June 2025 Social Security Payouts: If you’re counting on your Social Security check to land on time this June, you’re not alone. Millions of Americans rely on these monthly payments to cover essentials like rent, groceries, and medical bills. But with shifting schedules, policy changes, and even calendar quirks, it’s more important than ever to know exactly when your payment will arrive—and whether you’re first in line or stuck waiting. Let’s break down the June 2025 Social Security payment schedule, explain why some folks won’t see a check this month, and share what you can do to stay ahead of the curve.

June 2025 Social Security Payouts

Navigating Social Security payments can be complex, especially with calendar quirks and policy changes. By staying informed and proactive, you can ensure your benefits arrive as expected and manage your finances effectively. Whether you prefer direct deposit or paper checks, understanding the June 2025 Social Security payment schedule and staying on top of key dates will help keep you financially secure.

| Category | Details |

|---|---|

| SSI Payment Date | May 30, 2025 (early due to June 1 falling on a Sunday) |

| No SSI Check in June? | Correct—June’s payment was issued early on May 30. |

| SSA Payment Dates | June 3, 11, 18, or 25, depending on your birth date and benefit start date. |

| Average Retirement Benefit | $1,997.13/month as of March 2025. |

| SSA Official Calendar | SSA.gov Payment Schedule |

June 2025 Social Security Payouts Schedule

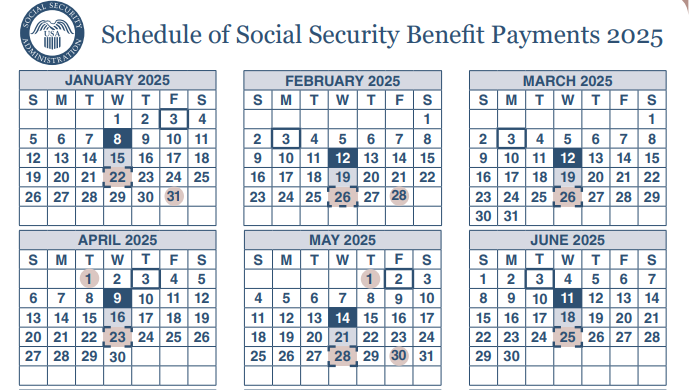

The Social Security Administration (SSA) issues payments based on a recipient’s birth date and the type of benefits they receive. Here’s how it works:

For SSI Recipients:

- Payment Date: May 30, 2025

- Reason: Since June 1 is a Sunday, payments were issued early on the last business day of May.

- Note: No SSI payments will be made in June; the next payment is scheduled for July 1, 2025.

For Social Security Retirement, Disability (SSDI), and Survivor Benefits:

- Recipients who began receiving benefits before May 1997:

- Payment Date: June 3, 2025

- Recipients who began receiving benefits after May 1997:

- Payment Dates Based on Birth Date:

- June 11: Birthdays between 1st–10th

- June 18: Birthdays between 11th–20th

- June 25: Birthdays between 21st–31st

- Payment Dates Based on Birth Date:

What’s the Average Social Security Check in 2025?

As of March 2025, the average Social Security retirement benefit is $1,997.13 per month.

For SSI recipients:

- Individuals: $967

- Couples: $1,450

For SSDI recipients:

- Average: $1,580

- With Dependents: Up to $2,826

Important Considerations

Early SSI Payment:

The early issuance of SSI payments in May means recipients will not receive a payment in June. It’s essential to budget accordingly to cover expenses until the next payment on July 1.

Potential Delays:

The SSA is experiencing operational challenges due to staffing reductions and the implementation of the Social Security Fairness Act, which may lead to delays in processing certain services.

Pro Tips for Staying Ahead

- Set Up Direct Deposit: Ensure your payments arrive promptly by enrolling in direct deposit through your my Social Security account.

- Monitor Your Payment Schedule: Keep track of payment dates and plan your budget accordingly.

- Stay Informed: Regularly check the SSA website for updates on payment schedules and policy changes.

How to Contact Social Security for Issues?

If you encounter any issues with your payments or need assistance, here’s how to reach out:

- Call the SSA: You can contact the SSA toll-free at 1-800-772-1213. The call center operates Monday through Friday, 7 a.m. to 7 p.m.

- Visit a Local SSA Office: If you’d like to speak to someone in person, find your local Social Security office through the SSA Office Locator.

- Use the SSA Website: The SSA website provides a wealth of resources, including FAQs, forms, and account access for beneficiaries.

Additional Details on Payment Methods

Social Security payments can be received in several ways, each with its pros and cons. Here’s a quick look:

1. Direct Deposit

- Pros: Fast, secure, and convenient. Payments are automatically deposited into your bank account.

- How to Set It Up: Visit the Direct Deposit Enrollment page, or update your bank details via your my Social Security account.

2. Direct Express® Debit Card

- Pros: If you don’t have a bank account, you can receive your payments on a government-issued prepaid debit card. The card is free to use for most purchases and offers ATM access.

- How to Get It: Apply through the Direct Express website.

3. Paper Checks

- Pros: Some individuals may prefer receiving a paper check.

- Cons: Slower delivery and potential for loss or theft.

- How to Get It: You can still opt for a paper check by contacting the SSA.

Impact of Inflation on Social Security Payments

In recent years, inflation has been a concern for many Americans, especially retirees living on fixed incomes like Social Security. The SSA adjusts benefits each year based on the Cost of Living Adjustment (COLA), which helps ensure payments keep up with inflation.

For 2025, the COLA increase is expected to be around 3.2%, in line with recent inflation rates. This means that Social Security recipients will see a slight boost in their benefits to help offset rising costs. However, inflation is still a challenge for many beneficiaries, so it’s important to plan ahead and budget wisely.

Changes in Social Security for 2025

The Social Security Fairness Act, passed in 2024, is set to introduce some important changes. It aims to address certain gaps in benefits for public sector workers and improve cost-of-living adjustments. Here’s what you need to know:

- Increased Benefits for Certain Workers: Those who have worked in jobs not covered by Social Security may see an increase in their benefits starting in 2025.

- Revised COLA Formula: The COLA formula will be updated to more accurately reflect the costs that retirees face.

Additionally, there are discussions around the possibility of expanding Social Security benefits, especially for individuals who have been receiving payments for longer periods. While these changes may take time to implement, it’s important to stay updated on any proposed legislation that could impact your benefits.

Practical Tips for Managing Social Security Benefits

While it may seem straightforward, managing your Social Security benefits effectively requires more than just waiting for that check to arrive. Here are some tips to make sure your finances are in top shape:

1. Set Up Automatic Bill Pay

Take advantage of the security of your Social Security payments by setting up automatic bill pay. Many utility companies, landlords, and insurance providers accept payments via bank transfer or debit. This ensures you never miss a payment, especially when your check lands during a busy month.

2. Create a Realistic Budget

When you rely on Social Security, sticking to a budget is crucial. Since your payment dates are fixed, map out all your expenses—rent, utilities, groceries, transportation—and allocate enough funds each month. Be prepared for times when the cost of living increases or unexpected expenses arise.

3. Consider a Financial Advisor

While Social Security can be a reliable source of income, it’s rarely enough for a comfortable lifestyle. Consider meeting with a financial advisor to discuss ways to supplement your income. Whether it’s through investments, pensions, or part-time work, planning ahead can ensure you maintain financial stability as you age.

4. Understand the Tax Implications

If you work while receiving Social Security, your benefits may be taxed. It’s a good idea to understand how your benefits might affect your tax bracket. Some individuals will be required to pay taxes on their Social Security payments if their income exceeds a certain threshold.

Still Waiting on Your Social Security Back Pay? Retroactive Payments Are Rolling Out Now

Double Social Security Checks in May? What You Need to Know About This Month’s Payout Schedule

Should You Claim Social Security Early? The Surprising Risks & Rewards in Uncertain Times