New CRA Benefit Payments Rolling Out in July: If you’re a Canadian citizen or resident, you may already know that the Canada Revenue Agency (CRA) rolls out several benefits throughout the year to help support households across the country. In July 2025, a new set of benefit payments will be distributed to eligible Canadians, and it’s important for you to know whether you qualify for these financial aids. Whether you’re a single parent, a senior citizen, or someone with disabilities, there are payments designed to help make life a little easier. This article will break down the new CRA benefits rolling out in July 2025, explain how you can check if you’re eligible, and guide you through the application process. By the end of this, you’ll have a complete understanding of the programs available and how to ensure you don’t miss out on these essential benefits.

New CRA Benefit Payments Rolling Out in July

As July 2025 approaches, it’s essential to understand which CRA benefit payments are available to you and how to ensure you’re eligible for them. From helping families with children to providing crucial support for people with disabilities, these benefits are designed to make life more affordable. Make sure to check your eligibility through the CRA’s online tools, and don’t miss out on these valuable payments. Whether you’re working, raising children, or managing a disability, there’s a program tailored to assist you.

| Benefit Type | Payment Date | Eligibility Requirements | Amount |

|---|---|---|---|

| Canada Disability Benefit (CDB) | July 17, 2025 | Approved for Disability Tax Credit (DTC), age 18-64 | Up to $200 per month |

| GST/HST Credit | July 4, 2025 | Canadian residents aged 19+, net family income under threshold | Up to $133.25 per quarter |

| Ontario Trillium Benefit (OTB) | July 10, 2025 | Ontario residents, meets income criteria | Varies based on income and family size |

| Canada Workers Benefit (CWB) | July 11, 2025 | Workers aged 19+, earned income under province’s limit | Up to $456.50 per family |

| Canada Child Benefit (CCB) | July 18, 2025 | Primary caregiver of a child under 18 | Up to $666.41 per month |

| Climate Action Incentive | July 15, 2025 | Residents of certain provinces | Varies by province and family size |

What Are CRA Benefit Payments?

The CRA distributes various benefit payments to Canadian residents to help ease the financial burden of everyday expenses. These benefits are designed to target those who need them most, such as low-income families, seniors, and people with disabilities. The goal is to provide financial relief in areas such as housing, child care, and transportation. Some of these benefits are automatically granted based on tax filings, while others require applications.

In July 2025, the CRA will issue a series of benefit payments. These payments include key financial support programs like the Canada Disability Benefit (CDB), Canada Child Benefit (CCB), GST/HST Credit, and more. Let’s take a deeper dive into these payments to help you understand them better.

1. Canada Disability Benefit (CDB)

The Canada Disability Benefit (CDB) is one of the most significant payments for individuals who are facing physical or mental disabilities. This benefit is designed to provide financial support for those who have qualified for the Disability Tax Credit (DTC). If you or someone you know is living with a disability, this is the payment to keep an eye on.

Key Facts:

- First Payment Date: July 17, 2025

- Eligibility: Individuals aged 18 to 64 who are approved for the Disability Tax Credit (DTC) and who have filed their 2024 tax return.

- Amount: Up to $200 per month ($2,400 annually), subject to income thresholds.

If you haven’t yet applied for the Disability Tax Credit, make sure to do so before the deadline to be eligible for this benefit.

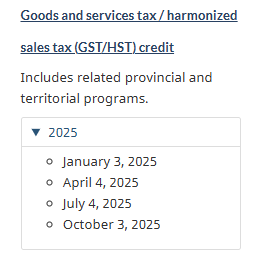

2. GST/HST Credit

If you’re a Canadian resident aged 19 or older, the GST/HST Credit is another benefit you may qualify for. This credit is designed to help those with lower incomes offset the cost of the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) paid on goods and services.

Key Facts:

- Payment Date: July 4, 2025

- Eligibility: Canadian residents who are 19 years old or older, living with a spouse, or a child. The net family income must be under a specific threshold.

- Amount: The maximum amount is $133.25 per quarter for singles, $174.50 for couples, and $46 per child under 19.

How to Check:

If you’re wondering whether you qualify for the GST/HST Credit, check the CRA website or log into your CRA My Account to view your eligibility and payment amounts.

3. Ontario Trillium Benefit (OTB)

For Ontario residents, the Ontario Trillium Benefit (OTB) is another important payment, especially for those living in lower-income households. This benefit combines several existing tax credits into one payment. It includes credits for the Ontario Energy and Property Tax Credit, the Northern Ontario Energy Credit, and the Ontario Sales Tax Credit.

Key Facts:

- Payment Date: July 10, 2025

- Eligibility: Residents of Ontario as of December 31, 2024, who meet income criteria.

- Amount: The amount varies depending on income level and family composition.

The Ontario Trillium Benefit can help cover the costs of energy, taxes, and sales. It’s a great resource if you live in Ontario and need a financial boost.

4. Canada Workers Benefit (CWB)

The Canada Workers Benefit (CWB) is designed for working Canadians with lower incomes. The CWB helps offset the cost of living for those who earn a wage. If you’re a worker aged 19 or older, you may be eligible for this payment, which is calculated based on your family’s total income.

Key Facts:

- Payment Date: July 11, 2025

- Eligibility: Workers aged 19+ with income below a certain threshold.

- Amount: Up to $456.50 for families, with an additional $136.83 for those eligible for the disability supplement.

This benefit is meant to provide support for people who are employed but still face financial hardship.

5. Canada Child Benefit (CCB)

The Canada Child Benefit (CCB) is designed to provide financial support to parents or guardians who are primarily responsible for the care of children under the age of 18. The benefit is calculated based on family income and the number of children in the household.

Key Facts:

- Payment Date: July 18, 2025

- Eligibility: Primary caregiver of a child under 18.

- Amount: Up to $666.41 per month for children under 6, and $562.33 per month for children aged 6 to 17.

Parents can rely on this payment to help cover expenses like child care, education, and everyday costs.

6. Climate Action Incentive

For residents living in provinces that don’t have carbon pricing, the Climate Action Incentive (formerly known as the Climate Action Incentive Payment) provides compensation for the additional cost of carbon taxes. This payment is meant to balance out the cost of living in these provinces.

Key Facts:

- Payment Date: July 15, 2025

- Eligibility: Residents of provinces such as Alberta, Manitoba, Ontario, and Saskatchewan.

- Amount: The amount varies based on family size and the province in which you reside.

This payment aims to help offset the costs of living in areas with higher carbon taxes.

How to Check If You’re Eligible for New CRA Benefit Payments Rolling Out in July?

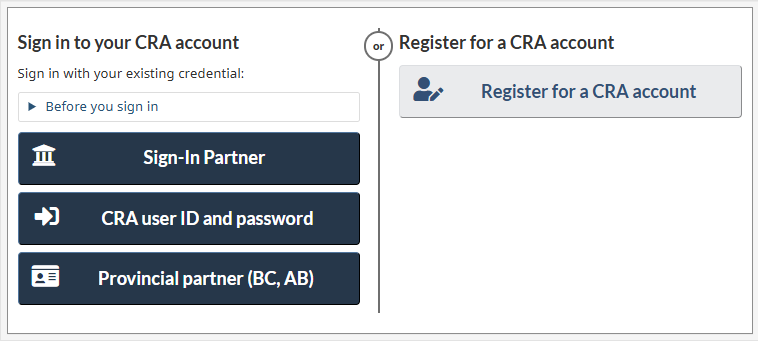

Checking eligibility for these payments is easy. The CRA My Account is the best place to check if you qualify for a specific benefit and see your payment status.

Steps to Check Eligibility:

- Log into your CRA My Account: Make sure you have an active CRA account.

- Review the Eligibility Requirements: Go to the “Benefits and Credits” section and select the benefit you’re interested in.

- Use the CRA’s Benefit Estimator Tool: This tool helps estimate the benefits you might be entitled to.

- Ensure Your Tax Returns are Filed: Some benefits, such as the GST/HST credit, require up-to-date tax filings to qualify.

If you don’t already have a CRA account, it’s a good idea to set one up, as it’s required for many of these payments.

Additional Resources and Tips for Claiming Benefits

1. Ensure You File Your Taxes On Time

To qualify for many of the CRA benefits, including the GST/HST Credit and Canada Child Benefit (CCB), you must have filed your most recent tax return. Even if you do not owe any taxes, filing is essential to ensure that you’re considered for various benefits.

2. Stay Updated on Eligibility Changes

Eligibility criteria for CRA programs can change from year to year, based on family size, income, or other factors. Keep yourself informed through the CRA website or by speaking with a tax advisor.

3. Don’t Miss Deadlines

Deadlines for applying for benefits vary, and missing them could delay or forfeit your eligibility. Make sure you’re aware of key dates such as June 30, which is the cut-off date for applying for some benefits like the Canada Disability Benefit (CDB).

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

CRA Surprise Payout Coming Summer 2025 – Are You Getting It?

Benefit Cheat Who Stole £53,000 Only Loses £36 a Month; Outrage Sparks Nationwide