Impending Social Security Cuts Could Devastate Retirees: Social Security benefits have long been a critical safety net for millions of Americans, especially retirees. But there’s a storm brewing on the horizon. Social Security cuts, projected to hit in the next decade, could slash benefits by a significant amount—potentially devastating retirees’ financial security. This isn’t just some far-off issue; it’s something that could deeply affect you, your family, or someone you know. The sooner we understand the issue, the better we can plan to avoid the worst outcomes. So, what exactly are these cuts? And how could they affect you? Let’s break it down.

Impending Social Security Cuts Could Devastate Retirees

Social Security is one of the most critical programs in America, providing financial support to millions of retirees and their families. But the program is in trouble. Without action, we could see significant cuts to benefits as early as 2034. This could mean big losses for retirees who rely on these payments. It’s up to lawmakers to find a solution before it’s too late, but that doesn’t mean you should sit back and wait for the situation to unfold. The sooner you start planning for potential cuts, the better prepared you’ll be. By saving more, delaying your Social Security benefits, and exploring other income sources, you can help ensure a secure retirement no matter what happens with the future of Social Security.

| Key Topic | Details |

|---|---|

| Projected Cuts | Social Security benefits could be reduced by 19%-23%. |

| Average Benefit Reduction | $336 per month, or $4,039 annually for the average retiree. |

| Year of Depletion | Social Security trust funds projected to deplete by 2034. |

| Impact on Retirees | Seniors may lose a significant portion of their monthly income. |

| Actions to Prevent Cuts | Raising payroll taxes, adjusting retirement age, COLA adjustments. |

| Source | Social Security Trustees Report |

What’s Happening with Social Security?

The clock is ticking, and if Congress doesn’t step up soon, Social Security could face cuts that many retirees aren’t ready for. The program has been a foundational part of the U.S. social safety net for decades, ensuring that seniors, the disabled, and survivors of deceased workers can still make ends meet. However, the system isn’t as healthy as it used to be.

Why are Cuts Happening?

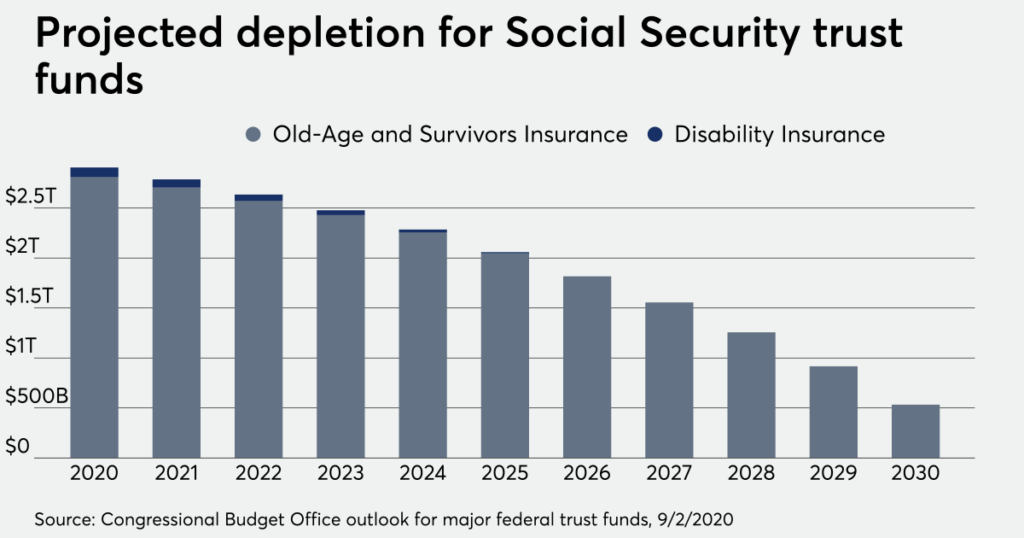

First, a little context. Social Security benefits come from two main trust funds: the Old-Age and Survivors Insurance (OASI) trust fund and the Disability Insurance (DI) trust fund. These funds are supported by payroll taxes paid by workers. The problem is that the number of retirees is growing faster than the number of workers paying into the system. We have more seniors than ever, thanks to the aging Baby Boomer generation, but the workforce isn’t growing as quickly.

In fact, by 2034, the Social Security trust funds are expected to be depleted, which means there won’t be enough money to pay the full benefits to recipients. If no changes are made, beneficiaries could see their payments reduced by 19% to 23%.

What Does This Mean for You?

If you’re a retiree or plan to retire in the near future, you could see a significant drop in your monthly Social Security benefits. For example, the average retiree currently receives about $1,976 per month. A 19% cut would mean about $336 less per month, or about $4,039 less per year. That’s a major hit to someone relying on those funds for everyday expenses.

For younger people, it’s even more important to start planning now. Social Security might not provide the same level of support when you reach retirement age. Depending on what happens with the system, you could be looking at a future where you need more savings or alternative income streams to make up for that shortfall.

Historical Context of Social Security

Social Security was signed into law in 1935 by President Franklin D. Roosevelt. The program was designed to provide a safety net for elderly Americans who could no longer work and needed financial support. At that time, there were around 40 workers for every retiree. Today, that ratio has shrunk to about 2.7 workers per retiree, making it much harder to sustain the program as it was originally designed.

Over the years, Congress has made several adjustments to Social Security, such as increasing the payroll tax rate and raising the retirement age. However, these changes have not been enough to keep up with the growing number of retirees.

What Can Be Done to Prevent Impending Social Security Cuts Could Devastate Retirees?

Fortunately, it’s not all doom and gloom. There are solutions that could prevent these cuts from happening. But it will take action, and there’s still a lot of work to do.

1. Increase Payroll Taxes

One of the most straightforward ways to address this problem is to increase the payroll tax rate. Right now, workers pay 6.2% of their earnings up to $160,200 (as of 2025) to fund Social Security. Raising this tax rate or eliminating the income cap could generate more revenue and help the system stay solvent for longer.

2. Adjust the Retirement Age

Another option is to gradually increase the retirement age. The full retirement age for Social Security benefits is currently 66 or 67, depending on when you were born. If it were raised, fewer people would claim benefits at an earlier age, which would reduce the overall financial strain on the system.

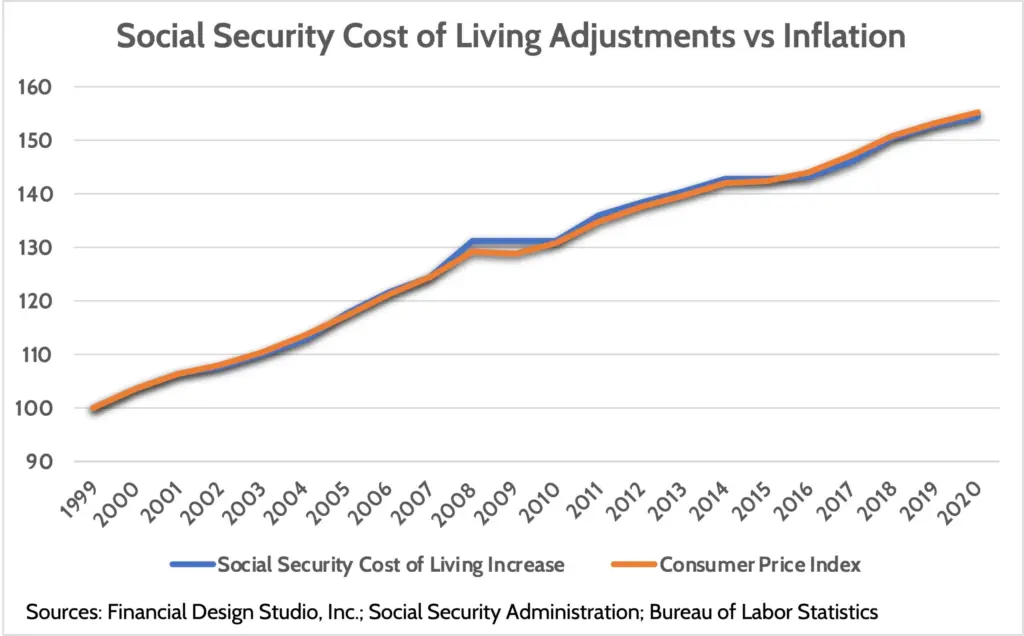

3. Change the Cost-of-Living Adjustment (COLA) Formula

Social Security benefits are adjusted for inflation each year through a cost-of-living adjustment (COLA). If the formula for COLA were changed, benefits would increase at a slower rate, saving the system money in the long run.

4. Cutting Benefits

This is the least popular option, but it is on the table. If all else fails, Congress could implement across-the-board cuts to Social Security benefits. However, this would be politically difficult, as it would have a major negative impact on retirees and the public.

Impact on Different Groups

Younger Workers

For younger workers, the looming cuts are a major concern. Many Millennials, Gen Z, and younger Gen X individuals may have to rely more on their personal savings, 401(k)s, and IRAs for retirement. Social Security may provide less income than what previous generations have received, so it’s essential to start saving as early as possible and build a diversified portfolio.

Disabled Individuals and Survivors

People with disabilities and survivors of deceased workers are also at risk of benefit reductions. For disabled workers who rely on Disability Insurance (DI), cuts could mean struggling even more with daily living costs. Likewise, survivors of deceased workers, who depend on Survivor Benefits, might see a reduction in their monthly support, further compounding their challenges.

Expert Opinions and Legislative Proposals

Experts agree that bipartisan cooperation is crucial to solving the Social Security issue. Economists such as Dr. William Gale, a senior fellow at the Brookings Institution, suggest that a combination of revenue increases and benefit adjustments will be necessary to stabilize the system. Some of the legislative proposals currently on the table include raising the payroll tax, changing the COLA formula, or even creating a new Social Security Trust Fund that could draw on other revenue sources, like investment income.

What Can You Do to Prepare for Potential Cuts?

It’s easy to feel helpless in the face of potential cuts, but there are steps you can take to prepare yourself financially. Here are a few ideas to help you stay ahead of the curve:

1. Start Saving More

One of the most important things you can do is to increase your personal savings. Social Security was never meant to be the sole source of retirement income, and this situation highlights just how critical it is to have multiple income streams. Whether it’s contributing more to your 401(k), setting up an IRA, or building an emergency fund, the more you save, the better prepared you’ll be for whatever comes.

2. Delay Your Social Security Benefits

If you’re still working, you can increase your future Social Security benefits by delaying when you start claiming benefits. If you wait until you’re 70, your monthly benefits will be higher. This strategy can help offset the impact of any cuts to your monthly payments.

3. Diversify Your Income Sources

Social Security shouldn’t be your only source of income in retirement. Look into options like pensions, real estate, or even side businesses that can generate passive income. The more diversified your retirement income, the less dependent you’ll be on Social Security.

Social Security Myths Debunked

There are several misconceptions floating around about Social Security. Let’s clear some of them up:

- Myth 1: Social Security will be there for everyone forever.

Reality: The program is facing financial difficulties, and cuts are likely unless action is taken. - Myth 2: Social Security is just for retirees.

Reality: The program also supports disabled individuals and survivors of deceased workers. - Myth 3: Social Security is the only way to save for retirement.

Reality: It should be part of a broader retirement strategy, alongside savings, investments, and other income sources.

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

Social Security Employees Sound Alarm on Delays; Here’s How Your Benefits Could Be Affected