New GOP Retirement Plan Could Cost Millennials $420,000: The New GOP Retirement Plan is making waves — and not in a good way. If you’re a Millennial, or part of Gen X, you could be looking at a $420,000 hit to your Social Security benefits over your lifetime. That’s not an exaggeration. According to data from the Congressional Budget Office (CBO), the proposed plan to raise the full retirement age from 67 to 69 would significantly reduce lifetime benefits for anyone born after 1978. That includes millions of hardworking Americans who are already juggling student loans, rising housing costs, and stagnant wages. Whether you’re 35 or 55, this article explains what’s going on — and more importantly — how to prepare for what’s ahead.

New GOP Retirement Plan Could Cost Millennials $420,000

The New GOP Retirement Plan proposes raising the retirement age to 69 — a change that would drastically cut Social Security benefits for millions of Americans, particularly Millennials and Gen Xers. While the stated goal is to extend the solvency of the trust fund, the cost to individuals is steep, and the benefit to the system is minimal — just one year of additional solvency.

This plan disproportionately affects working-class Americans, especially those in physically demanding jobs or with shorter lifespans. Fortunately, there are more equitable and sustainable alternatives that policymakers can pursue. For now, your best defense is preparation: save more, check your benefits, diversify your investments, and stay informed.

| Topic | Details |

|---|---|

| Proposal | Raise Social Security full retirement age from 67 to 69 |

| Target Age Group | Primarily affects Americans aged 30 to 55 |

| Estimated Lifetime Loss | Up to $420,000 in Social Security benefits |

| Implementation Timeline | Starts in 2026, phased in over 8 years |

| Impact on Trust Fund | Extends Social Security solvency by only 1 year (2034 → 2035) |

| Better Alternatives | Lift payroll tax cap, tie age to life expectancy, close corporate loopholes |

| Official SSA Website | https://www.ssa.gov |

What Is the New GOP Retirement Plan Could Cost Millennials $420,000?

The Republican Study Committee, a conservative policy group in Congress, has proposed increasing the full retirement age (FRA) for Social Security from 67 to 69 for people born after 1978.

The change would be phased in over 8 years, starting in 2026. This means by 2033, anyone who wants to receive full Social Security benefits will need to wait until age 69 — not 67 as currently promised.

Why does that matter?

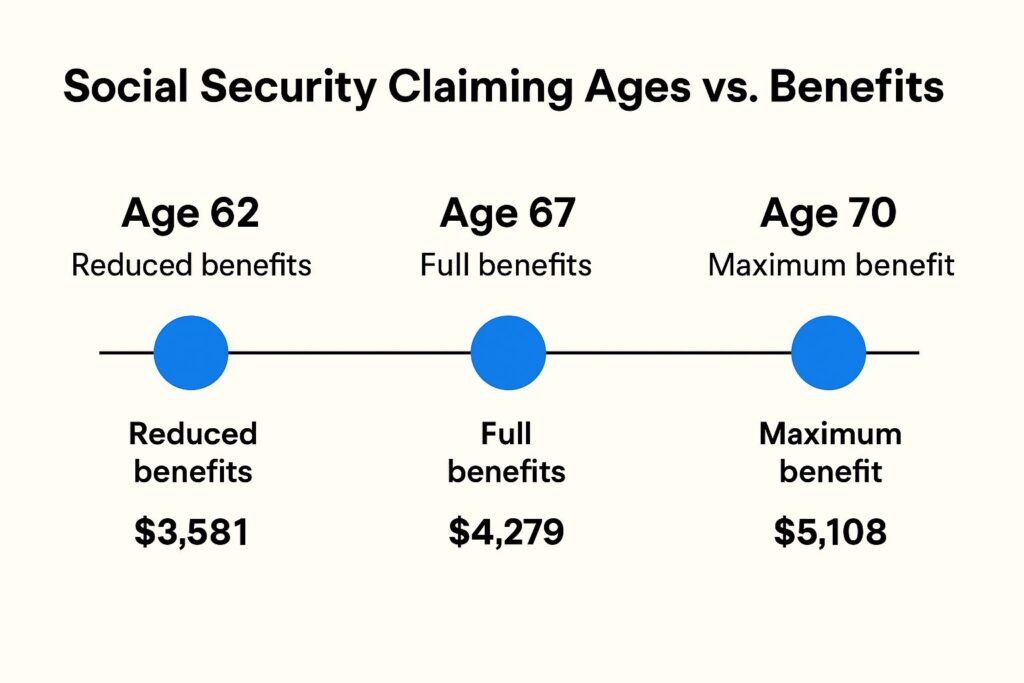

Because retiring earlier than the new full age will result in a penalty — a reduction in your monthly check for life. And even if you wait until 69, the value of the total benefits you receive over your lifetime will be significantly lower.

According to the CBO, the average American could lose up to $3,500 per year, which adds up to over $100,000–$400,000+ depending on your earnings and how long you live after retiring.

Who Is Most Affected?

This plan doesn’t affect everyone equally. The groups likely to feel the biggest impact include:

Millennials and Gen X (Born After 1978)

These are the Americans targeted directly by the proposal. Anyone in their 30s to early 50s will either need to work two more years or face significant benefit reductions.

Physically Demanding Jobs

Workers in labor-intensive fields like:

- Construction

- Manufacturing

- Healthcare

- Hospitality

…often can’t reasonably work into their late 60s. For them, retiring early isn’t a choice — it’s a necessity. But that means permanently smaller Social Security checks.

Lower-Income and Shorter-Lived Americans

Statistically, lower-income Americans have shorter lifespans than wealthier ones. This means they already receive fewer years of benefits — and would now be required to work longer to get even less.

This policy change doesn’t just reduce benefits. It widens inequality.

Why Was This Plan Proposed?

According to Republicans behind the proposal, the goal is to “protect” Social Security’s future. Right now, the Social Security Trust Fund is projected to run out of reserves by 2034, at which point only 77% of promised benefits could be paid from ongoing tax revenue.

By raising the retirement age, the logic goes, fewer people will draw benefits at the same time, easing the financial burden on the system.

However, according to the Congressional Budget Office, this proposed change would only add one year to the program’s solvency — shifting the trust fund depletion date from 2034 to 2035.

One year of solvency in exchange for $420,000 less per person? That’s a raw deal for younger generations.

The Math Behind the Plan

Let’s break down a few examples:

Example 1: Anna, Age 38, School Teacher

- Expected to retire at 67 under current law

- If the FRA moves to 69, and she retires at 67, she’ll get a 13% permanent reduction in benefits

- Over 25 years, she could lose $150,000–$250,000 in benefits

Example 2: Carlos, Age 52, Construction Worker

- Physically unable to work past 66

- Would retire early, locking in a 25–30% penalty

- Could lose $300,000+ depending on life expectancy

For many Americans, this change doesn’t just mean working longer — it means living poorer in retirement.

What Are Better Alternatives?

The good news? There are smarter, more equitable ways to extend Social Security’s solvency — without gutting benefits for future retirees.

Raise or Remove the Payroll Tax Cap

In 2025, Social Security taxes only apply to the first $168,600 of earned income. Billionaires pay the same amount into Social Security as someone earning $170,000. If this cap were lifted or adjusted, the system could be stabilized without reducing benefits.

Tie Retirement Age to Life Expectancy (Equitably)

Countries like Sweden and Germany adjust the retirement age based on national life expectancy, but they also protect blue-collar workers and low-income individuals through early-out options and disability allowances.

Close Tax Loopholes for the Wealthy and Corporations

The U.S. loses hundreds of billions annually through corporate tax shelters and special-interest deductions. Redirecting even a fraction of that toward Social Security could provide years of solvency without cuts.

What You Can Do Right Now?

Regardless of what happens in Congress, you should start planning today. Here are actionable steps to protect your retirement future:

1. Check Your Social Security Statement

Go to ssa.gov/myaccount and sign up for an account. You’ll be able to:

- Review your earnings history

- Estimate future benefits

- Track your contributions

Make sure your earnings are reported correctly. Errors could cost you later.

2. Increase Your Retirement Contributions

Start small if needed. Increase your savings rate by just 1–2% per year. Over time, it makes a massive difference thanks to compound interest.

Use:

- Employer 401(k) or 403(b)

- Roth IRA or Traditional IRA

- SEP IRA if you’re self-employed

3. Max Out a Health Savings Account (HSA)

If you’re eligible, contribute to an HSA. These accounts:

- Let your money grow tax-free

- Can be used for medical expenses in retirement

- Don’t require distributions at a certain age

4. Work With a Fiduciary Financial Advisor

Fiduciaries are legally required to work in your best interest. A qualified advisor can help you:

- Project your retirement needs

- Optimize tax strategies

- Build a plan that adjusts for changes like this proposal

GOP Pushes Federal Workers to Retire; While Quietly Making It Harder to Do So Safely

GOP Tax Bill Contains a Quiet Threat to Federal Workers; Could This Be the End of the Civil Service?

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!

Real-Life Case Studies

Let’s take a look at real Americans and how this could play out.

Erica, 40, Nurse in North Carolina

Erica has been working since age 21 and plans to retire at 67. With the GOP plan, she’d need to work two extra years or lose $12,000/year in retirement income. Over a 30-year retirement, she stands to lose over $300,000.

Martin, 45, Self-Employed IT Consultant

Martin maxes out his 401(k) and IRAs. He’ll likely be fine — but even he could lose $100,000+ in Social Security benefits if the plan passes. He’s now adjusting his FIRE (Financial Independence, Retire Early) plans accordingly.