Full Retirement Age Is Changing Again: Social Security is one of the cornerstones of retirement planning in the United States. It provides a safety net for individuals who have paid into the system during their working years. But did you know that the Full Retirement Age (FRA) for Social Security benefits has been changing, and it could significantly affect the amount you receive once you retire? Understanding these changes and how they impact your future benefits is crucial for making informed retirement decisions. Let’s break it down in a way that’s easy to understand, even if you’re not a retirement expert.

Full Retirement Age Is Changing Again

Understanding Full Retirement Age (FRA) and how it impacts your Social Security benefits is crucial for making informed retirement decisions. Whether you decide to start benefits early, wait until FRA, or delay until age 70, each choice has financial implications. The key is to balance your financial needs with your long-term goals and health considerations. Ultimately, whether you’re just starting your career or already thinking about retirement, it’s essential to make informed decisions. Remember, Social Security benefits can provide a solid foundation for your retirement, but careful planning is necessary to maximize those benefits.

| Key Information | Details |

|---|---|

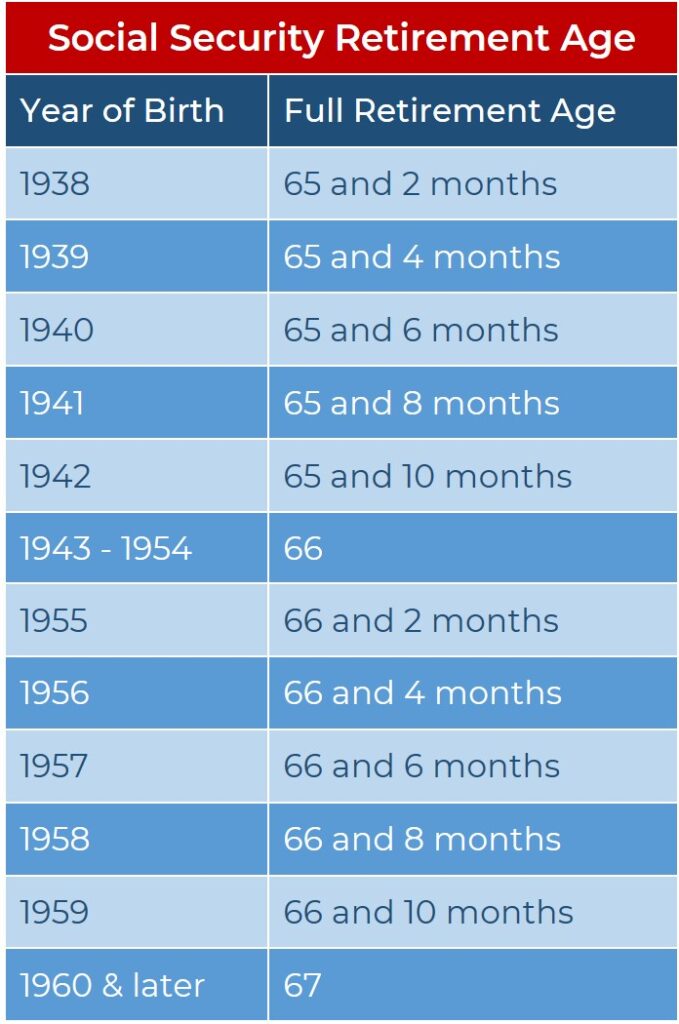

| Current Full Retirement Age | 66 years and 10 months for those born in 1959 and 67 for those born in 1960 or later. |

| Age to Start Receiving Benefits (without Reduction) | Full Retirement Age (FRA), varies by birth year. |

| Early Retirement | Starting benefits at 62 results in a permanent reduction in monthly payments. |

| Delayed Retirement Benefits | Delaying beyond FRA increases monthly benefits by 8% per year until age 70. |

| Future Changes | Potential increases in FRA to 69, depending on future legislative action. |

| Official Source | Social Security Administration |

What Is Full Retirement Age (FRA)?

Full Retirement Age (FRA) is the age at which you can start receiving your Social Security benefits without any reductions. For example, if you start receiving your benefits at FRA, you’ll get the full amount based on your work history and earnings.

It’s important to note that FRA is not the same as the earliest age you can begin claiming benefits. You can start collecting benefits at age 62, but there’s a catch: if you claim early, your monthly benefits will be permanently reduced. On the other hand, if you wait until after your FRA, your benefits will grow, which can be quite beneficial in the long run.

Understanding the ins and outs of FRA will help you make a more informed decision about when to start collecting Social Security.

Why Full Retirement Age Is Changing Again?

In short, people are living longer, and the Social Security system needs to be sustainable. The Social Security program was designed decades ago when people didn’t live as long. Now, as life expectancy increases, the government is adjusting the FRA to ensure that the system doesn’t run out of funds too soon.

The most significant change started in 1983, when the U.S. Congress began raising the FRA gradually from age 65 to 67. This was due to increasing life expectancy, which meant people would collect benefits for a longer period. If you were born after 1959, you’ll be affected by these changes.

Right now, FRA is 67 for those born in 1960 or later, but discussions have already started about potentially increasing FRA even more in the future. There is a possibility that the FRA could rise to 69 for individuals born between 1960 and 1975. If this happens, it will likely have a significant impact on people who are planning their retirements.

Understanding the Impact of FRA on Your Social Security Benefits

The Basics: What Happens if You Retire Early?

You might be wondering: “Should I take my Social Security early, or wait until I’m older?” Here’s what you need to know:

- If you claim benefits at age 62, you’ll receive a reduced monthly amount.

- For example, let’s say your full benefit is $1,000 at FRA. If you start at 62, you might only get around $750 per month (a 25-30% reduction).

- Why? The government reduces your monthly payments because they’ll be paying you for a longer period of time. Essentially, you’re starting to collect your benefits earlier than planned, which is financially costly for the system.

- Is it worth it? It depends on your financial situation and health. If you need the income right away or if you have health concerns that might limit your ability to work longer, claiming early might make sense. If you expect to live a shorter life or if you’re experiencing financial hardship, claiming earlier could be the best option.

The Perks of Delaying Retirement

If you can afford to delay claiming Social Security, you might be in for a nice bonus. For every year you wait beyond your Full Retirement Age, your benefit increases by 8% each year until you reach age 70.

Let’s say you’re eligible for $1,000 per month at FRA, and you decide to wait until age 70 to start collecting. By the time you’re 70, your monthly benefit could be $1,320 (a 32% increase). That’s a significant difference, especially if you’re in good health and expect to live a long time.

Why Is Waiting Beneficial?

- Higher monthly benefits: As mentioned, delaying can increase your monthly benefits by 8% per year, which compounds over time.

- Longer lifespan: If you live longer than average, you’ll end up receiving more total benefits by waiting.

- Increased income security: A higher monthly benefit means more financial stability in the later years of retirement. Delaying retirement can provide a more comfortable lifestyle in the long run.

The Catch: What If You Claim Before FRA and Keep Working?

Let’s say you retire early, claim your Social Security, and keep working. What happens then? Well, if you earn too much, the government will reduce your benefits.

- For 2025, if you’re under Full Retirement Age, you can earn up to $21,240 per year without affecting your Social Security benefits. But for every $2 you earn over that amount, the Social Security Administration will withhold $1 in benefits.

- Once you reach FRA, the rules change: You can earn as much as you want without any reduction in benefits.

This means that if you plan to continue working in retirement, it might be worth it to wait until after FRA to start claiming benefits, especially if your income will exceed the annual limits. Working while receiving benefits before FRA can significantly reduce the money you receive each month.

Will the Full Retirement Age Keep Increasing?

As we mentioned earlier, the FRA has been gradually increasing since 1983, and there’s a chance it could increase further in the future. Currently, the FRA for those born in 1960 or later is 67. However, there’s talk about increasing it to 69 for those born between 1960 and 1975.

This change is still up for debate, but it reflects the growing pressure to address the financial stability of the Social Security system. If Congress passes future legislation increasing the FRA, it could impact your retirement plans.

How Social Security Benefits Are Calculated?

Social Security benefits aren’t just a flat rate. They are based on your average lifetime earnings. The more you’ve earned throughout your career, the higher your benefits will be. Here’s how it works:

- The Social Security Administration (SSA) calculates your average indexed monthly earnings (AIME), which is based on your highest-earning 35 years of work.

- They apply a formula to this amount to calculate your Primary Insurance Amount (PIA), which is the amount you’d receive if you start collecting at your Full Retirement Age.

- Higher lifetime earnings result in a higher benefit, so it’s important to make sure you’re earning well during your working years if you want to maximize your Social Security.

It’s important to note that any gaps in your work history (such as years without significant earnings or time spent out of the workforce) can negatively affect your Social Security benefit. Working longer or earning more can significantly increase your future benefit.

How Taxes Impact Your Social Security Benefits?

Did you know your Social Security benefits can be taxed? Many people are surprised to learn this, especially because Social Security is often thought of as “tax-free” in retirement. But depending on your total income, you may have to pay federal taxes on your benefits.

- If your combined income (your adjusted gross income, plus non-taxable interest, and half of your Social Security benefits) exceeds $25,000 for single filers or $32,000 for married couples, you could be taxed on up to 85% of your Social Security benefits.

- The more you earn in pension payments, retirement income, or wages, the higher the portion of your benefits that will be taxed.

Taxation of Social Security benefits varies from state to state, so it’s important to plan ahead for taxes in your state of residence, as some states may tax Social Security benefits as well.

Social Security and Spouses

Social Security benefits also apply to married couples and divorced individuals in special ways. For example:

- Married couples: If you’re married and your spouse has earned a higher benefit than you, you can claim spousal benefits, which may be worth more than your own Social Security.

- Widows: If your spouse passes away, you may be eligible to claim survivor benefits, which could be equal to or greater than your spouse’s benefits.

- Divorced individuals: If you were married for at least 10 years, you could qualify for divorced spouse benefits, even if you’re remarried. You can claim your ex-spouse’s benefits if you meet certain criteria, and your ex-spouse doesn’t need to be receiving benefits for you to claim them.

If you’re married or have been, it’s worth carefully reviewing your combined benefits strategy to ensure you’re maximizing what you’re entitled to.

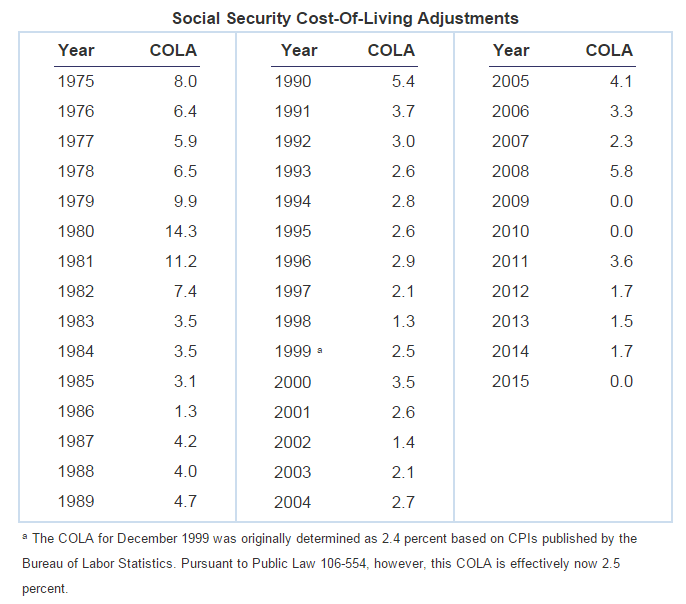

The Impact of Inflation and Cost of Living Adjustments (COLA)

Social Security benefits aren’t fixed; they adjust with inflation. This is done through Cost of Living Adjustments (COLA), which ensures that your benefit maintains purchasing power despite rising prices.

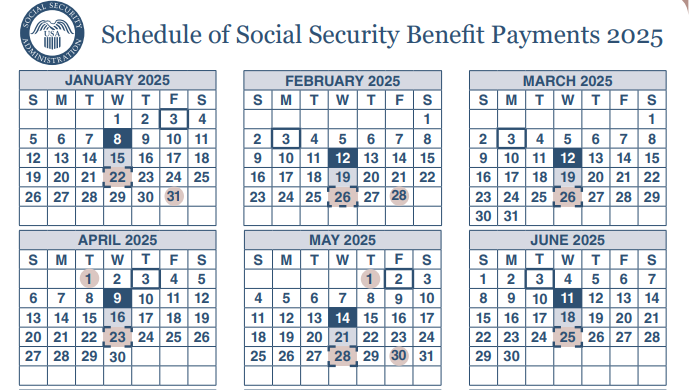

Every year, COLA increases are made based on inflation data, helping retirees keep up with the cost of living. However, the COLA increase can vary from year to year. In 2025, Social Security recipients will see a 2.6% increase in their benefits due to inflation.

The impact of COLA can be significant, especially during periods of high inflation. For retirees, this helps to ensure that their benefits continue to meet their financial needs over time.

Strategies to Maximize Social Security Benefits

To get the most out of Social Security, consider these strategies:

- Wait until age 70 to start benefits for a larger monthly check.

- Maximize your earnings by working longer or earning more, which increases your AIME.

- Coordinate with your spouse to maximize combined benefits. For married couples, it might make sense for one spouse to delay benefits while the other claims.

- Be strategic about claiming survivor benefits for widows and widowers, ensuring you claim at the right time for maximum benefits.

How Social Security Affects Retirement Planning?

Social Security is just one piece of your retirement puzzle. While it provides a reliable income base, it’s important to consider other savings and investment accounts (like 401(k)s or IRAs) to ensure a comfortable retirement. A holistic retirement strategy that includes Social Security can help you achieve financial security.

Since Social Security benefits are generally not enough to cover all your retirement expenses, having a well-diversified plan that includes personal savings, investments, and Social Security is the key to financial peace of mind in retirement.

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Social Security Just Raised Full Retirement Age—And It Might Not Stop There

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy