Other Countries Have Solved Their Social Security Problems: Social Security, for many, is the safety net of retirement. It’s the promise that after a lifetime of work, you’ll have some financial support when you can no longer work. But despite this promise, the U.S. faces significant challenges in keeping Social Security sustainable for future generations. Countries like Canada, Sweden, and Germany seem to have found solutions to their own retirement systems, so why can’t America get it together? This article dives into why America struggles to fix its Social Security system, explores the obstacles in the way, and offers practical advice on what needs to change. Whether you’re a concerned citizen or someone working in policy, this article will give you a deeper understanding of why Social Security in America is in trouble and what can be done to fix it.

Other Countries Have Solved Their Social Security Problems

Social Security is one of the cornerstones of retirement in America, but it’s also facing a major financial crisis. Demographic shifts, political gridlock, and an outdated funding model are all contributing to the system’s struggles. However, it’s not too late to fix it. By raising the retirement age, adjusting taxes, and exploring new solutions like private accounts, the U.S. can secure a sustainable future for Social Security. The road to reform won’t be easy, but it’s necessary for the generations to come. Whether you’re just starting to think about retirement or you’ve been paying into the system for years, understanding the issues at play is the first step toward securing your financial future.

| Key Points | Details |

|---|---|

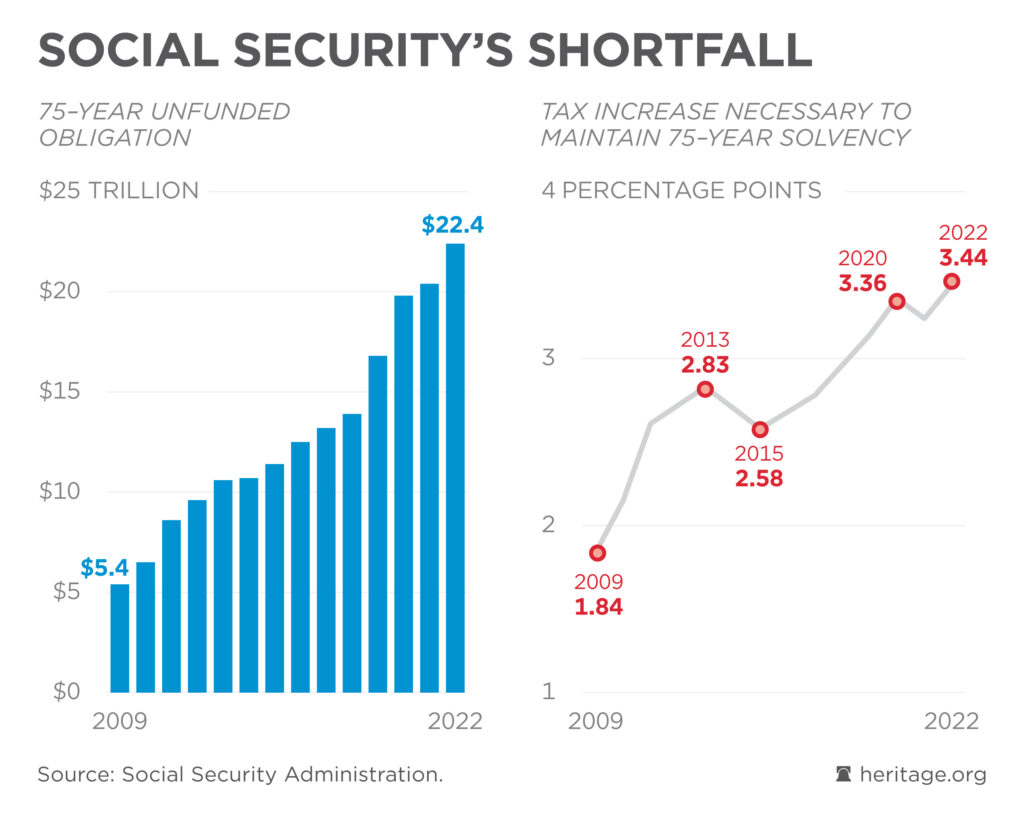

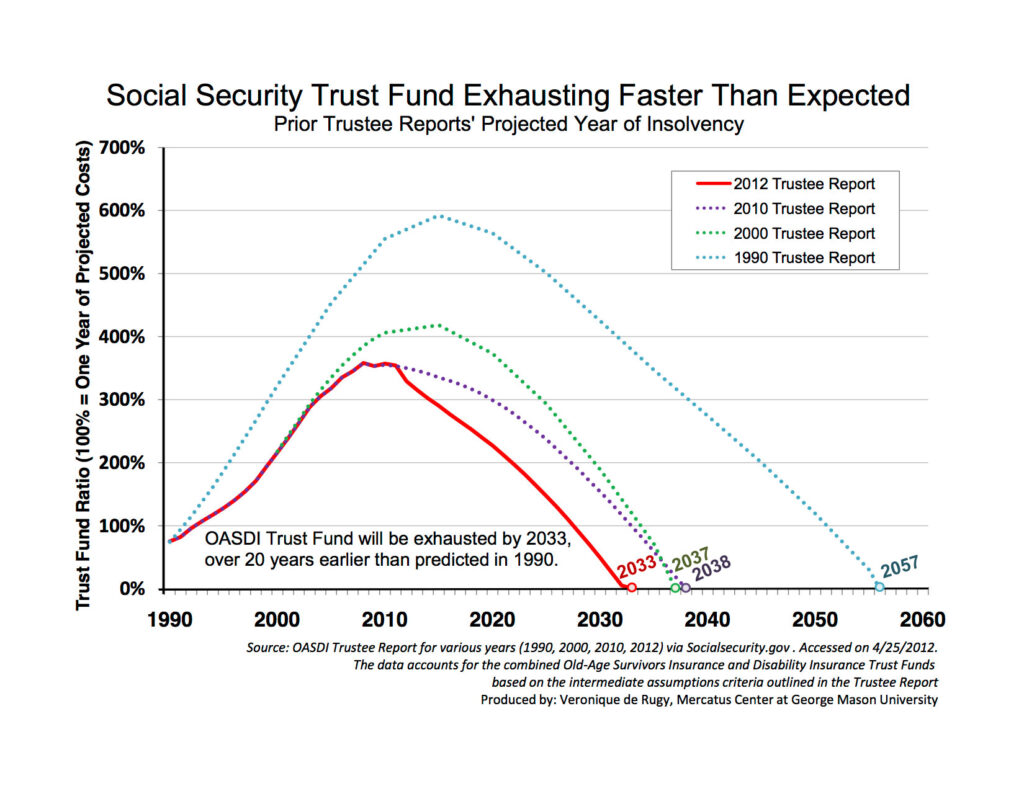

| Social Security’s Future | America’s Social Security system faces a $20 trillion funding shortfall by 2033. |

| Political Gridlock | Bipartisan cooperation in Congress is essential but often blocked by ideological divides. |

| Lower Replacement Rates | The U.S. replaces only 41% of pre-retirement income compared to other countries like Denmark (90%). |

| Demographic Challenges | An aging population combined with fewer workers paying into the system spells trouble. |

| Solutions from Other Countries | Nations like Sweden have adopted more flexible retirement systems, including private accounts and higher retirement ages. |

| Additional Challenges | Healthcare costs, inflation, and a growing wealth gap further strain Social Security. |

| Potential Solutions | Raising retirement age, means-testing, increasing payroll taxes, and diversifying investment options are among key solutions. |

What’s Wrong with America’s Social Security System: Other Countries Have Solved Their Social Security Problems

The United States is often seen as a leader in the world, but when it comes to Social Security, we’re falling behind. Other developed countries have managed to keep their systems strong, while ours is running into significant problems.

In the U.S., the Social Security system relies on a pay-as-you-go method, meaning current workers fund the benefits of retirees. This system has worked well in the past, but as the baby boomer generation ages and fewer workers are available to pay into the system, it’s causing a serious funding shortfall.

The Numbers Don’t Lie: The Social Security and Medicare Trustees predict that the trust funds for Social Security could be depleted by 2033, meaning the program could only pay out about 77% of benefits unless action is taken. That’s a 23% cut in benefits—something no one wants to see.

But what’s causing this issue? Here are the main culprits:

1. Demographic Shifts:

The aging population in America is one of the biggest factors contributing to Social Security’s financial woes. More and more people are retiring, and fewer are entering the workforce. In the 1950s, there were about 16 workers paying into Social Security for every retiree. Now, that number has dropped to 2.8 workers per retiree. This means less money is flowing into the system while more money is being paid out.

2. Political Gridlock:

Unlike countries such as Germany or Sweden, which have made changes to their systems, America is stuck in a political tug-of-war. There’s been little agreement on how to reform Social Security, with conservatives and liberals offering vastly different solutions. For instance, some want to raise the retirement age, while others are more focused on adjusting benefits. Each side has its own ideas, but getting bipartisan support has been nearly impossible.

3. The Funding Formula:

The way Social Security benefits are calculated is also part of the problem. The U.S. Social Security system replaces only about 41% of an average worker’s pre-retirement earnings—significantly lower than other nations like the Netherlands, where benefits replace over 90%. This means that Americans are expected to rely on personal savings, employer pensions, or other investments to cover the gap. Unfortunately, many people are not saving enough to make up for this shortfall.

4. Public Perception and Trust:

Many Americans are worried about whether Social Security will even be around when they retire. This lack of confidence is a significant barrier to reform. If people don’t trust the system, they may not support necessary changes, and this fear only grows as the system’s funding shortfall looms larger.

5. Rising Healthcare Costs and Inflation:

Healthcare costs in the U.S. are rising sharply, and this places additional pressure on the Social Security system. As people live longer, their healthcare needs increase. Many retirees find themselves spending a large portion of their Social Security checks on medical expenses. Inflation also erodes the purchasing power of benefits, meaning that Social Security may not go as far as it did for previous generations.

Practical Solutions: What Can Be Done?

While the situation is serious, it’s not too late to take action. Here are some potential steps that could help stabilize Social Security for future generations:

1. Gradually Raise the Retirement Age:

One of the simplest solutions is to gradually increase the retirement age. Right now, Americans can start receiving Social Security at age 62, with full benefits available at 66 or 67. Raising the retirement age might seem controversial, but it would help balance the number of people receiving benefits with the number of people working and paying into the system. This is already happening in some countries, like Germany, where the retirement age is set to increase to 67 by 2031.

2. Tackle Payroll Taxes:

Another potential solution is to adjust the payroll tax rate. The payroll tax, which funds Social Security, is currently 6.2% for employees and employers each. Increasing this tax by just 1-2% could significantly shore up the system’s finances. This solution would require bipartisan support, but it’s one that could have a major impact without dramatically altering the structure of Social Security.

3. Create Private Accounts:

In some countries like Chile and Sweden, private accounts allow people to invest a portion of their Social Security taxes in the stock market or other assets. While this would add some risk to the system, it could also generate higher returns, which would help bolster Social Security’s funds. This idea has been controversial in the U.S., but it’s worth exploring in a limited way.

4. Means-Testing Benefits:

Means-testing involves adjusting the benefits people receive based on their income or wealth. This could help ensure that Social Security’s funds are going to those who need it most. For example, if you’re a millionaire, you might not need as much from Social Security as someone who has little to no retirement savings. Means-testing could help target resources more effectively.

5. Addressing Inflation and Healthcare Costs:

To alleviate the strain of rising healthcare costs, expanding Medicare and other health programs to cover more retirees could ease the burden on Social Security. Additionally, adjusting Social Security benefit increases to better account for inflation, rather than just using the Consumer Price Index (CPI), could ensure that benefits maintain their purchasing power over time.

Social Security Overhaul Confirmed by Government; Why Elon Musk’s Exit Won’t Change What’s Coming

Social Security’s 2026 Boost Could Be the Biggest Game-Changer for Retirees in Years: Check Details

Social Security Employees Sound Alarm on Delays; Here’s How Your Benefits Could Be Affected