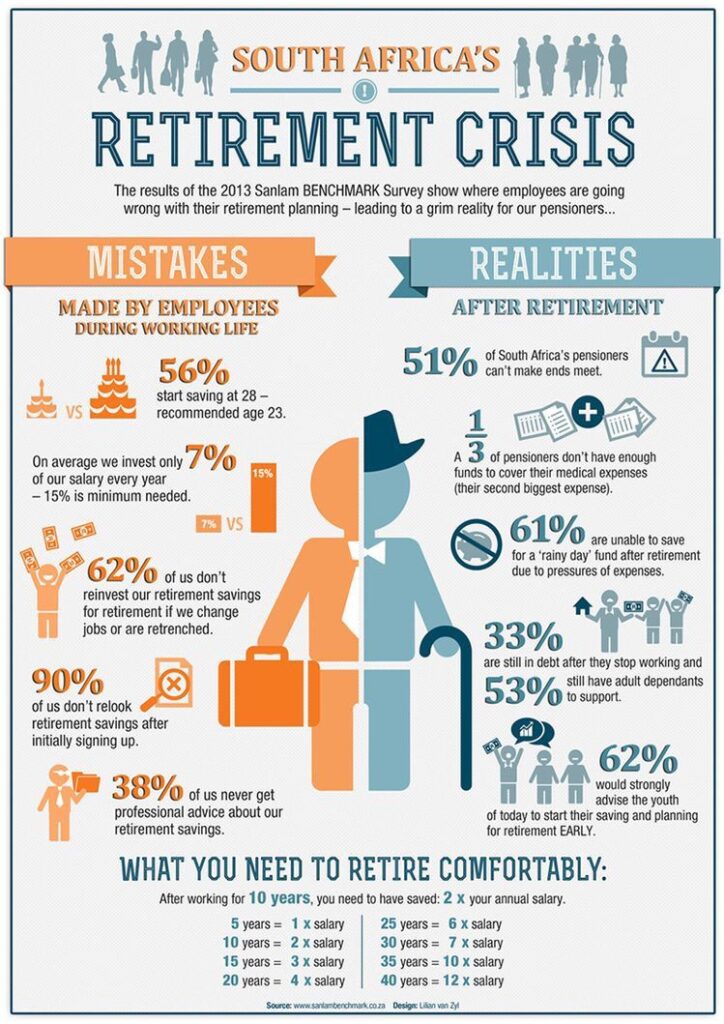

Retirement Crisis Looms: South Africa is facing a retirement crisis. With the vast majority of its population unprepared for retirement, many South Africans will be forced to work well into their old age, stretching well beyond the traditional retirement age of 65. If things don’t change soon, this could have devastating consequences for the financial stability of many families. In this article, we’ll dive into the details of the crisis, why it’s happening, and what can be done to ensure a better, more secure future for South Africans.

Retirement Crisis Looms

South Africa’s retirement crisis is a ticking time bomb. With most people underprepared for life after work, many will be forced to work well into their later years – potentially beyond the age of 80. However, with early planning, consistent savings, and the right investment strategies, individuals can still ensure that they’re ready for the future. The key is to take action now before it’s too late.

| Key Insight | Details |

|---|---|

| Only 6% of South Africans can afford to retire comfortably | According to the latest Retirement Reality Report from 10X Investments, only 6% of South Africans are on track to retire comfortably. |

| Retirement savings are far behind | Many South Africans will need to save R7.5 million by the age of 63 to secure a comfortable retirement. |

| Most people start too late | South Africans are delaying their retirement savings until it’s almost too late, often requiring 30-40% of monthly income to make up the difference. |

| Women disproportionately affected | Women are more likely to have no retirement plan compared to men, and they save less for retirement. |

| The Two-Pot System | A new retirement policy in South Africa, introduced in 2024, allows workers to access part of their retirement savings early, which has led to a rise in withdrawals and a potential depleting of savings. |

| Extended working years ahead | According to studies, most South Africans will need to work into their 80s if they want to retire comfortably. |

The financial health of South Africa’s working population is teetering on the edge. With rising costs of living and many people struggling to save enough, most South Africans are facing the grim reality of working much longer than they anticipated. The days of enjoying a peaceful, financially stable retirement are becoming more and more distant for many people.

Why the Retirement Crisis Is Happening?

The reasons behind this looming retirement crisis are multifaceted. Let’s break it down into simpler terms:

- Inadequate Savings

Many South Africans simply aren’t saving enough. According to the 10X Investments Retirement Reality Report, only 6% of people are on track to retire comfortably. What does that mean? Well, to maintain your lifestyle after you retire, you need to replace about 75% of your final salary with retirement savings and investments. For example, if you want to live on R25,000 a month in retirement, you should aim to have saved R7.5 million by the time you’re 63. But most South Africans won’t have close to that amount saved up by the time they retire. South Africa’s savings culture is often described as poor. Many people fail to take advantage of employer-sponsored retirement plans, and personal savings outside of pension plans are often negligible. Instead of building wealth for the future, many people live paycheck to paycheck, focusing on the present without thinking about the long term. This failure to plan for retirement places a significant burden on the country’s economy and results in a reliance on government pensions and family support in later years. - Starting Too Late

Retirement savings need to start early in life, preferably in your 20s or 30s. But for many, this doesn’t happen. It’s not until people reach their 40s or 50s that they realize how far behind they are. By then, it’s hard to catch up. The problem is that in your 40s, you may need to save 30% to 40% of your income just to make up for lost time – a tough challenge for most people. Starting later in life requires a drastic increase in monthly contributions to retirement savings, and even then, it may still be impossible to save enough in time to retire comfortably. The longer a person waits to start saving for retirement, the harder it becomes to accumulate sufficient wealth to support a comfortable retirement. This highlights the importance of teaching young people the value of saving and investing early, so they don’t find themselves in this difficult situation later in life. - Financial Constraints

For many, it’s not even that they’re lazy or careless with their savings. It’s that they simply can’t afford to save. According to the report, 72% of people whose retirement plans were off track said they simply couldn’t save enough. Many people live paycheck to paycheck, with just enough money to cover bills and day-to-day living costs. At the end of the month, there’s nothing left to put into retirement savings. In South Africa, the rising cost of living and the ever-increasing debt levels are having a significant impact on people’s ability to save. With inflation rates pushing up the prices of goods and services, many people are finding it increasingly difficult to stretch their salaries. Household debt is also rising, which adds to the financial stress and further limits the ability to save. Additionally, some South Africans struggle with job insecurity, contract work, or informal work arrangements, which do not provide access to formal retirement savings plans. Without access to employer-sponsored pension schemes or medical benefits, people in these sectors have to rely solely on personal savings, which are often minimal. - Gender Disparities

Women in South Africa are particularly affected. A shocking 49% of female respondents in the Retirement Reality Report said they don’t have any retirement savings plan, compared to 43% of men. This is a significant disparity that cannot be ignored. There are several reasons for this, including the gender pay gap, women often taking breaks from work for childcare, and the fact that women tend to live longer than men, meaning they need more savings to last throughout their retirement years. The gender pay gap means women earn less on average than men, making it harder for them to save and invest for the future. Additionally, women often take time off work for family responsibilities, which means they may miss out on years of pension contributions. The impact of these factors is compounded by the longer life expectancy of women, which means they need more money saved for retirement in order to maintain their standard of living.

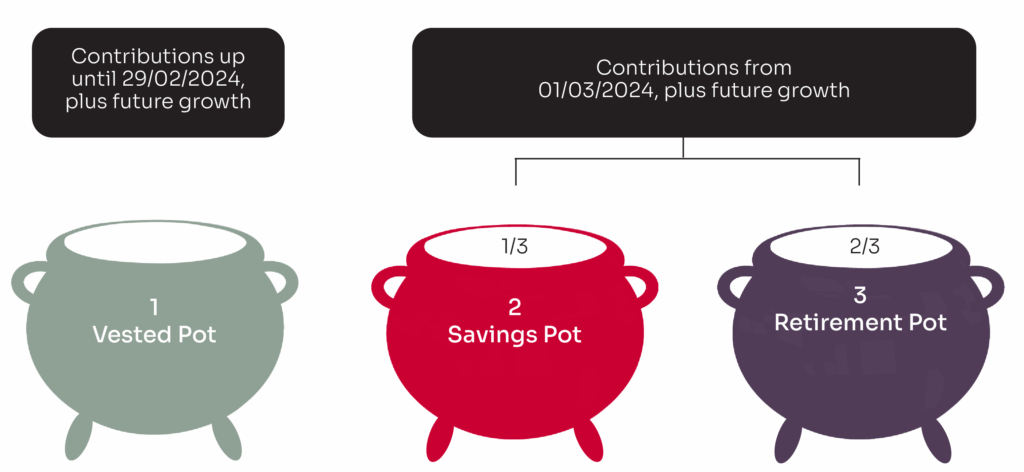

The Two-Pot System and Its Impact

In an attempt to address some of these issues, South Africa introduced the Two-Pot Retirement System in September 2024. This system allows individuals to access a portion of their retirement savings early, meant to help them during times of financial need. While this seems like a good idea, it has had unintended consequences.

Since its introduction, there’s been a surge in withdrawals, with around 2.4 million fund members withdrawing R43 billion of their savings. This is problematic because it depletes the national savings pool, potentially leaving people with far less than they need for retirement. Many workers are dipping into their retirement savings for short-term financial relief, but in doing so, they risk compromising their long-term financial security.

The idea behind the Two-Pot System was to offer financial relief to individuals facing short-term financial difficulties, such as medical emergencies or unexpected expenses. However, by allowing early withdrawals from retirement funds, it creates a situation where individuals may be dipping into their future security for immediate needs, effectively undermining their retirement plans.

The Reality of Working into Your 80s

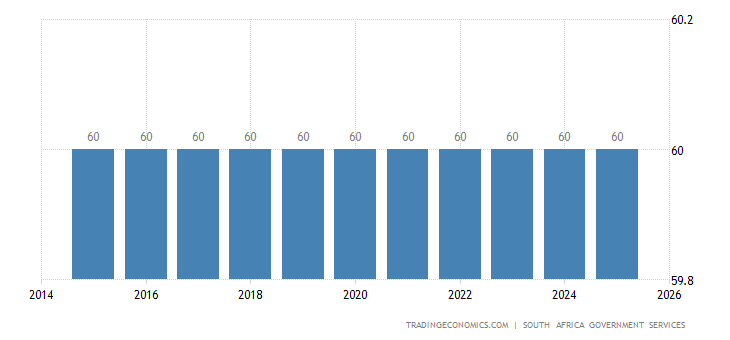

While the official retirement age in South Africa is still 65, it’s becoming increasingly clear that many people won’t be able to retire at this age. According to a study by Sanlam Corporate, most South Africans will need to keep working well into their 80s if they want to retire comfortably. This is a harsh reality that many people simply aren’t prepared for.

Working into your 80s isn’t just a financial issue – it’s a physical and emotional one. As people age, they face health challenges, decreased energy levels, and a reduced ability to keep up with a demanding job market. Additionally, the younger generation may find it harder to compete with older workers for the same positions, leading to a potential intergenerational conflict in the workforce.

The longer people work, the more they risk facing health issues and burnout. By the time they reach the age of 80, many individuals may not have the physical capacity to continue working full-time, yet may still need to do so in order to meet their financial needs.

Practical Steps to Avoid the Retirement Crisis Looms

So, what can South Africans do to avoid this looming retirement crisis? Here are a few actionable steps:

- Start Saving Early

It’s never too early to start saving for retirement. The earlier you start, the more time your money has to grow. Even small contributions can add up over time, so don’t wait for the “perfect moment” to start saving. Saving early allows individuals to take advantage of compound interest – the interest on your interest. Over time, this can help grow your savings significantly, even if you start with a small amount. The key is consistency. - Automate Your Savings

If saving money feels like a challenge, automate it! Set up automatic transfers to your retirement savings account each month. This way, you won’t even have to think about it, and you’ll gradually build your retirement fund without even noticing. Automating your savings helps ensure that you don’t spend the money that should be going toward retirement. It removes the temptation to skip contributions or spend the money on other things. - Take Advantage of Employer Contributions

If your employer offers a retirement savings plan with matching contributions, take full advantage of it. It’s free money! If you’re not sure whether your company offers a retirement plan, ask your HR department about it. Employer contributions are an excellent way to increase your savings without putting in extra effort. Take full advantage of any matches or additional contributions your employer makes to your retirement plan. - Invest Wisely

It’s important not to just stash your savings under the mattress – invest your money in ways that allow it to grow. Whether it’s through retirement accounts, real estate, or other forms of investment, make sure your money works for you. Diversifying your investments helps reduce risk and maximize returns. Consider working with a financial advisor to determine the best investment strategy for your goals. - Create a Plan

Work with a financial advisor to create a retirement plan. An expert can help you assess your current financial situation, project future needs, and create a strategy for getting there. It’s better to plan now than be caught unprepared when it’s time to retire. Financial planning is an ongoing process that involves monitoring your investments, adjusting your savings plan, and preparing for unexpected life events. A professional can guide you through this process.

Extra Tips for Success

- Review Your Plan Regularly

Retirement planning isn’t a “set it and forget it” type of deal. Your needs, income, and life circumstances change over time. Review your plan at least annually to ensure that it still fits your goals. - Learn Financial Literacy

Understanding the basics of finance—like how investments work, the power of compound interest, and managing debt—is essential for anyone looking to build wealth for retirement. Consider attending workshops or taking online courses to enhance your financial knowledge. - Manage Your Debt

High-interest debt (like credit card debt) can hinder your ability to save for retirement. Focus on paying down debt as quickly as possible, so you can free up more money for savings.

South Africa’s SRD Grant Extended—Is Universal Basic Income Next?

New 2025 Traffic Rules in South Africa—Avoid Fines With This Must-Read Guide

World Bank’s Huge Investment in South Africa – Here’s How It Impacts You!