New Retirement Rule Shakes Up RMDs: Retirement planning is one of the most important financial journeys in an American’s life. Yet, one of the most complex and often overlooked elements of retirement accounts is Required Minimum Distributions, or RMDs. Recently, however, new legislation has shaken up the rules surrounding RMDs, providing more flexibility for retirement savers. Whether you’re just starting to save for retirement or are nearing that all-important retirement age, it’s essential to understand these changes. In this article, we’ll dive into what RMDs are, the recent retirement rule changes, and most importantly, how these changes affect you and your retirement planning. If you want to avoid penalties, minimize tax burdens, and make the most of your retirement funds, this guide will give you all the tools you need to navigate the updated rules with confidence.

New Retirement Rule Shakes Up RMDs

The new SECURE 2.0 Act changes bring much-needed flexibility for retirement savers, allowing for a longer time frame before RMDs must begin. These retirement rule changes can have a significant impact on how you plan for retirement, especially when it comes to taxes and charitable giving. With the right strategies, you can minimize tax penalties, use RMDs for charitable contributions, and ensure that your retirement savings last well into your later years.

| Topic | Details |

|---|---|

| What are RMDs? | Required Minimum Distributions (RMDs) are the minimum amounts you must withdraw from certain retirement accounts each year once you reach a certain age. |

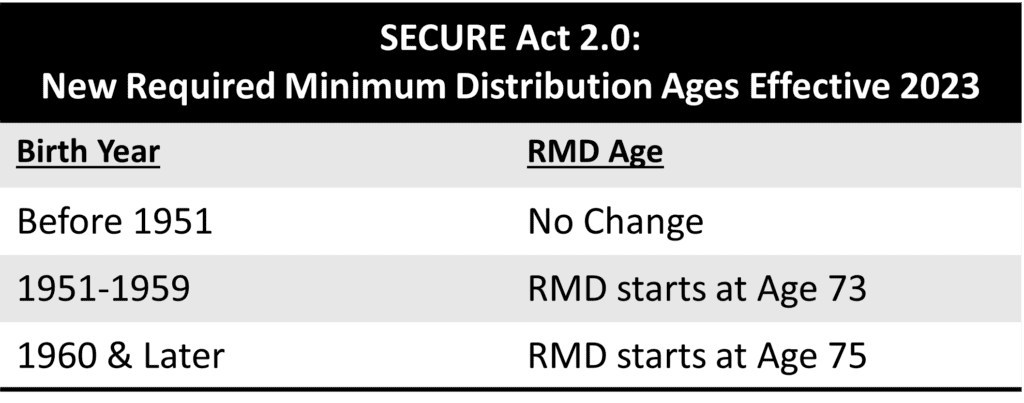

| New RMD Age | The RMD starting age has been raised to 73 for individuals born between 1951-1959 and to 75 for those born in 1960 or later. |

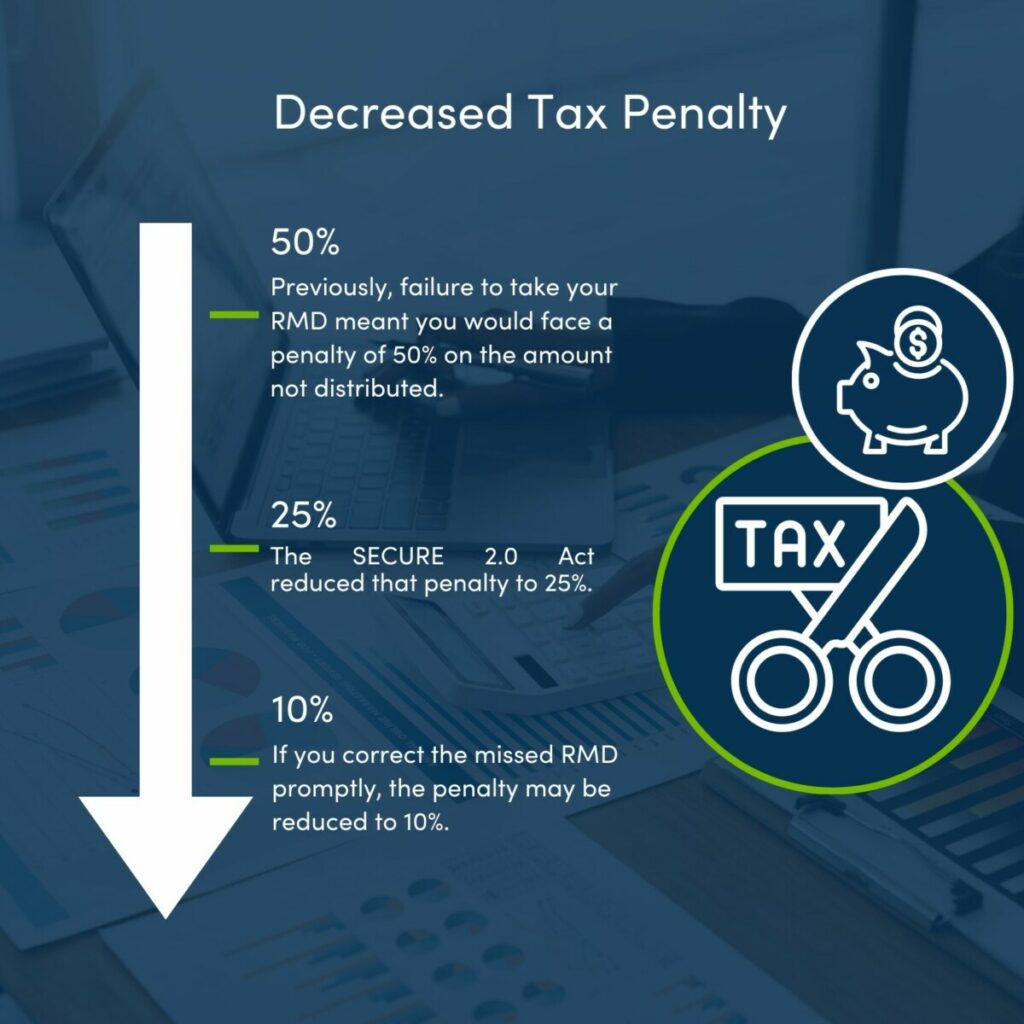

| RMD Penalties | Failure to take RMDs can lead to penalties of up to 25% of the amount not withdrawn. |

| Charitable Donations via RMDs | Qualified Charitable Distributions (QCDs) let you donate up to $100,000 from your IRA to charity, which counts as part of your RMD. |

| Roth 401(k) Rule Changes | Roth 401(k)s are now exempt from RMDs, aligning them with Roth IRAs. |

| Inherited IRA Rules | Inherited IRAs now have stricter rules requiring the account to be emptied within 10 years. |

Understanding RMDs and Their Importance

What exactly are RMDs? Required Minimum Distributions are the amounts you must begin withdrawing from certain types of retirement accounts once you reach a certain age. RMDs apply to accounts like traditional IRAs, 401(k)s, and other tax-deferred accounts. These accounts grow tax-deferred, but the government wants to ensure that they are eventually taxed. This means that the IRS requires you to start withdrawing a portion of the account balance once you hit a certain age.

Why do RMDs matter? Failing to take your RMDs can result in hefty penalties. In fact, the penalty for not taking your RMD is up to 25% of the amount you should have withdrawn. This penalty can severely impact your retirement savings. However, the new rules make it easier for savers to plan and avoid these penalties by providing more time before RMDs need to start.

The History of RMDs

RMDs have existed in some form for decades, but they’ve evolved with changing laws. In the past, individuals had to begin taking RMDs at age 70½. However, the SECURE Act of 2019 raised this age to 72, and now, under the SECURE 2.0 Act of 2022, the required age for taking RMDs has been raised even further— age 73 for those born between 1951 and 1959, and age 75 for individuals born in 1960 or later.

This shift in the age requirements allows retirees to leave their retirement savings untouched for a longer period, thus offering more opportunities for their investments to grow.

What’s New with RMDs?

The SECURE 2.0 Act introduces several important retirement rule changes regarding RMDs that affect how and when retirees must withdraw funds from their tax-deferred retirement accounts. Let’s break down the key updates:

Increased Starting Age for RMDs

Previously, RMDs began at age 72 under the SECURE Act of 2019. However, the SECURE 2.0 Act raised the RMD starting age to 73 for individuals born between 1951 and 1959, and to 75 for those born in 1960 or later.

What does this mean for you?

If you were born between 1951 and 1959, you now have more time to let your retirement savings grow before the IRS requires you to start taking RMDs. Likewise, if you were born in 1960 or later, you’ll have even more time to benefit from tax-deferred growth before you must take any required distributions.

How to Calculate Your RMD?

Calculating your RMD is straightforward once you know your account balance and the IRS life expectancy factor. Here’s how it works:

- Find your account balance as of December 31 of the previous year.

- Look up your life expectancy factor in the IRS RMD tables.

- Divide the account balance by the life expectancy factor to determine the minimum amount you must withdraw.

Example:

Suppose your traditional IRA balance is $150,000 at age 74. Using the IRS table for your age, let’s say the life expectancy factor is 25.5.

$150,000 ÷ 25.5 = $5,882.35

So, for the year, you must withdraw at least $5,882.35 from your IRA to satisfy your RMD.

The Tax Implications of RMDs

While RMDs are a necessary part of retirement, they come with tax consequences. RMDs are considered taxable income, which means they will increase your adjusted gross income (AGI) for the year. If your AGI exceeds certain thresholds, you may find yourself in a higher tax bracket.

For example, if you are in the 12% tax bracket and your RMDs push your income into the 22% bracket, your tax burden could increase significantly. That’s why planning ahead for RMDs is crucial, so you aren’t hit with a large tax bill in your retirement years.

How to Minimize the Tax Impact of RMDs?

There are several strategies that can help reduce the tax impact of RMDs, such as:

- Roth Conversions: Converting funds from a traditional IRA to a Roth IRA before you reach the RMD age can help you avoid paying taxes on future RMDs. With a Roth IRA, you won’t be required to take RMDs during your lifetime.

- Annuities: Purchasing an annuity with some of your retirement funds can create a guaranteed income stream without the need for an RMD. Annuities can be a great way to ensure income while avoiding tax penalties.

- Withdraw More Early: If you’re in a lower tax bracket early in retirement, it might make sense to withdraw more than the minimum required. By doing so, you can reduce the size of your future RMDs, and your withdrawals will be taxed at a lower rate.

Roth IRAs vs. Roth 401(k)s: New Retirement Rule Shakes Up RMDs

Roth IRAs are a favorite among retirees because they are not subject to RMDs during the account holder’s lifetime. This is an excellent feature, as it allows your retirement savings to grow tax-free and gives you flexibility when it comes to withdrawals.

However, before the SECURE 2.0 Act, Roth 401(k)s required RMDs, similar to traditional 401(k)s. The good news is that starting in 2024, Roth 401(k)s will be exempt from RMDs, just like Roth IRAs.

Key Takeaways:

- Roth IRAs: No RMDs during your lifetime.

- Roth 401(k)s: Starting in 2024, no RMDs during your lifetime.

If you have a Roth 401(k), now is the time to plan for converting some or all of those funds into a Roth IRA, where they can continue to grow without being subject to RMDs.

Charitable Giving Through Your RMD

Did you know that RMDs can also be used for charitable giving? If you’re 70½ or older, you can contribute up to $100,000 annually from your IRA directly to charity without paying income taxes on the donation. This is known as a Qualified Charitable Distribution (QCD).

Using your RMD for charitable giving not only satisfies your RMD requirement, but it also lowers your taxable income, making it an excellent strategy for those who wish to support causes they care about while minimizing taxes.

Example:

Suppose you have an RMD requirement of $8,000 and decide to donate it to charity. Instead of receiving the $8,000 in your pocket, you direct it to a qualifying charity, and it counts as part of your RMD. You won’t have to pay any taxes on the donation, which reduces your tax bill for the year.

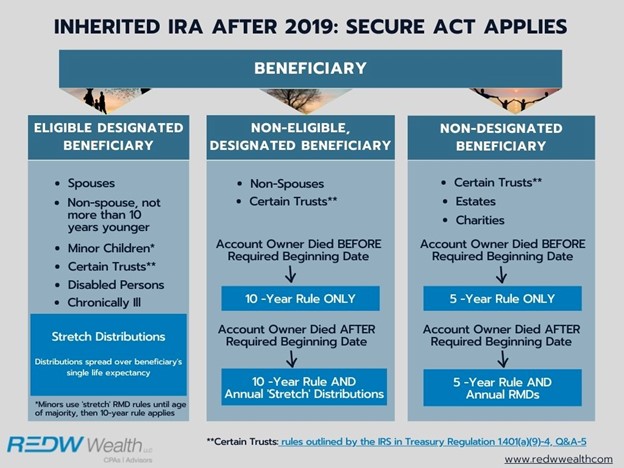

Inherited IRAs: The 10-Year Rule

If you inherit an IRA, there are new rules to be aware of. Under the SECURE 2.0 Act, beneficiaries must withdraw the entire balance of an inherited IRA within 10 years of the original account holder’s death. This eliminates the ability to stretch RMDs over the beneficiary’s lifetime, which was previously an option for many beneficiaries.

However, spouses and certain other beneficiaries (like minors or those with disabilities) may still have the ability to take RMDs over their lifetime.

Americans Admit Wasting Tons of Money on These 5 Things—Are You Guilty Too?

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026