Federal Workers Beware: In 2025, the landscape for federal employees has shifted dramatically. Massive layoffs, agency reorganizations, and early retirement offers are no longer just headlines — they’re everyday realities across the U.S. federal workforce. If you’re a government employee, you’ve probably heard terms like RIF, VERA, and DSR in meetings or HR memos. But what do they actually mean for your career? This guide is designed to break down everything in a professional, easy-to-understand tone — whether you’re a federal HR officer or just got your first GS job. By the end of this article, you’ll have a clearer view of how to prepare, protect your benefits, and take control of your federal career during uncertain times.

Federal Workers Beware

Federal employment in 2025 is at a crossroads. Massive RIFs, early retirement pushes, and structural shifts are challenging workers across every department. But with preparation, knowledge, and proactive planning, you can navigate this transition without sacrificing your future security. If you’re facing a VERA offer, expect a RIF, or just want to understand your options, now is the time to take control. Review your records, get your numbers in order, and don’t be afraid to ask for help.

| Topic | Details |

|---|---|

| RIF (Reduction in Force) | Structured layoff system triggered by reorgs, budget cuts, or downsizing. |

| VERA (Voluntary Early Retirement Authority) | Early retirement for eligible employees — age 50+ with 20 years or any age with 25. |

| DSR (Discontinued Service Retirement) | Involuntary early retirement if separated due to RIF or similar restructuring. |

| Federal Layoffs (2025) | Over 275,000 planned; 58,000+ confirmed; major agencies affected include IRS, HHS, EPA. |

| Benefit Impacts | Early retirement reduces annuity; legislation may eliminate key supplements and change formulas. |

| Action Plan | Check SF-50 and OPF, estimate retirement payout, consult HR or a federal benefits planner. |

| Official Resources | OPM RIF Center, MSPB, FERS Handbook |

What Is a Reduction in Force (RIF)?

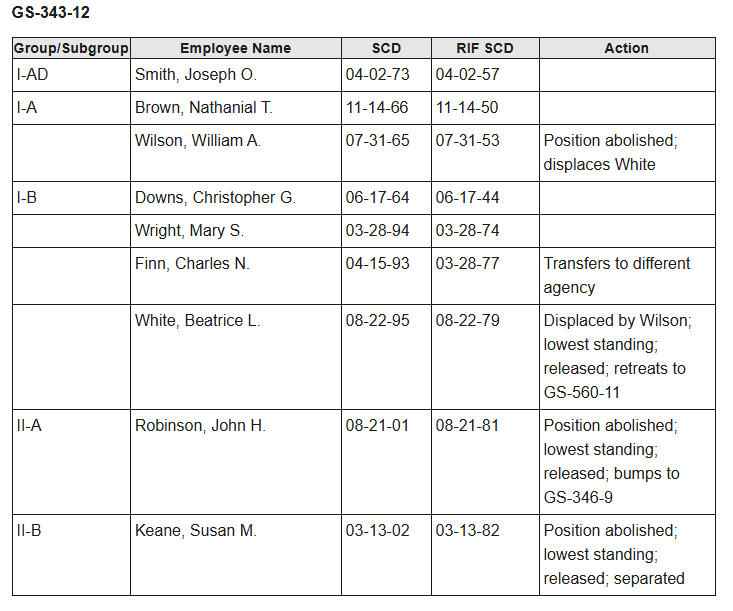

A Reduction in Force (RIF) is the formal term the federal government uses when eliminating positions due to budget cuts, reorganizations, downsizing, or loss of funding. Unlike the private sector, federal layoffs aren’t based on manager discretion — they’re governed by strict OPM rules (under 5 CFR Part 351).

When a RIF occurs, your job retention depends on several factors:

- Tenure group (permanent or temporary)

- Veterans’ preference

- Length of service

- Last three performance ratings

This system determines who stays, who goes, and who gets placed in a different job (a process called bump or retreat rights).

In 2025, RIFs are hitting across the board — the IRS, HHS, and EPA have all confirmed workforce reductions. According to public records and watchdog groups, over 275,000 federal workers are at risk, and more than 58,000 layoffs have already been executed or finalized.

Why Are RIFs Happening Now?

Several key drivers are fueling this wave of downsizing:

- Budget Reductions: Fiscal tightening and deficit control measures from Congress.

- Executive Orders: Shifting policy priorities under the Trump administration have resulted in agency overhauls.

- Technological Automation: Agencies are integrating AI and IT systems, reducing the need for manual labor.

- Program Consolidation: Some programs are being merged or eliminated entirely, especially in health, education, and environmental sectors.

For example, in early 2025, the IRS sent out letters offering early resignation with buyouts, stating that those who refused might be subject to a RIF. Meanwhile, HHS is under legal scrutiny for allegedly using inaccurate employee data in determining who to let go.

What Is VERA (Voluntary Early Retirement Authority)?

VERA allows eligible federal employees to retire early under specific conditions. It’s typically offered when an agency wants to reduce staff numbers voluntarily before triggering a RIF.

Eligibility:

- Age 50 or older with at least 20 years of federal service

- Any age with 25 or more years of creditable federal service

Employees who accept VERA can start collecting their annuity immediately. However, because you’re retiring earlier, your total pension will likely be smaller than if you stayed until your regular minimum retirement age.

It’s essential to understand that VERA is optional — you can turn it down. But in some cases, refusing VERA might lead to a forced exit through a RIF, where your options may be more limited.

What Is DSR (Discontinued Service Retirement)?

DSR is a type of involuntary early retirement. If you’re separated due to a RIF, or your agency abolishes your position and you’re not eligible or selected for reassignment, you may qualify for DSR.

Eligibility Criteria for DSR:

- Age 50 with at least 20 years of service, or

- Any age with 25 or more years of service

- The separation must be involuntary and not due to misconduct

Like VERA, DSR lets you start drawing your FERS annuity earlier. However, you may lose access to the FERS Annuity Supplement (if Congress passes current proposals) and miss out on earning higher lifetime benefits.

Federal Workers Beware: How Will Your Pension Be Affected?

If you’re under the Federal Employees Retirement System (FERS), your pension is based on the following formula:

1% x Years of Service x High-3 Average Salary

Let’s look at an example:

- Age: 55

- Years of service: 25

- High-3 salary average: $90,000

Annual Annuity = 1% x 25 x $90,000 = $22,500

However, if you stayed until 62 with 30 years of service, that same formula would be:

- 1.1% x 30 x $90,000 = $29,700/year

So, retiring early could cost you $7,200 per year — or $144,000 over 20 years.

Further risks:

- Congress is considering switching from High-3 to High-5, which would reduce the average salary used in calculations.

- Proposed legislation may also eliminate the FERS Annuity Supplement, which currently helps bridge income until Social Security kicks in.

Practical Steps to Take Right Now

Here’s how to get ahead of a RIF or early retirement situation:

Step 1: Review Your SF-50 and OPF

Your Standard Form 50 (SF-50) and Official Personnel File (OPF) contain your work history and are critical in a RIF. Check for:

- Correct dates of service

- Accurate grade and position series

- Updated performance ratings

Errors can affect your RIF ranking and eligibility for benefits.

Step 2: Estimate Your Retirement

Use the FERS Retirement Calculator available through your agency’s HR portal or OPM. Alternatively, request a retirement estimate directly from HR.

Step 3: Check for “Bump or Retreat” Rights

In a RIF, you may be entitled to transfer into a lower-grade position to avoid separation. Ask your HR office about this and make sure you meet the qualifications.

Step 4: Consider Professional Help

Certified financial planners who understand federal retirement — especially those affiliated with NAPFA or the National Active and Retired Federal Employees Association (NARFE) — can provide personalized advice.

Step 5: Be Ready to Appeal

If you’re RIF’d and believe the process was flawed or discriminatory, you can appeal through the Merit Systems Protection Board (MSPB). But don’t wait — appeals must be filed within 30 days.

Tax Refunds Are Hitting Bank Accounts This Week—Are You on the IRS Payment List?

House Reconciliation Bill Passes; Federal Employees Brace for Major Retirement Shake-Up

Federal Retirement Cuts Approved: What the House’s New Bill Means for Government Workers

Agencies Most Affected by 2025 Workforce Restructuring

- IRS – Offered voluntary resignations and buyouts.

- Department of Health & Human Services (HHS) – Facing lawsuits over flawed RIF decisions.

- Environmental Protection Agency (EPA) – Significant program cuts driven by policy shifts.

- Department of Education – Reorganization plans targeting mid-level positions.

- Department of Veterans Affairs (VA) – Reallocating staff due to modernization efforts.