How Much You Really Need to Earn to Live Comfortably: In today’s fast-paced world, the question of how much money you need to earn to live comfortably is more important than ever. Living comfortably can mean different things to different people based on their goals, values, and circumstances. From having the freedom to travel and eat out regularly to simply affording housing and healthcare, it’s crucial to understand what it really means to live comfortably—and how much you need to earn to get there.

How Much You Really Need to Earn to Live Comfortably?

Knowing how much money you need to live comfortably is essential for achieving financial security. In the U.S., the number tends to be around $186,000 annually, but this can vary widely based on location, family size, lifestyle choices, and generational perspectives. The key to financial security is to budget, save, and invest wisely, while also adjusting your income expectations as your circumstances change.

| Key Insight | Data/Stat | Source |

|---|---|---|

| Average annual income Americans think they need to live comfortably | $186,000 | Bankrate |

| Percentage of Americans who feel they need $100K+ annually | 43% | Bankrate |

| Percentage of Americans who feel financially secure with their current earnings | 6% | Publicnow |

| How much money Gen Z feels they need to live comfortably | $200,000 | Docs Publicnow |

| Average perception of “rich” in America | $520,000 | Bankrate |

The Changing Definition of Comfortable Living

Once upon a time, the idea of being financially comfortable might have meant owning a modest home, having a couple of cars, and taking a family vacation every year. Today, though, with rising living costs, inflation, and shifting expectations, what constitutes a comfortable lifestyle is changing. In fact, most Americans now think they need $186,000 a year to live comfortably—a number that has steadily increased over time due to the rising costs of healthcare, housing, education, and more.

In 2023, the amount Americans thought they needed was a bit higher at $233,000 annually. This number has dropped in 2024, likely due to a combination of moderating inflation and changes in economic conditions, but the fact remains that Americans, in general, need more money to meet the same standards of living today than they did even five years ago.

Factors Influencing How Much You Really Need to Earn to Live Comfortably

1. Location, Location, Location

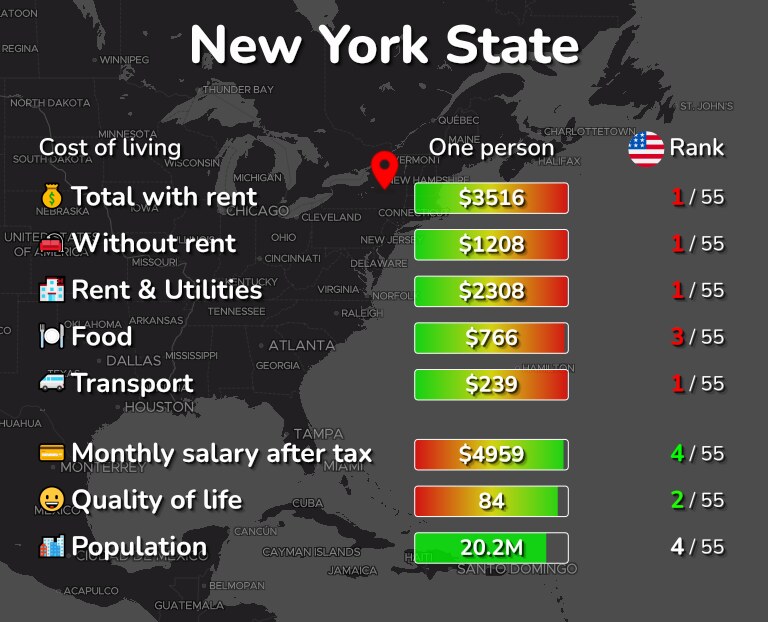

Where you live plays a huge role in how much you need to earn. The cost of living varies dramatically across the U.S. For example, in places like New York, San Francisco, or Los Angeles, even a six-figure income can feel like it doesn’t stretch far enough. Rent, food, utilities, and childcare in these cities are often significantly higher than the national average.

Meanwhile, in cities like Boise, Tucson, or Pittsburgh, your dollars will go much farther. The housing market in particular can make a huge difference—a median home price in places like New York can be upwards of $800,000, while in smaller towns, it can be as low as $250,000.

2. Lifestyle and Expenses

The lifestyle choices you make also influence how much you need to earn. If you love dining out, traveling, and buying high-end products, your cost of living will be much higher. On the other hand, if you’re focused on saving, budgeting, and avoiding unnecessary purchases, you can probably live comfortably on a lower income.

It’s also essential to consider lifestyle inflation—the tendency for individuals to increase their spending as their income increases. For example, if your salary jumps from $60,000 to $100,000, it might feel tempting to move into a larger home, upgrade your car, or go on more vacations, but this will ultimately keep you at the same financial comfort level.

3. Family Size

For those with a larger family, you’ll have a different set of financial priorities. A family of four will need more money to cover basic expenses like food, healthcare, and schooling. For instance, in Houston, a family of four might need to make at least $206,000 to be comfortable. However, single individuals or couples without children can live more modestly on less income.

Generational Perspectives on What’s Needed to Live Comfortably

Americans across generations have varied opinions on how much is enough. Younger generations tend to have higher expectations for their incomes compared to older ones. Here’s what different age groups estimate they need to live comfortably:

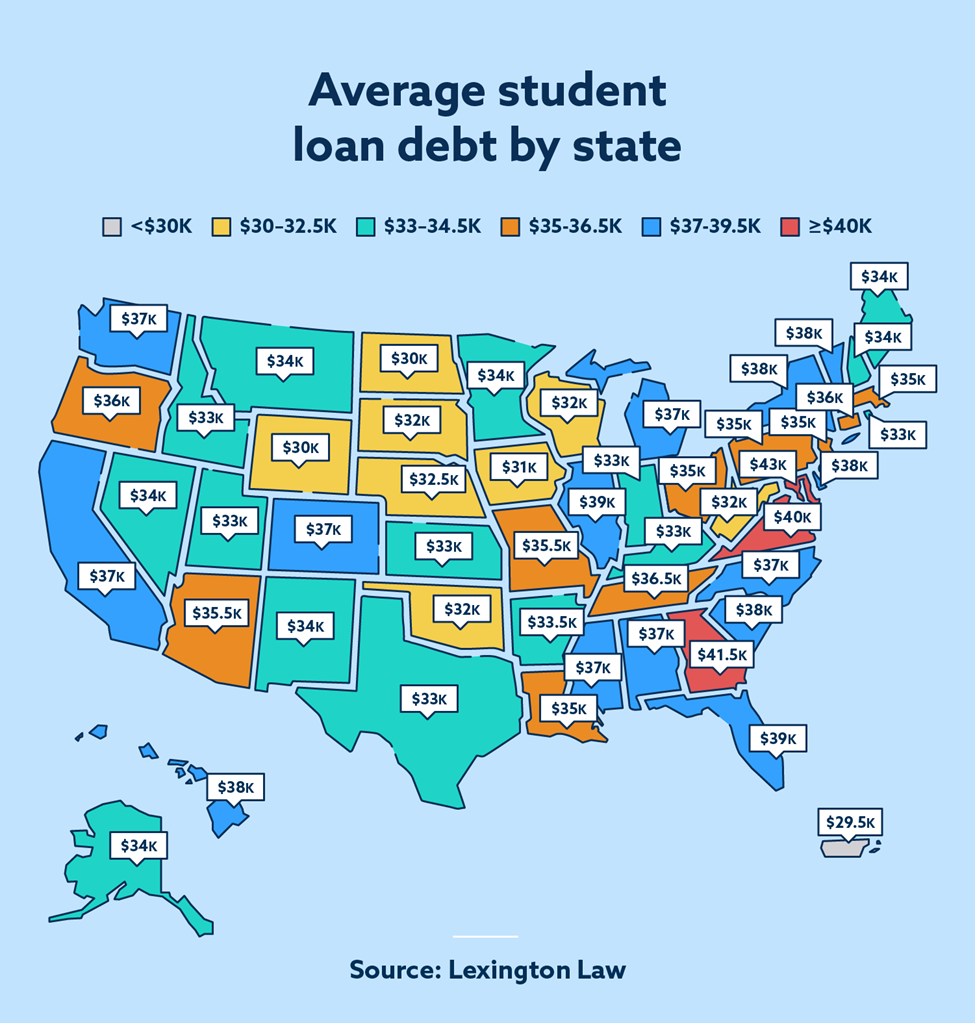

- Gen Z (Ages 18-27): They estimate they need $200,000 annually to live comfortably, likely due to rising educational debt and high living expenses.

- Millennials (Ages 28-43): Millennials, just a bit older, believe they need around $199,000 annually to live comfortably, driven by housing costs, student loan repayments, and retirement savings.

- Gen X (Ages 44-59): For Gen X, the average estimate is $183,000. This group is perhaps most focused on saving for their children’s education and their own retirement.

- Baby Boomers (Ages 60-78): Baby Boomers feel they need about $171,000 annually to live comfortably, as they have fewer financial responsibilities and many may have already paid off their homes.

The Influence of Debt, Savings, and Inflation

Debt: A Key Challenge

Many Americans struggle with debt—whether it’s student loans, credit card balances, or mortgages—and this impacts how much they need to earn to feel financially secure. According to recent studies, student loan debt is a major factor that affects younger generations’ financial comfort. On top of that, the cost of credit card debt, often accruing high interest rates, also eats into a large portion of people’s income, making it harder to save.

The Impact of Inflation

Inflation continues to affect Americans’ purchasing power. The value of money decreases over time, which means that the amount of money you need to live comfortably also increases. For example, if you needed $100,000 to live comfortably in 2000, that same lifestyle might now cost $150,000 today. It’s important to plan for this in your financial goals, making sure that your income keeps up with inflation and increasing costs.

Savings and Investing

It’s essential to save and invest wisely to achieve long-term financial security. Building an emergency fund, contributing to retirement accounts like 401(k)s, and making smart investment decisions can help you reach your financial goals. Investing in stocks, bonds, or mutual funds can make a huge difference in building wealth over time, helping your money grow faster than inflation.

How to Make Sure You’re Earning Enough?

To achieve the lifestyle you want and ensure you’re financially secure, follow these steps:

- Create a Budget: Start by tracking your income and expenses. Tools like Mint and You Need a Budget (YNAB) are great for staying on top of your spending.

- Increase Your Income: Whether through asking for a raise, switching careers, or starting a side hustle, increasing your income can significantly boost your financial comfort level.

- Start Saving and Investing Early: The earlier you start saving, the better. Small contributions to your retirement accounts will compound over time, giving you a strong financial cushion in the future.

- Manage Debt: Prioritize paying off high-interest debt (like credit cards) and manage student loans wisely. Debt can quickly become a financial burden if left unchecked.

- Plan for Big Expenses: Whether it’s buying a home, saving for a child’s education, or traveling, planning ahead can make these milestones less stressful.

You Won’t Believe How Much It Really Costs to Live Comfortably in Virginia and Maryland

This Is the New Magic Number You’ll Need for a Comfortable Retirement (And It’s Not $1 Million)

Retired? Don’t Panic—Smart Strategies for Withdrawing Savings During Market Volatility