How the ‘Big Beautiful Bill’ Steals $1,600 from Those Who Can Least Afford It: When Congress names a piece of legislation something flashy like the “Big Beautiful Bill,” it sounds promising—patriotic, even. But according to a recent deep-dive from the Congressional Budget Office (CBO), this bill is anything but helpful for working-class Americans. In fact, the CBO says it effectively steals $1,600 a year from the poorest families, while giving the richest households a $12,000 annual bonus in tax cuts. This article breaks down what’s really going on—clearly, calmly, and honestly. Whether you’re a professional policy analyst or a concerned parent, you’ll find the facts, context, and steps you can take to protect your future.

How the ‘Big Beautiful Bill’ Steals $1,600 from Those Who Can Least Afford It

Don’t let the name fool you. The Big Beautiful Bill is not designed to uplift working families. It’s a costly, regressive, and ultimately harmful piece of legislation. While the rich benefit from massive tax giveaways, the most vulnerable Americans are left with fewer safety nets, more paperwork, and greater instability. The fight over this bill is about values. Do we support those who work hard but struggle to get by? Or do we reward those who already have the most? That answer is still being written—and your voice could help shape it.

| Feature | Details |

|---|---|

| Who loses the most? | Bottom 10% of income earners — $1,600/year |

| Who benefits most? | Top 10% gain approximately $12,000/year |

| Programs impacted | Medicaid, SNAP (food stamps), ACA subsidies |

| Work requirements | 80+ hours per month to qualify for aid |

| Total program cuts | Approximately $1 trillion over 10 years |

| Deficit projection | Adds $2.4 trillion to the deficit by 2035 |

| CBO source | Congressional Budget Office |

What Is the “Big Beautiful Bill”?

Formally known as the One Big Beautiful Bill Act, this legislation was introduced by lawmakers aiming to permanently extend certain tax cuts and reduce what they call “excessive government spending.” In practice, it’s a sweeping policy package that includes:

- Tax breaks primarily for high-income earners and corporations

- Deep cuts to public assistance programs

- New eligibility requirements—especially for benefits like Medicaid and SNAP

- Work and community engagement mandates

The bill is branded as a way to “rebalance” the budget and reward work, but the reality is more sobering. The CBO’s 10-year projection paints a stark picture: the bill benefits the wealthy and corporations, while low-income Americans bear the brunt.

A Breakdown of Winners and Losers

Who’s Losing: The Bottom 10%

Households in the bottom 10% of earners, typically making less than $18,000 annually, are expected to lose an average of $1,600 per year under the bill. This comes in the form of:

- Reduced access to Medicaid

- Stricter food assistance eligibility

- Increased healthcare premiums via reduced ACA subsidies

- New red tape requiring monthly proof of work or community service

That $1,600 may not sound like much to a senator, but for millions of families, it’s the difference between food and hunger, or medication and crisis.

Who’s Gaining: The Top 10%

The bill would provide an estimated $12,000 in annual tax relief to the wealthiest 10% of households. These savings come from:

- Corporate tax cuts

- Lower capital gains taxes

- Expanded deductions and loopholes

This isn’t trickle-down economics—it’s a geyser going upward.

Why It Matters: Real-World Impacts

Consider this scenario: Maria, a 29-year-old home healthcare worker, earns $22,000 a year while raising two children. Under the current system, she qualifies for:

- Medicaid for her kids

- SNAP to help with food costs

- Premium tax credits through the ACA

Under the “Big Beautiful Bill,” Maria would have to document at least 80 hours per month of paid work or qualifying service, or risk losing all benefits. If she misses one document deadline—due to illness, lack of internet, or confusion—her support disappears.

This isn’t hypothetical. According to a 2019 trial in Arkansas, similar work reporting requirements led to over 18,000 people losing Medicaid—many of them unaware they had even failed to comply.

Historical Context: We’ve Been Here Before

This isn’t the first time Congress has used tax cuts and social program reductions to reshape the federal budget. Similar bills include:

- The 2017 Tax Cuts and Jobs Act, which lowered the corporate tax rate from 35% to 21%, and benefited wealthy households disproportionately.

- The 1996 Personal Responsibility and Work Opportunity Reconciliation Act, which introduced work requirements for welfare and significantly cut aid over time.

What’s different today is the scale. The “Big Beautiful Bill” combines large-scale permanent tax cuts with mandatory work reporting—a first for Medicaid and ACA benefits.

What Gets Cut?

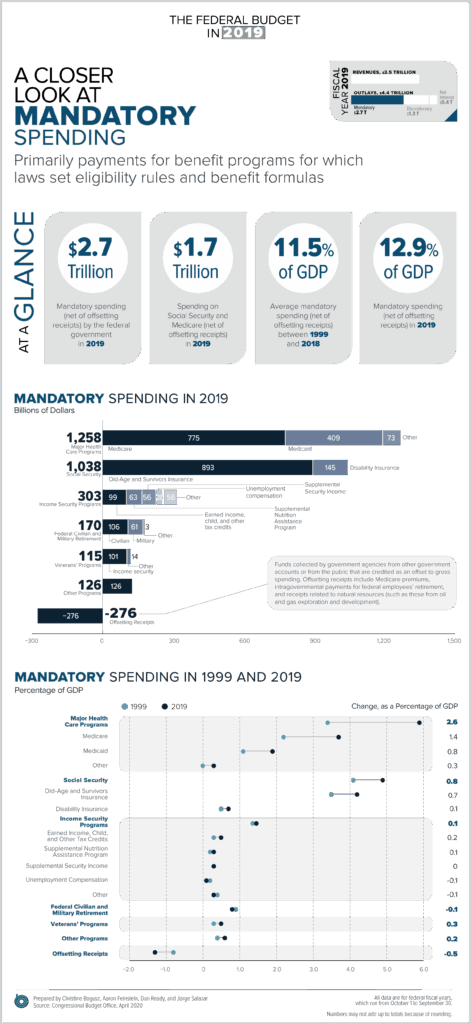

The CBO outlined where the budget “savings” come from—and who they hurt.

Medicaid

- Total cuts: $793 billion over 10 years

- States may have to tighten eligibility or reduce services

- Affects seniors, disabled individuals, low-wage workers, and children

SNAP (Food Stamps)

- Cuts tied to stricter eligibility enforcement

- New work requirements for most adults without dependents

- Time-limited benefits unless requirements are continually met

ACA Subsidies

- Subsidies reduced or phased out for many enrollees

- Premium costs will rise, especially for older adults

- Estimated 5 million people could lose coverage

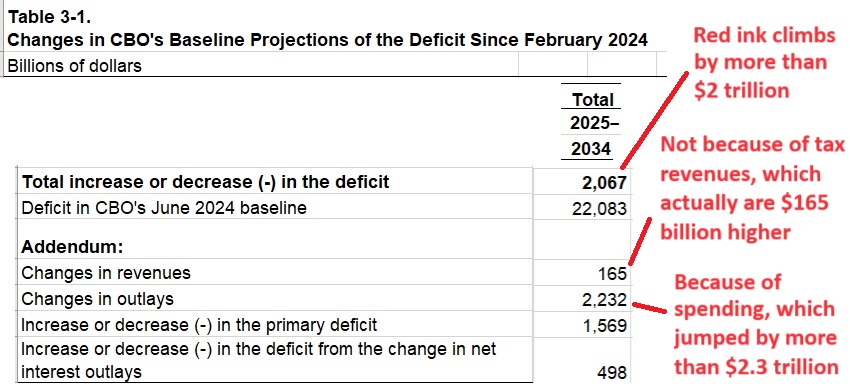

Deficit Debate: Does the Bill Really Save Money?

Surprisingly, the CBO says it doesn’t.

Despite all the program cuts, the bill adds $2.4 trillion to the federal deficit over the next decade. Why?

- The tax breaks outweigh the spending cuts

- Economic growth isn’t projected to increase enough to offset the revenue loss

- Interest payments on the increased debt rise over time

This shatters the myth that this is a fiscally conservative policy. It’s redistribution—just in the wrong direction.

Expert Perspectives

Economists and policy experts across the spectrum have weighed in.

Dr. Heather Boushey, Senior Economist at the Washington Center for Equitable Growth, states:

“This bill reads like a blueprint for inequality. It removes key supports for working families while giving the wealthiest households a bonus check from the government.”

Meanwhile, Michael Strain, a conservative economist at the American Enterprise Institute, acknowledges:

“There are real questions about efficiency, especially in targeting support through work mandates. But these provisions need careful study—not blunt cuts.”

What You Can Do Right Now About How the ‘Big Beautiful Bill’ Steals $1,600 from Those Who Can Least Afford It?

If you’re worried about the bill’s impact, here are concrete steps you can take:

1. Know Your Rights and Benefits

Use Benefits.gov to review what programs you qualify for under current law. Stay alert to any changes that affect eligibility or reporting.

2. Track Legislative Progress

Follow updates through:

- Congress.gov

- CBO.gov

- KFF.org

3. Contact Your Representatives

Let them know how this bill could affect you. Use tools at House.gov and Senate.gov to call, write, or schedule a meeting.

4. Join Advocacy Efforts

National nonprofits are leading efforts to block the bill. Organizations include:

- Feeding America

- Center on Budget and Policy Priorities

- Families USA

Trump’s ‘Big Beautiful Bill’: Will It Really Eliminate Taxes on Social Security?

Why House Republicans Are Quietly Nervous About Trump’s ‘Big Beautiful Bill’

One Big Beautiful Bill Act Explained: 4 Game-Changing Provisions You Can’t Ignore