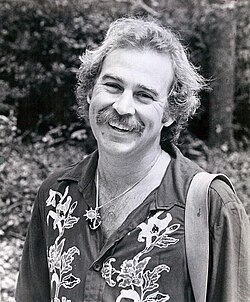

Jimmy Buffett’s Fortune Sparks Family Feud: When music legend Jimmy Buffett passed away in September 2023, the world lost more than just the voice behind Margaritaville. Buffett, a savvy businessman as well as a performer, left behind a sprawling empire valued at over $275 million. From beachfront real estate and music royalties to his 20% stake in the global Margaritaville brand, Buffett’s wealth was supposed to be carefully managed through a family trust.

Instead, it’s triggered a bitter legal feud between his widow, Jane Slagsvol Buffett, and his longtime accountant and co-trustee, Richard “Rick” Mozenter. The conflict, now playing out in two states, raises serious concerns about how even meticulously structured estate plans can unravel. This case serves as a real-world warning for anyone—wealthy or not—who’s counting on a trust to protect their loved ones and legacy.

Jimmy Buffett’s Fortune Sparks Family Feud

Jimmy Buffett’s smooth-sailing public image stands in stark contrast to the turbulence brewing in his estate. What was supposed to be a well-oiled plan is now a national case study in how trust design can go wrong. Whether you’re a retiree, a parent, a young investor, or a business owner, one thing is clear: The time to plan your legacy is now—and you’ve got to do it right. Choose the right people, build clear rules, and review often. Protecting your family and your name shouldn’t be left to chance.

| Topic | Details |

|---|---|

| Estate Value | Estimated $275 million |

| Key Players | Jane Slagsvol Buffett (widow), Richard Mozenter (accountant, co-trustee) |

| Assets Involved | Margaritaville stake, real estate, private jets, music royalties |

| Annual Trust Income | Less than $2 million per year |

| Lawsuits Filed | California (by Jane), Florida (by Mozenter) |

| Disputed Trustee Fees | $1.7–$1.75 million annually |

| Core Issues | Lack of transparency, power imbalance, trustee conflict |

| Official Site | Margaritaville |

What Went Wrong With Buffett’s Estate?

After Buffett’s death, the marital trust he created named both Jane and Mozenter as co-trustees. On paper, it was meant to provide Jane with income and preserve Buffett’s legacy. But over the next 16 months, Jane says Mozenter stonewalled her requests for financial information and operated the trust in a way that felt exclusive and secretive.

She recently filed a petition in Los Angeles County Probate Court, claiming:

- Mozenter delayed financial disclosures for over a year

- She only recently learned that the trust’s income was less than 1% of its total value

- The accounting and legal teams were paid up to $1.75 million per year

- She was treated with “hostility, condescension, and disrespect” when she asked for updates

Mozenter fired back with his own petition in Palm Beach County, Florida, arguing that:

- Buffett intentionally limited Jane’s role in the trust

- Jane has interfered with trust management by consulting outside advisors

- She was being “uncooperative” and risked disrupting the estate’s careful balance

This dual-state legal battle is costly, time-consuming, and has the potential to permanently fracture Buffett’s family and business legacy.

Timeline of Events

| Date | Event |

|---|---|

| Sept 1, 2023 | Jimmy Buffett passes away |

| Late 2023 | Jane begins requesting financial data from Mozenter |

| Mid–2024 | Jane receives limited and delayed income estimates |

| June 2025 | Jane files lawsuit in California Probate Court |

| June 2025 | Mozenter files counter-lawsuit in Florida |

| August 2025 | Court hearings scheduled in both jurisdictions |

The Bigger Picture: Why Trusts Fail

Buffett’s situation is not unique. Despite his wealth and access to top advisors, his trust ran into common pitfalls that affect families across the wealth spectrum. According to the American College of Trust and Estate Counsel (ACTEC), over 25% of family trusts experience conflict between trustees and beneficiaries. Here’s why:

1. Poor Trustee Selection

Being a trustee requires more than financial literacy. It demands emotional intelligence, clear communication, and fairness. Many people name a family member or long-trusted associate without asking whether they’ll be able to collaborate with other beneficiaries.

Mozenter may have been financially competent, but Jane’s claims suggest he wasn’t equipped to handle the personal dynamic.

2. Lack of Transparency

Buffett’s trust reportedly withheld performance data and income projections for over a year. This kind of opacity breeds suspicion and resentment, especially when beneficiaries feel ignored or excluded.

3. No Accountability Clause

Many trusts fail to include removal procedures for trustees who aren’t performing. Without a “check and balance,” beneficiaries may be stuck with trustees they don’t trust—or worse, have to sue them, as Jane is doing now.

4. Excessive Trustee Fees

Jane argues that Mozenter’s team collected nearly $1.75 million in annual fees. Even if these fees were contractually allowed, they raised serious questions given the low return on the estate. High fees + low performance = conflict.

5. Jurisdictional Confusion

Having lawsuits in two separate states complicates the process and multiplies legal costs. This could have been prevented by clearly assigning one legal jurisdiction for all trust disputes.

Lessons for Families: How to Avoid Buffett’s Mistakes

Whether your estate is $200,000 or $200 million, these steps can help you prevent future headaches:

Step 1: Choose the Right Trustee(s)

Select someone who:

- Understands finances

- Can work well with your family

- Has no conflict of interest

Consider using a neutral corporate trustee if there’s tension or complexity involved.

Step 2: Establish Transparency Rules

Set expectations for:

- Quarterly reports

- Independent audits

- Open financial access for key beneficiaries

Don’t assume everyone will “just get along.” Write it down.

Step 3: Define Removal Conditions

Trusts should include:

- A process for removing trustees (with cause)

- A voting mechanism if co-trustees disagree

- Guidelines for appointing replacements

Step 4: Clarify Trustee Compensation

Fees should reflect the estate’s size and complexity—not be based on arbitrary hourly rates. Tie trustee performance to actual results, and cap fees where appropriate.

Step 5: Update the Trust Regularly

Review your trust every 3–5 years or after big life events. Outdated trusts often contain:

- Dead or retired trustees

- Irrelevant distribution rules

- No contingency plans

Trust Terms Made Simple

- Trustee – The person or institution in charge of managing the trust

- Beneficiary – The person(s) who receive income or assets from the trust

- Marital Trust – A trust specifically for the surviving spouse

- Revocable Trust – Can be changed or canceled during your lifetime

- Irrevocable Trust – Can’t be changed without court approval once finalized

- Distributions – Payments made from the trust to a beneficiary

How Buffett’s Case Compares to Other Celebrity Estates?

Jimmy Buffett isn’t the only star whose estate became a legal drama. Here are others:

Prince – Died without a will, resulting in a six-year probate mess and millions in legal fees.

Aretha Franklin – Left behind multiple conflicting handwritten wills. Family members are still disputing the final settlement.

Robin Williams – His heirs ended up in court over personal memorabilia, despite having a trust.

These examples highlight that money alone doesn’t guarantee peace of mind. A poorly constructed plan can create conflict, not avoid it.

You Might Be Holding a Fortune! 5 Bicentennial Quarters Worth Serious Money

Cybersecurity Startup Cloudsek Raises $19 Million Led by Tenacity Ventures and Commvault