First SSA Deposits of June 2025 Are Coming: The first Social Security Administration (SSA) deposits of June 2025 are coming, and if you’re a retiree, SSI recipient, or someone with disability benefits, this news directly affects your bank balance. But who gets paid when? How much will you get? And could some delays hit your account this month? This article covers all the answers—clearly, professionally, and with practical tips that help both beginners and seasoned Social Security recipients navigate the landscape confidently.

First SSA Deposits of June 2025 Are Coming

June 2025’s Social Security and SSI payments are here—or almost. For millions of Americans, this month’s checks come with some quirks: early SSI, Fairness Act-related increases, and potential delays. Knowing your exact payment date, tracking your benefit amount, and staying alert to scams can make all the difference. Whether you’re planning bills, groceries, or a little summer fun, your Social Security is yours—you earned it.

| Highlight | Details |

|---|---|

| June SSA Retirement/SSDI Dates | Born 1–10 → June 11; 11–20 → June 18; 21–31 → June 25; Pre-1997 → June 3 |

| SSI Payment Date | Paid early on May 30 due to June 1 being a Sunday |

| 2025 COLA Increase | +2.5%, lifting average benefit to ~$1,976–$1,999 |

| Maximum Monthly Social Security Benefit | $5,108 (for those who delayed retirement to 70 with maximum taxable income) |

| SSI Maximum (2025) | Individual: $967/month, Couple: $1,450/month |

| Backlog from Fairness Act | 3.2 million affected; 900,000 complex cases in manual processing |

| Calendar Quirk | Two SSI payments in May (May 1 and May 30); none in June |

| Website for Benefit Info | SSA.gov |

Understanding June 2025 Social Security Payments

Every month, the SSA pays out over $100 billion in benefits to more than 72 million Americans. These payments cover retirees, people with disabilities (SSDI), survivors of deceased workers, and SSI recipients.

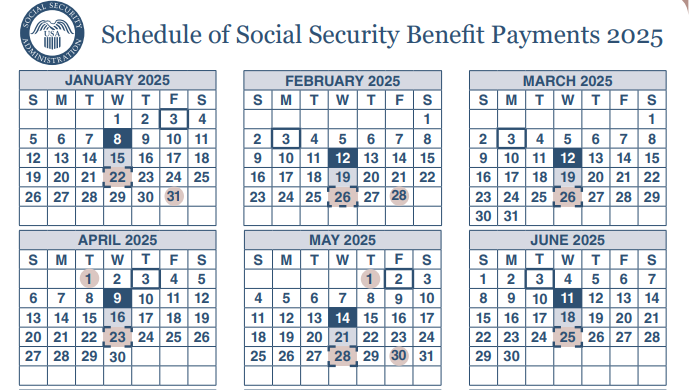

For June 2025, SSA retirement and disability payments are scheduled as follows:

- June 3: For those who started receiving benefits before May 1997

- June 11: If your birthday falls between the 1st and 10th of any month

- June 18: For birthdays on the 11th through 20th

- June 25: For birthdays on the 21st through the 31st

These dates are part of a structured SSA payment calendar that helps spread out disbursements evenly through the month.

Why SSI Payments Are a Bit Different in June?

Supplemental Security Income (SSI) operates on a different schedule. Normally, SSI is paid on the 1st of each month. However, if the 1st lands on a weekend or federal holiday, the payment is made on the previous business day.

That’s why June’s SSI payment was made early on May 30—because June 1 falls on a Sunday. Importantly, this means no SSI payment will be made in June itself, so recipients need to budget accordingly.

How Much Will You Receive in First SSA Deposits of June 2025?

Thanks to the 2025 Cost-of-Living Adjustment (COLA), SSA benefits increased by 2.5% this year. That means most people are receiving more in their monthly checks compared to last year.

Average Monthly Benefits (as of 2025):

- Retired worker: ~$1,976–$1,999

- Disabled worker (SSDI): ~$1,537

- SSI recipient (individual): $967

- SSI (couple): $1,450

Maximum Monthly Benefit Amounts:

These depend on when you start receiving retirement benefits and how much you earned throughout your working years.

- Early retirement (age 62): $2,831

- Full retirement age (~67): $4,018

- Delayed retirement (age 70): $5,108

These maximums apply to people who paid the maximum taxable amount into Social Security for at least 35 years and delayed benefits to age 70.

How COLA Is Calculated?

The COLA is determined using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA compares data from Q3 of the previous year to the same period the year before. If there’s inflation, the COLA increases benefits to help protect buying power.

In 2025, inflation was moderate compared to recent years, so the COLA increase came in at 2.5%—down from the 8.7% high seen in 2023 but still helpful.

Retroactive Payments from the Social Security Fairness Act

The Social Security Fairness Act (passed January 2025) repealed the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO)—policies that previously reduced benefits for many public-sector workers.

As a result:

- 3.2 million Americans were affected

- 2.3 million had payments adjusted automatically

- 900,000 complex or overlapping cases are still being manually processed

For eligible recipients, this has resulted in retroactive lump sum payments—sometimes several thousand dollars at once—and higher monthly benefits moving forward.

Possible Delays Due to SSA Workload

Because of the surge in Fairness Act-related reviews, SSA staff have prioritized retroactive processing. That’s great for public workers and surviving spouses, but it may delay:

- Direct deposit or address changes

- New benefit applications

- Appeals or documentation processing

If you’ve recently changed your bank or mailing address, confirm everything is up-to-date via My Social Security, and be patient—it may take extra time this month.

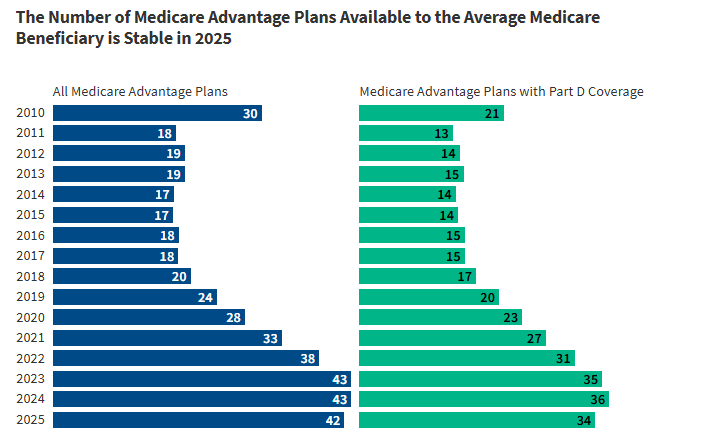

Medicare Premium Deductions from Social Security

If you’re enrolled in Medicare Part B, your premium may be automatically deducted from your SSA benefit. For 2025, the standard Medicare Part B premium is $179.80/month.

Some people also have Part D (prescription coverage) premiums withheld. These deductions may explain why your actual deposit amount is lower than the gross benefit listed on your SSA notice.

To review your Medicare deductions:

- Log in to My Social Security

- Check your benefit verification letter

- Visit Medicare.gov for premium details

What to Do If Your Payment Is Late?

If your payment doesn’t arrive on the expected date, follow these steps:

- Wait 3 business days. SSA advises not to report a missing check until then.

- Check your bank account or physical mailbox (for paper checks).

- Confirm your direct deposit info at ssa.gov.

- Contact SSA directly: 1‑800‑772‑1213 or visit a local office.

Watch Out for Scams

Scammers are increasingly targeting seniors with fake SSA calls, phishing emails, and text messages.

Here are a few reminders:

- The SSA will never call you to demand payment or personal information.

- They will not ask you to pay using gift cards, wire transfers, or cryptocurrency.

- Official communication will come via letter or through your My SSA account.

Planning for the Future

Whether you’re already collecting benefits or planning for retirement, here are a few tips:

- Delay your benefits if possible. Every year you delay past full retirement age increases your check.

- Work at least 35 years. SSA averages your top 35 years of earnings to calculate your benefit.

- Keep tabs on earnings statements. Mistakes in your earnings record can cost you.

- Set up automatic savings. Consider supplementing SSA with a Roth IRA or 401(k).

- Understand tax liability. Up to 85% of Social Security benefits may be taxable if you have other income.

Social Security Cuts Paused! What It Means for Student Loan Defaulters in 2025

3 Crucial Social Security Updates in 2025 That Could Redefine Your Retirement Strategy

June 2025 Social Security Payment Dates Revealed; See When Your Check Is Coming