Missed Your 2025 Stimulus Payment: If you’re searching for “Missed Your 2025 Stimulus Payment?”, you’re not alone. Thousands of Americans are still wondering when their 2025 Recovery Rebate Credit will arrive—or why it hasn’t. Whether your payment is missing due to a tax filing error, a change in address, or an IRS delay, this guide walks you through exactly what to do. We’ve broken everything down in a friendly, conversational tone that’s easy enough for a 10-year-old to follow, but also rich with insights that tax professionals, freelancers, and employers will appreciate. And yes—it includes verified data, official links, and practical advice you can use today.

Missed Your 2025 Stimulus Payment

If you missed your 2025 stimulus payment, don’t panic—but don’t wait either. Whether you need to file, amend, trace, or correct information, this guide gives you the roadmap. Filing your 2023 return and staying informed through IRS.gov are the most important steps. Remember: This isn’t a loan or a bonus—it’s money the law says you’re owed. Let’s get it back in your pocket.

| Topic | Details | Pro Tip |

|---|---|---|

| Payment Start Date | May 2025 | Use your IRS Online Account to confirm eligibility and status |

| Max Payment Amount | $1,400 per person (including qualifying dependents) | File or amend your 2023 return with the Recovery Rebate Credit |

| Filing Deadline | April 15, 2026 (for claiming via 2023 tax return) | Don’t wait—IRS delays are real |

| Payment Trace Tool | File Form 3911 | Takes 6–9 weeks to process |

| IRS Support | Call 800-919-9835 | Ask for “EIP Trace” support team |

| Address Update | File Form 8822 | Ensures check or notice gets to you |

| Scam Prevention | IRS never emails or texts unsolicited | Confirm every communication at IRS.gov |

What Is the 2025 Recovery Rebate Credit?

The Recovery Rebate Credit is a refundable tax credit available to individuals who missed out on earlier Economic Impact Payments (EIP)—also called “stimulus checks”—from prior COVID-19 relief efforts. If you didn’t receive the correct payment in 2020 or 2021, you can still get it now by filing or amending your 2023 federal tax return.

The credit is worth up to $1,400 per person, including additional amounts for qualifying dependents. It’s not taxable and won’t impact eligibility for government benefits like SNAP or Medicaid.

Who Is Eligible?

To qualify, you must meet these IRS criteria:

- Be a U.S. citizen or resident alien.

- Not be claimed as a dependent by another taxpayer.

- Have a valid Social Security Number.

- Meet income thresholds:

- Up to $75,000 for single filers

- Up to $112,500 for heads of household

- Up to $150,000 for married couples filing jointly

The IRS will reduce the credit if your income exceeds these amounts.

You also must have filed—or be willing to file—a 2023 tax return to claim it.

Why You Missed Your 2025 Stimulus Payment?

Several reasons may explain the delay:

- You didn’t file a 2023 tax return – The IRS has no record to base your payment on.

- You filed but left out the Recovery Rebate Credit – It must be claimed explicitly.

- IRS Processing delays – Especially if you filed a paper return.

- Wrong or outdated address – Payments sent by mail can get lost or returned.

- You were claimed as a dependent – Even if incorrectly, that will disqualify you.

- Banking errors – If the IRS has an old account on file, direct deposit fails.

If any of these sound like your situation, the fix is usually simple.

How to Check Your Payment Status?

- Go to IRS.gov/account

- Create or log in to your IRS account.

- Check the “Payment History” section.

- If it shows “Payment Sent,” but you didn’t get it, proceed to the next step.

What If the IRS Says “Payment Sent” But You Didn’t Get It?

First, double-check your address and bank account listed on your return. If everything looks good, but your check or direct deposit never arrived, you’ll need to initiate a Payment Trace.

Here’s how:

- Call 800-919-9835 and ask to initiate a payment trace.

- OR download and mail Form 3911, “Taxpayer Statement Regarding Refund.”

Form 3911 requires:

- The tax year (2023)

- Which stimulus you’re tracing (EIP3 / Recovery Rebate Credit)

- Whether it was direct deposit or check

- Your updated contact info

What If I Never Filed a 2023 Return?

The IRS doesn’t know to send you a payment unless you’ve filed a return. The good news? You can still file your 2023 tax return through April 15, 2026, and claim the credit.

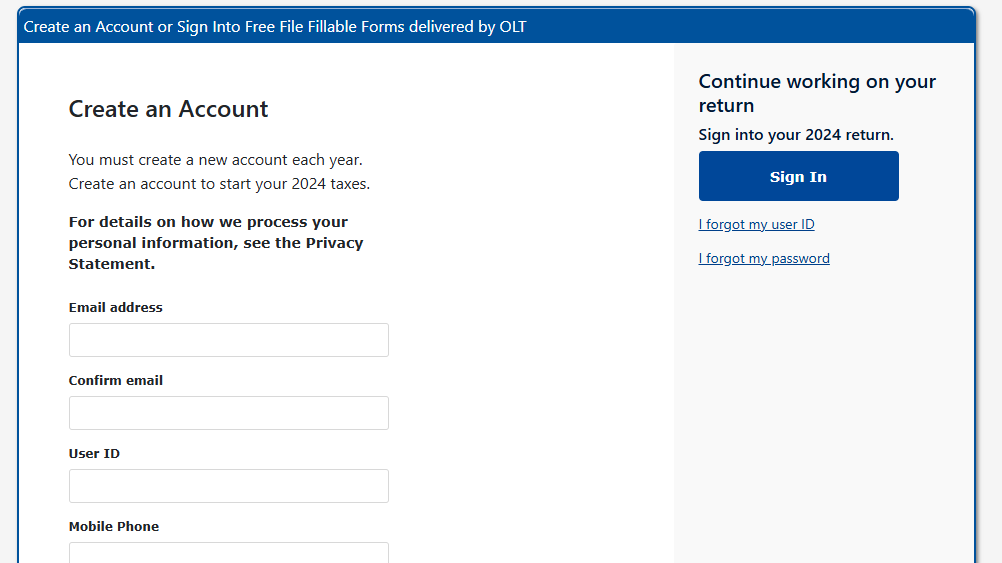

Even if your income was zero, or if you rely on Social Security, VA benefits, or SSDI, you may still qualify. Use IRS Free File if you earn under $79,000.

How to File or Amend a 2023 Tax Return?

To File a Return:

- Use IRS Free File or work with a tax preparer.

- Complete Form 1040 and claim the credit on Line 30.

To Amend a Return:

- Use Form 1040-X.

- Indicate the correction relates to the Recovery Rebate Credit.

Special Notes for Parents and Dependents

If you had a child in 2023 or if your dependent status changed, you may qualify for additional stimulus funds. Common issues include:

- Child listed without a valid SSN.

- Newborns not added to the return.

- Divorced parents both claiming the same child.

To fix this, file an amended return with the correct dependent information.

IRS Letters You Might Receive

The IRS sends out official letters before and after payment. Here are the most common:

- Letter 6475 – Confirms your third stimulus amount.

- Notice CP11 – Informs you of changes to your return.

- Letter 4883C – Requests identity verification.

How to Avoid Stimulus Check Scams?

With payments still rolling out, scammers are everywhere. Here’s what to watch for:

The IRS Will Never:

- Email you links or ask for your Social Security number online.

- Call demanding payment or bank info.

- Text you with “stimulus updates.”

The IRS Will:

- Send official letters to your mailing address.

- Require you to use IRS.gov or mail forms.

- Offer secure login options only through verified sites.

Advice for Freelancers, Low-Income Earners, and Seniors

Even if you didn’t file because your income was below the minimum threshold, you can (and should) still claim the credit.

- Gig workers and freelancers: Income from apps like Uber, DoorDash, and Etsy counts.

- Seniors and retirees: Even if you rely only on Social Security, you qualify.

- Students: If you’re not a dependent, you may be eligible.

Use VITA programs or AARP tax aid centers if you need help.

Big $1,312 Stimulus Payments Arriving in 2025 — Check If You Qualify!

IRS $1400 Stimulus Payment Status Live — Find Out When You’ll Get Paid!

$725 Monthly Stimulus Begins June 15; See If You’re Eligible Now!

Frequently Asked Questions

Q: Is the Recovery Rebate Credit taxable?

No, the credit is not taxable. It will not reduce your refund or increase your tax bill.

Q: What if my return is still processing?

Returns can take weeks to process, especially if filed by mail. Check your IRS account weekly.

Q: Can I still claim stimulus checks from 2020 or 2021?

Yes, but you must amend earlier returns or file them now. You typically have up to three years.

Q: What if I never received my IRS letter or notice?

Call the IRS or log in online. You can request reissuance of any official notices or letters.