Japan’s New Zero-Emission Car: Japan’s new zero-emission car is ready to change the game and make gas-powered vehicles a thing of the past. With the government setting a firm deadline to phase out new gasoline-only car sales by the mid-2030s, this zero-emission EV/FCEV rollout is far from a half-baked idea—it’s the real deal.

Pull up a chair, friend. Whether you’re a weekend driver, a career engineer, a fleet manager, or someone just curious, this article serves both kid-friendly clarity and professional-level insight.

Japan’s New Zero-Emission Car

Japan’s bold new zero-emission car isn’t just an automaker’s ambition—it’s a cultural and strategic shift. With a firm end date for gas-car sales, robust R&D across EV and FCEV tech, and major infrastructure buildouts on the way, Japan is laying the foundation for a sustainable transport revolution.

For drivers, everyday adopters, fleet operators, technicians, engineers, and investors: this is your wake-up call and your opportunity. From micro-mobility to heavy-duty transport, from backyard plug-ins to highway hydrogen stops, the future’s being built right now—and it’s clean, connected, and smart.

| Topic | Data & Stats | Professional Insight |

|---|---|---|

| Gasoline Phase-Out | New gas-only sales banned by mid-2030s | Engineers must pivot—EV/FCEV skills define future roles. |

| Tiny Urban EV: KG Motors Mibot | 3,300 pre-orders sold; 62-mile range; top speed 37 mph; ~$7,000 | Small EVs are a growth niche—great for urban mobility innovators, parts suppliers, and startups. |

| Toyota 3rd-Gen Fuel Cell | 2× durability, 20% more range vs. previous gen; cost-effective development | Ideal for fleets—trucks, buses, and commercial vehicles ready to adopt. |

| Global EV Sales | +25% growth expected in 2025, ~22 million units sold; China = 2/3, EU =17%, US =7% | EV adoption is mainstream—demand calls for a broader and deeper talent pool. |

| Japan EV Market Size | $46.97B in 2025, projected to reach $94.5B by 2029 (CAGR 19.1%) | Massive opportunity in R&D, grid communications, EV after-sales services. |

| Hydrogen Price Disparity | Japan ~¥2,000/kg; China ~¥500–1,000/kg | Infrastructure innovation and cost reduction are key; chances for public-private partnerships. |

| Japan’s H₂ Infrastructure | ~167 hydrogen stations; needs ~900+ by 2030 | Engineers, planners, investors—all have a role as Japan scales up the network. |

| Nissan Third-Gen Leaf | Launching autumn in U.S. | Major legacy OEM pivot; strong aftermarket and retrofit potential. |

| Smart-Charging & Cybersecurity | Smart chargers emerging; cybersecurity is a growing challenge | IT specialists and energy managers in high demand. |

Why Now? The Big Picture

Japan has pledged to reach net-zero carbon emissions by 2050. In support of that goal, the government announced that all new gasoline-only passenger cars will be banned by the mid-2030s, allowing only EVs (battery-electric vehicles), FCEVs (fuel-cell electric vehicles), and hybrids. Major Japanese automakers like Toyota, Nissan, Mazda, and Honda are doubling down on battery-electric and hydrogen technologies. This transition signifies a major win for cleaner air, reduced reliance on oil, and a more resilient global auto industry.

Two key drivers behind this shift stand out:

Climate Commitments: Japan’s 2050 net-zero pledge requires fast-tracking emissions reductions, with transport playing a central role.

Global Competition: With the USA, Europe, and China ramping up EV and hydrogen investments, Japan must step up its game or risk falling behind.

What Exactly Is This “New Zero-Emission Car”?

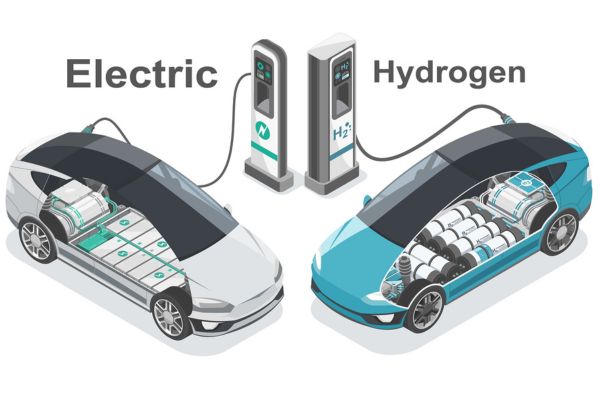

Japan’s newest zero-emission vehicle isn’t just a concept—it’s road-ready, combining two clean technologies:

- Battery-Electric Vehicle (EV)

A fully electric ride with no internal combustion engine, no tailpipe emissions, and smooth, silent acceleration. These run on lithium-ion (or next-gen) batteries and plug into standard power sources. - Fuel-Cell Electric Vehicle (FCEV)

These machines use hydrogen tanks that feed fuel cells, generating electricity by combining hydrogen with oxygen. The only emission? Water vapor. Toyota’s third-generation fuel cell system—unveiled in February 2025—boasts double the durability, roughly 20% more driving range, and lower production costs. It’s designed to serve both passenger and heavy-duty fleet vehicles.

By offering both EV and FCEV options, Japan gives consumers two zero-emission paths: go electric with a plug or go hydrogen with a fill-up.

Mini Wheels, Major Impact: The Mibot

Meet the Mibot from KG Motors. Think cute, compact, and practical.

- 62-mile real-world range

- Top speed of 37 mph—perfect for city streets

- Fully chargeable via standard outlets in about 5 hours

- Over 3,300 units sold during pre-launch, priced around $7,000

This little guy shows that urban EVs don’t need to be flashy or pricey to matter. It shines a light on the value of low-cost, localized transport—and encourages parts suppliers, battery producers, and tier-two manufacturers to innovate for this developing “micro-mobility” sector.

The Roadmap: When Will Gas Cars Disappear?

Japan’s timeframe is clear:

- By the mid-2030s: No new gasoline-only cars can be sold.

- 2035 Goal: All new light vehicle sales must be EVs, FCEVs, or hybrids. CO₂ emissions will be slashed by 46% from the fiscal 2013 benchmark.

- 2050 Target: Full economy-wide net-zero carbon emissions.

For automakers, engineers, fleet managers, and after-market technicians, this timeline means a shift from gas tech to electric and hydrogen systems is not just suggested—it’s mandatory.

Toyota’s Fuel Cell Vision

- Third-Generation Fuel Cell: Built tougher, drives longer, costs less. It was showcased in February 2025 at H2 & FC Expo Tokyo.

- Target Rollout: 2025–2026—commercial fleet vehicles like buses, trucks, and industrial vans are first in line. Passenger cars will follow.

- China Joint Venture: A Beijing-area facility led by Toyota and SinoHytec targets 10,000 fuel cell systems annually, making China the pilot ground for refinement and cost scaling.

Combining government policy and private sector execution, Toyota is setting up a global fuel-cell ecosystem.

Roadblocks and Real-World Challenges

Even with strong tech and policy support, hurdles remain:

1. Infrastructure Gap

Japan currently operates about 167 hydrogen fueling stations but needs approximately 900 by 2030 to meet growing demand. EV charging infrastructure—especially home charging—remains easier to deploy and has fewer regulatory and logistical barriers.

2. Cost Premiums

Hydrogen in Japan costs around ¥2,000/kg, while China offers it for ¥500–¥1,000/kg. FCEVs also cost more upfront than comparable EVs or hybrids, though that gap is narrowing with mass production.

3. Energy Efficiency

Battery EVs are typically 80–95% energy-efficient. FCEVs run at about 38%. While EVs lose less energy overall, FCEVs refill faster and consistently perform better in heavy-duty applications.

4. Grid and Cybersecurity Concerns

As chargers and refueling stations become “smart”—connected to demand-response systems and data networks—the risk of cyberattacks grows. Utility providers and charging network operators must bolster cybersecurity readiness.

5. Safety Requirements

Hydrogen is highly flammable and requires robust leak-detection sensors, vent systems, and strict safety regulations. While safety training is evolving, these standards must be widely adopted and enforced.

What Japan’s New Zero-Emission Car Means for You?

For Everyday Drivers:

- City commuters may be more drawn to compact EVs like the Mibot—cheap, convenient, eco-friendly.

- Family drivers and long-distance users benefit from hydrogen’s fast fill-ups, especially on highways or where charging stations are sparse.

For Professionals & Businesses:

- EV/FCEV design, diagnostics, and maintenance expertise is now a hot skill set. Hybrid-only knowledge won’t be enough.

- Infrastructure projects—installing hydrogen stations, charging stations, secure grid connections—offer steady work.

- Fleet operators may need to pivot toward vehicle electrification strategy, maintenance protocols, and hydrogen-safety training.

For Investors & Policymakers:

- Significant market expansion in battery production, electrolyzers, fuel cells, hydrogen pipelines, station construction, and software solutions.

- Policy-makers need to craft subsidies, city plans, and grant programs to accelerate clean-vehicle adoption.

Step-by-Step Guide: Switching to Zero‑Emission

1. Choose Your Clean Ride

- Pick EV for daily commutes under 200 miles and overnight home charging.

- Opt for FCEV if you haul cargo, drive long routes, or live where home charging isn’t practical.

2. Survey Local Infrastructure

- Use PlugShare (EV) or H₂ Station Locator (hydrogen) to find nearby stations.

- Check load times, pricing, and payment systems for ease of use.

3. Calculate Total Ownership Costs

- Factor in purchase price, subsidies, expected energy costs, maintenance, and insurance.

- FCEVs typically cost more now, but total costs are converging as hydrogen scales.

4. Plan Maintenance & Safety

- EVs need battery health monitoring, software updates, and climate-control system checks.

- FCEVs require fuel cell stack inspections, hydrogen leak tests, and certified technicians.

5. Get Educated

- Follow Japan’s METI updates and global reports like IEA’s Global EV Outlook and BloombergNEF’s future mobility analyses.

6. Get Certified

- EV pros: obtain certifications in high-voltage systems, software diagnostics, and grid integration.

- FCEV specialists: seek training in hydrogen-specific technologies, station safety, and fuel-cell repair.

No Gas, No Diesel; Rehlko’s New Engine Shocks America with Bold Electric-Hydrogen Fusion

Ford’s Revolutionary Engine Tech Means You Won’t Need an Oil Change for 19,000 Miles

It’s Official: Honda’s First Electric Motorcycle Is Here; Meet the Wuyang‑Built E‑VO