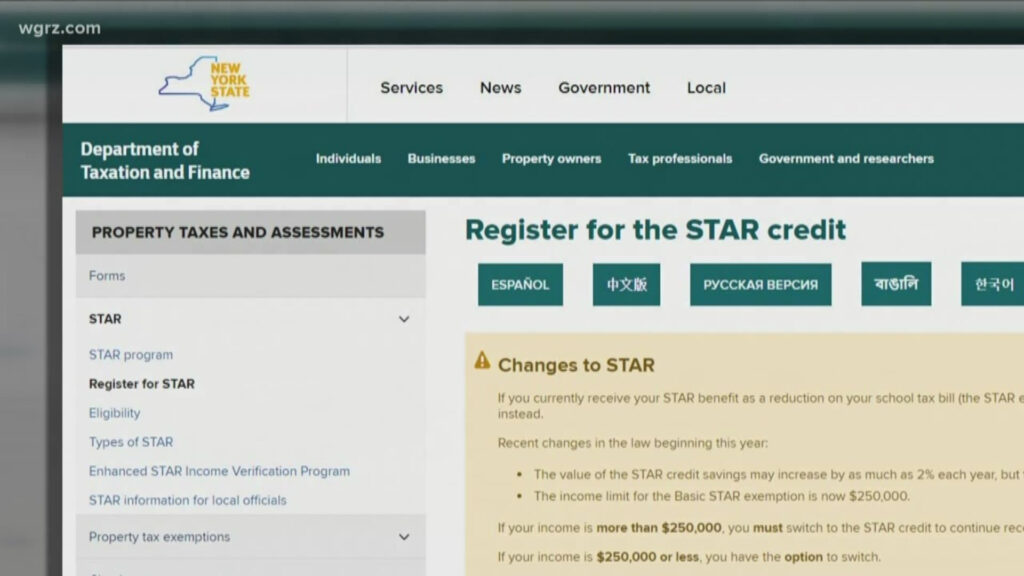

New York Stimulus Payment: If you’re a homeowner in New York State, you’ve likely heard about the STAR (School Tax Relief) Credit – and if you’re eligible, 2025 might be the year you finally receive your much-needed rebate. The STAR Credit is a financial boost that helps homeowners reduce their property tax burden. Whether you’re just hearing about it or you’ve already been benefiting from the program, it’s important to understand when you can expect your 2025 STAR Credit, how much you might get, and what to do if you haven’t received it yet. In this article, we’ll break it all down for you. We’ll take a look at the key dates, explain how to know if you qualify, and give you step-by-step instructions on how to track your STAR payment. From basic information to more detailed advice, we’ve got you covered.

New York Stimulus Payment

The 2025 STAR Credit is a significant benefit for New York homeowners, offering crucial financial relief through property tax reductions. By understanding the eligibility requirements, payment timeline, and how to track your credit, you’ll be able to maximize the value of this program. Keep an eye out for your check starting late June 2025 or sign up for direct deposit to get your credit faster. Stay informed, stay on top of your application, and make sure to get the full benefit of this program!

| Key Data | Details |

|---|---|

| Credit Amount | Basic STAR: Around $290. Enhanced STAR: Around $650. |

| Payment Timeline | Late June 2025 to September 2025 |

| Eligibility | Must be a primary residence; income limits apply. |

| Basic STAR Income Limit | Combined household income of $500,000 or less. |

| Enhanced STAR Income Limit | Combined household income of $107,300 or less. |

| Application Deadline | March 15, 2025 (for the 2025-2026 tax year). Next opens Sept 15, 2025. |

| Official STAR Info | New York State Department of Taxation and Finance |

What is the STAR Credit?

The STAR Credit is a program introduced by the state of New York to help reduce the property tax burden for homeowners. STAR stands for School Tax Relief, and this credit is designed to provide relief from local school taxes, which are a significant part of property tax bills.

There are two types of STAR benefits:

- Basic STAR: Available to homeowners with a primary residence and an income of $500,000 or less.

- Enhanced STAR: Available for homeowners who are 65 years or older with a combined income of $107,300 or less.

The STAR program is typically applied directly to your property tax bill, but for those who qualify, you can now receive the STAR Credit, which is issued in the form of a check. For those eligible, the 2025 STAR Credit will be sent starting in late June 2025 and continuing into September 2025, giving homeowners plenty of time to benefit from this relief.

When Will You Receive Your 2025 STAR Credit?

So, when can you expect your STAR Credit to hit your mailbox? The state of New York has started issuing payments for 2025 in late June. However, don’t worry if you don’t receive your payment right away. While some homeowners will get their checks quickly, others may need to wait a little longer, with distribution continuing into August and even September.

The payments are generally mailed as physical checks, though you can opt for direct deposit if you enroll through the state’s online portal. The state’s Homeowner Benefit Portal is your go-to spot for tracking your payment, checking your eligibility, and even signing up for direct deposit.

It’s worth noting that payments are issued in batches, so if your payment is delayed, it could simply be because your batch hasn’t been processed yet. Don’t panic if your check doesn’t show up immediately – it’s on the way!

How Much Will You Get?

The amount of your STAR Credit will depend on which version you qualify for:

- Basic STAR: Most homeowners who qualify for Basic STAR can expect to receive around $290.

- Enhanced STAR: For homeowners 65 or older who qualify for Enhanced STAR, the check will likely be around $650.

These amounts can vary slightly depending on local school taxes and other factors. But in general, these payments are meant to give a significant relief to homeowners, helping to ease the burden of school taxes.

The STAR Credit is designed to provide property tax relief, and the amounts distributed are intended to be helpful, but not a life-changing sum of money. However, if you qualify for Enhanced STAR, the larger rebate amount can make a significant difference, particularly for seniors on fixed incomes.

Who is Eligible for the STAR Credit?

The eligibility criteria for the STAR Credit are relatively straightforward, but it’s important to ensure you meet the requirements before expecting your payment.

1. Primary Residence

To qualify, the property must be your primary residence. If the property is a second home or rental property, you will not be eligible for the STAR Credit. This is an important distinction, and it’s essential to understand that only homeowners living in their property full-time are eligible.

2. Income Limits

- Basic STAR: The combined income of all owners and their spouses must be $500,000 or less.

- Enhanced STAR: For the 2025-2026 tax year, homeowners must have a combined income of $107,300 or less to qualify for Enhanced STAR.

Income limits are set to ensure that the benefit goes to those who need it most. The higher-income cutoff for Basic STAR ensures that the credit isn’t going to those who can afford it, while the Enhanced STAR provides greater relief for seniors on limited incomes.

3. Age Requirement for Enhanced STAR

For the Enhanced STAR benefit, at least one of the property owners must be 65 or older by the end of the year in which the exemption begins. This benefit is particularly designed to help seniors on fixed incomes, allowing them to keep more of their income for other needs, such as healthcare and groceries.

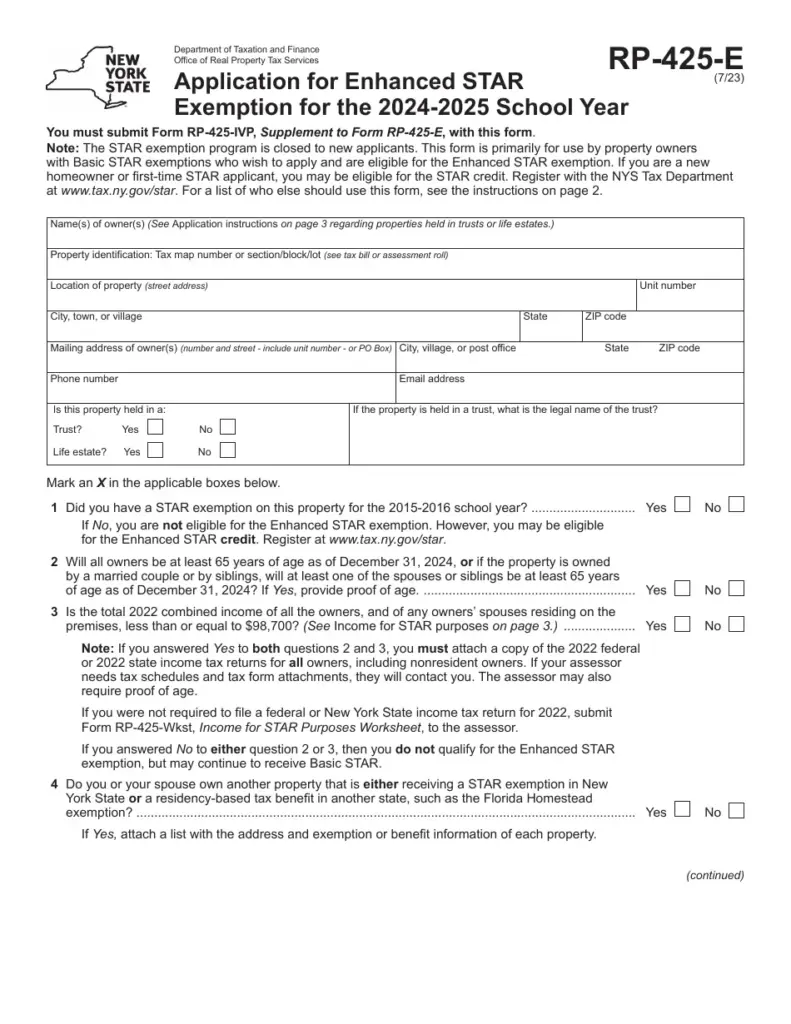

How to Apply for the New York Stimulus Payment?

You can apply for the STAR Credit in several ways:

- New Applicants: If you haven’t received the STAR Credit before, you’ll need to apply online or by phone. You had until March 15, 2025, to apply for the 2025-2026 tax year. Don’t worry if you missed that deadline — you can apply for the next year when the application window opens again on September 15, 2025.

The online process is quick and easy, and the portal guides you through the necessary steps. Keep in mind that after you apply, you’ll be notified of your eligibility status, and if you’re accepted, your payment will be processed in the next batch.

- Renewal Applicants: If you’ve previously received the STAR Credit, there’s no need to apply again unless there’s a change in your eligibility. You should automatically receive your payment if you’re still eligible.

Step-by-Step Guide to Applying:

- Check Eligibility: Verify that your income and primary residence status meet the criteria for Basic or Enhanced STAR.

- Apply Online: Visit the NY State Department of Taxation and Finance’s STAR portal to apply.

- Track Your Payment: Use the STAR Credit Delivery Schedule to track when your payment will arrive.

- Consider Direct Deposit: If you prefer to receive your payment electronically, you can enroll in direct deposit through the state’s portal.

This process can be done entirely online, and many homeowners find that once they’re set up, they don’t need to do anything else in future years unless their eligibility status changes.

How to Track Your STAR Credit Payment?

If you’re wondering when your check will arrive, the New York State Department of Taxation and Finance offers a helpful tool to track your STAR Credit payment. It’s called the STAR Credit Delivery Schedule, and it lets you see exactly when your check will be mailed or when your direct deposit will be processed.

In addition to the delivery schedule, the Homeowner Benefit Portal provides access to updates about your eligibility status, and the progress of your application. It’s your one-stop-shop for all things STAR-related.

IRS $1400 Stimulus Payment Status Live — Find Out When You’ll Get Paid!

Missed Your 2025 Stimulus Payment? What to Do If It Hasn’t Arrived by June

New York Is Sending Out $400 Stimulus Checks—Here’s Why You Don’t Need to Apply