Married and Rated 60% Disabled by the VA: If you’re a married U.S. veteran with a 60% disability rating from the Department of Veterans Affairs (VA), you might be wondering what kind of monthly compensation you’re owed—and what you can do to make the most of it. Whether you’re recently separated from service or have been fighting this fight for a while, this guide is your roadmap. We’re talking real numbers, real strategies, and real advice—delivered in plain English. Because let’s be honest: the VA system can be complicated, and no one has time to guess their way through it. So, let’s break it all down: what the VA pays, how they decide your pay, how your family impacts your benefits, and what you can do if you think they got it wrong.

Married and Rated 60% Disabled by the VA

If you’re married and rated 60% disabled by the VA, you’re looking at $1,523.93 or more in monthly tax-free compensation. Add dependents, check if your spouse qualifies for Aid & Attendance, and don’t sleep on those extra benefits. Most importantly: this is money you’ve earned. You served your country—now it’s time for your country to serve you. Keep your records updated. File for increases if your condition worsens. And never be afraid to ask for help from a VSO or veteran advocate.

| Category | Details |

|---|---|

| Base Monthly Compensation | $1,523.93 (for 60% rating, married veteran) |

| Each Child Under 18 | +$63.00 per child |

| Child 18+ in School | +$205.00 per child (full-time, qualifying institution) |

| Spouse Receiving Aid & Attendance (A&A) | +$117.00 |

| Update Dependents | VA Dependent Update Portal |

| Appeal Your Rating | VA Decision Review & Appeals |

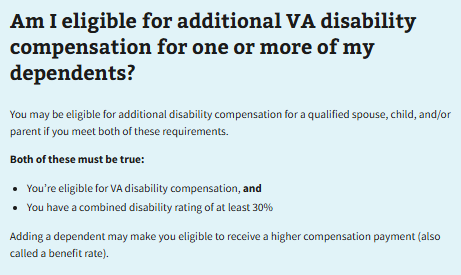

How VA Disability Ratings Work?

Before we dig into the money, let’s talk about how the VA decides you’re 60% disabled in the first place.

The VA uses a “whole-person” formula to combine multiple service-connected conditions. So, if you have a back injury (40%), PTSD (30%), and hearing loss (10%), those don’t just add up to 80%. The VA uses a “combined rating table”, which rounds your disabilities into a single rating between 0% and 100%.

Once that number lands at 60%, you cross a critical threshold. That’s when dependents start to impact your benefits in a big way.

What Does a 60% Rating Mean for a Married Veteran?

As of December 1, 2024, a married veteran rated 60% disabled earns a base compensation of $1,523.93 per month. This is tax-free, federally backed income. And that’s just the beginning.

Let’s be clear: that base rate doesn’t include kids, elderly parents, or a spouse who needs assistance. All those scenarios raise your monthly compensation.

Base Monthly Rates (2024–2025)

| Status | Monthly Compensation |

|---|---|

| Veteran alone | $1,395.93 |

| Veteran + spouse | $1,523.93 |

| Veteran + spouse + one parent | $1,625.93 |

| Veteran + spouse + two parents | $1,727.93 |

Dependent Add-Ons

| Dependent Type | Extra Monthly Amount |

|---|---|

| Each child under 18 | +$63.00 |

| Each child 18+ in school | +$205.00 |

| Spouse receiving Aid & Attendance (A&A) | +$117.00 |

Example:

If you’re a 60% disabled vet with a spouse, two kids under 18, and your spouse qualifies for A&A:

- Base: $1,523.93

- 2 kids: 2 × $63 = $126.00

- Spouse A&A: $117.00

- Total = $1,766.93/month

What’s Aid & Attendance? (A&A)

Aid & Attendance is a special addition to your monthly VA benefits if your spouse needs help with daily activities like eating, dressing, or bathing.

To qualify, you’ll need:

- A doctor’s letter or medical record showing your spouse requires help

- A completed VA Form 21-2680

It’s not just for the elderly—spouses recovering from surgery or chronic illness may qualify too.

How to Add or Update Dependents If You’re Married and Rated 60% Disabled by the VA (Step-by-Step Guide)

If you’ve recently gotten married, had a child, adopted, or now care for a dependent parent, you may be eligible for extra monthly VA compensation—but here’s the kicker: the VA won’t know unless you tell them.

Adding or updating your dependents is your responsibility, and it can have a big impact on your monthly income. Thankfully, the process isn’t as hard as it used to be, especially now that the VA allows you to handle many updates online.

Who Counts as a Dependent?

Let’s start with who qualifies:

- Spouse – legally married (including same-sex marriages)

- Children – biological, adopted, or stepchildren:

- Under age 18, or

- Between 18–23 if attending a qualifying school full-time

- Dependent parents – if they rely on you financially and meet VA income requirements

Tip: If you’re unsure whether someone qualifies, consult with a Veterans Service Officer (VSO) for free. They can help review eligibility before you file.

Documents You’ll Need

Before jumping into the process, gather these items to avoid delays:

| Dependent Type | Required Documentation |

|---|---|

| Spouse | Marriage certificate, Social Security Number |

| Child | Birth certificate (or adoption paperwork), SSN |

| Stepchild | Marriage certificate + stepchild’s birth certificate |

| Child 18–23 in school | Proof of full-time enrollment |

| Dependent parent | Proof of income and dependency |

Important: For dependent children over 18, you’ll need to submit VA Form 21-674: Request for Approval of School Attendance.

How to Add Dependents Online (Fastest Method)

The VA has made it much easier to manage your family info through their online system. Here’s how to do it:

Step-by-Step Instructions

- Log in to your VA.gov account

- Go to va.gov/view-change-dependents

- Use Login.gov, ID.me, DS Logon, or My HealtheVet to sign in.

- Navigate to “Add or Remove Dependents”

- This tool will guide you through a series of questions about your household.

- Upload supporting documents

- Upload scans or clear photos of required documents (like a marriage license or birth certificate).

- Review and submit your application

- Double-check everything for accuracy before submitting.

- Check back for updates

- You’ll receive confirmation from the VA and can monitor your claim status in your VA dashboard.

How to Add Dependents by Mail

If you prefer paper forms or don’t have easy access to the internet, you can still file the old-school way.

Forms You’ll Need:

- VA Form 21-686c – Declaration of Status of Dependents

- VA Form 21-674 – for school-aged dependents

Mailing Address:

Mail the completed forms and documentation to your VA regional office.

What If You Think Your Rating Should Be Higher?

A 60% rating is significant, but what if your condition has worsened? What if the VA lowballed you?

You can:

- Request an increase

- File a Supplemental Claim

- Go through a Higher-Level Review

- Appeal to the Board of Veterans’ Appeals

Pro Tip: A Veterans Service Officer (VSO) can help you for free. Find one near you: VSO Finder

How VA Compensation Fits Into Real Life

Let’s get practical. A consistent $1,500–$2,000/month in tax-free income is a powerful foundation. Here’s how some veterans use it:

- Rent or mortgage assistance: It might cover half (or more) of your monthly payment

- Supplement retirement or Social Security

- Pay for college (yours or your kids’) with Chapter 35 benefits

- Use it to qualify for other benefits, like subsidized housing or Medicaid

Expert Advice: Don’t Go It Alone

Trying to navigate the VA on your own can be overwhelming. That’s where Veteran Service Officers (VSOs) come in. They know the system and can help with:

- Initial claims

- Appeals

- Adding dependents

- Aid & Attendance applications

VA Disability Payments 2025: Exact Dates & New Monthly Amounts Revealed!

Chapter 31 VA Benefits: Can You Still Qualify With a Less-Than-Honorable Discharge?

June 2025 VA Benefits Boost: How Much Extra Will You See in Your Deposit?