Proposed $40,000 SALT Cap: If you’re living in a state with sky-high property taxes and hefty income tax—think New York, California, New Jersey, or Connecticut—the term SALT deduction probably hits close to home. And if you’re in that upper-middle-income bracket, the new proposed $40,000 SALT cap might sound like music to your ears. This major tax policy shift is causing a buzz from Capitol Hill to suburban dinner tables. Why? Because raising the SALT deduction cap from $10,000 to $40,000 could mean thousands in tax savings for some Americans—while leaving others high and dry. In this in-depth guide, we’ll walk you through:

- What the SALT cap is

- Who stands to benefit

- The real-world impact on professionals and families

- Key statistics, expert analysis, and a clear action plan

Let’s break it down in simple terms—without losing the professional depth.

Proposed $40,000 SALT Cap

The proposed $40,000 SALT cap could be a game-changer for upper-middle-income earners in high-tax states—especially those with big property tax bills and multiple income streams. But for most Americans, it’s unlikely to move the needle. If you’re in the income bracket and state where this could help, now is the time to prepare. Stay informed. Talk to a tax advisor. And don’t miss a chance to save a few thousand bucks—because in this economy, every dollar matters.

That said, this policy raises big questions about tax fairness, geographic inequality, and how we define “middle class” in America today. While it may offer real relief to some, it’s not a one-size-fits-all solution. The benefits are narrow, the cost is high, and the debate isn’t going away anytime soon. As always, the fine print matters—so keep your eyes on Congress, and your receipts close.

| Topic | Details |

|---|---|

| What’s Changing? | Proposal to raise SALT deduction cap from $10K to $40K |

| Who Gains the Most? | Upper-middle-class earners in high-tax states ($200K–$600K income) |

| Example Savings | $9,600 for a $500K income couple in NY with a $2.5M home |

| Who Gains Nothing? | Standard deduction filers (about 90% of U.S. taxpayers) |

| Federal Budget Impact | Estimated cost: $320 billion over 10 years |

| Phaseout Threshold | Households above $500K income see reduced benefits |

| Official Resources | IRS, Congress.gov |

What Is the Proposed $40,000 SALT Cap and Why Should You Care?

The State and Local Tax (SALT) deduction lets taxpayers deduct the amount they paid in state income taxes, property taxes, and local sales taxes from their federal income.

This helps prevent double taxation, especially for folks in states that charge a lot in income or property taxes. But since 2017, taxpayers could only deduct up to $10,000. That cap hit hardest in high-cost states where property and income taxes are higher than average.

Timeline: How We Got Here

| Year | Event |

|---|---|

| 2017 | TCJA passes under Trump; SALT deduction capped at $10,000 |

| 2018–2023 | High-tax states push to repeal the cap; various failed attempts |

| 2025 (May) | House passes proposal to raise cap to $40,000 |

| 2026 (Projected) | Proposal would expire unless renewed |

Who Wins with the $40,000 Cap?

Big Winners: High-Earners in High-Tax States

- Families earning $200K–$600K

- Homeowners with property taxes above $10K

- Professionals in states like NY, CA, CT, MA, NJ

Example: A couple earning $500,000 in Manhattan pays roughly $35,000 in property and income taxes. Under the current cap, only $10,000 is deductible. With a $40,000 cap, they could deduct the full amount, saving up to $9,600 on their federal return.

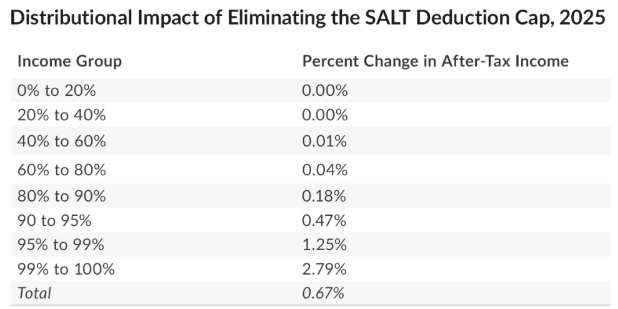

No Change: Middle- and Low-Income Taxpayers

Roughly 90% of Americans take the standard deduction ($29,200 for married couples in 2025). For these folks, this SALT change won’t affect their tax bill at all.

Pros and Cons of the $40,000 SALT Cap

| Pros | Cons |

|---|---|

| Helps taxpayers in high-cost-of-living areas | Primarily benefits wealthy households |

| Restores fairness for blue states | Estimated $320B hit to federal budget |

| Encourages itemizing deductions | Minimal impact for majority of Americans |

| May boost housing affordability | Could widen wealth inequality |

Expert Analysis: What Economists and Lawmakers Are Saying

Political Perspective

The SALT cap debate doesn’t follow strict party lines—it’s mostly regional. Lawmakers from states with high taxes, regardless of party, often support raising the cap.

- Rep. Jim Himes (D-CT): “This [cap raise] would be good for my state.”

- Senators from low-tax states like Florida or Texas? Not so much.

Economic Viewpoint

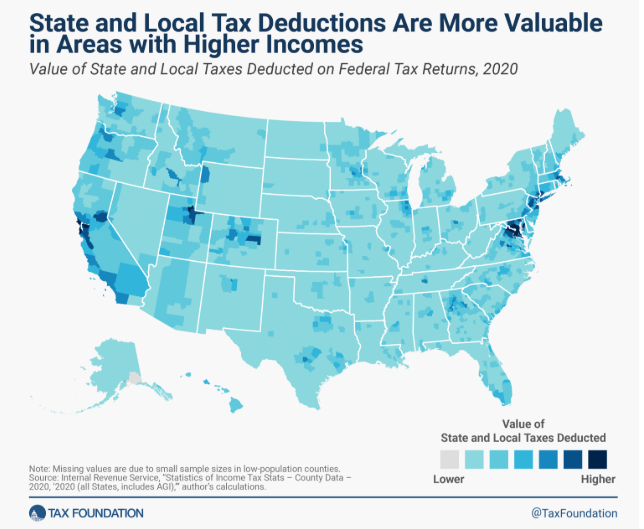

According to the Tax Foundation:

- Only 13% of households earning $100K–$200K would benefit

- Over 75% of the tax break would go to the top 10% of earners

What This Means at the Kitchen Table

This isn’t just a policy debate—it’s about how much cash families get to keep. Think about it this way:

- A middle-class couple in Ohio taking the standard deduction? No change.

- A dual-income family in San Francisco with $300K in income and $20K in property taxes? They’d likely see a few thousand dollars back.

- An elderly widow in New Jersey living off retirement income with high property taxes? Might benefit modestly, depending on deductions.

It’s about more than numbers—it’s about groceries, college savings, and a little breathing room. That’s why this debate has heart.

Case Study: The Williams Family in New Jersey

Let’s meet the Williams family, a real-world example that might remind you of someone you know.

- Location: Montclair, NJ

- Income: $275,000 combined (two public school teachers)

- Home value: $1.1 million

- Annual property tax: $21,000

- Other state/local taxes: $12,000

Under the $10,000 SALT cap: They lose $23,000 in potential deductions.

With the $40,000 cap: They could deduct all $33,000—potentially saving them around $5,500 in federal taxes.

For the Williamses, that’s one kid’s summer camp, one car loan, or a healthy IRA contribution. Real money, real impact.

What Should You Do Now? Step-by-Step Guide

- Check Your Last Tax Return

Did you itemize? Were your total SALT payments more than $10K? - Estimate Potential Savings

Use tools like the IRS Withholding Estimator or ask a CPA. - Talk to a Tax Pro

Especially if you’re in the $200K–$600K range and in a high-tax area. - Watch for Updates

This bill has passed the House but not the Senate.

GOP Tax Bill Contains a Quiet Threat to Federal Workers; Could This Be the End of the Civil Service?

Trump’s ‘Big Beautiful Bill’: Will It Really Eliminate Taxes on Social Security?

Senate Republicans Reveal the Quiet Changes They Want in Trump’s ‘Big, Beautiful Bill’

Frequently Asked Questions (FAQs)

Is this a permanent change?

No. As written, the higher cap would only apply through 2026.

What if I don’t itemize deductions?

Then this change will not impact you.

Will it lower my state taxes too?

No. The SALT cap only affects federal tax returns.

Why not just eliminate the cap?

Because full repeal would cost the government over $900 billion in lost revenue over 10 years.