How Much Do You Need to Earn to Get the Full $5,108 Social Security Benefit? If you’re aiming to retire with a Social Security check worth $5,108 per month, you’re not alone—but reaching that golden number isn’t as easy as it sounds. For most Americans, it’s a dream, but not an impossible one. So, how much do you need to earn to get the full $5,108 Social Security benefit in 2025?

Social Security is one of the most important pillars of retirement income in the U.S., yet it’s often misunderstood. While many assume benefits are automatic or fixed, the truth is, how much you earn and when you claim benefits play a massive role in determining your monthly payout. The good news? With the right knowledge and a bit of long-term planning, you can significantly increase what you receive. Let’s break it down like we’re sitting on the front porch, talking real numbers, real rules, and some no-nonsense advice—whether you’re just entering the workforce or nearing your golden years.

How Much Do You Need to Earn to Get the Full $5,108 Social Security Benefit?

Let’s be honest—getting the full $5,108 Social Security benefit isn’t something most people stumble into. It takes intentional planning, a strong earning history, and a whole lot of patience. But whether you hit that max or not, what really matters is understanding the system and using it to your advantage.

Social Security isn’t just a number—it’s part of your life story. It reflects the decades you’ve spent working, providing, saving, and showing up. So don’t leave it to chance. Make informed decisions, talk to professionals, and start planning today—your future self will be glad you did. Because when it comes to retirement, peace of mind is the real jackpot.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit (2025) | $5,108 |

| Required Annual Earnings (2025) | $176,100 or more |

| Earning Period | 35 highest earning years |

| Retirement Age for Max Payout | Age 70 |

| Median U.S. Wage (2025) | $62,088 (Bureau of Labor Statistics) |

| Official Source | ssa.gov |

What Is the $5,108 Social Security Benefit?

The $5,108 monthly Social Security benefit is the maximum amount an individual can receive if they meet very specific criteria—and it’s set by the Social Security Administration (SSA) each year. For 2025, that number is $5,108. But here’s the kicker: very few Americans will actually qualify for it. Think of it as the “perfect score” in the Social Security game. To hit that number, you need to have earned the maximum taxable income for Social Security purposes every year for 35 years and delay claiming your benefits until age 70. That’s the government’s way of rewarding those who contributed the most over a long and consistent career—and who were patient enough to wait for a bigger monthly check.

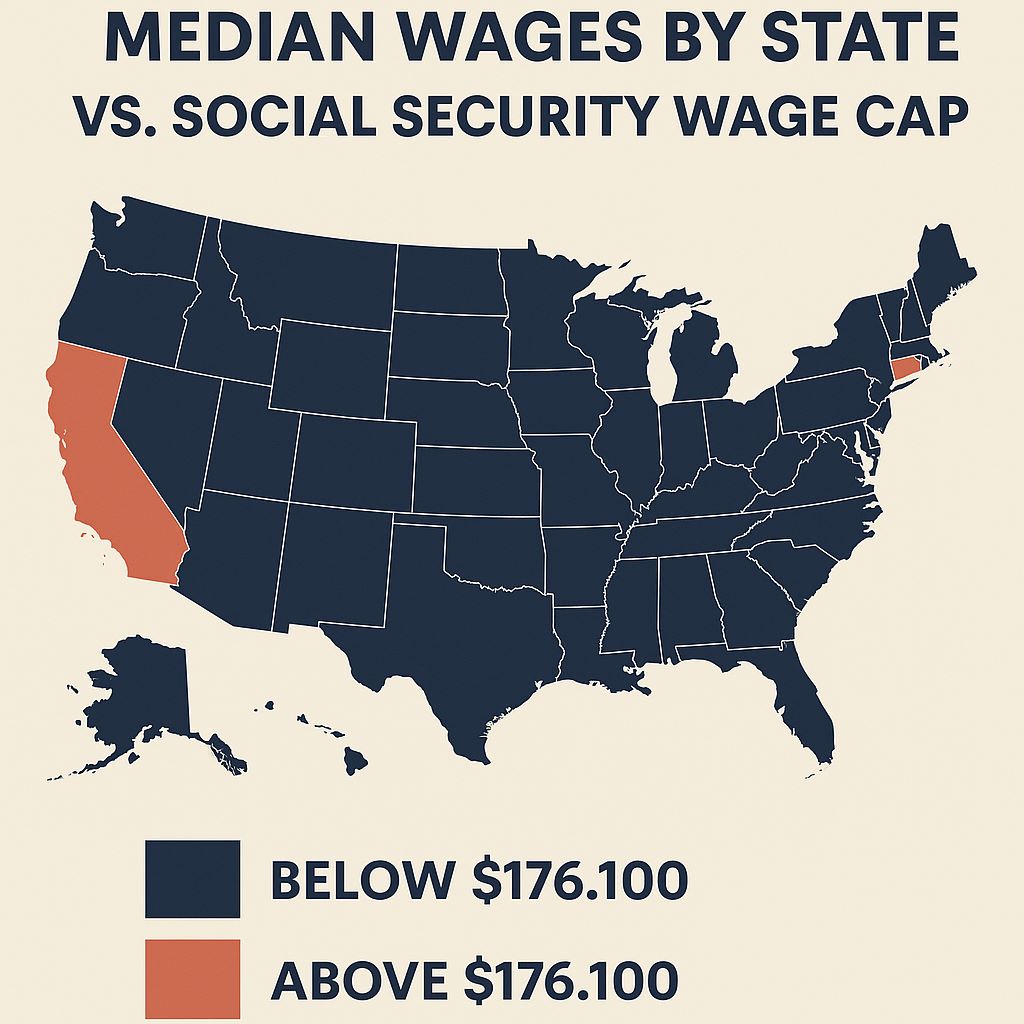

But let’s be clear: $5,108 isn’t an automatic amount, nor is it a “guaranteed” benefit for everyone. So if you’re seeing that maximum number and wondering, “Where’s mine?”—you’re not alone. The figure is calculated using your Average Indexed Monthly Earnings (AIME) over your 35 highest-earning years. The SSA then applies a formula with specific “bend points” that favor lower- and middle-income earners but still give credit to high earners. Only those who consistently hit the Social Security wage cap—which is \$176,100 in 2025—and defer benefits until age 70 can unlock the top benefit. In simpler terms: it’s Social Security’s version of a high-score bonus. It reflects a lifetime of top-tier earnings, full participation in the program, and smart timing.

How Do You Qualify for the Full $5,108 Social Security Benefit?

You need to do three major things:

1. Earn the Max Taxable Income for 35 Years

Social Security only taxes income up to a certain limit, known as the wage base. In 2025, this cap is $176,100. You need to hit this number every year for 35 years to be in the top club.

If you earned less than the wage base in some years, it’s not the end of the world—but it does lower your average and payout.

2. Work at Least 35 Years

Social Security calculates your benefit using your highest 35 years of earnings. If you work less than 35 years, they count zeroes—and those hurt.

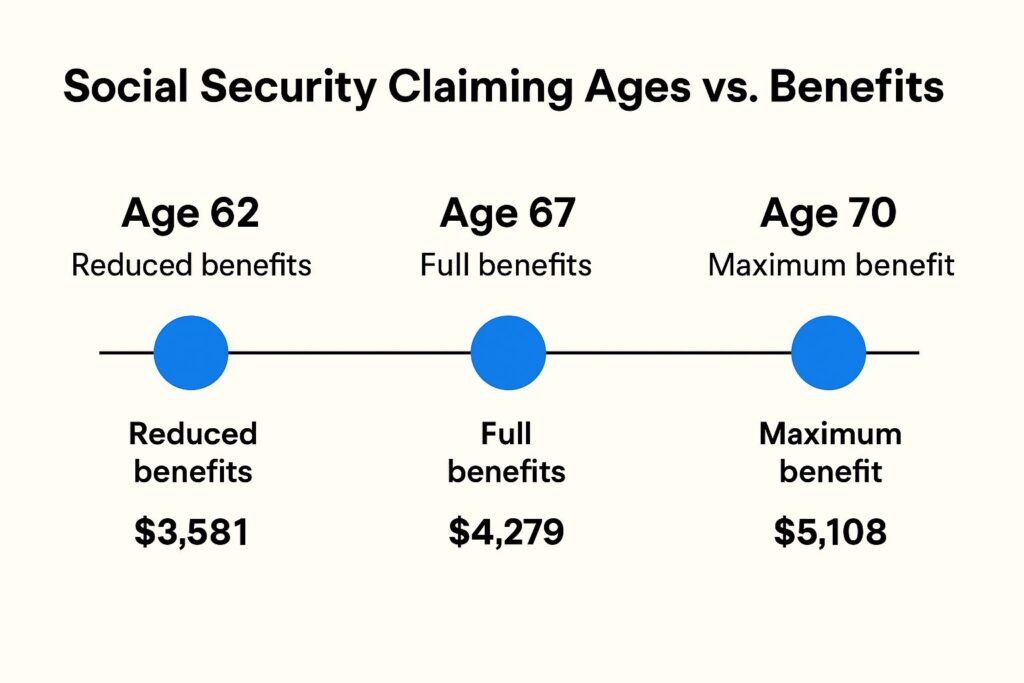

3. Delay Retirement Until Age 70

You can start benefits as early as age 62, but each year you wait past your Full Retirement Age (FRA) boosts your benefit by about 8% per year. Waiting until age 70 gets you the max.

According to the Social Security Administration, delaying retirement from 67 to 70 can add over 24% more to your check.

Real-World Example

Let’s say Jane is a high-level tech manager making over $176,100 every year. She starts working at 25, retires at 70, and delays claiming Social Security until then. She qualifies for the $5,108 monthly max.

Now compare that with John, who made about $60,000 a year and retired at 62. His monthly check might hover around $1,500–$2,000. Big difference.

The Math Behind Social Security

Your benefit is based on something called the Primary Insurance Amount (PIA), calculated from your Average Indexed Monthly Earnings (AIME).

- First $1,174/month @ 90%

- Next $1,174 to $7,078 @ 32%

- Amount above $7,078 @ 15%

Why Most Americans Don’t Qualify for the Max Benefit

Most folks won’t earn enough for 35 straight years to qualify. Here’s why:

- Job changes or layoffs

- Time off for caregiving or education

- Lower-wage professions

- Self-employment taxes or deductions

According to the Bureau of Labor Statistics, the average U.S. salary in 2025 is about $62,088—well below the $176K cap.

Steps to Get Full $5,108 Social Security Benefit?

You may not hit $5,108, but you can still increase your payout. Here’s how:

Step 1: Work Longer

Each extra year can replace a lower-earning year in your calculation.

Step 2: Maximize Earnings

Aim to earn more—or defer income into Social Security-eligible wages.

Step 3: Delay Claiming

Every year past FRA adds up. Waiting till age 70 is like giving your future self a raise.

Step 4: Check Your Earnings Record

Mistakes happen. Log in to SSA.gov and fix any missing income.

Step 5: Stay Informed

Social Security rules evolve.

Additional Planning Tips for High Earners

If you’re a high earner already, here are more tips to ensure you don’t leave money on the table:

- Max out your 401(k) or IRA to supplement Social Security.

- Consider delaying Social Security and using other savings to bridge the gap.

- Meet with a financial planner annually to align strategies.

Big Changes to Social Security in 2025: Who Can Still Claim Full Retirement Benefits?

Say Goodbye to Your Social Security Benefits If You Make These 5 Costly Mistakes in June 2025

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy

How Social Security Fits in Your Retirement Plan

Even with the max benefit, $5,108/month may not cover all retirement needs, especially with inflation and rising healthcare costs. Here’s how to view Social Security in the bigger picture:

- It’s a guaranteed income stream, indexed for inflation.

- Treat it as a foundation, not the full house.

- Supplement with personal savings, investments, pensions, or annuities.

Social Security for Couples

Married? You have even more to consider:

- Spousal benefits allow one partner to claim up to 50% of the other’s FRA benefit.

- Surviving spouses may receive survivor benefits.

- Coordinating claims between spouses can significantly boost total household income.