DWP Offering £5,644 in Financial Aid: If you’re over the State Pension age and living with a long-term illness, disability, or mental health condition that makes daily life harder, you may be eligible for a generous financial support scheme from the UK government. It’s called Attendance Allowance, and it’s designed to help people who need extra care or supervision. The Department for Work and Pensions (DWP) provides this benefit, which can pay up to £5,644.60 per year—tax-free. And here’s the kicker: your savings and income don’t matter. That’s right—this benefit is not means-tested. Whether you’re retired from a job in construction, teaching, nursing, or finance, or even if you own your home outright, you could still qualify.

DWP Offering £5,644 in Financial Aid

Attendance Allowance is a lifeline for older adults who need help with daily life. It’s designed to ease the burden of illness or disability and empower people to live independently. With up to £5,644.60 per year, tax-free, available to those who qualify, this DWP benefit can provide both financial peace of mind and better quality of life. The process might feel intimidating, but help is available—and applying could be the best decision you make this year. If you or a loved one fits the criteria, don’t wait. Reach out, get the form, and take the first step toward financial support and security.

| Feature | Details |

|---|---|

| Benefit Name | Attendance Allowance |

| Annual Amount | Up to £5,644.60 (2024/25) |

| Weekly Rates | – Lower rate: £72.65- Higher rate: £108.55 |

| Eligibility Age | Must be State Pension age (currently 66 in the UK) |

| Application Methods | Apply online (limited slots) or by post |

| Official Website | gov.uk/attendance-allowance |

| Processing Time | Typically 6 to 8 weeks (longer in some cases) |

| Additional Benefits Triggered | May unlock extra support like Pension Credit, Housing Benefit, Council Tax Reduction |

| Medical Conditions Considered | Includes arthritis, Parkinson’s, dementia, COPD, heart disease, poor eyesight, stroke, mental health issues, and more |

What Is Attendance Allowance?

Attendance Allowance is a government benefit that helps older adults with the extra costs of having a disability or health condition. It’s specifically for people who are of State Pension age or older and need assistance with daily tasks or supervision to stay safe.

Unlike other benefits, you don’t need to have someone caring for you full-time to be eligible. You just need to show that you need help—even if you don’t currently receive it.

And here’s a key point: this benefit is completely tax-free and does not depend on your income or savings. So even if you have a decent pension or a good amount saved up, you might still qualify.

This support can ease the financial pressure that comes with needing assistance—whether it’s paying for private care, mobility aids, or help with housework.

Who Qualifies for Attendance Allowance?

To qualify, you must meet certain criteria:

- Age: You must be 66 or older (the current State Pension age).

- Residency: You must live in the UK, be habitually resident, and not subject to immigration control.

- Disability or Illness: You must have a physical or mental disability or illness that requires help with personal care or supervision.

- Duration: You must have needed help for at least 6 months—unless you’re terminally ill, in which case you can qualify more quickly.

Examples of eligible conditions include:

- Arthritis

- Alzheimer’s or dementia

- Vision or hearing impairments

- Heart failure

- COPD or other respiratory conditions

- Parkinson’s Disease

- Diabetes with complications

- Mental health issues like depression, anxiety, or PTSD

- Mobility problems after stroke or injury

The key is that the condition affects your ability to carry out daily activities like washing, dressing, eating, managing medications, or staying safe at home.

How Much Can You Get?

There are two payment levels, depending on how much support you need:

Lower Rate – £72.65 per week

If you need help either during the day or night (but not both).

Higher Rate – £108.55 per week

If you need help during both day and night, or if you’re terminally ill.

That means the maximum annual benefit is:

£108.55 x 52 weeks = £5,644.60

And remember: this is tax-free, doesn’t impact your other income, and can also unlock additional benefits.

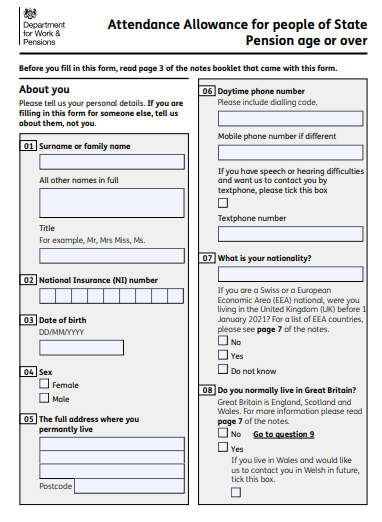

How to Apply for DWP Offering £5,644 in Financial Aid?

Applying is straightforward, but you’ll need to describe your condition and how it affects your daily life. You can apply in two ways:

1. Apply Online

The government recently launched an online application portal (pilot phase). You can find it here:

Apply online

Note: Online applications are still being tested, and the number of online submissions may be limited weekly.

2. Apply by Post

If you prefer the old-school method or need extra assistance:

- Download the form from the official gov.uk website

- Or request a paper form by calling 0800 731 0122

- Complete and return it to:

Freepost DWP Attendance Allowance

(No stamp or postcode needed)

You can ask a family member or trusted friend to help fill out the form.

If you’re applying on behalf of someone (e.g., with Power of Attorney), you must use the postal method.

Tips for Filling Out the Form

- Be honest, not modest – Explain everything, even if it feels minor. This isn’t the time to downplay your needs.

- Use examples – “I fall when trying to get out of bed” or “I forget to take my insulin unless someone reminds me.”

- Include good and bad days – Mention if your condition fluctuates. The form should reflect your worst days.

- List all conditions – Even if one is more severe, mention all diagnosed issues.

You can get help filling out the form from:

- Citizens Advice: citizensadvice.org.uk

- Age UK: ageuk.org.uk

- Local disability support groups

What Happens After You Apply?

After submitting your application, here’s what to expect:

- Processing Time: Usually takes 6 to 8 weeks

- Medical Evidence: They may request more info from your GP

- Assessment: You probably won’t need a face-to-face assessment, but in some cases they might arrange one

- Decision: You’ll get a letter explaining whether you’ve been approved and at what rate

If you’re not approved, you have the right to appeal or ask for a mandatory reconsideration.

What Can Attendance Allowance Help Pay For?

While there are no restrictions on how you use the money, most people use it for:

- Hiring a carer or cleaner

- Getting transportation to appointments

- Buying special diets or equipment

- Paying for heating or home maintenance

- Managing prescription costs or other out-of-pocket expenses

Even if you don’t spend the money on care, you still qualify if you need the help.

Rachel Reeves’ Pension Megafund: A £6,000 Boost or a Gender Pay Gap in Disguise?

UK Pension Alert: Millions of Savers Unknowingly Losing Money to Hidden Fees – Are You One of Them?

The £694 State Pension Error That Could Cost You 17 Years of Lost Money

Extra Perks: What Other Benefits Might You Unlock?

Receiving Attendance Allowance can be a gateway to other forms of support. You might be able to claim or increase:

- Pension Credit

- Housing Benefit

- Council Tax Reduction

- Carer’s Allowance (if someone looks after you)