Most Retirees Lose Their Social Security Checks: When it comes to retirement, one of the most critical sources of income for older Americans is Social Security. This government benefit helps millions of retirees stay financially stable in their golden years. However, something that many retirees don’t realize is that in some states, their Social Security checks could be reduced—sometimes significantly—by state taxes. This can be an unwelcome surprise for those planning to rely on their benefits for living expenses. In this article, we’ll explore which U.S. states are taxing Social Security benefits, how it works, and what you can do to plan accordingly. Whether you’re already retired or just starting to think about your future, understanding this issue is essential to ensure that your retirement savings and Social Security benefits aren’t eaten up by unexpected taxes.

Most Retirees Lose Their Social Security Checks

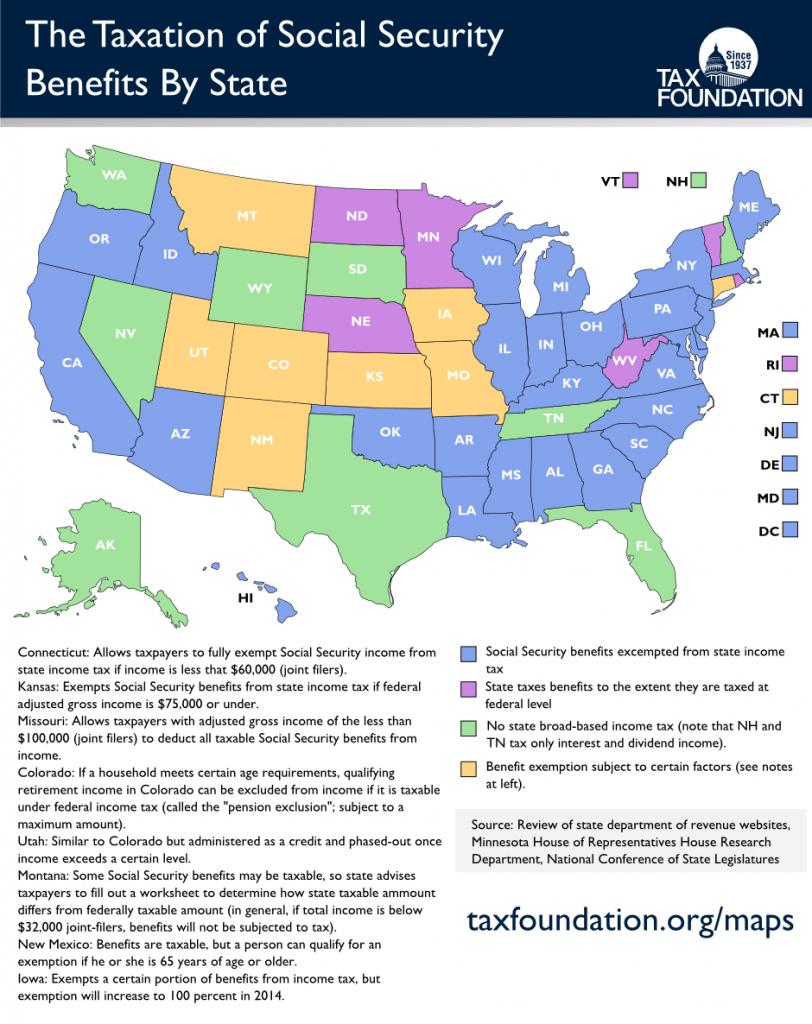

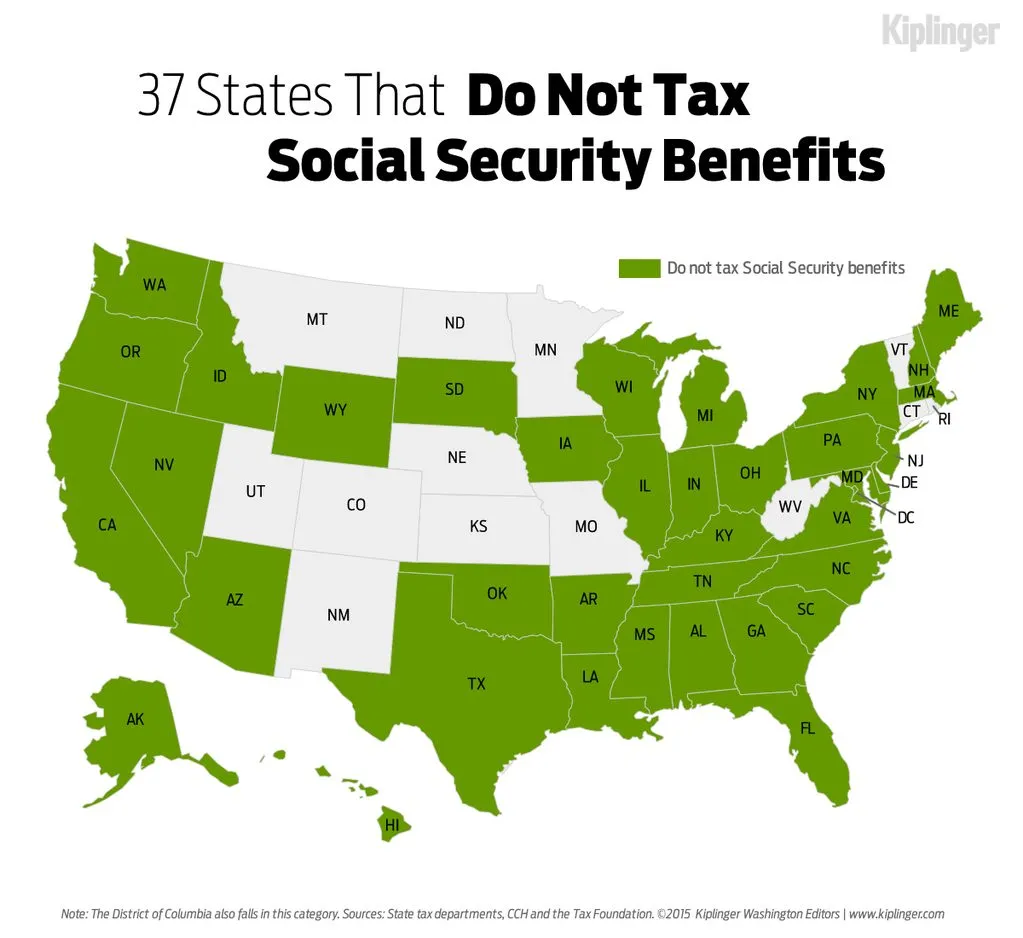

Social Security is an essential income source for retirees, but state taxes can significantly reduce the amount you receive each month. States like Colorado, Minnesota, and New Mexico are some of the biggest culprits, with various income thresholds that trigger taxes on benefits. However, states like California, Florida, and Texas offer a tax-free haven for Social Security. If you’re planning your retirement, understanding these tax rules is vital to ensuring that you don’t lose out on valuable benefits. By staying informed and working with a financial advisor, you can avoid unexpected tax bills and keep your retirement savings intact. Always keep an eye on state tax law changes and plan ahead to make the most of your Social Security benefits.

| State | Income Threshold | Tax on Social Security | Special Notes |

|---|---|---|---|

| Colorado | $20,000 (Under 65) | Social Security benefits taxed for those under 65 who exceed the income threshold | Exemption applies to those 65 and older |

| Connecticut | $75,000 (Single) | Taxes Social Security benefits for single filers with an AGI over $75,000 or joint filers over $100,000 | |

| Kansas | $75,000 | Taxes Social Security benefits for individuals with an AGI exceeding $75,000 | |

| Minnesota | $78,000 (Single) | Taxes Social Security benefits for single filers with AGI over $78,000 and joint filers over $100,000 | |

| Montana | $25,000 (Single) | Taxes Social Security benefits for single filers with AGI over $25,000 and joint filers over $32,000 | |

| Nebraska | $45,790 (Single) | Taxes Social Security benefits for single filers with AGI over $45,790 and joint filers over $61,760 | |

| New Mexico | $100,000 (Single) | Taxes Social Security benefits for single filers with AGI over $100,000 and joint filers over $150,000 | |

| Rhode Island | $95,800 (Single) | Taxes Social Security benefits for single filers with AGI over $95,800 and joint filers over $119,750 | |

| Utah | $45,000 (Single) | Taxes Social Security benefits for single filers with MAGI over $45,000 and joint filers over $75,000 | |

| Vermont | $50,000 (Single) | Taxes Social Security benefits for single filers with AGI over $50,000 and joint filers over $65,000 | |

| West Virginia | $50,000 (Single) | Taxes Social Security benefits for single filers with AGI over $50,000 and joint filers over $100,000 | Social Security taxes will be eliminated starting in 2026 |

What Does It Mean to Lose Social Security Checks?

First off, let’s clear up what it means to “lose” a Social Security check. Essentially, when we say that retirees in certain states are “losing” their Social Security checks, we are talking about how these benefits are being reduced due to state taxes. While your federal Social Security benefits are generally exempt from state taxes in most states, some states have decided to tax these benefits, either partially or fully, based on your income.

How Does State Taxation of Social Security Work?

In the U.S., Social Security benefits are subject to federal income tax if your combined income exceeds a certain threshold. However, states can also choose whether or not to tax Social Security benefits. Some states, like California, do not tax Social Security benefits at all, while others, like those listed above, tax them at different levels depending on your total income.

For instance, if you live in Colorado and you’re under 65, the state will tax your Social Security benefits if your taxable income exceeds $20,000. If you’re over 65, however, you’re exempt from these taxes. This means that your age can directly affect whether your benefits are taxed.

How Are Social Security Benefits Taxed?

Each state has its own rules for taxing Social Security benefits, and these rules can vary significantly. Here’s an example:

- In Minnesota, Social Security benefits are taxed if your adjusted gross income (AGI) is over $78,000 for single filers, or over $100,000 for joint filers. This means that if you exceed these thresholds, the state will take a portion of your Social Security benefits, reducing your monthly check.

In some states, this might mean a small reduction, while in others, it could be substantial. For instance, if you live in West Virginia, Social Security benefits are taxed once your AGI exceeds $50,000 for single filers and $100,000 for joint filers. However, there’s good news: West Virginia has announced that it will gradually eliminate the tax on Social Security starting in 2026. So if you live there, you’ll eventually see a relief in this area.

States That Tax Social Security Benefits: What You Need to Know

If you’re thinking about retiring soon or already in retirement, it’s important to be aware of whether your state taxes Social Security benefits. Let’s dive deeper into some key states that are seeing the most retirees lose part of their Social Security checks.

1. Colorado

Income Threshold: $20,000 (Under 65)

Tax Impact: Social Security benefits taxed for those under 65 with income exceeding $20,000; 65 and older are exempt.

In Colorado, if you’re under 65 and your taxable income exceeds $20,000, you’ll be subject to state taxes on your Social Security benefits. However, if you’re 65 or older, you get a nice break and your benefits will not be taxed at all. So, if you plan on retiring early, it might be wise to look at states with more favorable tax laws for retirees.

2. Minnesota

Income Threshold: $78,000 (Single), $100,000 (Joint)

Tax Impact: Social Security taxed if your AGI exceeds the threshold.

In Minnesota, retirees could see their Social Security checks reduced by taxes if their income surpasses $78,000 (single) or $100,000 (joint). If you’re in this boat, you might want to consider moving to a state with lower taxes on retirement income.

3. New Mexico

Income Threshold: $100,000 (Single), $150,000 (Joint)

Tax Impact: Taxes Social Security for higher income retirees.

New Mexico is another state where higher-income retirees will see a chunk of their Social Security benefits taxed. If your income is over $100,000 as a single filer or $150,000 as a joint filer, expect to pay state taxes on your benefits. This can be a significant cut for those relying on Social Security as their primary source of income.

4. West Virginia

Income Threshold: $50,000 (Single), $100,000 (Joint)

Tax Impact: Social Security taxed above income thresholds. However, they plan to eliminate this tax by 2026.

West Virginia is an interesting case because, while it taxes Social Security benefits above certain income thresholds, it is planning to eliminate this tax by 2026. If you live here or plan to retire in West Virginia, you’ll have to keep an eye on upcoming changes.

Tax-Free States for Social Security

Some states completely exempt Social Security benefits from taxation. If you want to maximize your benefits, you might want to look into these states:

- California

- Florida

- Nevada

- Texas

These states won’t take a chunk of your Social Security check, which is great news if you’re looking to keep your retirement benefits intact.

How to Plan Around As Most Retirees Lose Their Social Security Checks?

Consider Relocating for Retirement

If you’re approaching retirement or already retired, it may be time to reconsider where you live. States that do not tax Social Security benefits, like Florida or Texas, may be ideal for retirees who want to maximize their income. Moving to one of these states could save you a significant amount of money in the long run.

Work with a Financial Advisor

Social Security taxation can be complicated, and state tax laws change frequently. To make sure you’re not losing more of your benefits than necessary, it’s important to work with a financial advisor who understands the nuances of both federal and state taxation. A good advisor can help you create a tax-efficient retirement strategy that minimizes your tax burden and maximizes your benefits.

Look Into State-Specific Tax Breaks

Some states offer tax breaks specifically for retirees. For example, in Montana, seniors may qualify for exemptions or reductions based on their income levels. Additionally, West Virginia is phasing out Social Security taxes by 2026. These kinds of exemptions can reduce the amount of Social Security benefits you have to pay taxes on, so be sure to take advantage of them if you qualify.

Social Security Sends Out $967–$1,450 Checks; Check Your Deposit Date Now

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

2025 COLA Drop Shocker: How Your Social Security Check Could Take a Hit!