Open a Custodial Roth IRA: As parents, we always want the best for our kids—whether it’s helping them do their homework, teaching them life skills, or preparing them for a future full of financial stability. One of the most powerful gifts you can give your child is a head start on saving for retirement. And believe it or not, you can do this by opening a custodial Roth IRA with your kid’s summer earnings. In this article, we’ll explore why a custodial Roth IRA is a great investment vehicle, how it works, and step-by-step guidance on how to set it up. It’s an opportunity that many parents overlook, but it could be the smartest financial move you make for your child. Plus, you’ll be helping them build wealth with tax-free growth, all while teaching them the importance of saving early.

Open a Custodial Roth IRA

Opening a custodial Roth IRA for your child’s summer earnings is a powerful way to give them a financial leg up in life. Not only will it help them build a strong retirement nest egg, but it will also teach them valuable lessons about money, saving, and investing. With tax-free growth and the power of compounding, starting early could make all the difference. By taking this simple step, you’re not just setting your child up for success—you’re empowering them to understand the importance of financial responsibility and planning for the future. So why wait? Get started today, and let your child’s financial future begin to unfold.

| Key Takeaways | Details |

|---|---|

| What is a Custodial Roth IRA? | A custodial Roth IRA is a retirement account for minors, managed by a parent or guardian. |

| Contribution Limit | The contribution limit for 2025 is $7,000 or the amount of your child’s earned income—whichever is less. |

| Tax Benefits | Roth IRAs allow for tax-free growth and tax-free withdrawals in retirement, making them a great tool for early savers. |

| Compounding Growth | Starting early can turn even small contributions into large amounts due to compounding over time. |

| Eligibility | Your child must have earned income, such as from a summer job, to contribute to a custodial Roth IRA. |

| Flexible Withdrawals | Contributions (but not earnings) can be withdrawn anytime without penalty. |

What Is a Custodial Roth IRA?

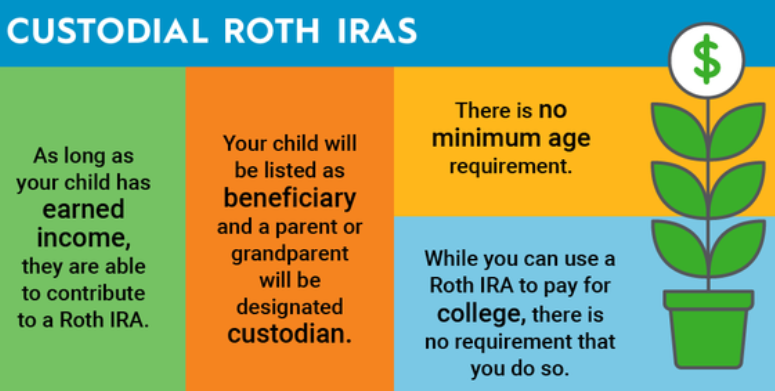

Let’s break this down: a Roth IRA is an individual retirement account that allows you to invest money now, and when you retire, you can withdraw it tax-free. Usually, these accounts are for adults, but a custodial Roth IRA is an account set up for a minor, managed by a custodian (typically a parent or guardian).

If your child earns money—whether it’s from a summer job, a part-time gig, or any other source of earned income—they can contribute to this Roth IRA. But, just like with regular Roth IRAs, the key benefit is the tax-free growth of your contributions.

So, why is this important? Simple. If your child starts early—say, by contributing just $3,000 from their summer earnings—it could grow significantly over decades. They may not need to worry about saving for retirement down the road.

Why Is Opening a Custodial Roth IRA So Smart?

If you’ve been wondering if it’s worth the time and effort, the answer is a resounding yes. Here’s why:

- Tax-Free Growth: Roth IRAs are magical for long-term savers because your investments grow without being taxed. When you withdraw the money during retirement (after age 59½), it’s completely tax-free.

- Starting Early = More Compounding: Let’s face it: time is your best friend when it comes to growing money. The earlier your child starts saving, the more compounding can work its magic. Think of it like planting a tree—you need time for it to grow big and strong. The longer you wait, the smaller the tree will be. For instance, if your child invests $3,000 at age 15, assuming a 7% return, by the time they reach 65, they could have more than $40,000. That’s some serious growth, all from a relatively small contribution early on.

- Teaches Financial Responsibility: Opening a custodial Roth IRA gives your child an opportunity to learn how saving and investing work. They’ll understand the importance of starting early, and this knowledge will be invaluable as they grow older.

- No Taxes on Contributions: Unlike traditional IRAs, Roth IRAs allow for tax-free withdrawals on contributions and earnings (if you follow the rules). That’s a huge plus, especially for kids who are working at low tax rates early in life.

- Flexible Withdrawals: In many cases, contributions to a Roth IRA can be withdrawn anytime, without penalty or tax. However, the earnings aren’t so flexible—they have to be kept in the account until retirement to avoid penalties. But it’s still great to know you have that flexibility with your child’s contributions.

How Does a Custodial Roth IRA Work?

A custodial Roth IRA works much like a standard Roth IRA, except the minor is not yet old enough to manage the account. The custodian (that’s you, the parent or guardian) makes all investment decisions on behalf of the child until they reach the age of majority. At that point, the child takes over full control of the account.

Eligibility Requirements:

- Earned Income: The child must have earned income to contribute to the account. This means money made from a job, self-employment, or freelance work. For example, if your child works at a summer camp and earns $4,000, they can contribute that full $4,000 to the custodial Roth IRA.

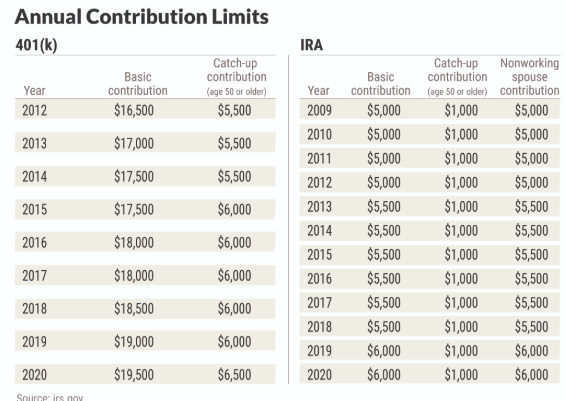

- Contribution Limits: For 2025, the maximum contribution is $7,000 or the total amount of the child’s earned income for the year, whichever is smaller.

Step-by-Step Guide to Open a Custodial Roth IRA

Step 1: Ensure Your Child Has Earned Income

This is a no-brainer: your child needs earned income to contribute to a Roth IRA. If your child has a part-time job, works for a local business, or even does freelance work like dog walking or babysitting, that counts as earned income. You’ll need to keep track of this income and ensure it’s properly documented for tax purposes.

Step 2: Choose a Custodial Roth IRA Provider

There are a number of financial institutions that offer custodial Roth IRAs. Look for providers that offer low fees, a wide selection of investment options, and easy-to-use platforms. Some well-known providers include:

- Vanguard

- Charles Schwab

- Fidelity

Step 3: Open the Account

To open the account, you’ll need to provide both your and your child’s personal information, including:

- Your Social Security number

- Your child’s Social Security number

- Your child’s earned income verification

Once you’ve gathered the necessary documents, the process typically takes less than 30 minutes.

Step 4: Fund the Account

Now for the fun part! You can make contributions up to the earned income amount for the year, but not exceeding $7,000. If your child earned $5,000 over the summer, that’s the maximum amount they can contribute.

Step 5: Invest the Funds

Most custodial Roth IRA providers will allow you to choose from a range of investment options, such as stocks, bonds, mutual funds, or ETFs. For a beginner, you might want to start with low-cost index funds or ETFs that track the broader market, as they offer long-term growth potential.

Additional Tips for Parents

- Maximize Contributions: If your child earns more than the Roth IRA limit, try to contribute the full amount. You can set up automatic monthly contributions so that the money is invested gradually throughout the year.

- Start Small: Even if your child can only contribute a small amount, it’s better than nothing. The key is getting started and letting the money grow over time.

- Review Regularly: As your child gets older, you should review the account regularly together to ensure it’s being managed well and making progress toward their retirement goal.

- Encourage Long-Term Thinking: The purpose of a Roth IRA is to build wealth over the long term. Help your child understand that the money should not be withdrawn until retirement. This lesson will help instill financial discipline.

Average 401(k) Contribution Rate Revealed — Are You Saving Enough to Retire?

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

Retired? Don’t Panic—Smart Strategies for Withdrawing Savings During Market Volatility