Dave Ramsey’s 15-Year Mortgage Rule Sparks Backlash: Dave Ramsey’s 15-year mortgage rule has long been touted as a bulletproof path to homeownership without the debt burden. But in 2025, with rising home prices, increased living costs, and stagnant wage growth for many, Ramsey’s advice has started to feel—well—out of touch to some Americans. The backlash online has been loud, and the question at the center of it all is this: Is Ramsey’s advice realistic in today’s market? Let’s break it all down, step by step, with real numbers, sound advice, and expert insight. Whether you’re a first-time buyer, a seasoned homeowner, or just exploring your options, this guide will walk you through everything you need to know.

Dave Ramsey’s 15-Year Mortgage Rule Sparks Backlash

Dave Ramsey’s mortgage advice comes from a place of discipline and debt avoidance, and for some folks, it works like a charm. But for many Americans, especially in today’s economy, the 15-year mortgage rule can feel restrictive and out of reach. The key takeaway? Financial advice isn’t one-size-fits-all. You’ve got to do what’s right for you and your family, in your market, with your income, and your goals. Whether that’s a 15-year, 30-year, or even renting for a while—make the choice that lets you sleep well at night and build long-term wealth.

| Aspect | Details |

|---|---|

| Dave Ramsey’s Mortgage Rule | 15-year fixed-rate mortgage, monthly payments under 25% of take-home pay, 20% down payment to avoid PMI |

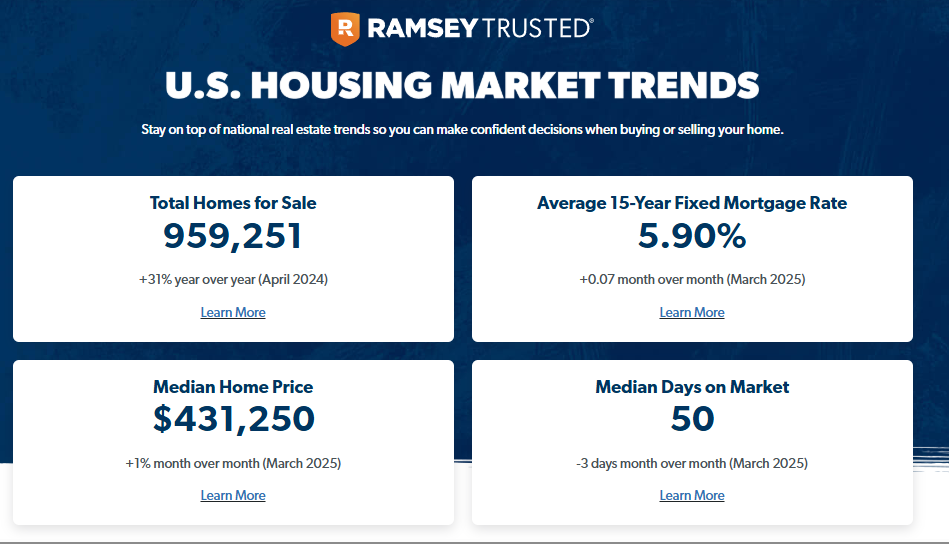

| Median Home Price (2024) | ~$400,000 |

| Median Household Income (2024) | ~$75,000/year or ~$6,250/month (Source: U.S. Census Bureau) |

| Problem With Ramsey’s Rule | Requires ~$11,000/month income for many markets to meet his 25% take-home rule on a 15-year loan |

| Main Criticism | Lacks flexibility, unrealistic for middle-class buyers, ignores regional price differences |

| Official Source | Ramsey Solutions |

What Is Dave Ramsey’s 15-Year Mortgage Rule?

At its core, Ramsey’s advice aims to keep people out of financial trouble. He believes you should:

- Only get a 15-year fixed-rate mortgage (not a 30-year or adjustable-rate mortgage)

- Your monthly mortgage payment (including taxes and insurance) should be no more than 25% of your take-home pay

- You should put down at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI)

This strategy is designed to help people pay off their homes faster, avoid excessive interest payments, and reduce financial stress. In a perfect world, that sounds great. But here’s the rub…

Why Dave Ramsey’s 15-Year Mortgage Rule Sparks Backlash?

1. It’s Just Not Affordable for Most Americans

Let’s say you’re eyeing a $400,000 home (right around the U.S. median). You put down 20%—that’s $80,000 upfront—and finance the rest ($320,000) with a 15-year fixed-rate mortgage.

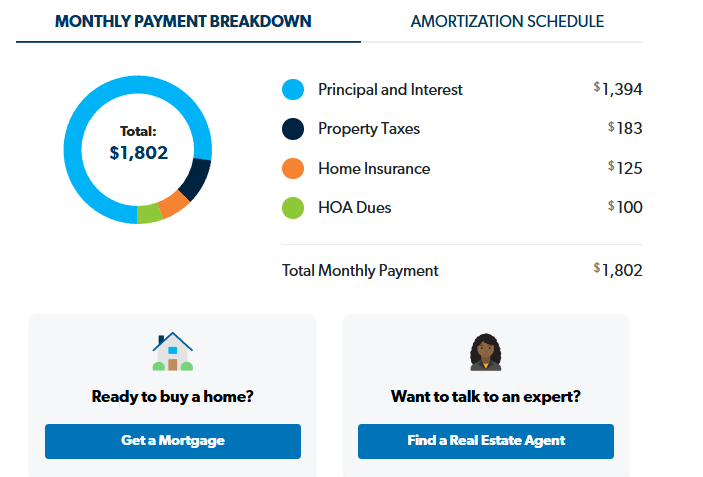

With interest rates hovering around 6.5% in 2025, your monthly principal and interest alone would be around $2,784, and with taxes and insurance, your full payment might be closer to $3,300 per month.

Now, to keep that under 25% of take-home pay, you’d need to bring home about $13,200/month, or roughly $158,400/year.

Problem? The median U.S. household income is less than half that.

Even for dual-income households, hitting these numbers isn’t easy unless you’re in a high-paying profession. Ramsey’s model doesn’t account for that reality.

2. It Ignores Regional Disparities

Home prices in San Francisco, Boston, or New York are vastly different from cities like Omaha or Birmingham. In expensive markets, a modest starter home can cost $800,000 or more. Ramsey’s rules would require incomes well over $250,000 to follow the 15-year plan.

That might work for tech workers in Silicon Valley, but what about school teachers, firefighters, or small business owners?

3. The “Flexibility Factor” of the 30-Year Mortgage

Many financial planners say the 30-year mortgage is not evil—it’s just misunderstood. The key benefit? Flexibility.

A 30-year loan has lower monthly payments. That doesn’t mean you have to drag it out for three decades—you can pay it off early, make extra principal payments, or refinance. But the lower payment gives you wiggle room for emergencies, investments, or lifestyle needs.

Example:

A $320,000 loan on a 30-year fixed at 6.5% has a monthly payment of about $2,024 (excluding taxes/insurance). Compared to $2,784 for a 15-year, that’s $760 in cash flow you could redirect toward:

- Investing in an IRA or 401(k)

- Starting a side hustle

- Building an emergency fund

- Paying down other debt

4. Lost Investment Opportunities

Here’s another angle: If you’re locked into high mortgage payments with a 15-year loan, you might be missing out on compound growth elsewhere.

The S&P 500’s historical return averages 7–10% annually (after inflation). If you’re disciplined and invest the difference between 15-year and 30-year payments, you could grow more wealth over time than you’d save in interest.

Of course, this depends on behavior—Ramsey’s counterargument is that most people won’t actually invest the difference.

Real-World Stories

“I Tried Ramsey’s Rule. Here’s What Happened.”

Ashley, 32, Atlanta, GA:

“We saved like crazy to put down 20% and got a 15-year loan. But after the first year, we were so cash-strapped, we had to dip into our emergency fund just to cover a car repair. It was stressful, and honestly, we would’ve been better off going with a 30-year loan and paying extra when we could.”

“Ramsey Helped Me Get Out of Debt Fast”

Jordan, 45, Phoenix, AZ:

“I followed Dave’s advice to the letter. Paid off my mortgage in 14 years. It was tough, but now I’m 100% debt-free and it feels amazing. You just have to be ready to sacrifice.”

A Balanced Perspective: When Ramsey’s Rule Works

- You’re high-income and want to be debt-free quickly

- You have very stable employment

- You’re a disciplined budgeter

- You’re in a low-cost housing market

Alternatives That Make Sense

1. The 30-Year with Prepayments

Take a 30-year mortgage but treat it like a 15-year—when times are good, send in extra payments. When times are tight, pay the minimum. You’re in control.

2. First-Time Buyer Programs

Many states offer low down-payment loans, down-payment assistance, and tax credits.

3. Adjustable-Rate Mortgages (ARMs)

If you’re not planning to stay in the home for more than 5–7 years, an ARM could offer a lower rate up front. Just know the risks—if rates go up, your payment will too.

Dave Ramsey Slams Washington: “Do Your Job!”- Blistering Message About Protecting Your Money

Her Boyfriend Says 401(k)s Are a Scam; Dave Ramsey’s Response Left Her Speechless

Tariffs Are Back — But Are They Fixing America’s Trade Deficit or Making It Worse?

Practical Guide: Steps to Choose the Right Mortgage

Step 1: Know Your Budget

Use an online mortgage calculator (like this one from NerdWallet) to compare monthly payments between loan types and rates.

Step 2: Compare Loan Offers

Talk to at least three lenders. Ask about interest rates, closing costs, and terms. Don’t settle for the first offer.

Step 3: Run the Numbers Long-Term

Use amortization schedules to understand how much total interest you’ll pay over the life of the loan. A 15-year mortgage can save tens of thousands—but only if you can afford it.

Step 4: Plan for the Unexpected

Job loss, medical bills, and surprise expenses happen. Choose a mortgage that leaves you some breathing room in your budget.