RSDI Payments Are Rolling Out: Whether you’re a seasoned retiree, a new disability recipient, or a survivor figuring it out one step at a time, we’ve got you covered. The RSDI program—short for Retirement, Survivors, and Disability Insurance—is part of what most people call “Social Security.” It’s how millions of Americans keep a roof over their heads, groceries in their kitchens, and peace of mind in their homes. And each month, the Social Security Administration (SSA) ensures that these payments go out on a structured schedule, tied closely to beneficiaries’ birthdates and application timelines.

This June 2025, a fresh wave of monthly RSDI payments is rolling out—some with retroactive increases, thanks to legislative changes. This article offers a step-by-step breakdown of what to expect, how much money might hit your bank account, and what to do if your check is delayed.

RSDI Payments Are Rolling Out

The RSDI payment system is one of the most trusted income sources for older and disabled Americans—and this June 2025, it’s running on time, with added boosts for many. Whether you’re receiving retirement benefits, SSDI, or survivor payments, understanding the timing, amounts, and recent legislative changes empowers you to take control of your finances. Use the SSA tools, stay aware of changes, and never hesitate to ask for help. These benefits were earned through hard work—and staying informed ensures you get every penny you deserve.

| Aspect | Details |

|---|---|

| Payment Dates (June 2025) | Pre-May 1, 1997: June 3 Birthdays 1–10: June 11 Birthdays 11–20: June 18 Birthdays 21–31: June 25 |

| SSI | May 30 (shifted due to weekend) |

| Average Monthly Benefits | Retiree: ~$1,915 Couples: ~$3,287 Disabled Worker: ~$1,537 Spouse: ~$911 Widow(er): ~$1,774 Max at Age 70: ~$5,108 |

| Retroactive Payments | Over 2.5M Americans receiving additional payments due to the Social Security Fairness Act (processed through Nov 2025) |

| SSA Contact | Phone: 1‑800‑772‑1213 TTY: 1‑800‑325‑0778 Online: ssa.gov |

What Is RSDI and Who Qualifies?

RSDI is a federal program that includes three main types of benefits:

- Retirement Benefits – Based on your work history and age at retirement.

- Survivor Benefits – For the spouse and children of deceased workers.

- Disability Benefits (SSDI) – For individuals who are medically unable to work.

To qualify for RSDI, you must have earned enough work credits by paying into the Social Security system through payroll taxes. For SSDI, in particular, your work history must be recent, and your disability must be long-term and prevent substantial gainful activity.

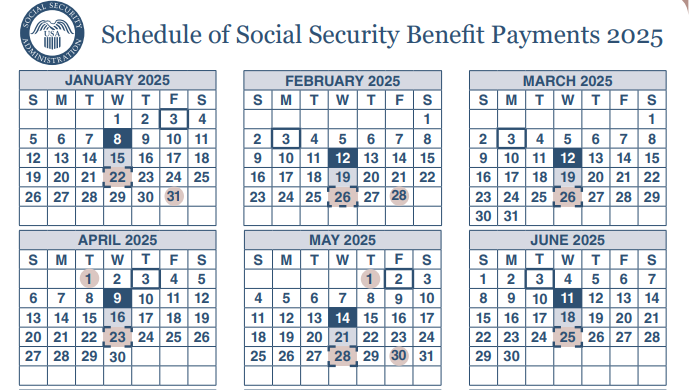

June 2025 Payment Schedule: When Will You Get Paid?

If you receive Social Security or SSDI, your payment date depends on when you first started receiving benefits and your birth date.

For Those Who Started After May 1997

The SSA pays benefits on the second, third, or fourth Wednesday of each month based on your birth date:

- Birthdays on 1st–10th: Payment on June 11

- Birthdays on 11th–20th: Payment on June 18

- Birthdays on 21st–31st: Payment on June 25

For Those Who Started Before May 1997

If you began receiving Social Security benefits before May 1997, you’ll be paid on the first Wednesday of every month, which is June 3 in 2025.

SSI (Supplemental Security Income) Recipients

SSI is separate from Social Security, although some people get both. SSI is always paid on the 1st of the month, but if the 1st falls on a weekend or holiday, SSA moves the payment to the closest business day. For June 2025, SSI was paid on May 30 (Friday).

How Much Will You Get in June 2025?

Here are the average Social Security benefit amounts for June 2025, according to the SSA:

- Retired worker: ~$1,915/month

- Retired couple (both receiving): ~$3,287/month

- Disabled worker (SSDI): ~$1,537/month

- Spousal benefit: ~$911/month

- Widow/widower: ~$1,774/month

- Delayed retirement credits (age 70): Up to ~$5,108/month

These figures vary based on lifetime earnings, retirement age, and whether you are receiving additional benefits, like spousal or survivor support.

Understanding RSDI Payments Are Rolling Out

Due to the Social Security Fairness Act, more than 2.5 million people—especially public employees like teachers, police officers, and municipal workers—are receiving retroactive payments. These adjustments correct for previously reduced benefits tied to the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

Key Facts:

- Started in April 2025

- Processing continues through November 2025

- Average retroactive payment: $2,500–$7,500

- Applies automatically if you qualify

What To Do If Your Payment Is Late or Missing

- Wait at least 3 business days past your scheduled payment date.

- Double-check your bank—electronic transfers may be delayed.

- Visit your mySocialSecurity account to confirm your payment status: ssa.gov/myaccount

- Call the SSA at 1‑800‑772‑1213 or TTY 1‑800‑325‑0778.

Be prepared with your Social Security Number (SSN) and any previous communication you’ve received.

Expert Tips: How to Maximize Your Benefits

- Delay Retirement If You Can – Every year you delay beyond full retirement age (up to 70) increases your benefit by about 8%.

- Understand Spousal and Survivor Benefits – Your spouse or surviving spouse may be eligible to receive up to 50% or more of your benefit.

- Track Your Earnings Record Annually – Mistakes in SSA’s records are rare, but they do happen.

- Coordinate With Other Retirement Income – Benefits may be reduced if you’re earning a salary or pension.

- Plan for Taxes – If your combined income is high enough, up to 85% of your benefits may be taxed. Consider this in your budgeting.

What You Need to Know About Social Security and Taxes

Yes, Social Security income can be taxed, depending on your total income level. Here’s how it breaks down:

- Individual filers earning $25,000–$34,000/year: Up to 50% of your benefits may be taxable.

- Over $34,000/year: Up to 85% may be taxable.

- Married couples filing jointly: Taxation starts at combined income over $32,000.

Use IRS Form SSA-1099 (provided by SSA each January) to report benefits when you file your taxes.

Avoiding Social Security Scams: Stay Safe

Social Security scams are common, especially among seniors. Here’s how to stay safe:

- SSA will never call to demand payment or threaten arrest.

- Don’t share your SSN over the phone unless YOU initiated the call.

- Ignore texts and emails asking for personal info.

- Report scams at ssa.gov/fraud.

Real-Life Examples: How Folks Are Using Their RSDI Wisely

Elaine, a 73-year-old widow from Georgia, uses her survivor benefits to pay for rent and medication. Her income went up $2,800 this year thanks to a retroactive correction.

Raymond, 62, delayed retirement until age 70 and now collects over $4,900/month—enough to cover travel and help his grandkids through college.

Sandra, a disabled worker in Arizona, uses her SSDI for home care and essential bills, and credits her mySocialSecurity account for keeping her on top of everything.

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy

Social Security Cuts Paused! What It Means for Student Loan Defaulters in 2025

Still Waiting on Your Social Security Back Pay? Retroactive Payments Are Rolling Out Now