Missed Student Loan Payments: Let’s be real—missing a student loan payment happens. Maybe you were between jobs, got overwhelmed, or simply didn’t know payments had restarted. Whatever the reason, the damage to your credit score can feel like falling off a cliff. But here’s the good news: just because you missed a few payments doesn’t mean your credit is ruined forever. If you’ve found yourself in this situation, don’t panic. This guide will walk you through exactly how to fix your credit score after missed student loan payments—step by step, with clear examples, practical tips, and advice even a 10-year-old could follow. Whether you’re a student, a working parent, or a professional juggling multiple debts, there’s a way forward.

Missed Student Loan Payments

Yes, missing student loan payments can be a serious financial blow—but it’s not a life sentence. With the right moves—rehabilitation, IDR plans, credit monitoring, and responsible borrowing—you can fix your credit and regain control over your finances. It takes time and patience, but your credit score can bounce back stronger than ever. Remember, the road may feel long, but every on-time payment is a step toward a better financial future.

| Topic | Key Data / Insight | Professional Take |

|---|---|---|

| Score drops | 2.2M borrowers lost over 100 points; 1M lost more than 150 points (Q1 2025) | High-scorers suffered the biggest losses. Late payments severely impact FICO scores. |

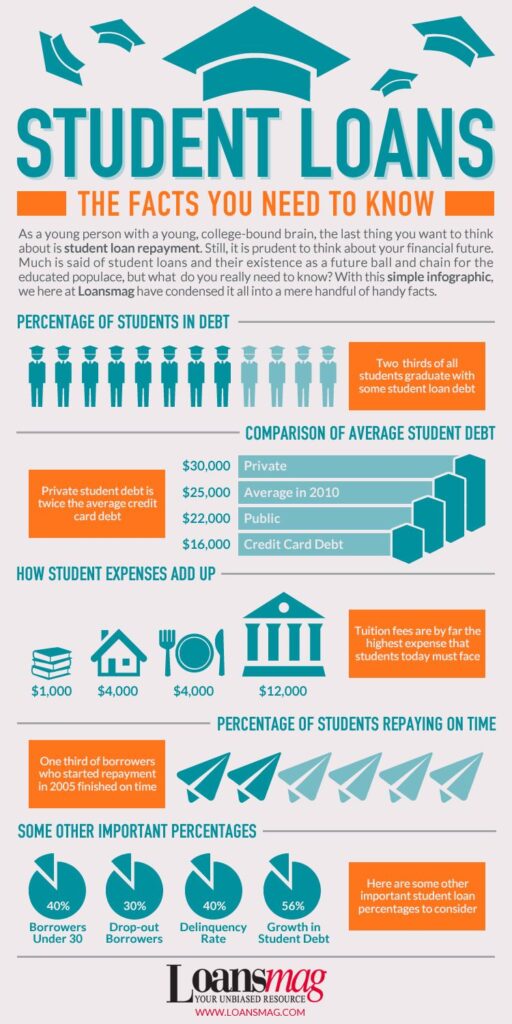

| Delinquency rate | Over 23.7% of federal borrowers are 90+ days behind | Nearly 1 in 4 borrowers are struggling with payments post-COVID pause. |

| Age-based impact | Borrowers aged 35–49 most affected | Mid-career professionals often hold the highest balances and carry more financial responsibilities. |

| Fixing default | Rehab removes default from your credit report; consolidation does not | Choose rehab if you want to clean your report; consolidate if you need faster access to “current” status. |

| Recovery timeline | Missed payments stay for 7 years, but the score can rebound in 12–24 months | Credit recovery is possible with discipline, effort, and consistency. |

| Official Resources | studentaid.gov, CFPB, AnnualCreditReport.com | Use these official resources for accurate information and dispute support. |

Understanding the Credit Damage

So, what actually happens when you miss a student loan payment?

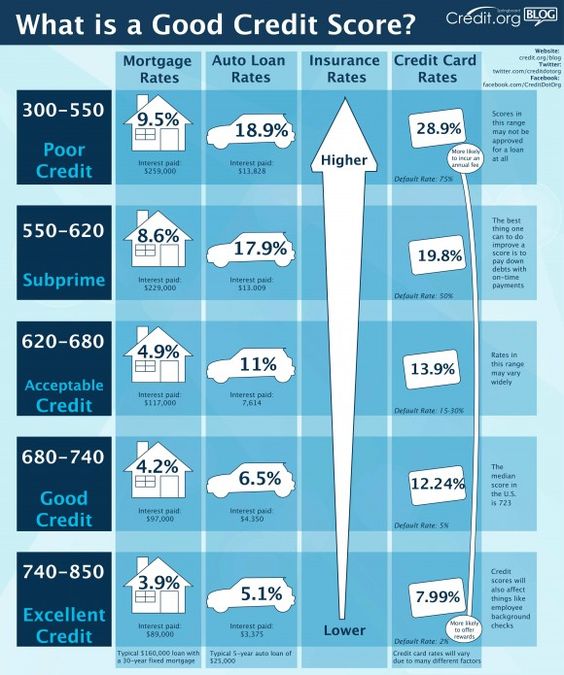

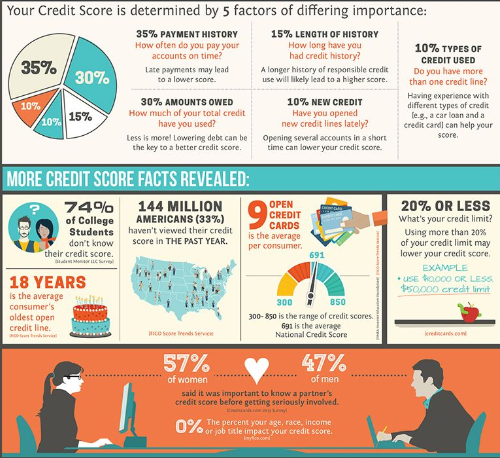

Federal student loans are typically reported to credit bureaus when you’re 90 days late. Private student loans may report sooner—sometimes after just 30 days. Either way, this delinquency lowers your FICO credit score, often significantly.

Here’s what you could see:

- A person with excellent credit (750+) missing one 90-day payment could see a 100–150 point drop.

- Missing multiple payments or going into default (270+ days late) can bring that number even lower, dropping scores into the 500s.

- That impacts your ability to get approved for apartments, credit cards, car loans, or even jobs that require credit checks.

This isn’t theoretical—it’s happening right now. As of Q1 2025, millions of borrowers saw their scores tumble due to missed payments following the end of the COVID-era payment pause. A Federal Reserve report showed the national average credit score fell from 718 to 715, with over 9 million Americans projected to suffer serious credit damage this year due to student loan-related delinquencies.

Missed Student Loan Payments: Here’s How to Fix Your Credit Score

Step 1: Know Where You Stand

Before you fix anything, you need to see the damage. Pull your credit reports from the three major bureaus: Equifax, Experian, and TransUnion.

You can get a free report weekly at AnnualCreditReport.com. Look for:

- Which loan(s) are delinquent or in default

- How many days late each is

- Any accounts reported as charged off or in collections

If you’re not sure whether your loan is federal or private, use the National Student Loan Data System (NSLDS).

Step 2: Bring Your Account Current

If you’re simply delinquent (not in default), the fastest fix is to catch up. Call your loan servicer and arrange a payment plan to clear overdue balances. Doing so can stop further negative reporting and stabilize your score.

If you’re in default, you have two main options:

Option 1: Loan Rehabilitation

- You agree to make 9 on-time payments within 10 months.

- Payments are usually based on your income.

- Once completed, the default is removed from your credit report.

- Your loan returns to good standing, and collections stop.

This is usually the best option if you’re looking for a clean slate in the long run. It’s slower, but it pays off.

Option 2: Loan Consolidation

- You combine your defaulted loan into a new Direct Consolidation Loan.

- You must agree to repay under an Income-Driven Repayment Plan (IDR).

- You get out of default fast—often within a few weeks.

The catch? The default remains on your credit report. However, it’s marked as “paid,” which lenders often view more favorably than an unresolved default.

Step 3: Choose a Smarter Repayment Plan

Many borrowers default because payments were just too high. Enter the Income-Driven Repayment (IDR) Plans:

- Monthly payments are based on 10–15% of your discretionary income.

- Some people qualify for payments as low as $0/month.

- After 20–25 years (or 10 if you work in public service), the remaining balance can be forgiven.

Popular plans include SAVE, REPAYE, and IBR.

Also, don’t forget to sign up for autopay. It:

- Ensures you never miss a payment again

- May give you a 0.25% interest rate reduction

Step 4: Monitor and Protect Your Credit

Once you’re back on track, you need to actively monitor your credit to prevent future damage.

Use tools like:

- Credit Karma

- Experian Free Credit Monitoring

- NerdWallet

Check for:

- Incorrect late payment entries

- Duplicate loans

- Loans listed as open that should be closed

If you see errors on your credit report:

- Dispute them directly through the credit bureau

- Provide documentation (e.g., proof of payment or forbearance)

You can also send goodwill letters asking lenders to remove accurate but harmful late payments—especially if you had a valid reason like medical hardship or job loss.

Step 5: Build Credit Elsewhere

Fixing your student loan record is key, but you should also improve your overall credit profile.

Tips to rebuild:

- Keep credit card balances below 30% of your credit limit

- Pay all bills (rent, utilities, phone) on time

- Consider a secured credit card if you have no open accounts

- Avoid hard inquiries unless necessary (like applying for a mortgage or car loan)

The goal is to show consistent, on-time behavior across all your credit activity. Over time, your credit score will rebound.

Real-Life Example: Maria’s Comeback Story

Let’s say Maria, a 38-year-old teacher, missed 5 payments after the COVID loan pause ended. Her FICO score dropped from 752 to 615 in six months.

Here’s what she did:

- Enrolled in loan rehabilitation

- Got on an IDR plan with a $45/month payment

- Set up autopay and avoided further missed payments

- Sent a goodwill letter for one late mark

Within 12 months, her score rebounded to 710, and she qualified for a mortgage.

Myth vs. Fact

| Myth | Fact |

|---|---|

| “My credit is permanently ruined after default.” | False. You can remove default via rehabilitation. |

| “Only private loans report to credit bureaus.” | False. Federal loans do too, especially once you’re 90+ days late. |

| “IDR plans are scams or tricks.” | Not true. They’re government-backed and help millions stay current. |

| “I have to pay the full balance to fix my score.” | Not true. Timely payments and resolving delinquency matter more. |

| “I’m stuck if I don’t earn much.” | False. Some plans offer $0/month payments based on income. |

Helpful Resources

| Resource | Purpose |

|---|---|

| Student Loan Default Help | Understand rehab, consolidation |

| Free Weekly Credit Reports | Monitor your credit reports |

| Disputing Credit Errors | Correct reporting issues |

| Find Your Loan Servicer | Contact info for your loan manager |

| IDR Enrollment & SAVE Plan Info | Lower monthly payments |

Student Loan Debt Could Haunt You Into Retirement—Even Your Benefits Aren’t Safe

How to Graduate Debt-Free: Proven Tips to Slash College Costs Before It’s Too Late

Not a Hurricane, Not a War—But This Disaster May Spike U.S. Gas Prices Overnight