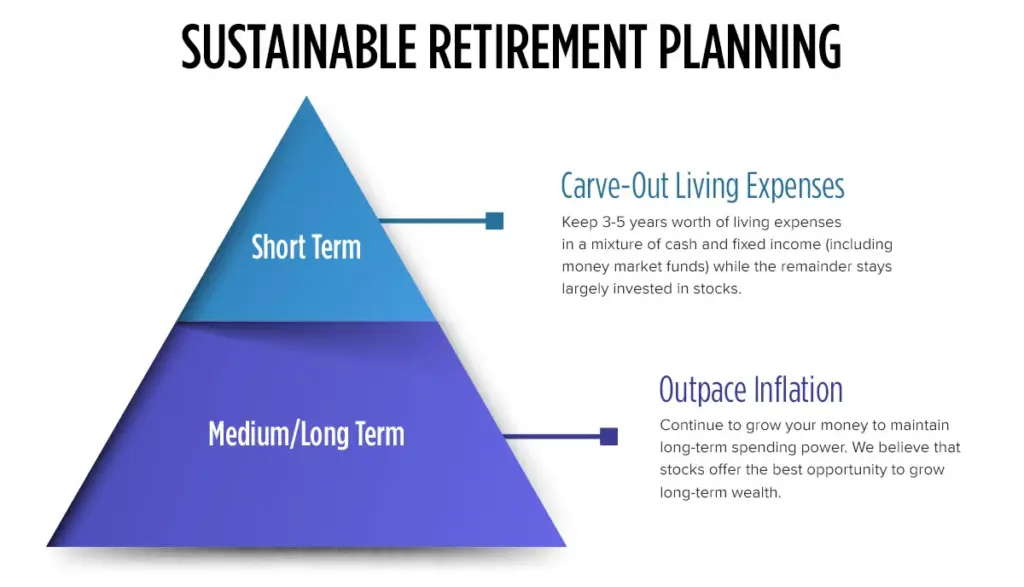

2. Apply the Bucket Strategy for Simplicity

The bucket approach divides your savings into three categories:

- Bucket 1 (0–2 years): Cash and HYSAs—your “living money” for bills and groceries.

- Bucket 2 (3–7 years): Bond funds or ladders—income stability with modest growth.

- Bucket 3 (8+ years): Stocks and growth investments—these ride out volatility and provide long-term returns.

This method helps reduce panic. You know your short-term needs are covered, giving your investments time to recover from downturns.

3. Use a Guardrail Withdrawal Strategy

Instead of blindly following a flat 4% withdrawal rate, try a guardrail system:

- Start with 4–5% of your portfolio’s value as your annual withdrawal.

- If your portfolio falls 10% or more, reduce your withdrawal by 10–15% the next year.

- If it rises significantly, you can increase withdrawals slightly—or just let the portfolio grow.

This system helps prevent depleting your savings too quickly and extends longevity even in bear markets.

4. Diversify Your Retirement Income Sources

Diversification isn’t just about what you invest in—it’s also about where your income comes from.

- Social Security: Delay benefits (if possible) to maximize payouts. At age 70, you’ll get ~32% more than if you claim at 66.

- Dividends: Invest in blue-chip dividend-paying stocks. They provide a steady income stream, even during downturns.

- Annuities: Fixed annuities or retirement income annuities provide guaranteed income. Look for low-fee options.

- Rental Income: Real estate can offer stable, inflation-hedged monthly income if managed well.

- Part-Time Work or Consulting: Many retirees enjoy light work that adds purpose and income.

5. Account for Taxes with a Withdrawal Order

Being smart about where you withdraw money from can save you thousands in taxes:

General Rule of Thumb:

- Withdraw from taxable brokerage accounts first.

- Then draw from tax-deferred accounts like traditional IRAs or 401(k)s.

- Save Roth IRAs for last—they grow tax-free and aren’t subject to RMDs (Required Minimum Distributions).

Why it matters: Tax brackets, Medicare premiums, and Social Security taxability all hinge on your income. Managing withdrawals can minimize surprises.

6. Consider Roth Conversions in Low-Income Years

Roth conversions allow you to move money from a traditional IRA into a Roth IRA—paying tax now so you avoid tax later.

This is especially beneficial:

- In early retirement before RMDs start at age 73.

- In market downturns, when IRA values are lower.

- If you’re in a temporarily lower tax bracket.

By converting in stages, you smooth out your tax burden and increase tax-free income in the future.

7. Plan for Healthcare and Long-Term Care Costs

The average 65-year-old couple will need about $315,000 (in today’s dollars) for healthcare in retirement, not including long-term care.

Key moves:

- Enroll in Medicare Part B and Part D on time to avoid penalties.

- Consider a Medicare Supplement (Medigap) plan or Medicare Advantage.

- Explore long-term care insurance in your 50s or early 60s.

- Use Health Savings Accounts (HSAs) if you’re still working—they offer triple tax benefits.

Being prepared reduces the risk of draining your investment accounts for a medical emergency.

8. Manage Emotions with Behavioral Finance Tips

Money and emotions are closely linked, especially during retirement. Avoid panic with these tactics:

- Limit market watching: Check your portfolio quarterly, not daily.

- Set rules in advance: Predetermine when you’ll rebalance or adjust withdrawals.

- Work with a fiduciary advisor: They help you stick to your plan and avoid reactive decisions.

- Practice mindfulness: Journaling, walks, and hobbies reduce stress and keep your financial mindset strong.

Behavioral finance studies show that staying calm and consistent beats reacting emotionally every time.

9. Use Rebalancing and Dollar-Cost Averaging

Rebalancing means adjusting your portfolio to stay aligned with your target allocation. Do it once or twice a year—or if things drift more than 5–10%.

Dollar-cost averaging (DCA): If you’re still investing (say, from part-time income), continue regular, fixed investments. This smooths out price fluctuations and avoids trying to time the market.

These practices maintain discipline and promote long-term growth.

Sample Smart Strategies for Withdrawing Savings During Market Volatility Walkthrough

Let’s say you’re 67 and retiring with a $1 million portfolio and $60,000 in annual expenses.

- Bucket 1: $120,000 in cash/HYSA for 2 years of expenses

- Bucket 2: $240,000 in a bond ladder and stable-value funds

- Bucket 3: $640,000 in a 60/40 stock-bond diversified portfolio

You withdraw ~4% annually ($40,000), supplementing the rest with Social Security and dividend income. You rebalance yearly and use a guardrail: if your total portfolio dips below $900,000, reduce your withdrawal by 10%.

Feeling the Squeeze? 10 Smart Financial Moves to Survive Economic Uncertainty

8 Proven Strategies to Stay Financially Afloat When Times Get Tough

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?